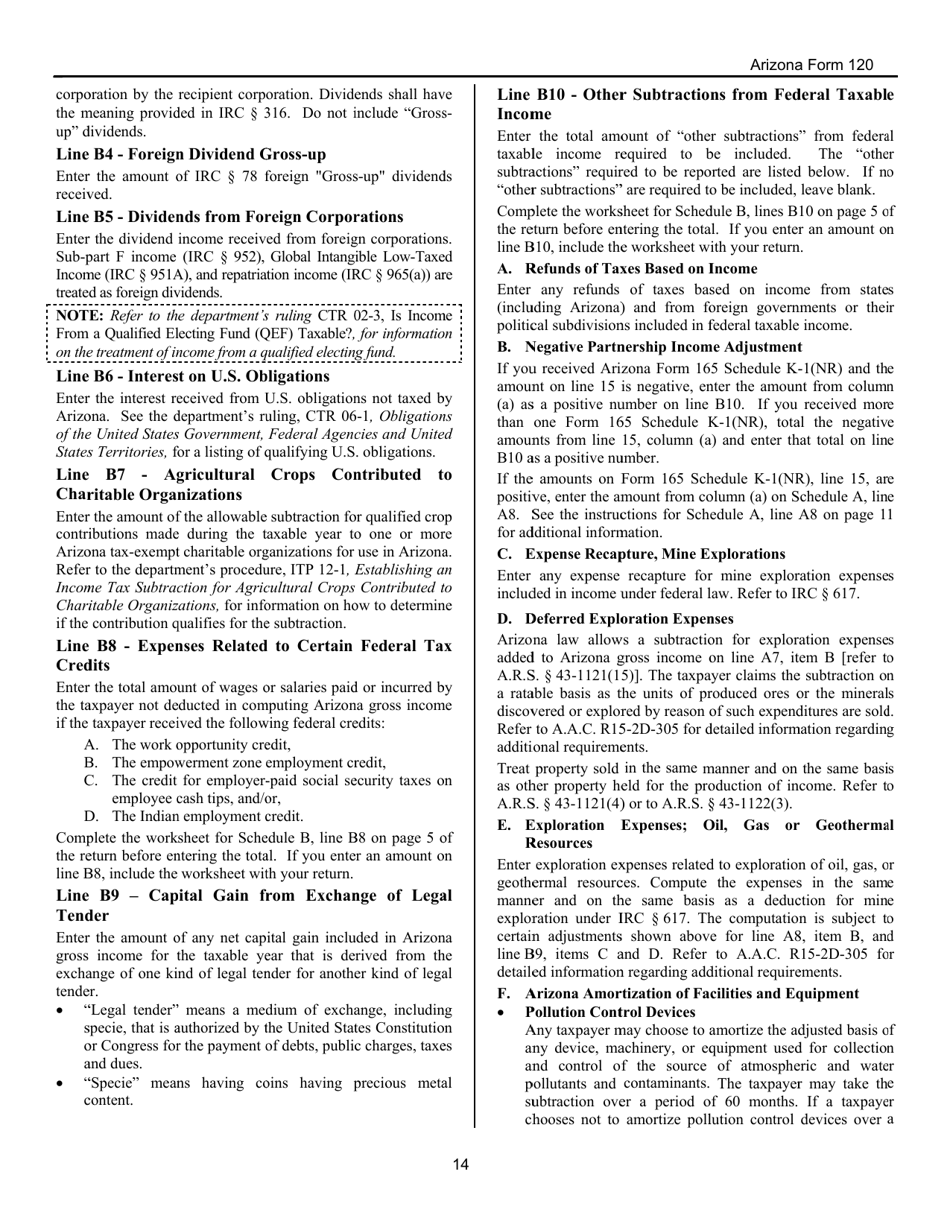

Arizona Form 120 Instructions

Arizona Form 120 Instructions - Corporations taxed as s corporations under subchapter s of the internal revenue code. • has income from business activity that is taxable in more than one state (a “multistate. 21 rows find the forms and instructions for filing arizona corporate income tax returns, including form 120, form 120/165,. This form is used to report. Who must use arizona form 120s. Complete arizona form 120 if the corporation: Corporations in arizona typically file their income tax returns using form 120 arizona corporation income tax return. Completing arizona form 120/165es complete form 120/165es in its entirety to ensure the proper application of the estimated tax.

Who must use arizona form 120s. Complete arizona form 120 if the corporation: Corporations in arizona typically file their income tax returns using form 120 arizona corporation income tax return. Completing arizona form 120/165es complete form 120/165es in its entirety to ensure the proper application of the estimated tax. Corporations taxed as s corporations under subchapter s of the internal revenue code. • has income from business activity that is taxable in more than one state (a “multistate. 21 rows find the forms and instructions for filing arizona corporate income tax returns, including form 120, form 120/165,. This form is used to report.

Complete arizona form 120 if the corporation: Corporations in arizona typically file their income tax returns using form 120 arizona corporation income tax return. 21 rows find the forms and instructions for filing arizona corporate income tax returns, including form 120, form 120/165,. This form is used to report. Corporations taxed as s corporations under subchapter s of the internal revenue code. • has income from business activity that is taxable in more than one state (a “multistate. Who must use arizona form 120s. Completing arizona form 120/165es complete form 120/165es in its entirety to ensure the proper application of the estimated tax.

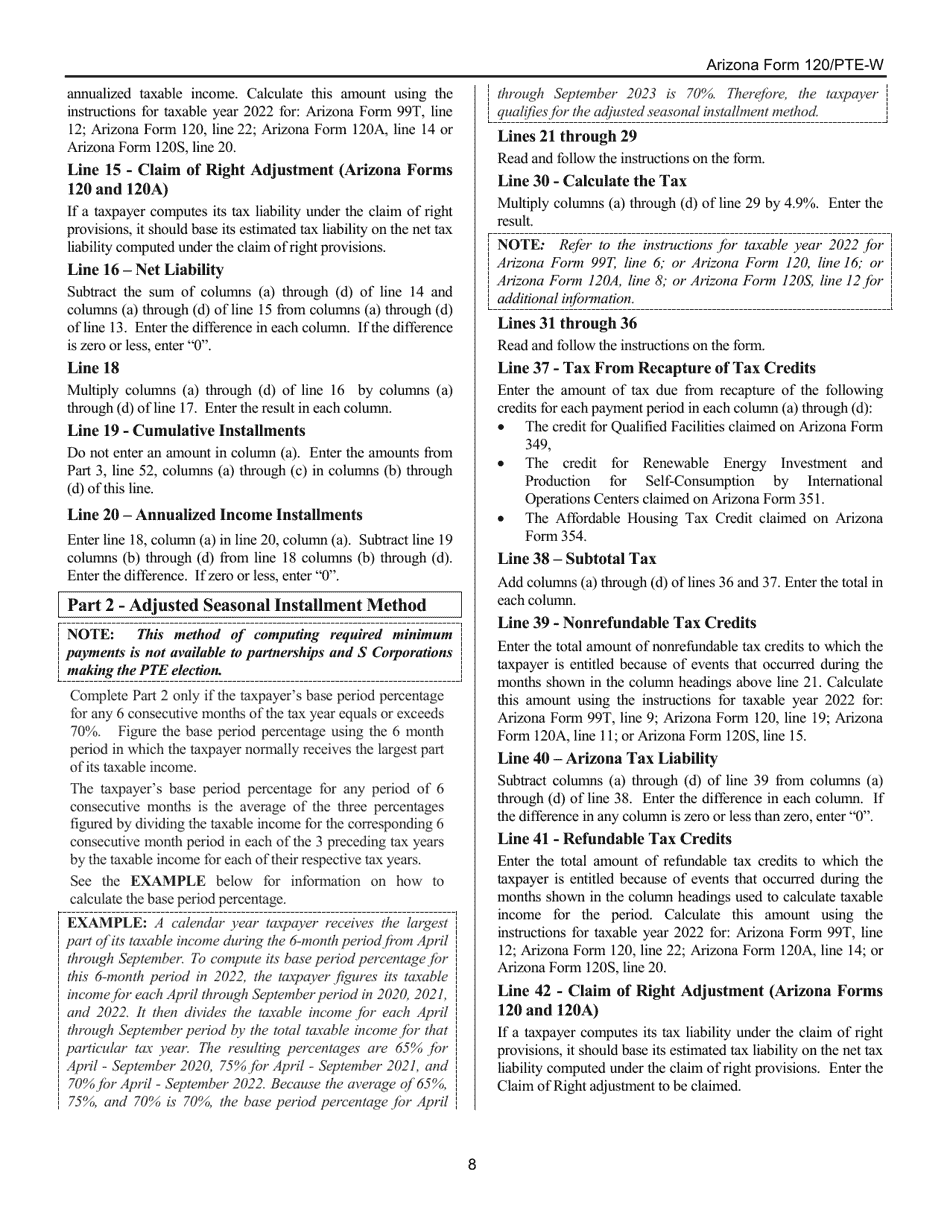

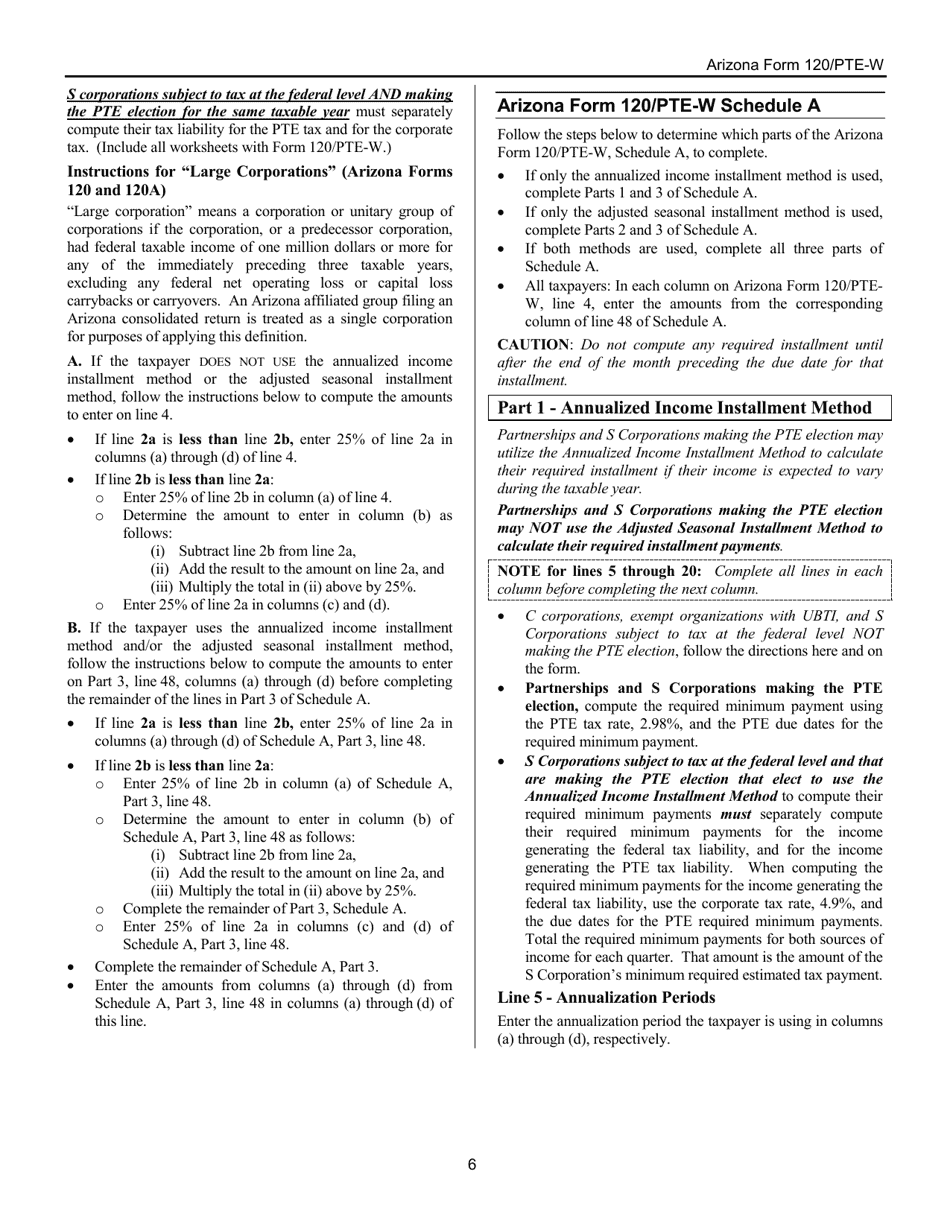

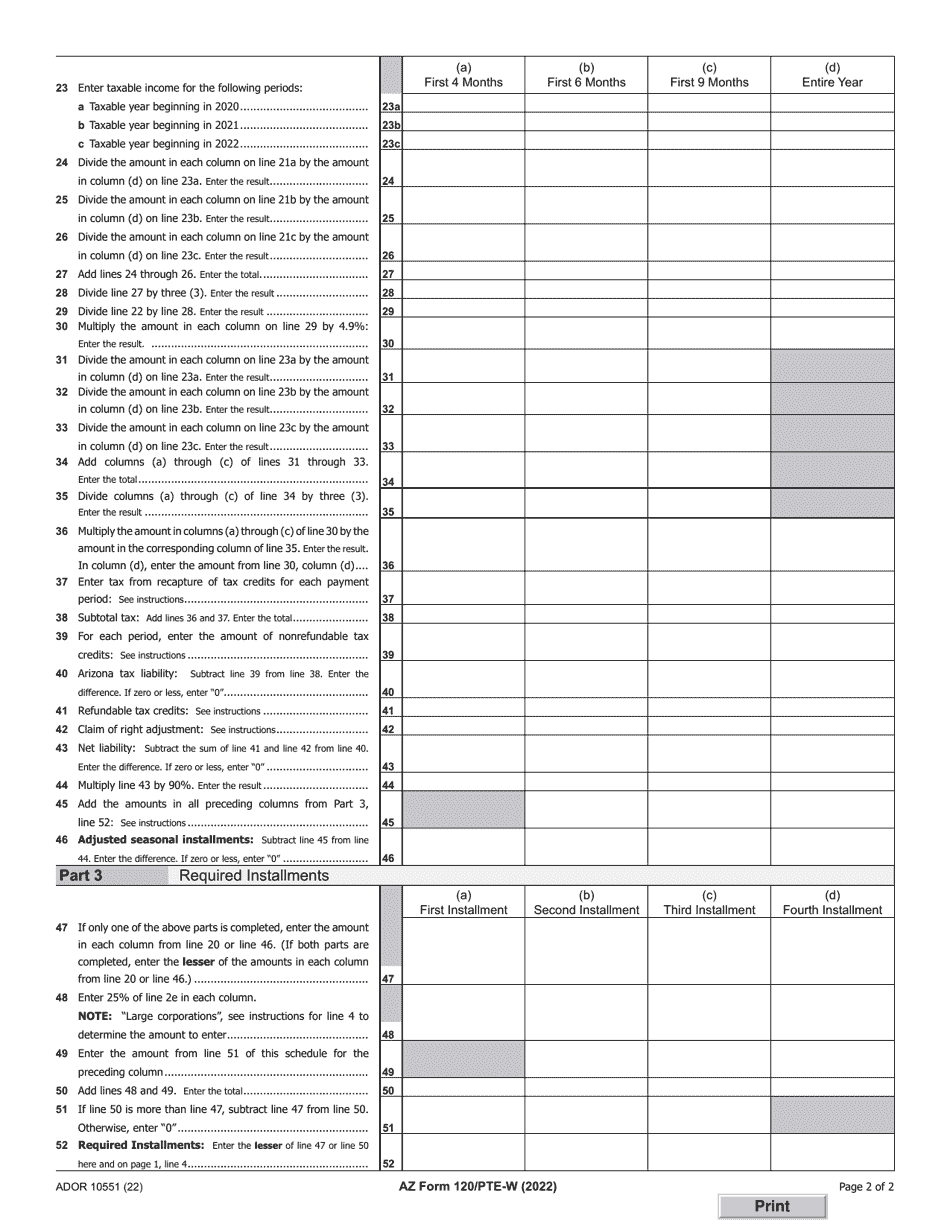

Download Instructions for Arizona Form 120/PTEW, ADOR10551 Estimated

• has income from business activity that is taxable in more than one state (a “multistate. Completing arizona form 120/165es complete form 120/165es in its entirety to ensure the proper application of the estimated tax. Who must use arizona form 120s. 21 rows find the forms and instructions for filing arizona corporate income tax returns, including form 120, form 120/165,..

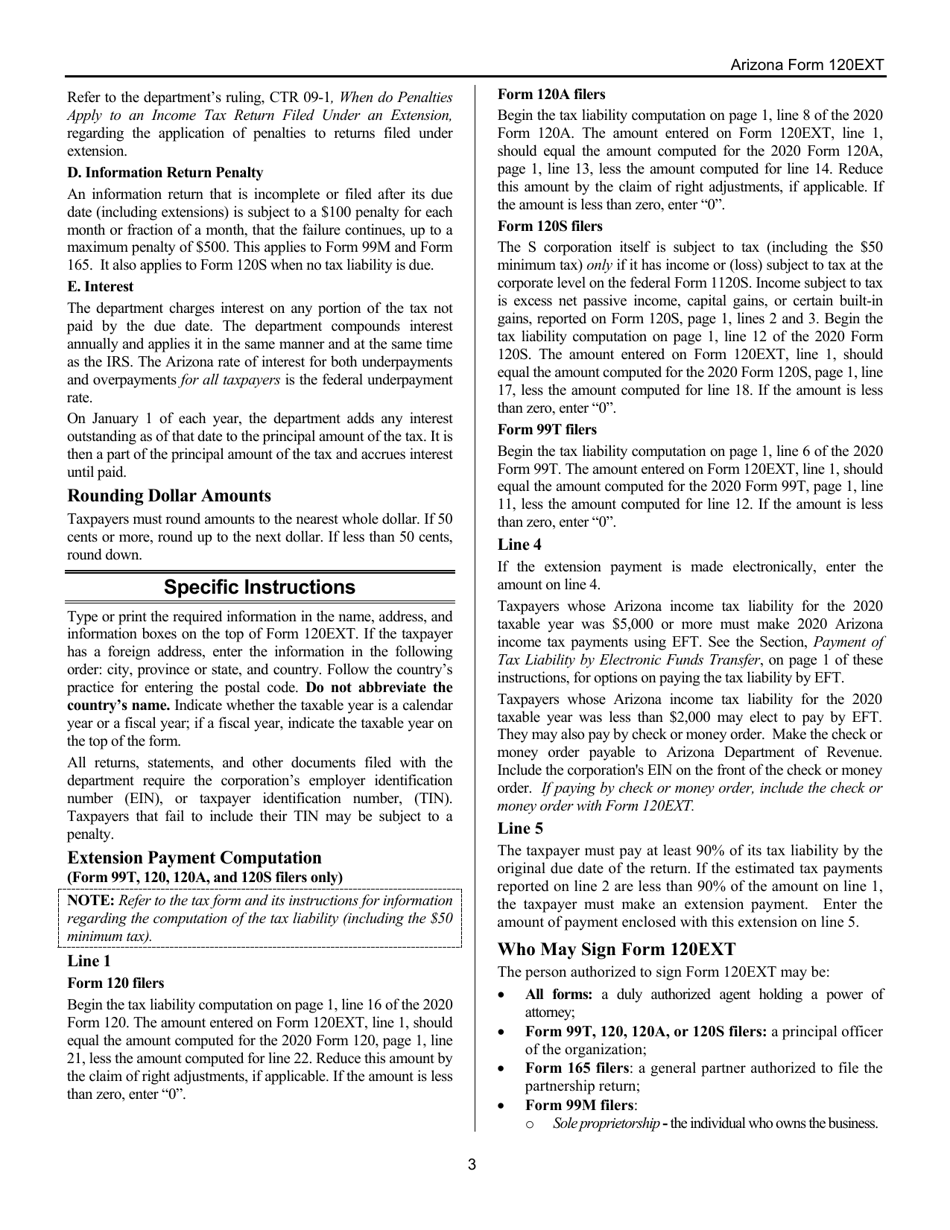

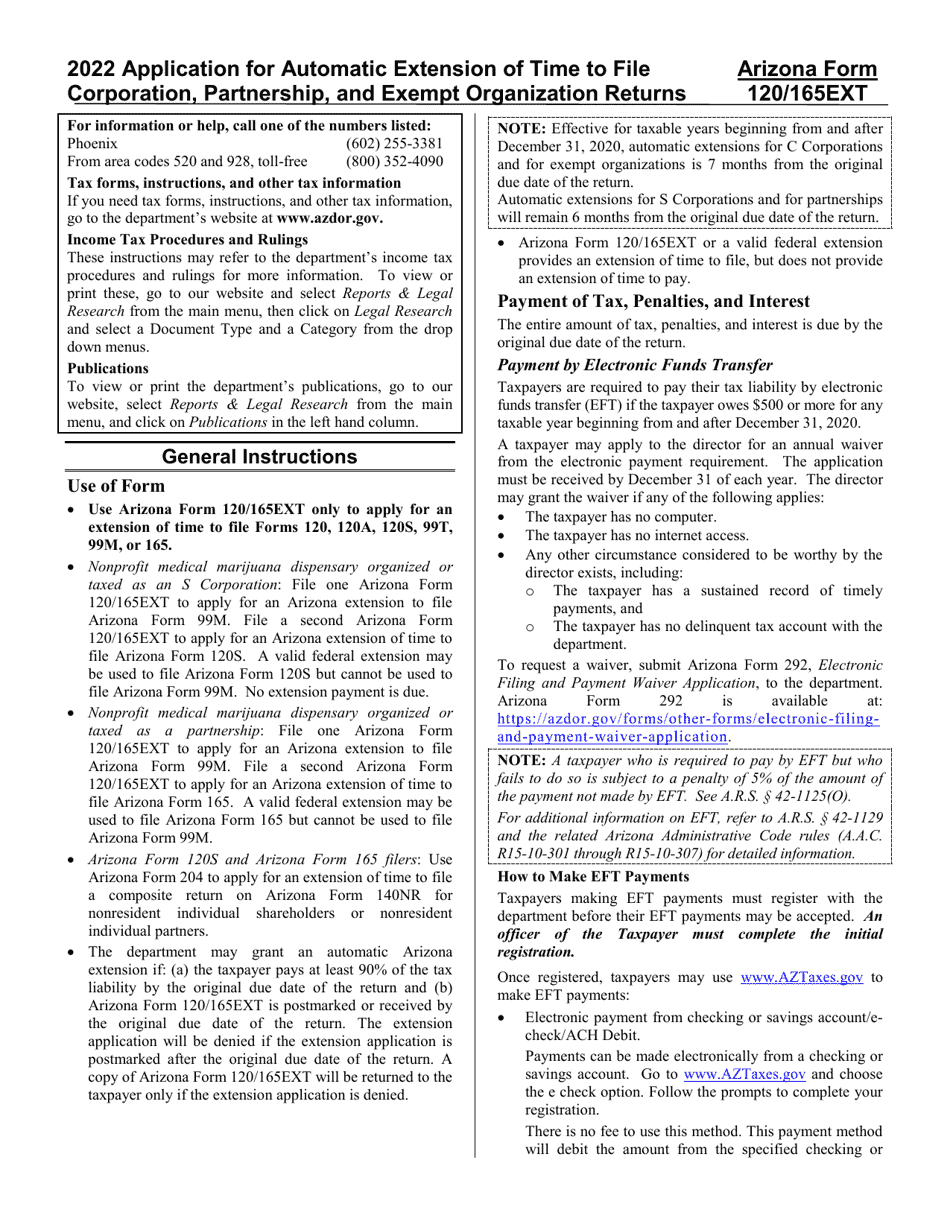

Download Instructions for Arizona Form 120EXT, ADOR10340 Application

Corporations in arizona typically file their income tax returns using form 120 arizona corporation income tax return. • has income from business activity that is taxable in more than one state (a “multistate. This form is used to report. Completing arizona form 120/165es complete form 120/165es in its entirety to ensure the proper application of the estimated tax. Corporations taxed.

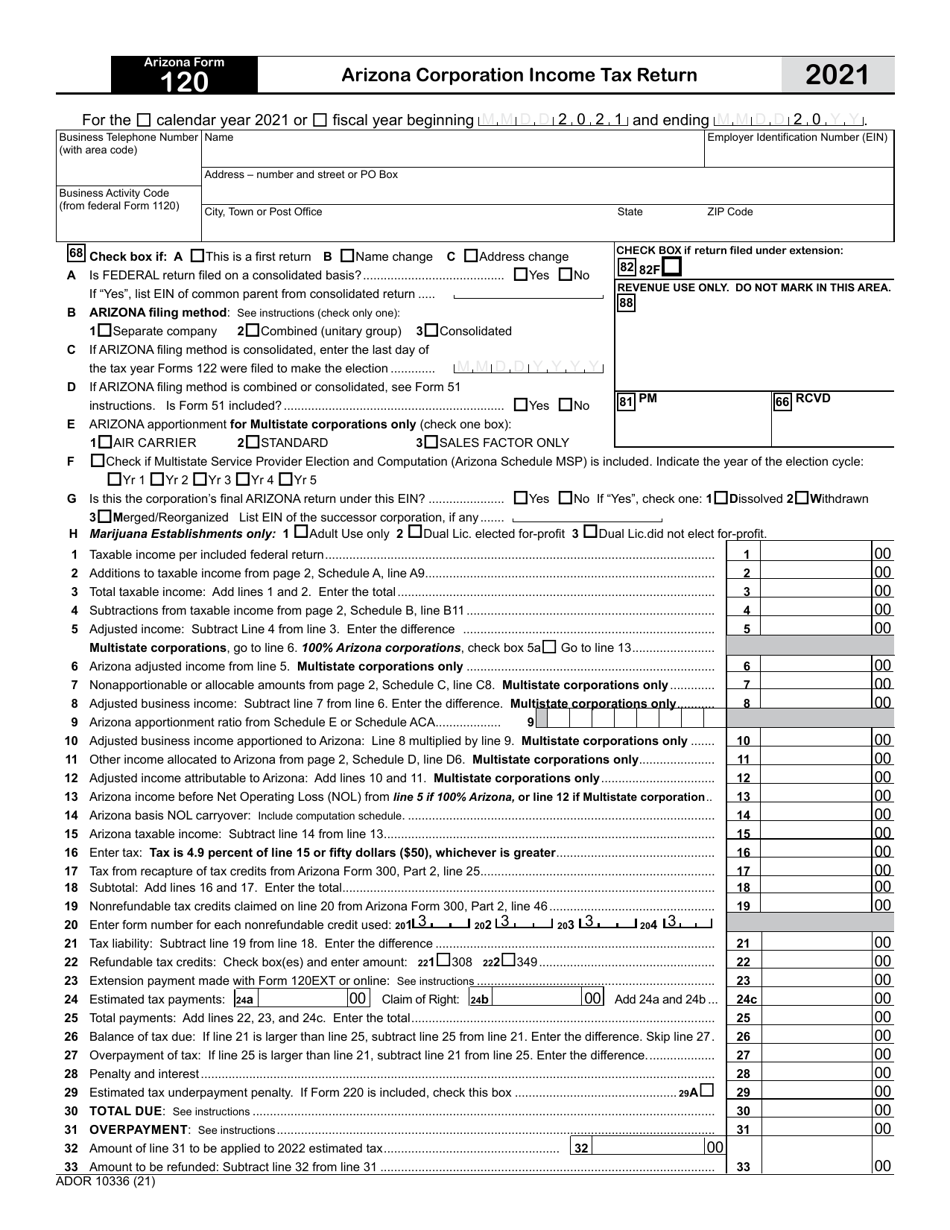

Arizona Form 120 (ADOR10336) Download Fillable PDF or Fill Online

• has income from business activity that is taxable in more than one state (a “multistate. Corporations in arizona typically file their income tax returns using form 120 arizona corporation income tax return. Corporations taxed as s corporations under subchapter s of the internal revenue code. 21 rows find the forms and instructions for filing arizona corporate income tax returns,.

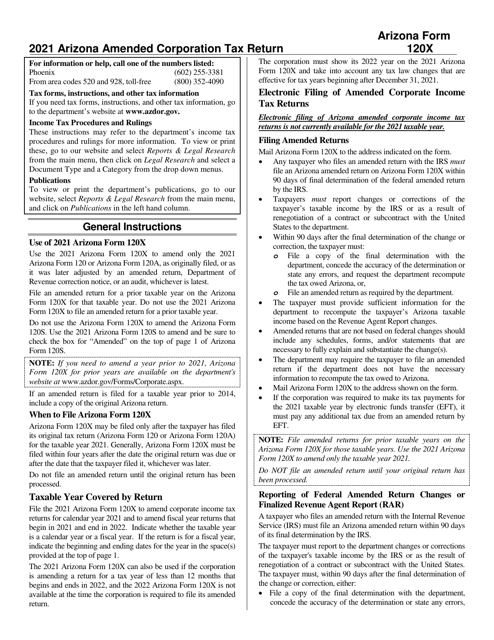

Download Instructions for Arizona Form 120X, ADOR10341 Arizona Amended

• has income from business activity that is taxable in more than one state (a “multistate. Complete arizona form 120 if the corporation: This form is used to report. Who must use arizona form 120s. Corporations in arizona typically file their income tax returns using form 120 arizona corporation income tax return.

Download Instructions for Arizona Form 120 Arizona Corporation

21 rows find the forms and instructions for filing arizona corporate income tax returns, including form 120, form 120/165,. Corporations taxed as s corporations under subchapter s of the internal revenue code. This form is used to report. Corporations in arizona typically file their income tax returns using form 120 arizona corporation income tax return. • has income from business.

Download Instructions for Arizona Form 120/PTEW, ADOR10551 Estimated

Corporations in arizona typically file their income tax returns using form 120 arizona corporation income tax return. 21 rows find the forms and instructions for filing arizona corporate income tax returns, including form 120, form 120/165,. Who must use arizona form 120s. Corporations taxed as s corporations under subchapter s of the internal revenue code. Complete arizona form 120 if.

Arizona Form 120/PTEW (ADOR10551) 2023 Fill Out, Sign Online and

This form is used to report. Complete arizona form 120 if the corporation: Who must use arizona form 120s. Corporations in arizona typically file their income tax returns using form 120 arizona corporation income tax return. Completing arizona form 120/165es complete form 120/165es in its entirety to ensure the proper application of the estimated tax.

Arizona Form A4 2023 Printable Forms Free Online

Corporations in arizona typically file their income tax returns using form 120 arizona corporation income tax return. Corporations taxed as s corporations under subchapter s of the internal revenue code. Who must use arizona form 120s. Completing arizona form 120/165es complete form 120/165es in its entirety to ensure the proper application of the estimated tax. Complete arizona form 120 if.

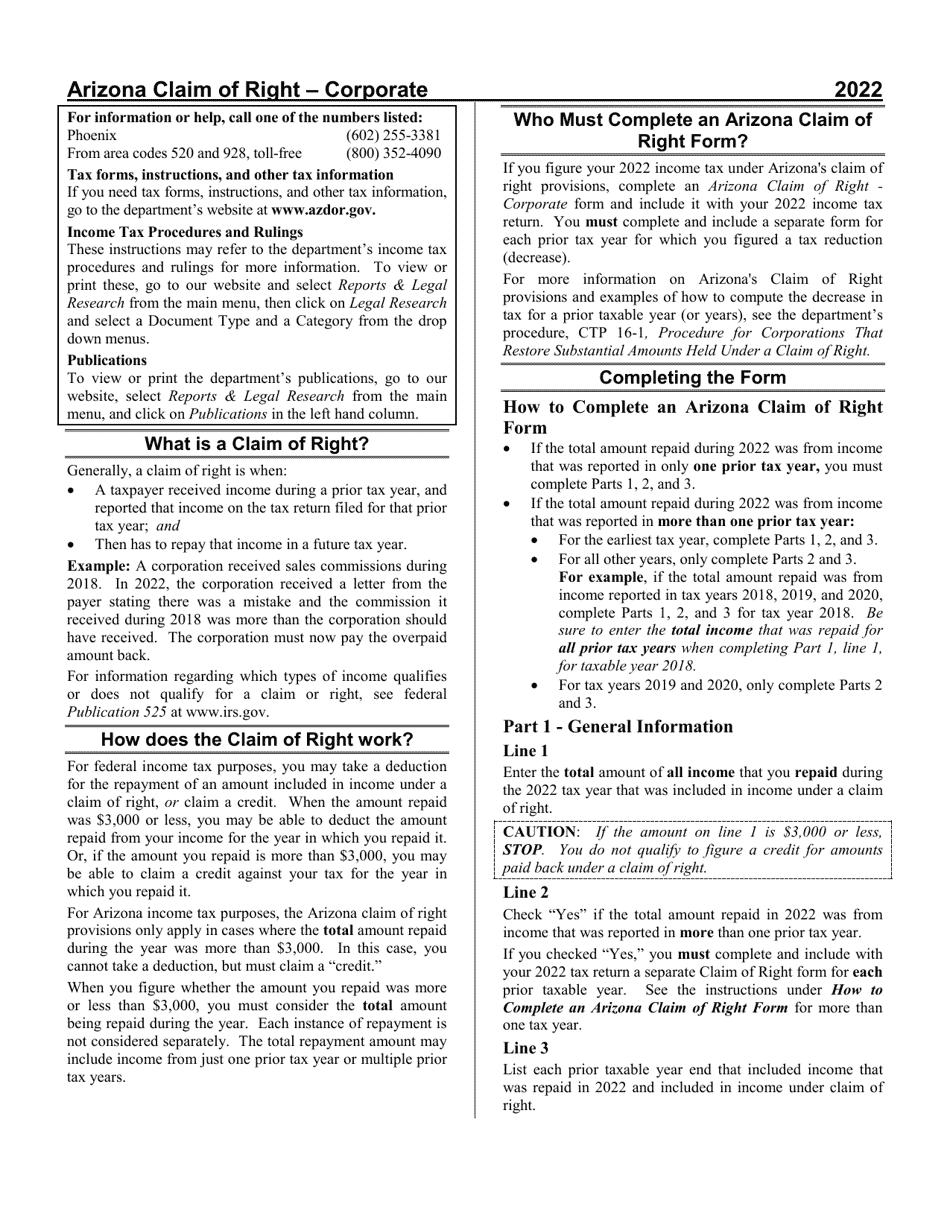

Download Instructions for Arizona Form CLAIM OF RIGHT CORPORATE

Who must use arizona form 120s. Corporations taxed as s corporations under subchapter s of the internal revenue code. • has income from business activity that is taxable in more than one state (a “multistate. This form is used to report. Complete arizona form 120 if the corporation:

Download Instructions for Arizona Form 120/165EXT, ADOR10340

Complete arizona form 120 if the corporation: Completing arizona form 120/165es complete form 120/165es in its entirety to ensure the proper application of the estimated tax. Who must use arizona form 120s. • has income from business activity that is taxable in more than one state (a “multistate. This form is used to report.

Who Must Use Arizona Form 120S.

Complete arizona form 120 if the corporation: Corporations in arizona typically file their income tax returns using form 120 arizona corporation income tax return. Corporations taxed as s corporations under subchapter s of the internal revenue code. Completing arizona form 120/165es complete form 120/165es in its entirety to ensure the proper application of the estimated tax.

This Form Is Used To Report.

• has income from business activity that is taxable in more than one state (a “multistate. 21 rows find the forms and instructions for filing arizona corporate income tax returns, including form 120, form 120/165,.