Arizona Tax Form 321

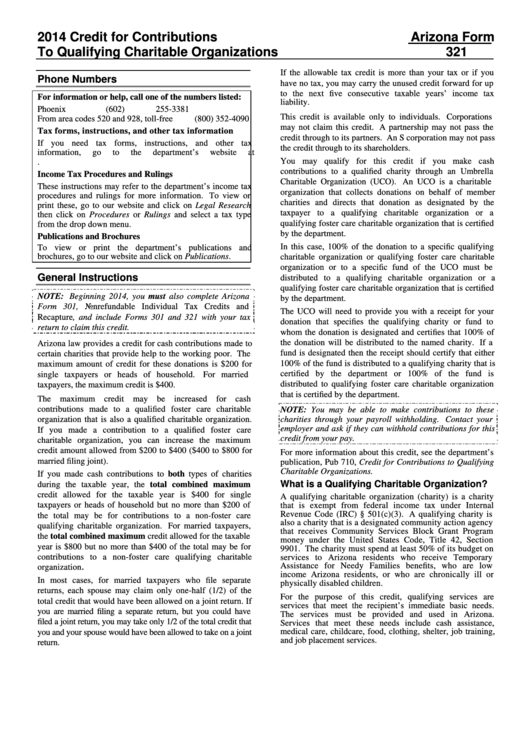

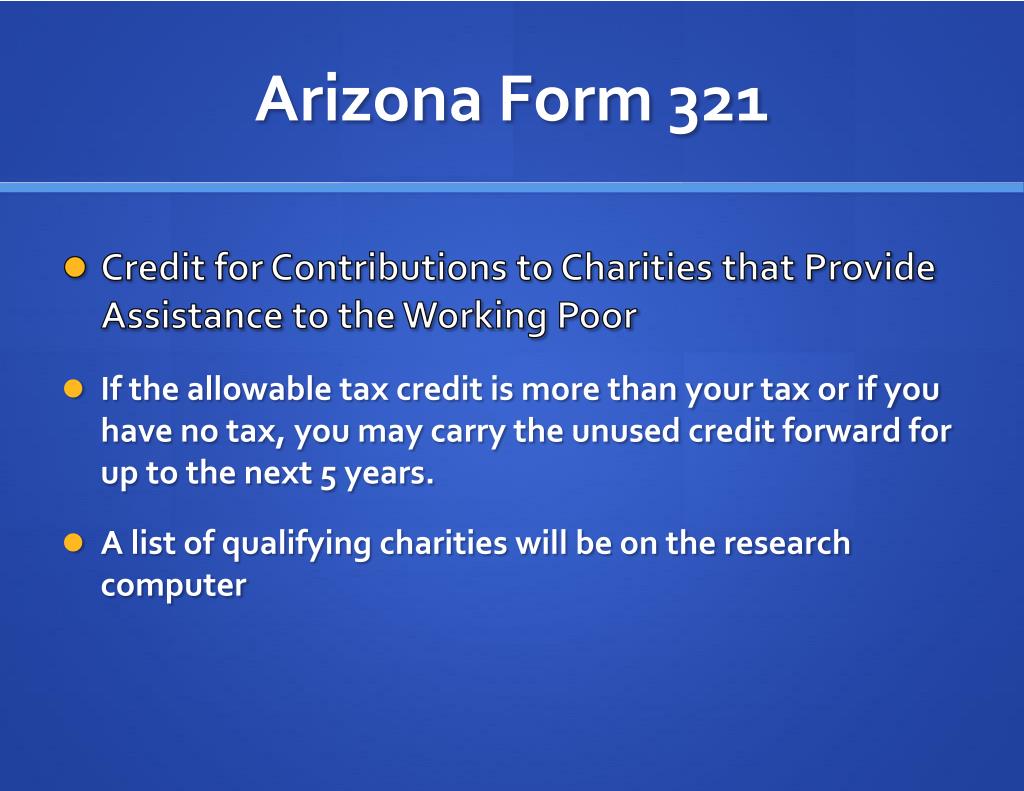

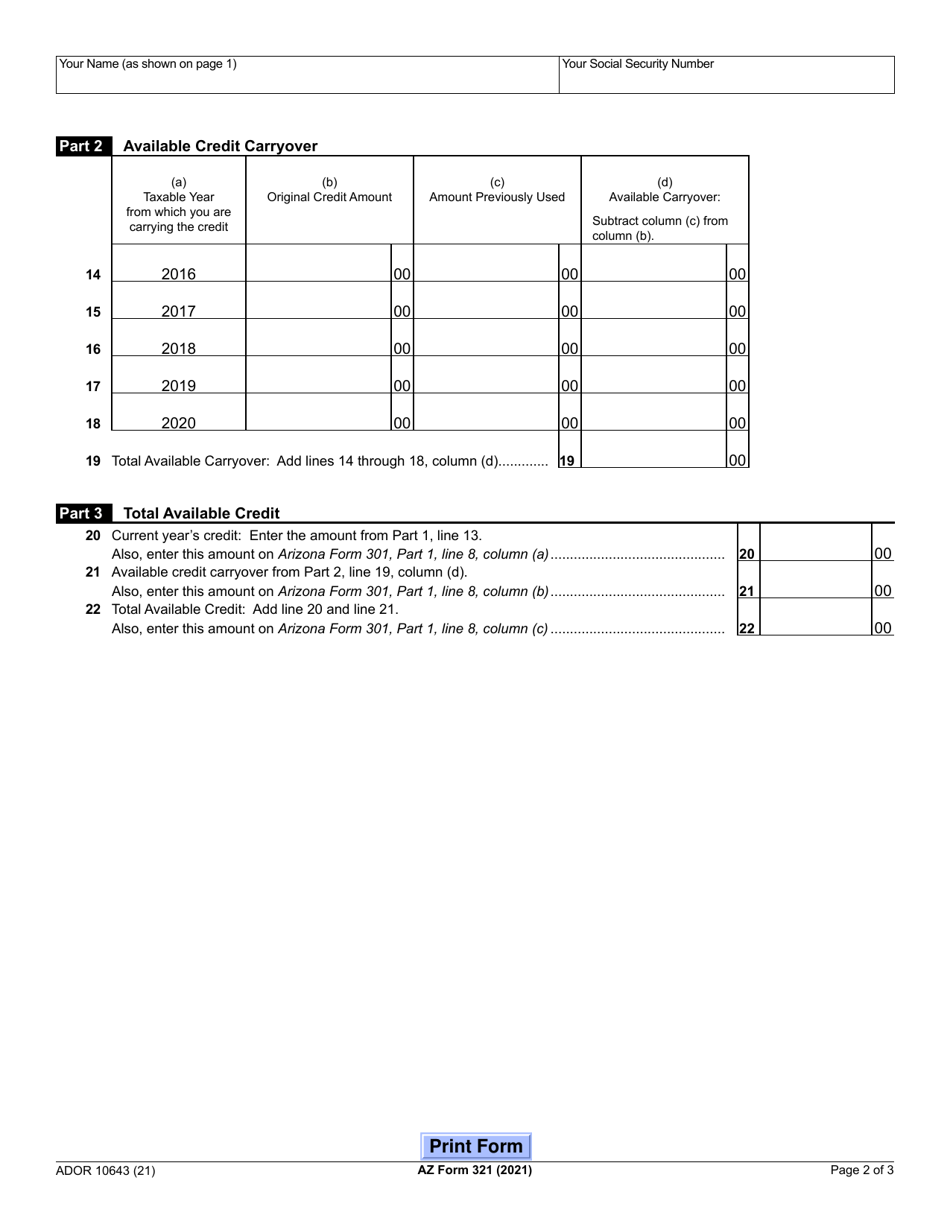

Arizona Tax Form 321 - Arizona department of revenue subject: Credit for contributions to charities that provide assistance to the. The maximum qco credit donation amount for. Credit for contributions to charities that provide assistance to the. To claim your arizona charitable tax credit after donating to an eligible charitable organization, fill out arizona form 321 and include it with your. If the allowable tax credit is more than your tax or if you have no tax, you may carry the unused credit forward for up to the next five. Arizona department of revenue subject: Az form 321 credit for contributions to qualifying charitable organizations. 13 rows a nonrefundable individual tax credit for voluntary cash contributions to a qualifying charitable organization (qco).

Arizona department of revenue subject: 13 rows a nonrefundable individual tax credit for voluntary cash contributions to a qualifying charitable organization (qco). Credit for contributions to charities that provide assistance to the. Arizona department of revenue subject: If the allowable tax credit is more than your tax or if you have no tax, you may carry the unused credit forward for up to the next five. Az form 321 credit for contributions to qualifying charitable organizations. The maximum qco credit donation amount for. Credit for contributions to charities that provide assistance to the. To claim your arizona charitable tax credit after donating to an eligible charitable organization, fill out arizona form 321 and include it with your.

Credit for contributions to charities that provide assistance to the. If the allowable tax credit is more than your tax or if you have no tax, you may carry the unused credit forward for up to the next five. Credit for contributions to charities that provide assistance to the. To claim your arizona charitable tax credit after donating to an eligible charitable organization, fill out arizona form 321 and include it with your. The maximum qco credit donation amount for. Az form 321 credit for contributions to qualifying charitable organizations. 13 rows a nonrefundable individual tax credit for voluntary cash contributions to a qualifying charitable organization (qco). Arizona department of revenue subject: Arizona department of revenue subject:

Arizona Tax Form 2024 Wilie Julianna

If the allowable tax credit is more than your tax or if you have no tax, you may carry the unused credit forward for up to the next five. To claim your arizona charitable tax credit after donating to an eligible charitable organization, fill out arizona form 321 and include it with your. 13 rows a nonrefundable individual tax credit.

Instructions For Form 321 Credit For Contributions To Qualifying

Arizona department of revenue subject: 13 rows a nonrefundable individual tax credit for voluntary cash contributions to a qualifying charitable organization (qco). Arizona department of revenue subject: Az form 321 credit for contributions to qualifying charitable organizations. The maximum qco credit donation amount for.

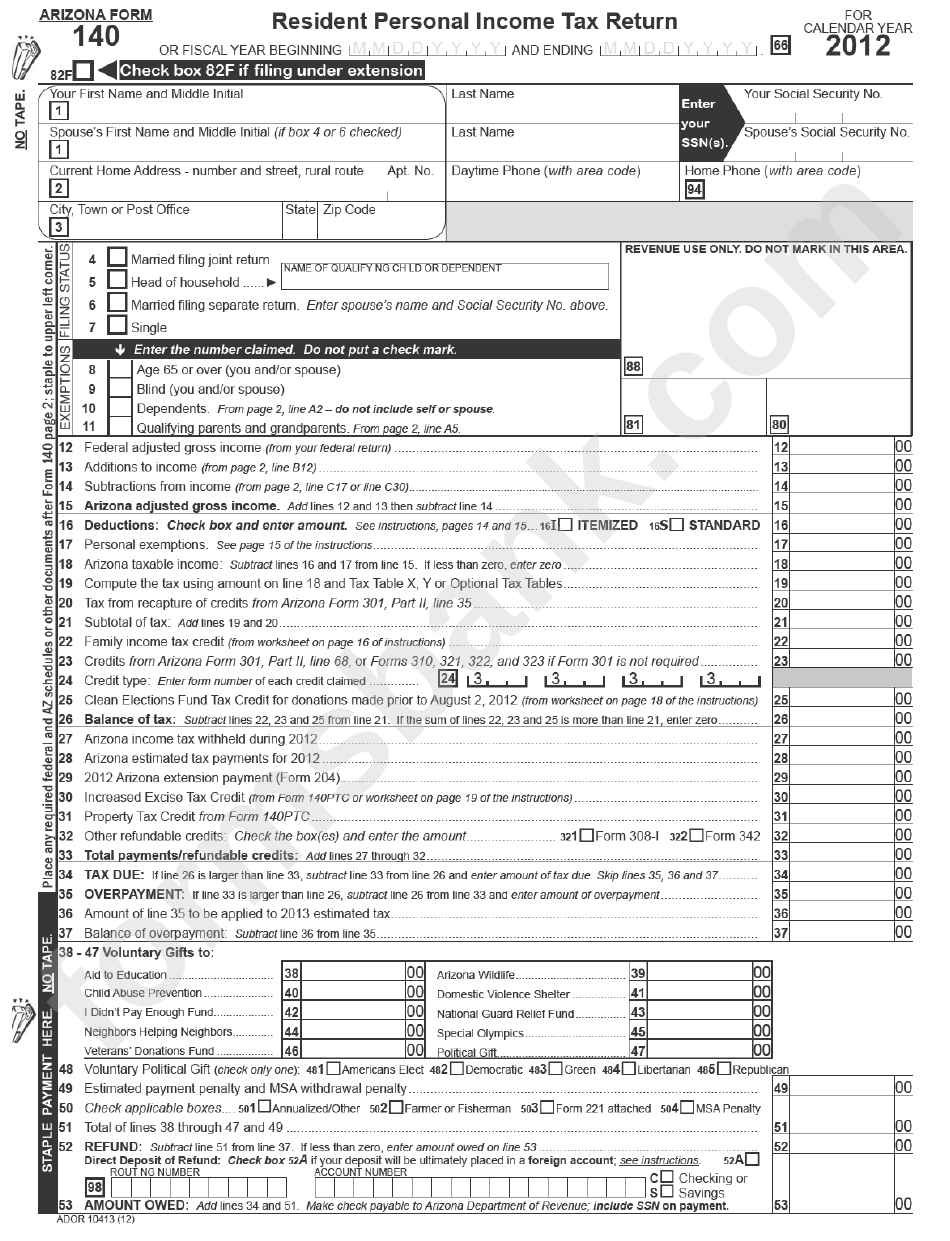

Arizona Fillable Tax Form 140a Printable Forms Free Online

The maximum qco credit donation amount for. Arizona department of revenue subject: Az form 321 credit for contributions to qualifying charitable organizations. Arizona department of revenue subject: Credit for contributions to charities that provide assistance to the.

PPT Arizona State Tax Return 2012 PowerPoint Presentation, free

13 rows a nonrefundable individual tax credit for voluntary cash contributions to a qualifying charitable organization (qco). Credit for contributions to charities that provide assistance to the. The maximum qco credit donation amount for. Arizona department of revenue subject: Arizona department of revenue subject:

Arizona Form 321 (ADOR10643) 2021 Fill Out, Sign Online and

If the allowable tax credit is more than your tax or if you have no tax, you may carry the unused credit forward for up to the next five. Arizona department of revenue subject: Az form 321 credit for contributions to qualifying charitable organizations. To claim your arizona charitable tax credit after donating to an eligible charitable organization, fill out.

Arizona Tax Credit Alert 2019 BeachFleischman CPAs

Az form 321 credit for contributions to qualifying charitable organizations. The maximum qco credit donation amount for. Credit for contributions to charities that provide assistance to the. Arizona department of revenue subject: If the allowable tax credit is more than your tax or if you have no tax, you may carry the unused credit forward for up to the next.

2022 Form AZ DoR A4 Fill Online, Printable, Fillable, Blank pdfFiller

Credit for contributions to charities that provide assistance to the. Arizona department of revenue subject: Az form 321 credit for contributions to qualifying charitable organizations. To claim your arizona charitable tax credit after donating to an eligible charitable organization, fill out arizona form 321 and include it with your. Credit for contributions to charities that provide assistance to the.

Arizona Charitable Tax Credit AZ Form 321 Fill Out and Sign Printable

To claim your arizona charitable tax credit after donating to an eligible charitable organization, fill out arizona form 321 and include it with your. 13 rows a nonrefundable individual tax credit for voluntary cash contributions to a qualifying charitable organization (qco). If the allowable tax credit is more than your tax or if you have no tax, you may carry.

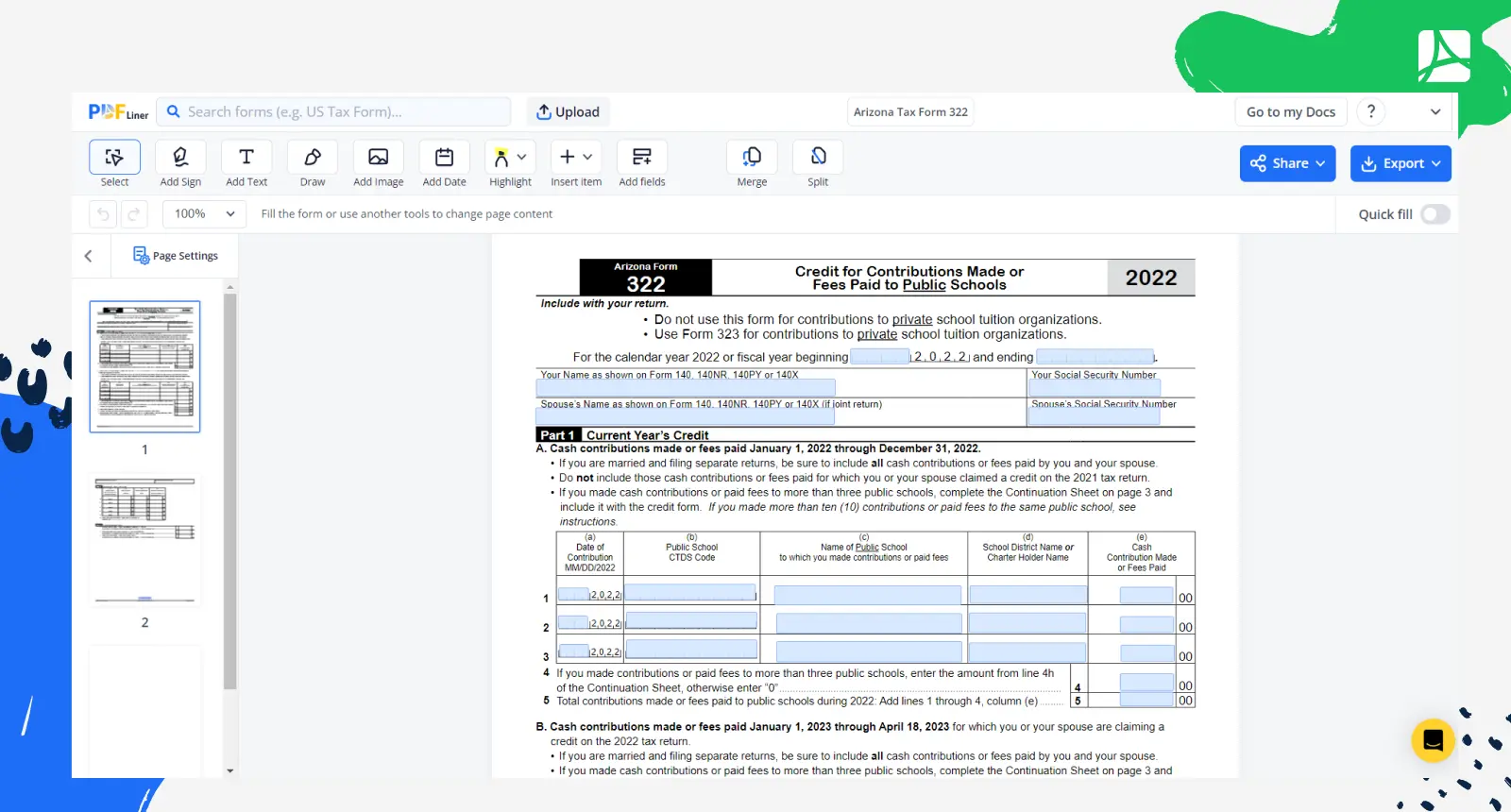

Printable Arizona Tax Form 322 blank, sign forms online — PDFliner

Arizona department of revenue subject: To claim your arizona charitable tax credit after donating to an eligible charitable organization, fill out arizona form 321 and include it with your. Credit for contributions to charities that provide assistance to the. The maximum qco credit donation amount for. Credit for contributions to charities that provide assistance to the.

Arizona form 321 qualifying Fill out & sign online DocHub

Arizona department of revenue subject: Credit for contributions to charities that provide assistance to the. If the allowable tax credit is more than your tax or if you have no tax, you may carry the unused credit forward for up to the next five. The maximum qco credit donation amount for. Arizona department of revenue subject:

Arizona Department Of Revenue Subject:

13 rows a nonrefundable individual tax credit for voluntary cash contributions to a qualifying charitable organization (qco). The maximum qco credit donation amount for. Arizona department of revenue subject: Az form 321 credit for contributions to qualifying charitable organizations.

To Claim Your Arizona Charitable Tax Credit After Donating To An Eligible Charitable Organization, Fill Out Arizona Form 321 And Include It With Your.

Credit for contributions to charities that provide assistance to the. If the allowable tax credit is more than your tax or if you have no tax, you may carry the unused credit forward for up to the next five. Credit for contributions to charities that provide assistance to the.