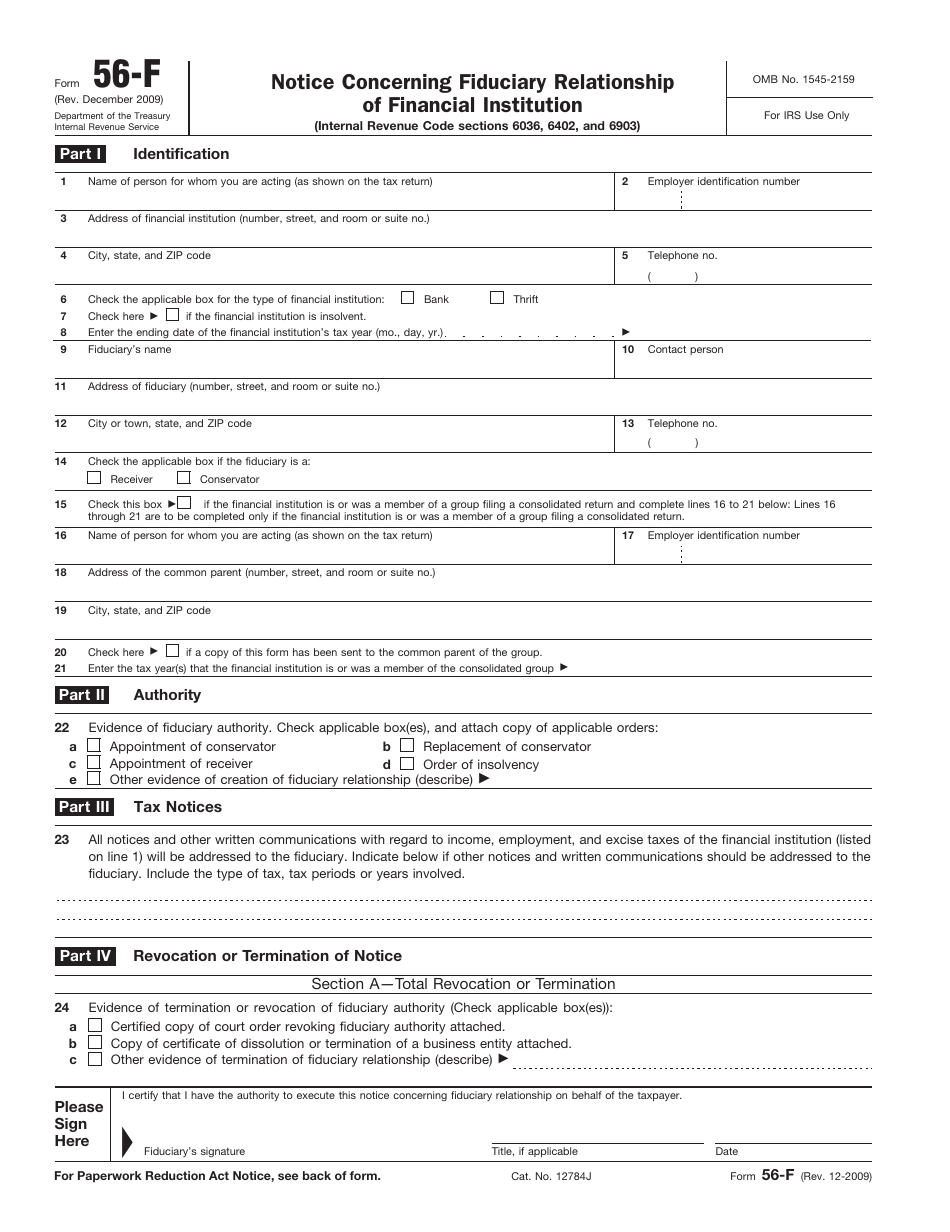

56 F Form

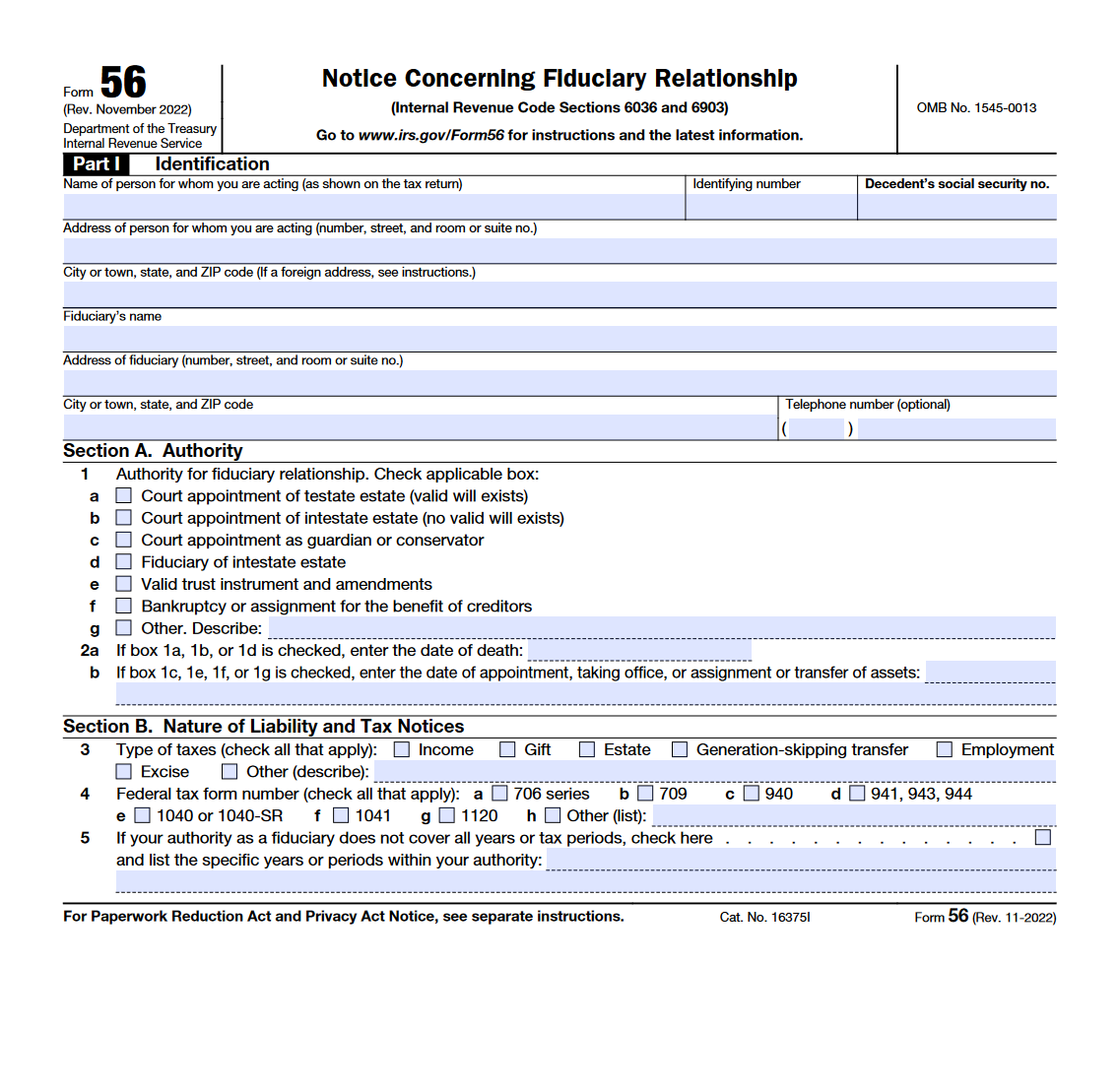

56 F Form - Form 56 is used to inform the irs that a person in acting for another person in a fiduciary capacity so that the irs may mail tax notices to the fiduciary concerning the person for whom he/she is acting. The form must also be filed in every subsequent tax year that the. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift).

The form must also be filed in every subsequent tax year that the. Form 56 is used to inform the irs that a person in acting for another person in a fiduciary capacity so that the irs may mail tax notices to the fiduciary concerning the person for whom he/she is acting. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift).

Form 56 is used to inform the irs that a person in acting for another person in a fiduciary capacity so that the irs may mail tax notices to the fiduciary concerning the person for whom he/she is acting. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). The form must also be filed in every subsequent tax year that the.

Form 561

Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Form 56 is used to inform the irs that a person in acting for another person in a fiduciary capacity so that the irs may mail tax notices to the fiduciary.

IRS Form 56. Notice Concerning Fiduciary Relationship Forms Docs 2023

Form 56 is used to inform the irs that a person in acting for another person in a fiduciary capacity so that the irs may mail tax notices to the fiduciary concerning the person for whom he/she is acting. The form must also be filed in every subsequent tax year that the. Use this form to notify the irs of.

BSF Constable Tradesmen Recruitment Online Form 2023, Short

Form 56 is used to inform the irs that a person in acting for another person in a fiduciary capacity so that the irs may mail tax notices to the fiduciary concerning the person for whom he/she is acting. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial.

Svalk børstetætningsliste Fform 2114 mm 3 m

Form 56 is used to inform the irs that a person in acting for another person in a fiduciary capacity so that the irs may mail tax notices to the fiduciary concerning the person for whom he/she is acting. The form must also be filed in every subsequent tax year that the. Use this form to notify the irs of.

IRS Form 56 YOU appoints You as Fiduciary over the SSN Account YouTube

Form 56 is used to inform the irs that a person in acting for another person in a fiduciary capacity so that the irs may mail tax notices to the fiduciary concerning the person for whom he/she is acting. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial.

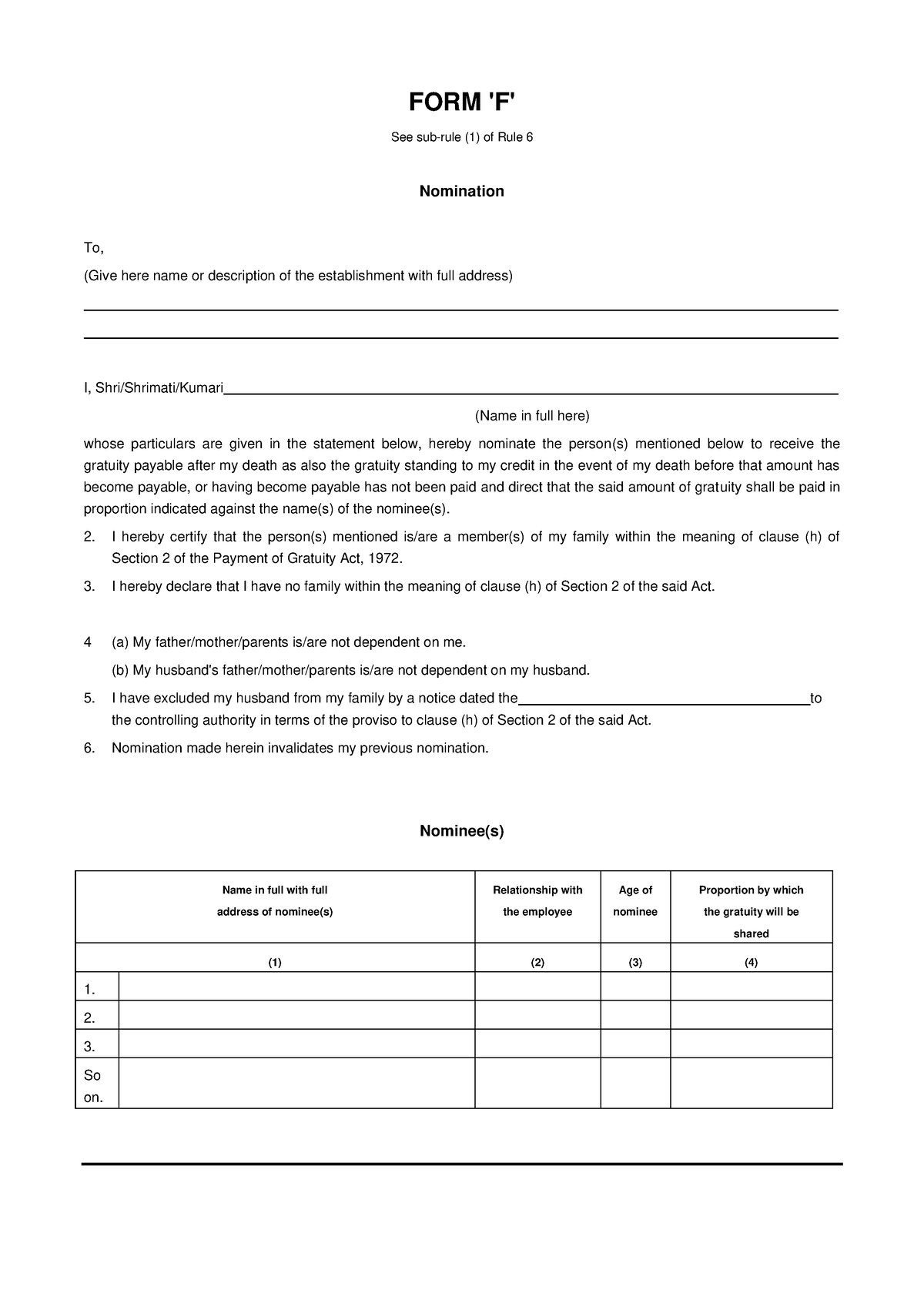

Form F FORM 'F' See subrule (1) of Rule 6 Nomination To, (Give here

The form must also be filed in every subsequent tax year that the. Form 56 is used to inform the irs that a person in acting for another person in a fiduciary capacity so that the irs may mail tax notices to the fiduciary concerning the person for whom he/she is acting. Use this form to notify the irs of.

IRS Form 56F Instructions Fiduciary of a Financial Institution

The form must also be filed in every subsequent tax year that the. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Form 56 is used to inform the irs that a person in acting for another person in a.

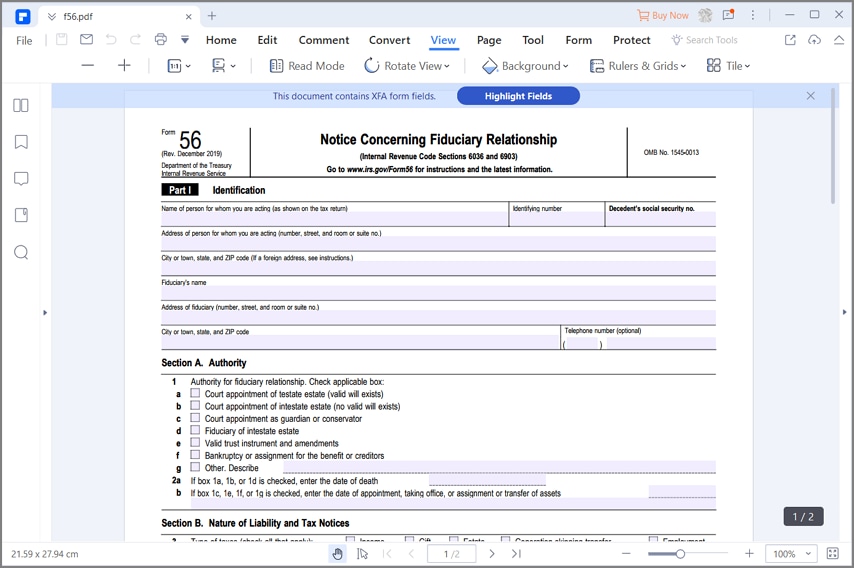

Form 56 Fillable Pd Printable Forms Free Online

The form must also be filed in every subsequent tax year that the. Form 56 is used to inform the irs that a person in acting for another person in a fiduciary capacity so that the irs may mail tax notices to the fiduciary concerning the person for whom he/she is acting. Use this form to notify the irs of.

A Look at the IR56F Form in Hong Kong HKWJ Tax Law

Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). The form must also be filed in every subsequent tax year that the. Form 56 is used to inform the irs that a person in acting for another person in a.

IRS Form 56F Fill Out, Sign Online and Download Fillable PDF

The form must also be filed in every subsequent tax year that the. Form 56 is used to inform the irs that a person in acting for another person in a fiduciary capacity so that the irs may mail tax notices to the fiduciary concerning the person for whom he/she is acting. Use this form to notify the irs of.

The Form Must Also Be Filed In Every Subsequent Tax Year That The.

Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Form 56 is used to inform the irs that a person in acting for another person in a fiduciary capacity so that the irs may mail tax notices to the fiduciary concerning the person for whom he/she is acting.