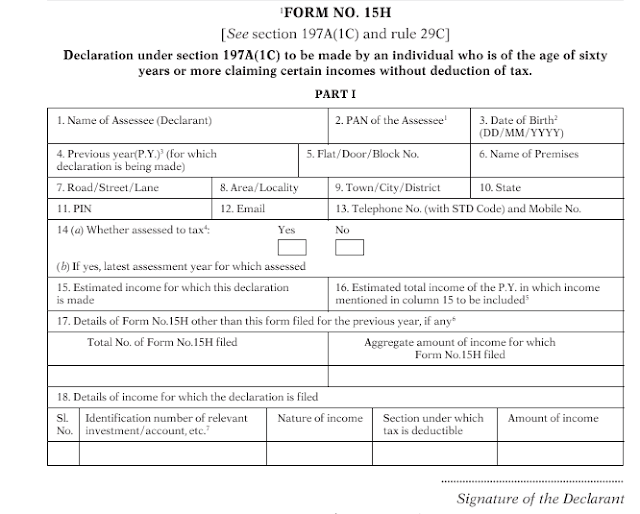

15H Form Income Tax

15H Form Income Tax - 15h is filed before filing this declaration during the previous year, mention the total number of such form. 15h declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain incomes. Declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain incomes without. In case any declaration(s) in form no.

In case any declaration(s) in form no. Declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain incomes without. 15h is filed before filing this declaration during the previous year, mention the total number of such form. 15h declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain incomes.

15h declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain incomes. 15h is filed before filing this declaration during the previous year, mention the total number of such form. Declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain incomes without. In case any declaration(s) in form no.

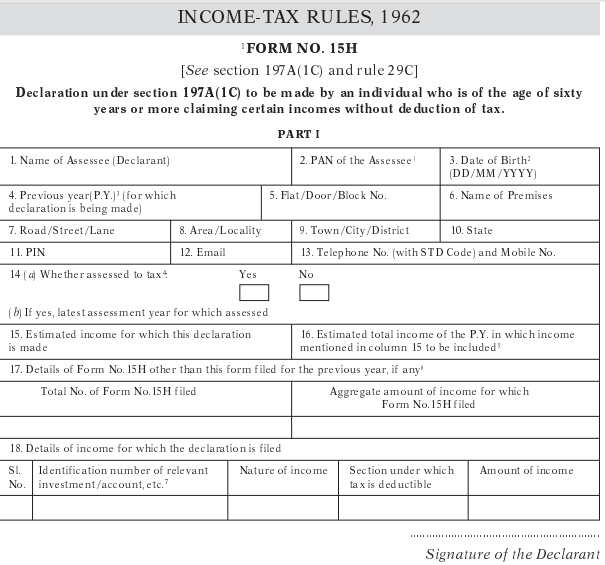

How to Fill Form 15H for Senior Citizen How to efile Form 15H on

15h is filed before filing this declaration during the previous year, mention the total number of such form. In case any declaration(s) in form no. Declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain incomes without. 15h declaration under section 197a(1c) to be made by an individual.

Form 15G and Form 15H in Tax

15h is filed before filing this declaration during the previous year, mention the total number of such form. In case any declaration(s) in form no. Declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain incomes without. 15h declaration under section 197a(1c) to be made by an individual.

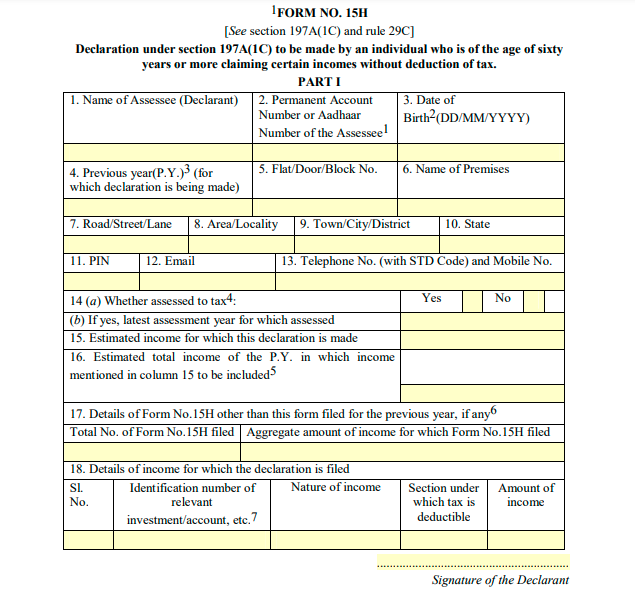

Form 15h Last Date 2023 Printable Forms Free Online

In case any declaration(s) in form no. Declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain incomes without. 15h declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain incomes. 15h is filed before filing.

What is Form 15H? How to Fill & Download Form No. 15H Marg ERP Blog

15h is filed before filing this declaration during the previous year, mention the total number of such form. In case any declaration(s) in form no. 15h declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain incomes. Declaration under section 197a(1c) to be made by an individual who.

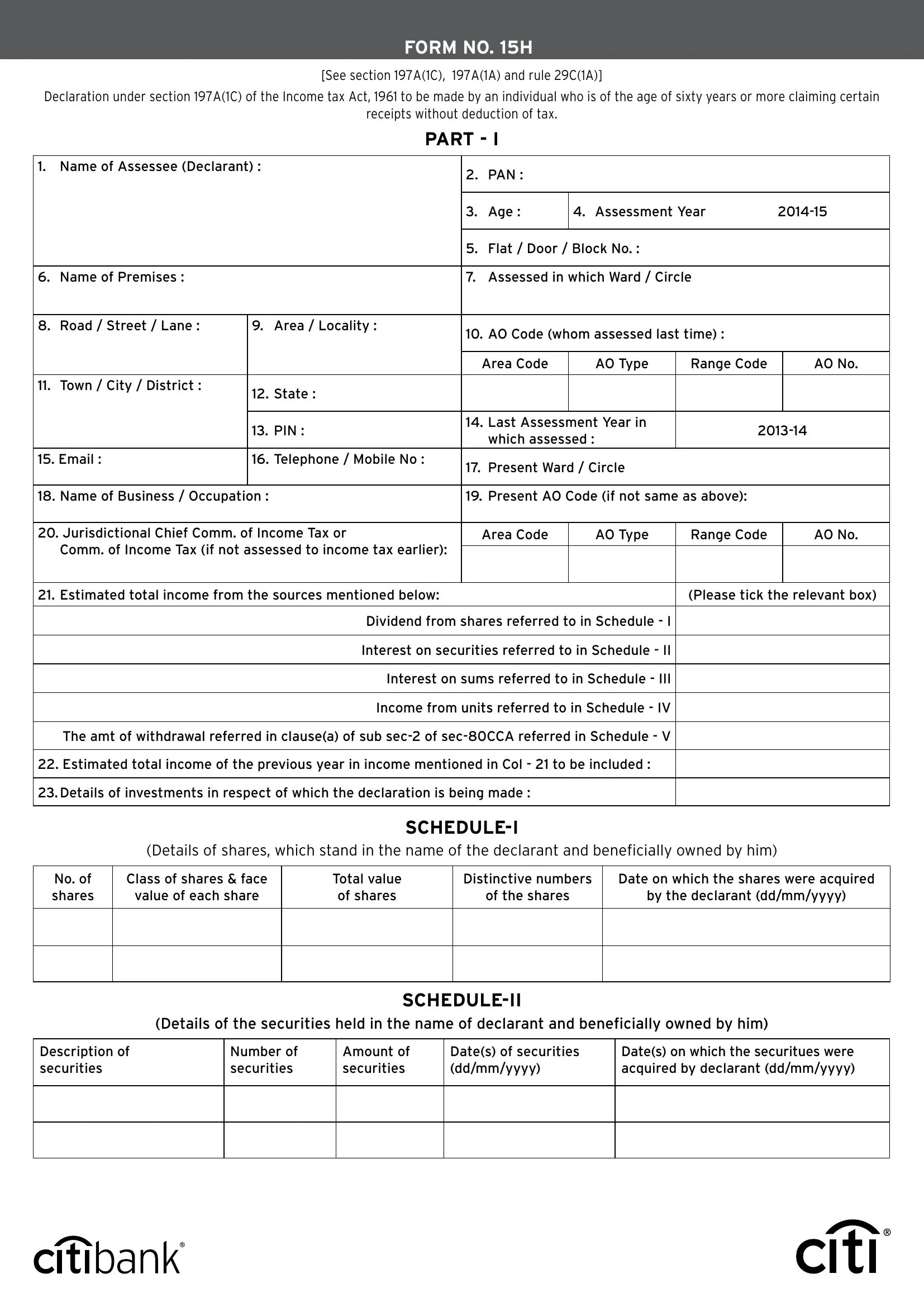

Form 15G and Form 15H in Tax

15h declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain incomes. 15h is filed before filing this declaration during the previous year, mention the total number of such form. In case any declaration(s) in form no. Declaration under section 197a(1c) to be made by an individual who.

Form 15H ≡ Fill Out Printable PDF Forms Online

15h is filed before filing this declaration during the previous year, mention the total number of such form. 15h declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain incomes. In case any declaration(s) in form no. Declaration under section 197a(1c) to be made by an individual who.

How to efile Form 15G / 15H online at Tax Portal SVJ Academy

In case any declaration(s) in form no. 15h declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain incomes. 15h is filed before filing this declaration during the previous year, mention the total number of such form. Declaration under section 197a(1c) to be made by an individual who.

Form 15H Declaration Download and Fill to Save Tax

15h is filed before filing this declaration during the previous year, mention the total number of such form. Declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain incomes without. In case any declaration(s) in form no. 15h declaration under section 197a(1c) to be made by an individual.

How To Fill Form 15H Tax Form 15H How To Fill Senior Citizen

In case any declaration(s) in form no. 15h is filed before filing this declaration during the previous year, mention the total number of such form. Declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain incomes without. 15h declaration under section 197a(1c) to be made by an individual.

Form 15h Fillable Pdf Fill Online, Printable, Fillable, Blank pdfFiller

Declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain incomes without. In case any declaration(s) in form no. 15h declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain incomes. 15h is filed before filing.

Declaration Under Section 197A(1C) To Be Made By An Individual Who Is Of The Age Of Sixty Years Or More Claiming Certain Incomes Without.

15h is filed before filing this declaration during the previous year, mention the total number of such form. In case any declaration(s) in form no. 15h declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain incomes.