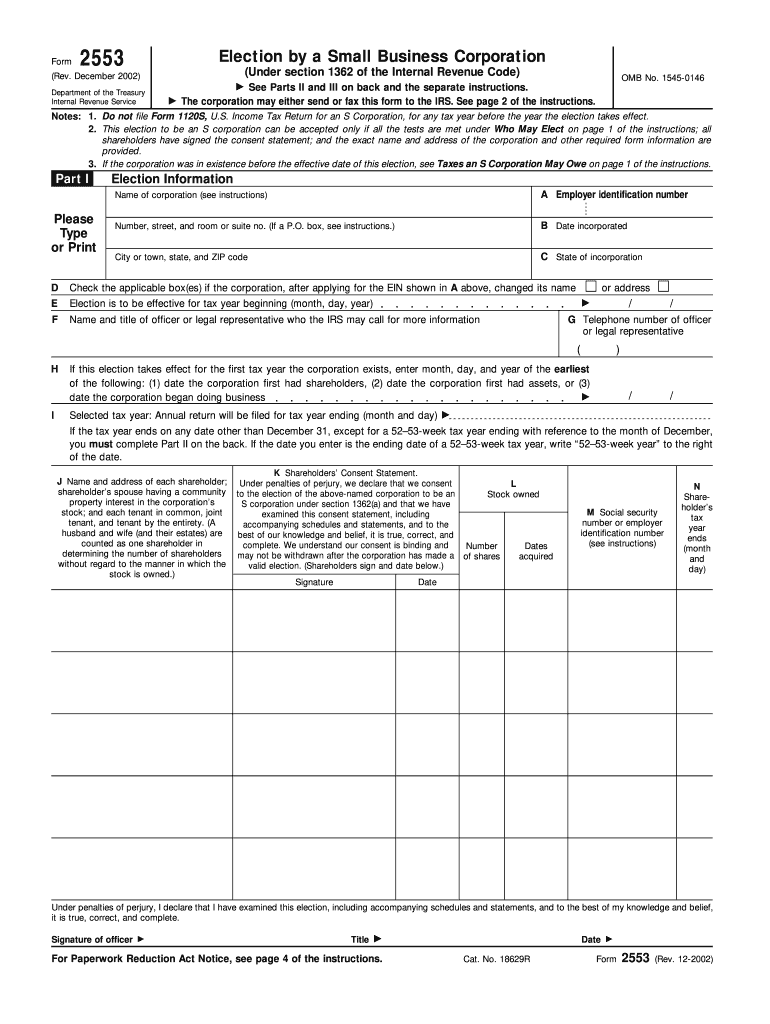

2553 Tax Form

2553 Tax Form - As of the 2018 tax year, form 1040, u.s. Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s corporations. Individual income tax return, is the only form used for personal. Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. What is irs form 2553?

Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s corporations. Individual income tax return, is the only form used for personal. As of the 2018 tax year, form 1040, u.s. Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. What is irs form 2553?

Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s corporations. Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. Individual income tax return, is the only form used for personal. What is irs form 2553? As of the 2018 tax year, form 1040, u.s.

How to Fill in Form 2553 Election by a Small Business Corporation S

Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s corporations. As of the 2018 tax year, form 1040, u.s. What is irs form 2553? Individual income tax return, is the only form used for personal. Business owners who have structured their business as a c corporation (c corp).

Irs 2553 Form S Corporation Irs Tax Forms

Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s corporations. As of the 2018 tax year, form 1040, u.s. Individual income tax return, is the only form used for personal. What is irs form 2553? Business owners who have structured their business as a c corporation (c corp).

How to Fill out IRS Form 2553 EasytoFollow Instructions YouTube

What is irs form 2553? Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. Individual income tax return, is the only form used for personal. Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s corporations. As of the.

Barbara Johnson Blog Form 2553 Instructions How and Where to File

Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. What is irs form 2553? Individual income tax return, is the only form used for personal. Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s corporations. As of the.

IRS Form 2553 Instructions How and Where to File This Tax Form

Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s corporations. Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. Individual income tax return, is the only form used for personal. As of the 2018 tax year, form 1040,.

Learn How to Fill the Form 2553 Election by a Small Business

Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. Individual income tax return, is the only form used for personal. As of the 2018 tax year, form 1040, u.s. Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s.

Form 2553 Election by a Small Business Corporation (2014) Free Download

What is irs form 2553? Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s corporations. Individual income tax return, is the only form used for personal. Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. As of the.

2002 Form IRS 2553 Fill Online, Printable, Fillable, Blank pdfFiller

As of the 2018 tax year, form 1040, u.s. Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. Individual income tax return, is the only form used for personal. Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s.

Government Templates ONLYOFFICE

Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. Individual income tax return, is the only form used for personal. Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s corporations. As of the 2018 tax year, form 1040,.

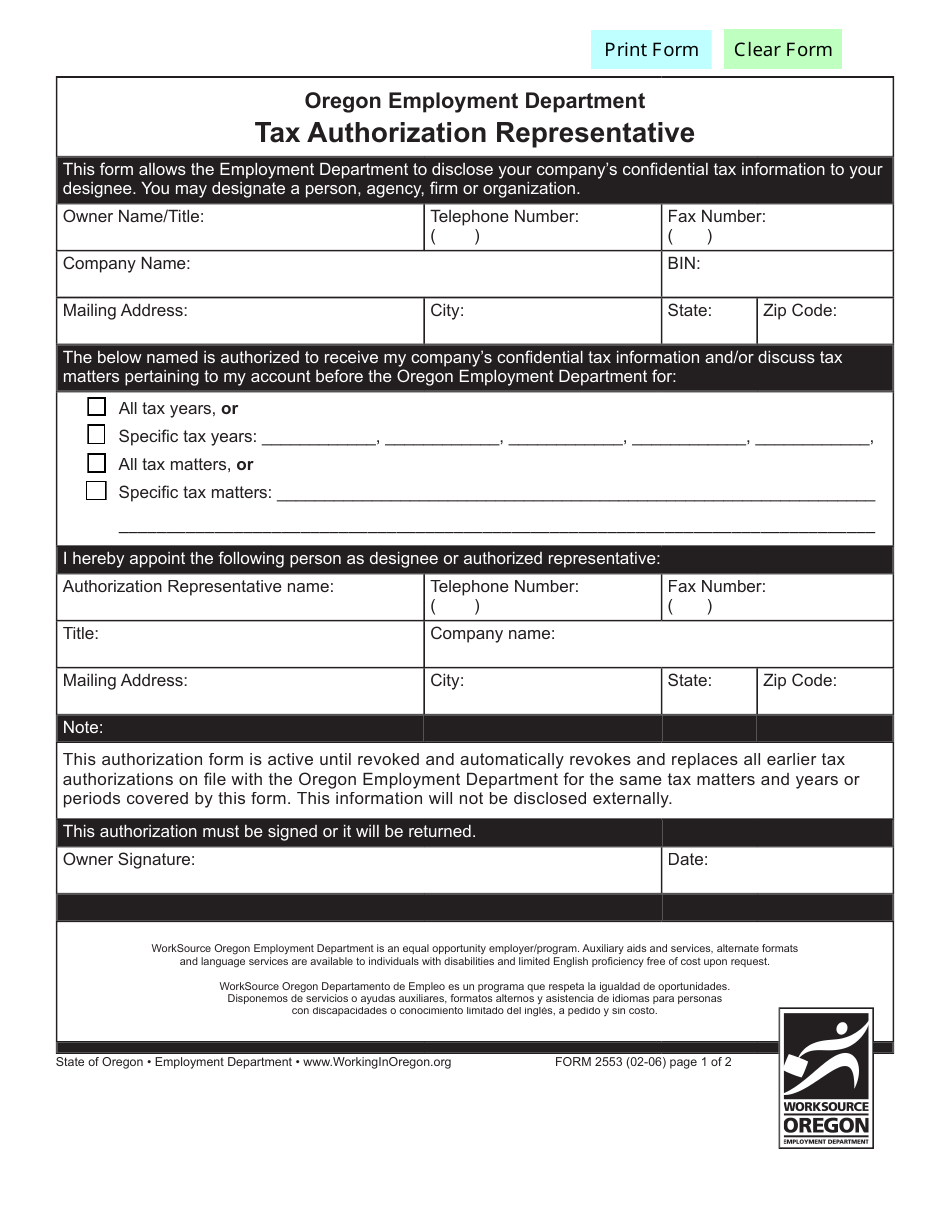

Form 2553 Fill Out, Sign Online and Download Fillable PDF, Oregon

Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s corporations. Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. What is irs form 2553? As of the 2018 tax year, form 1040, u.s. Individual income tax return, is.

Form 2553 Is The Irs Form For Small Business Corporations And Limited Liability Companies To Elect To Be Treated As S Corporations.

What is irs form 2553? As of the 2018 tax year, form 1040, u.s. Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. Individual income tax return, is the only form used for personal.