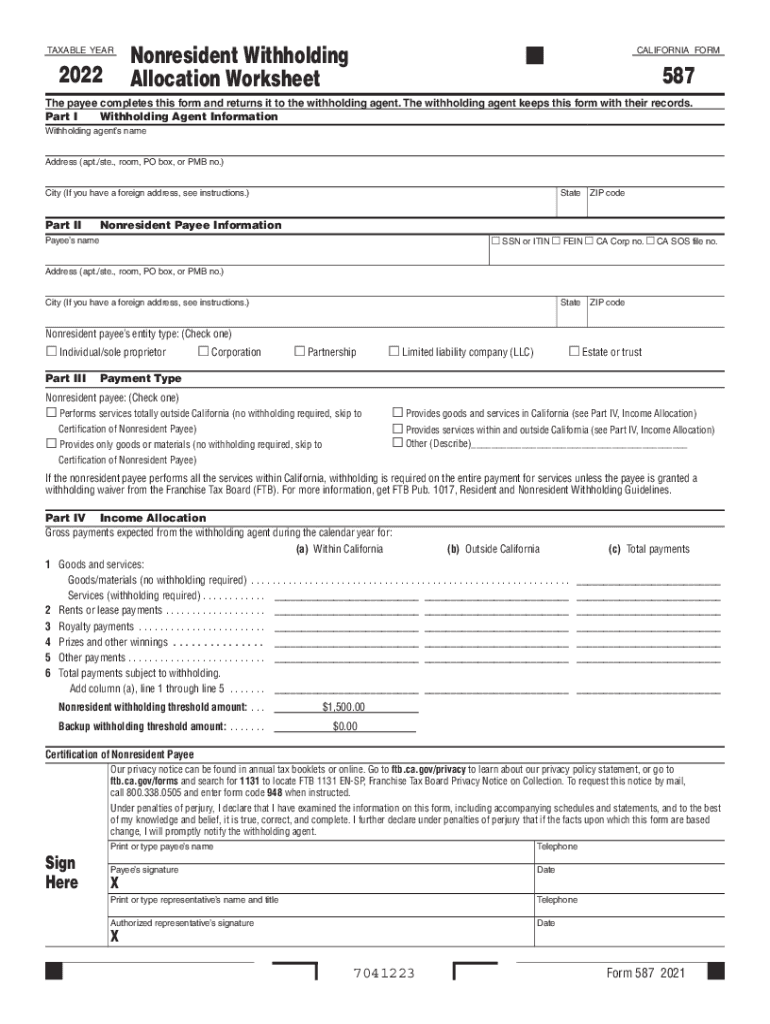

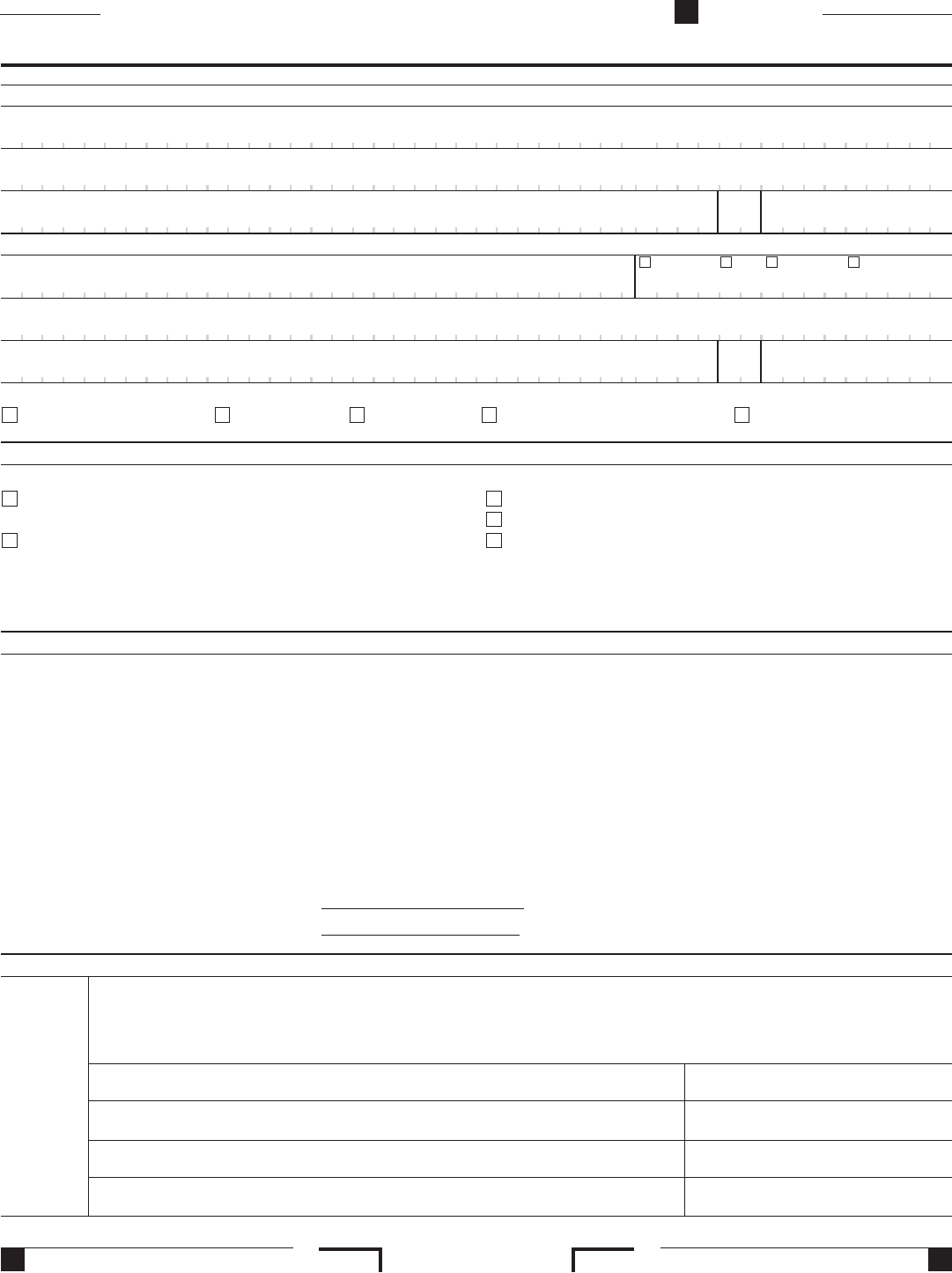

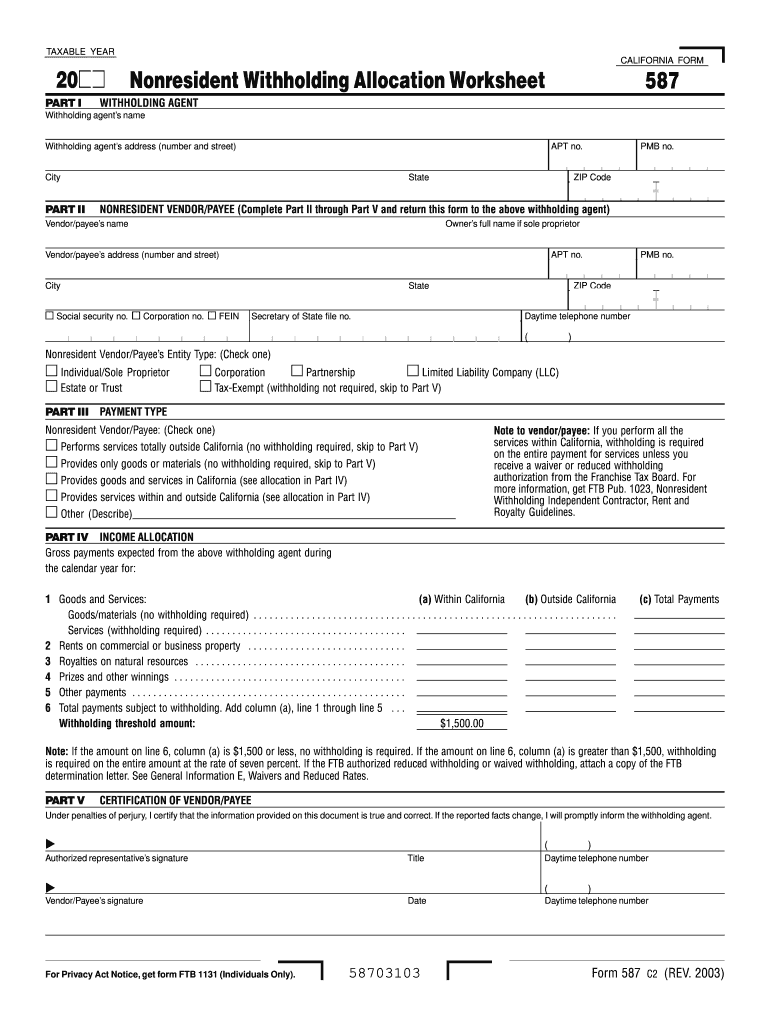

Ca 587 Form

Ca 587 Form - # you sold california real estate. # the payee is a. If the nonresident payee performs all the services within california, withholding is required on the entire payment for services unless the payee is. Download or print the 2023 california (nonresident withholding allocation worksheet) (2023) and other income tax forms from the california. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income. Download or print the 2023 california form 587 (nonresident withholding allocation worksheet) for free from the california franchise tax board. If the nonresident payee performs all the services within california, withholding is required on the entire payment for services unless the payee is. Use form 587 if any of the following apply: Use form 593, real estate withholding statement.

# the payee is a. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income. Use form 587 if any of the following apply: Download or print the 2023 california (nonresident withholding allocation worksheet) (2023) and other income tax forms from the california. If the nonresident payee performs all the services within california, withholding is required on the entire payment for services unless the payee is. Use form 593, real estate withholding statement. Download or print the 2023 california form 587 (nonresident withholding allocation worksheet) for free from the california franchise tax board. # you sold california real estate. If the nonresident payee performs all the services within california, withholding is required on the entire payment for services unless the payee is.

If the nonresident payee performs all the services within california, withholding is required on the entire payment for services unless the payee is. Use form 593, real estate withholding statement. Use form 587 if any of the following apply: Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income. Download or print the 2023 california (nonresident withholding allocation worksheet) (2023) and other income tax forms from the california. If the nonresident payee performs all the services within california, withholding is required on the entire payment for services unless the payee is. # the payee is a. # you sold california real estate. Download or print the 2023 california form 587 (nonresident withholding allocation worksheet) for free from the california franchise tax board.

Ca 587 20222024 Form Fill Out and Sign Printable PDF Template

Download or print the 2023 california form 587 (nonresident withholding allocation worksheet) for free from the california franchise tax board. # the payee is a. Download or print the 2023 california (nonresident withholding allocation worksheet) (2023) and other income tax forms from the california. Use form 593, real estate withholding statement. If the nonresident payee performs all the services within.

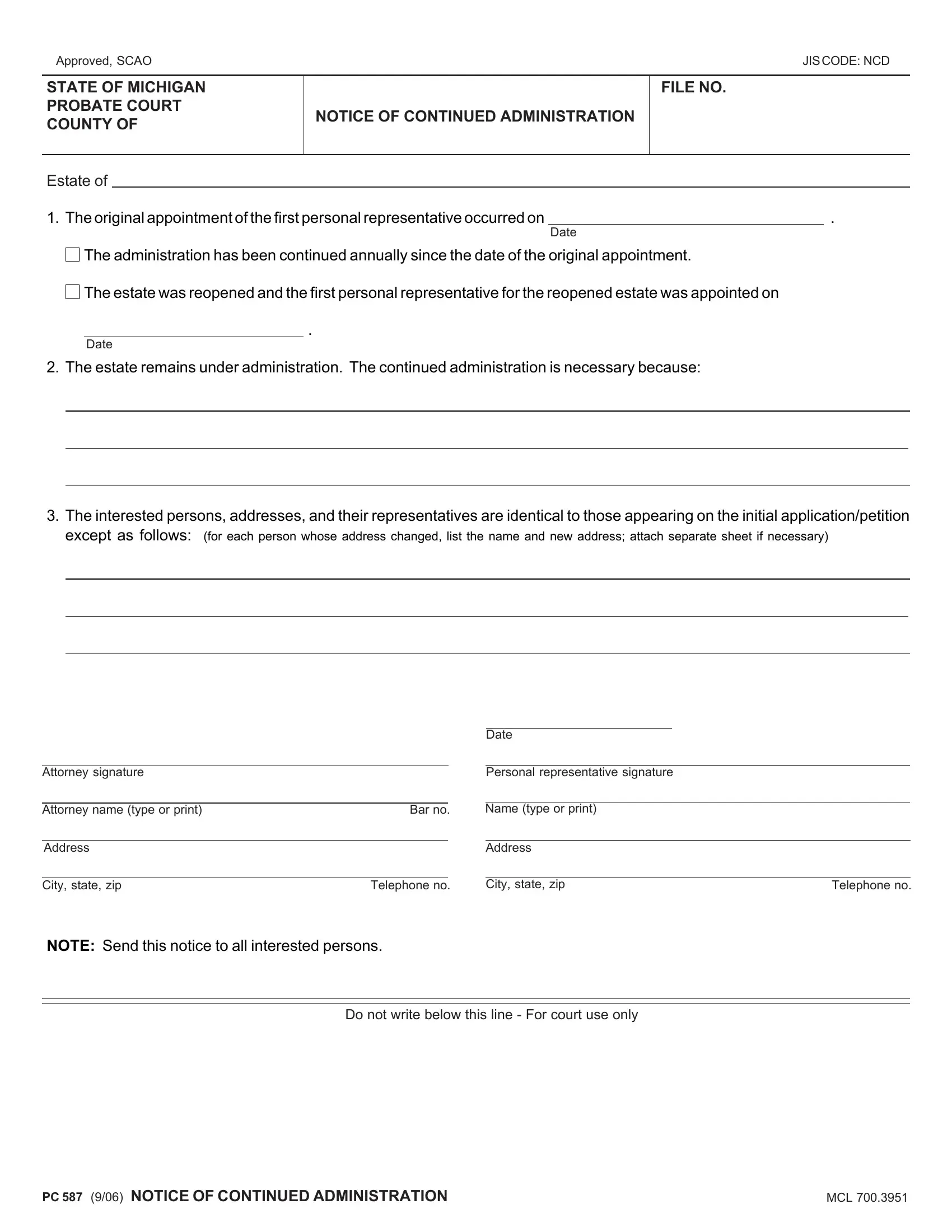

Form Pc 587 ≡ Fill Out Printable PDF Forms Online

Use form 587 if any of the following apply: Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income. Download or print the 2023 california (nonresident withholding allocation worksheet) (2023) and other income tax forms from the california. If the nonresident payee performs all the services within california, withholding is.

5877871633 15877871633 Who called from Lethbridge YP.CA

Use form 587 if any of the following apply: # the payee is a. If the nonresident payee performs all the services within california, withholding is required on the entire payment for services unless the payee is. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income. If the nonresident.

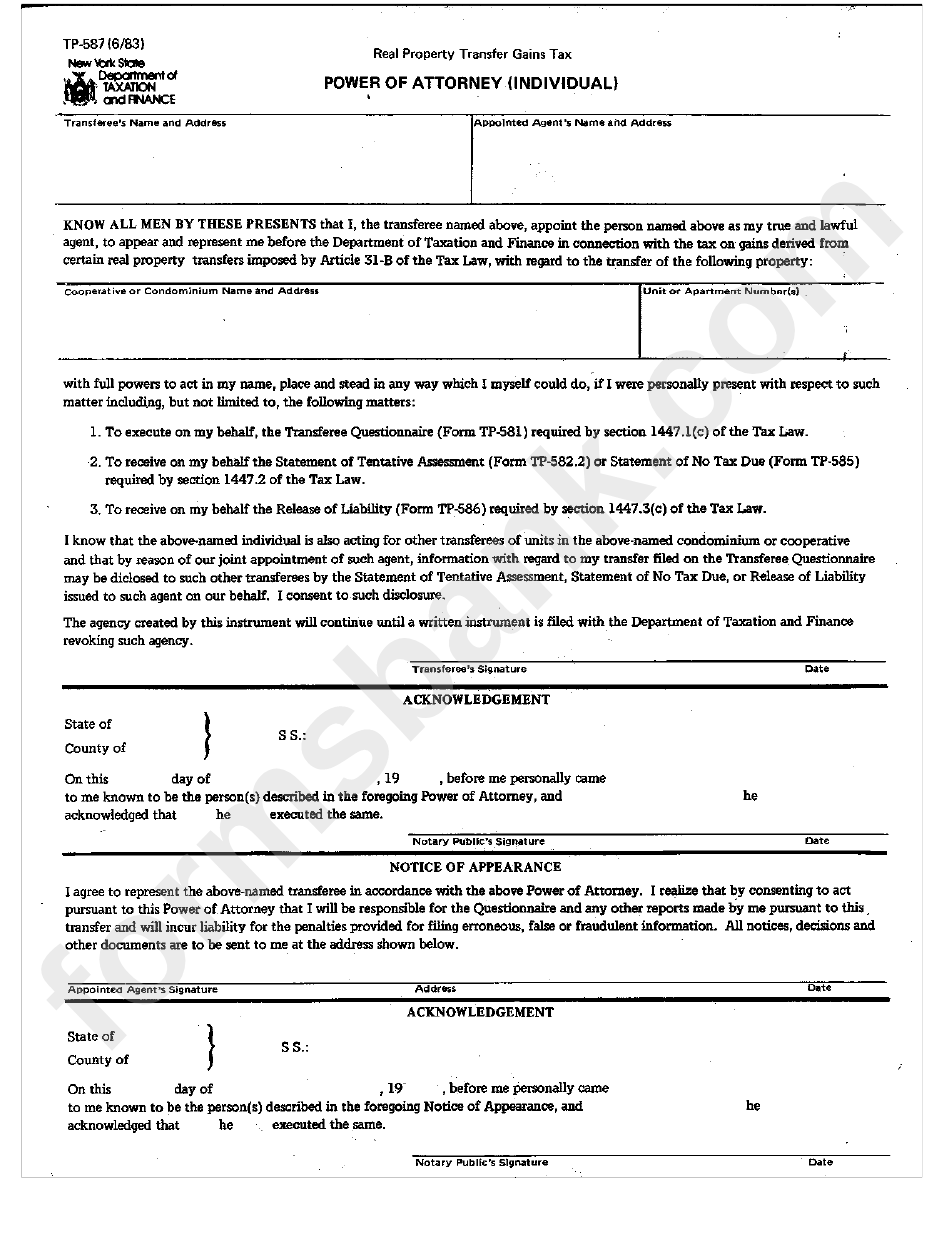

Form Tp587 Real Property Transfer Gains Tax Power Of Attorney

If the nonresident payee performs all the services within california, withholding is required on the entire payment for services unless the payee is. Use form 587 if any of the following apply: Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income. # the payee is a. Download or print.

CSX 587

If the nonresident payee performs all the services within california, withholding is required on the entire payment for services unless the payee is. Use form 593, real estate withholding statement. # the payee is a. If the nonresident payee performs all the services within california, withholding is required on the entire payment for services unless the payee is. Use form.

2017 Form 587 Nonresident Withholding Allocation Worksheet Edit

If the nonresident payee performs all the services within california, withholding is required on the entire payment for services unless the payee is. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income. Download or print the 2023 california form 587 (nonresident withholding allocation worksheet) for free from the california.

St 587 Form ≡ Fill Out Printable PDF Forms Online

Download or print the 2023 california form 587 (nonresident withholding allocation worksheet) for free from the california franchise tax board. If the nonresident payee performs all the services within california, withholding is required on the entire payment for services unless the payee is. # the payee is a. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is.

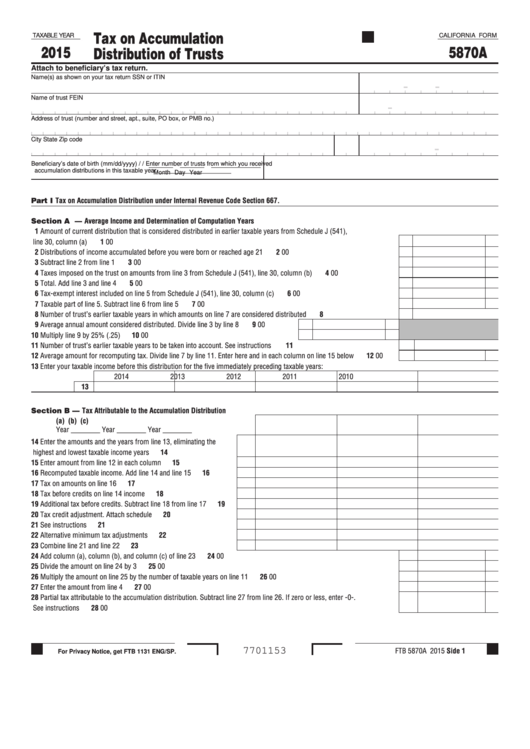

Fillable California Form 5870a Tax On Accumulation Distribution Of

If the nonresident payee performs all the services within california, withholding is required on the entire payment for services unless the payee is. Download or print the 2023 california (nonresident withholding allocation worksheet) (2023) and other income tax forms from the california. Use form 587 if any of the following apply: If the nonresident payee performs all the services within.

2013 Form 587 Nonresident Withholding Allocation Worksheet Edit

If the nonresident payee performs all the services within california, withholding is required on the entire payment for services unless the payee is. Download or print the 2023 california form 587 (nonresident withholding allocation worksheet) for free from the california franchise tax board. # you sold california real estate. If the nonresident payee performs all the services within california, withholding.

2023 Form 587 Printable Forms Free Online

Download or print the 2023 california form 587 (nonresident withholding allocation worksheet) for free from the california franchise tax board. Download or print the 2023 california (nonresident withholding allocation worksheet) (2023) and other income tax forms from the california. Use form 593, real estate withholding statement. # you sold california real estate. If the nonresident payee performs all the services.

Use Form 587 If Any Of The Following Apply:

Download or print the 2023 california (nonresident withholding allocation worksheet) (2023) and other income tax forms from the california. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income. If the nonresident payee performs all the services within california, withholding is required on the entire payment for services unless the payee is. If the nonresident payee performs all the services within california, withholding is required on the entire payment for services unless the payee is.

# The Payee Is A.

Use form 593, real estate withholding statement. # you sold california real estate. Download or print the 2023 california form 587 (nonresident withholding allocation worksheet) for free from the california franchise tax board.