Ca Estimated Tax Payment Form

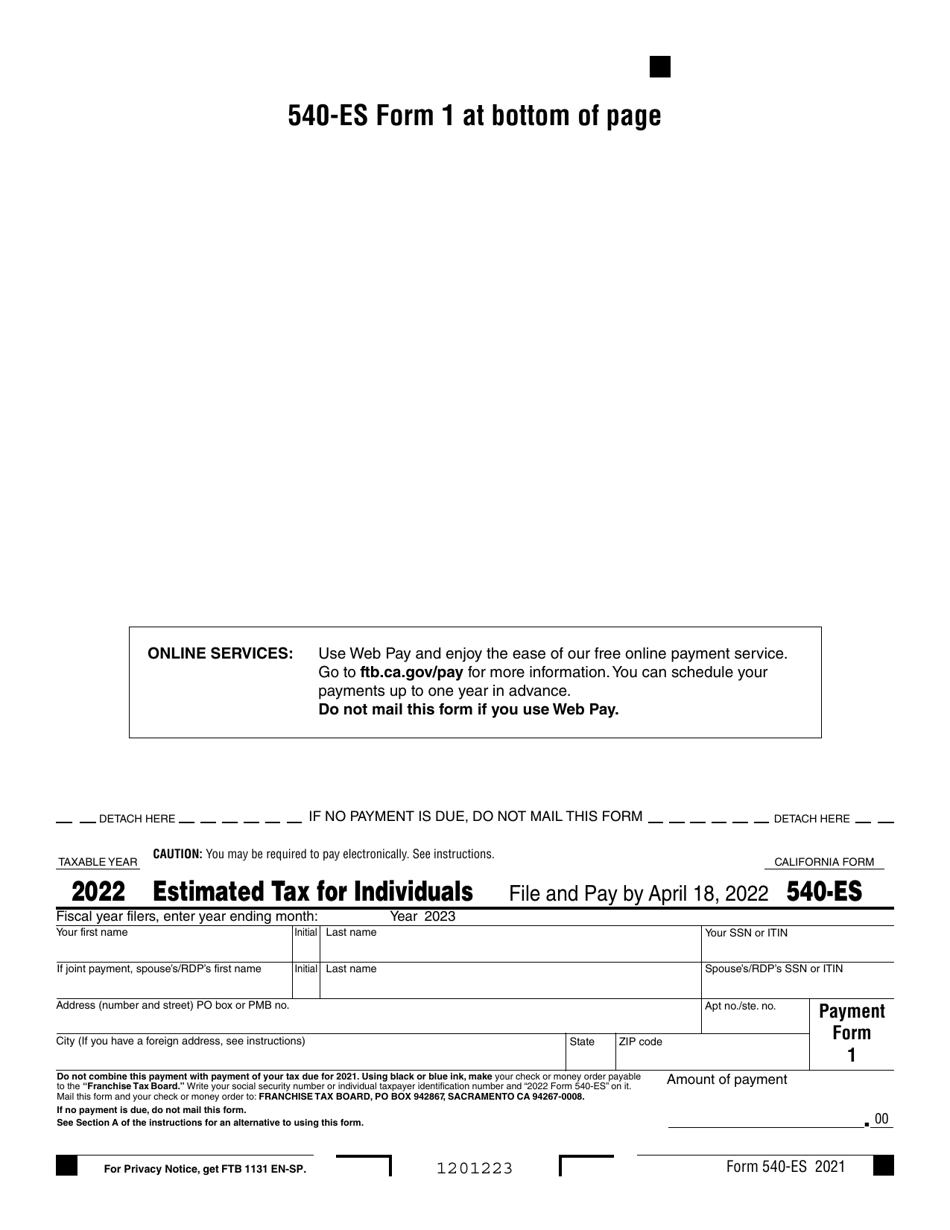

Ca Estimated Tax Payment Form - Estimated tax is used to. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Use web pay and enjoy the ease of our free online payment service. Go to ftb.ca.gov/pay for more information. You can schedule your payments.

Estimated tax is used to. Use web pay and enjoy the ease of our free online payment service. You can schedule your payments. Go to ftb.ca.gov/pay for more information. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties.

Use web pay and enjoy the ease of our free online payment service. You can schedule your payments. Go to ftb.ca.gov/pay for more information. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Estimated tax is used to.

2024 California Estimated Tax Vouchers Lonna Michaella

You can schedule your payments. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Estimated tax is used to. Go to ftb.ca.gov/pay for more information. Use web pay and enjoy the ease of our free online payment service.

2024 Tax Calculator Estimated Payments Maxie Sibelle

You can schedule your payments. Estimated tax is used to. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Go to ftb.ca.gov/pay for more information. Use web pay and enjoy the ease of our free online payment service.

Reducing Estimated Tax Penalties With IRA Distributions

Go to ftb.ca.gov/pay for more information. Estimated tax is used to. You can schedule your payments. Use web pay and enjoy the ease of our free online payment service. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties.

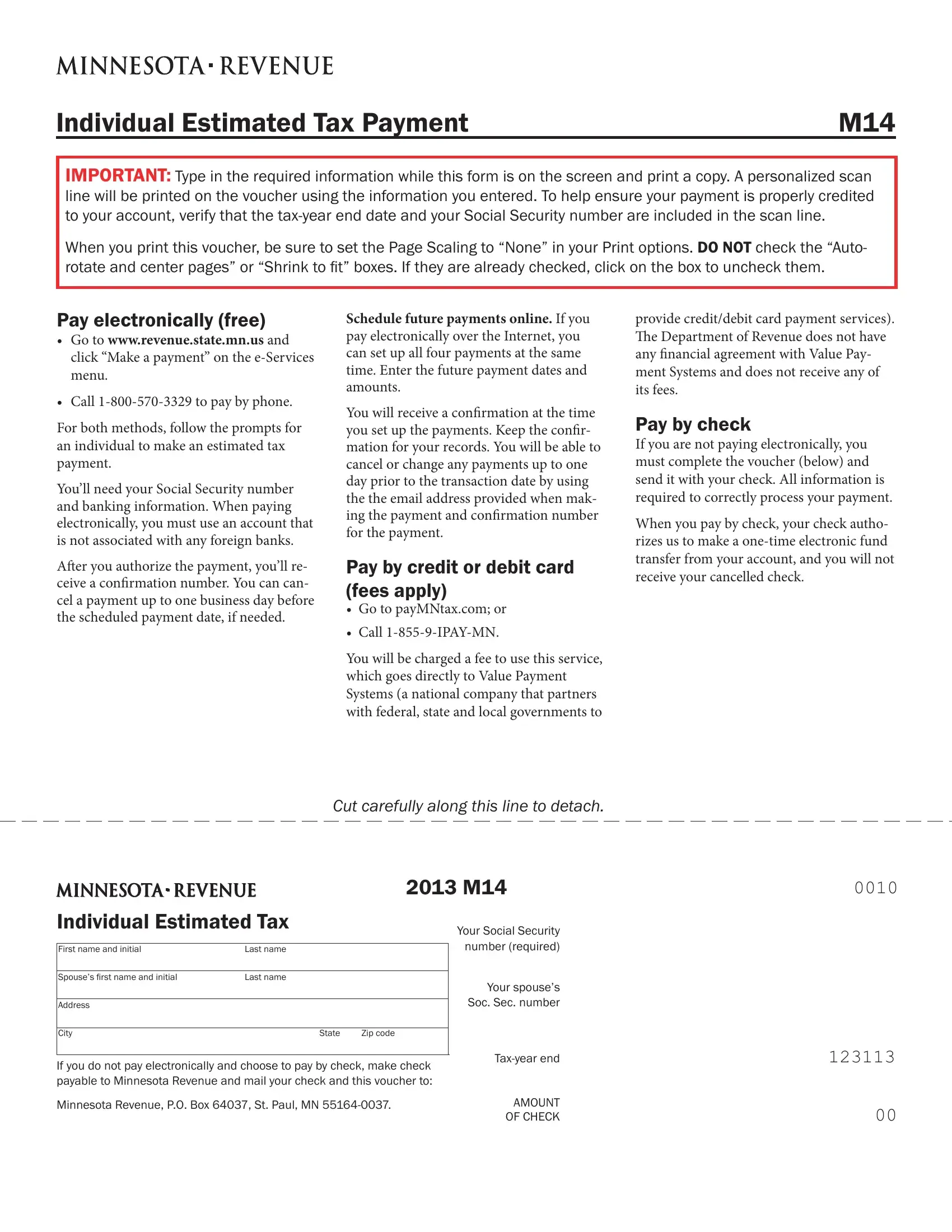

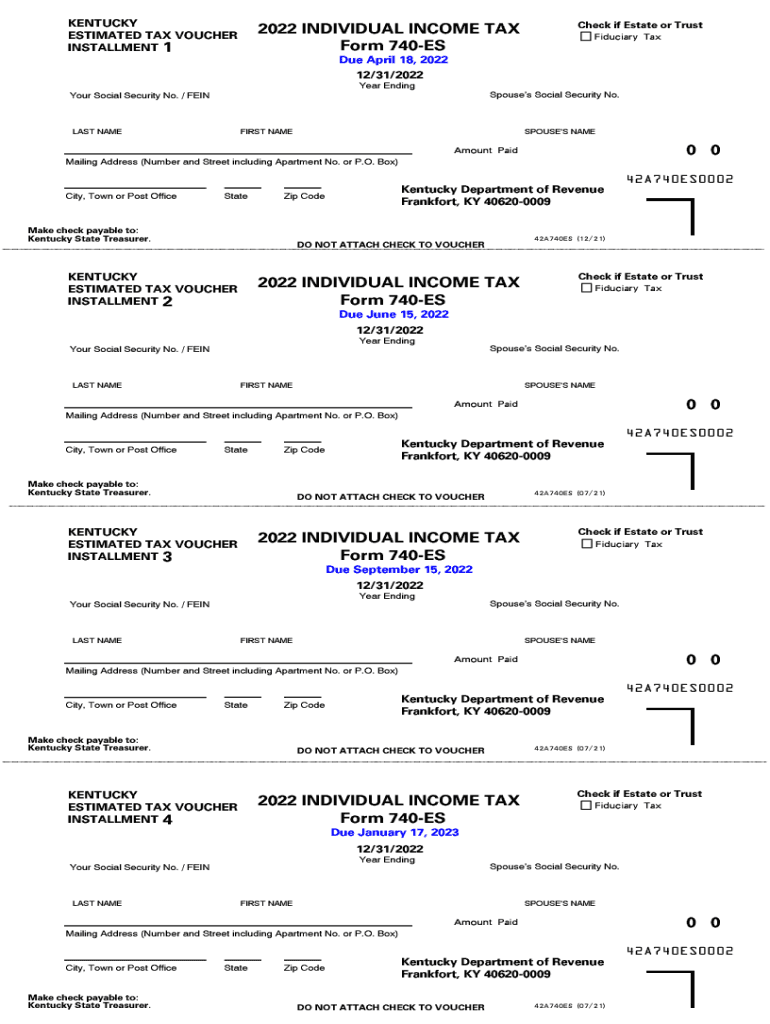

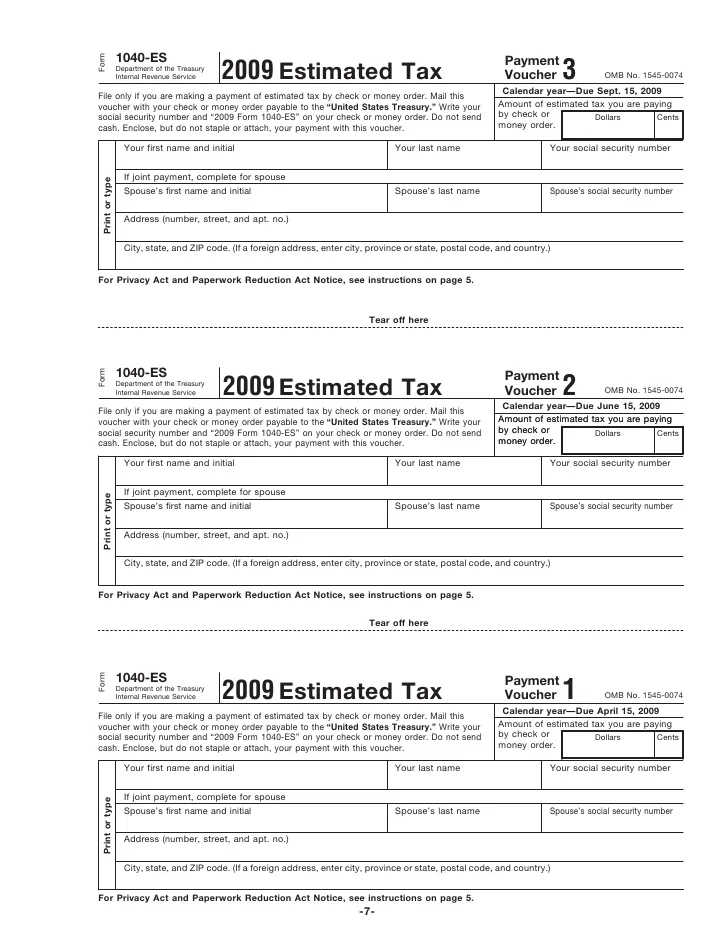

Individual Estimated Tax Payment PDF Form FormsPal

Use web pay and enjoy the ease of our free online payment service. Go to ftb.ca.gov/pay for more information. Estimated tax is used to. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. You can schedule your payments.

Virginia Department Of Taxation Forms 2024

You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Estimated tax is used to. You can schedule your payments. Use web pay and enjoy the ease of our free online payment service. Go to ftb.ca.gov/pay for more information.

Estimated Taxes 2024 California 2024 Evvie Jillane

You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Use web pay and enjoy the ease of our free online payment service. Estimated tax is used to. You can schedule your payments. Go to ftb.ca.gov/pay for more information.

Estimated Tax Payments 2024 California In India Erda Odelle

Use web pay and enjoy the ease of our free online payment service. You can schedule your payments. Go to ftb.ca.gov/pay for more information. Estimated tax is used to. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties.

Estimated Tax Payments 2024 For California Betty Chelsey

Estimated tax is used to. Go to ftb.ca.gov/pay for more information. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. You can schedule your payments. Use web pay and enjoy the ease of our free online payment service.

Form For Estimated Tax Payments 2024 Shawn

You can schedule your payments. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Estimated tax is used to. Go to ftb.ca.gov/pay for more information. Use web pay and enjoy the ease of our free online payment service.

Estimated Taxes 2024 Form Online Gale Thomasina

You can schedule your payments. Estimated tax is used to. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Go to ftb.ca.gov/pay for more information. Use web pay and enjoy the ease of our free online payment service.

Use Web Pay And Enjoy The Ease Of Our Free Online Payment Service.

Go to ftb.ca.gov/pay for more information. Estimated tax is used to. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. You can schedule your payments.