California Form 540 Schedule Ca Instructions

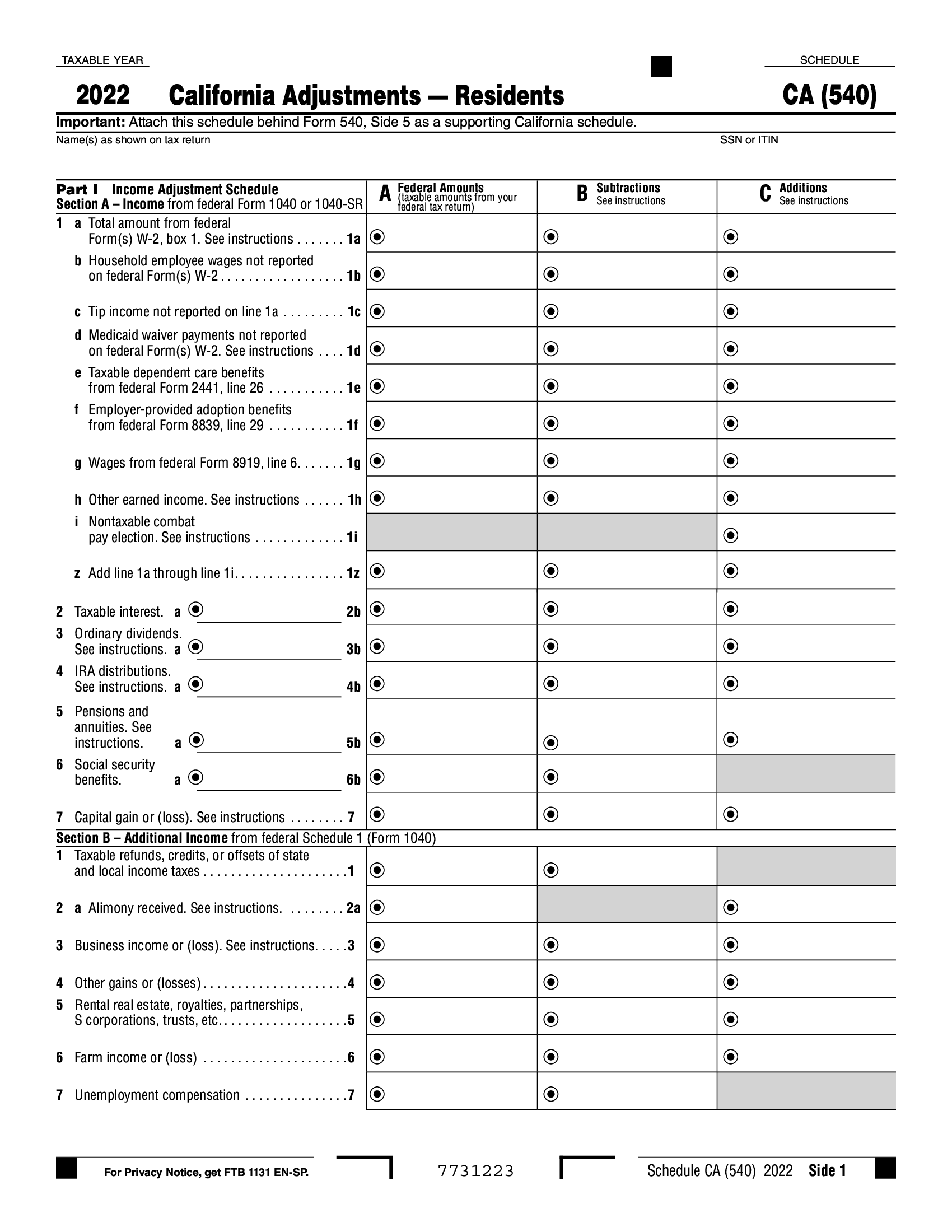

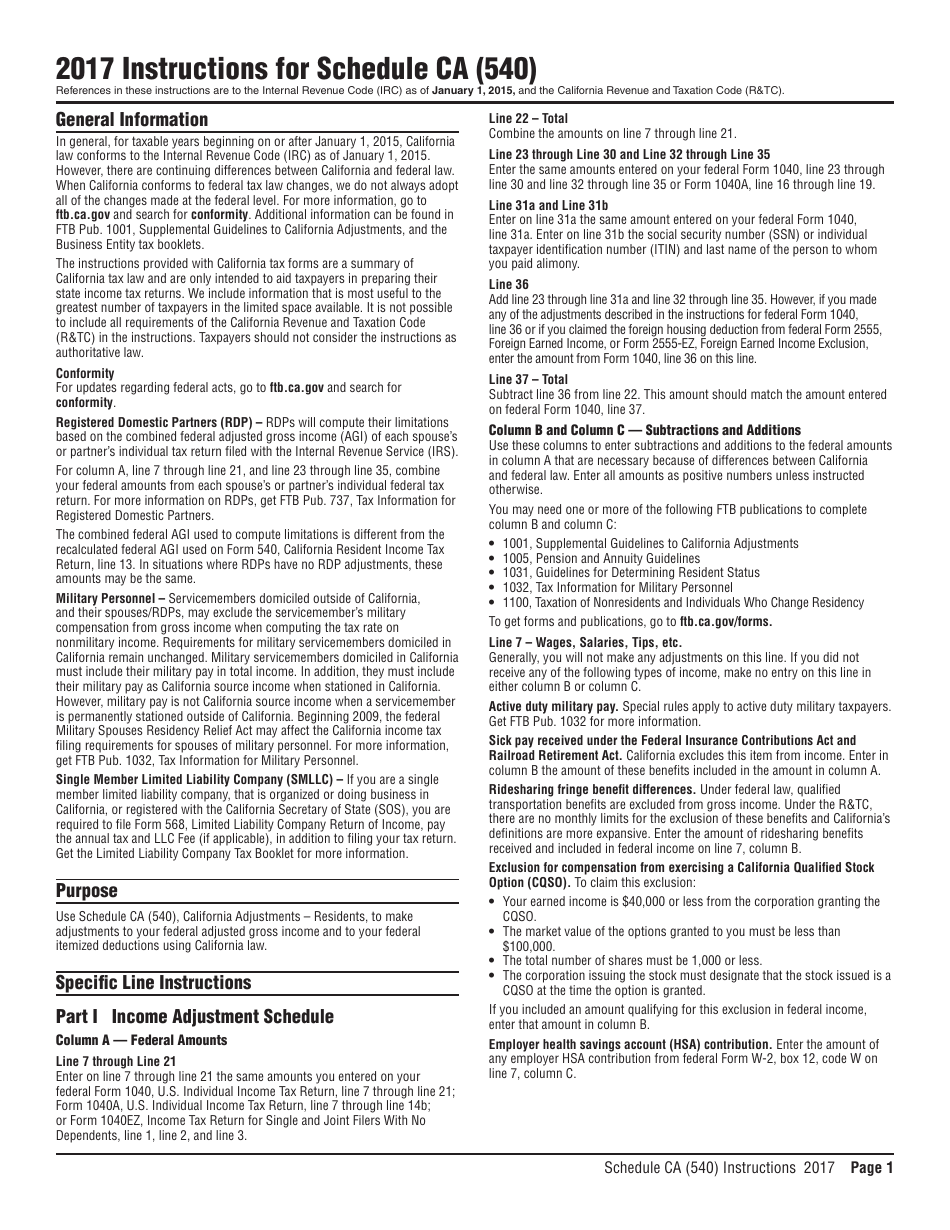

California Form 540 Schedule Ca Instructions - Form 540, california resident income tax return, line 76, and get form ftb 3514, or go to ftb.ca.gov and search for yctc. • foster youth tax credit. Download or print the 2023 california (instructions and forms for schedule ca (540)) (2023) and other income tax forms from the california franchise. If there are differences between your federal and california deductions, complete schedule ca (540). For more information, see specific line instructions for schedule ca (540) in part i, section b, line 3 or r&tc section 17131.8 or go. Your california itemized deductions from schedule ca (540), part ii, line 30; Or your california standard deduction shown below for your filing. • see form 540, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can claim. Attach this schedule behind form 540, side 6 as a supporting california schedule. California adjustments — residents important:

California adjustments — residents important: If there are differences between your federal and california deductions, complete schedule ca (540). Download or print the 2023 california (instructions and forms for schedule ca (540)) (2023) and other income tax forms from the california franchise. For more information, see specific line instructions for schedule ca (540) in part i, section b, line 3 or r&tc section 17131.8 or go. Attach this schedule behind form 540, side 6 as a supporting california schedule. • foster youth tax credit. • see form 540, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can claim. Your california itemized deductions from schedule ca (540), part ii, line 30; Form 540, california resident income tax return, line 76, and get form ftb 3514, or go to ftb.ca.gov and search for yctc. Or your california standard deduction shown below for your filing.

If there are differences between your federal and california deductions, complete schedule ca (540). California adjustments — residents important: Your california itemized deductions from schedule ca (540), part ii, line 30; • see form 540, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can claim. Form 540, california resident income tax return, line 76, and get form ftb 3514, or go to ftb.ca.gov and search for yctc. Download or print the 2023 california (instructions and forms for schedule ca (540)) (2023) and other income tax forms from the california franchise. • foster youth tax credit. Or your california standard deduction shown below for your filing. Attach this schedule behind form 540, side 6 as a supporting california schedule. For more information, see specific line instructions for schedule ca (540) in part i, section b, line 3 or r&tc section 17131.8 or go.

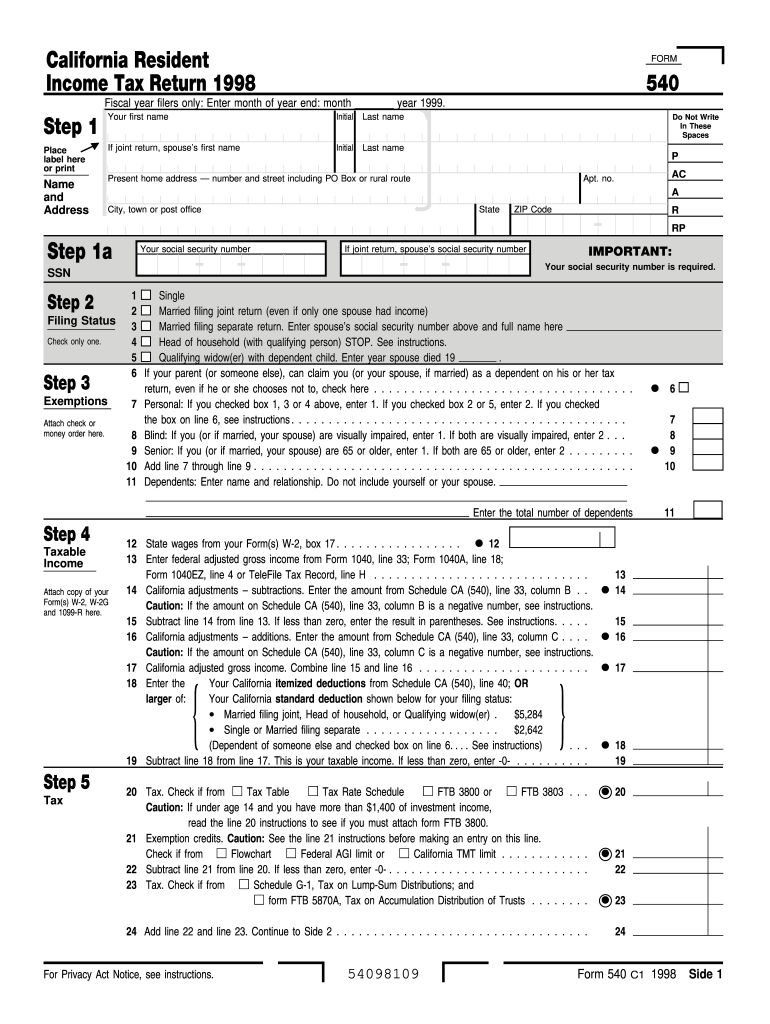

Form 540 Schedule CA. California Adjustments Residents Forms Docs

Or your california standard deduction shown below for your filing. • foster youth tax credit. California adjustments — residents important: Attach this schedule behind form 540, side 6 as a supporting california schedule. Download or print the 2023 california (instructions and forms for schedule ca (540)) (2023) and other income tax forms from the california franchise.

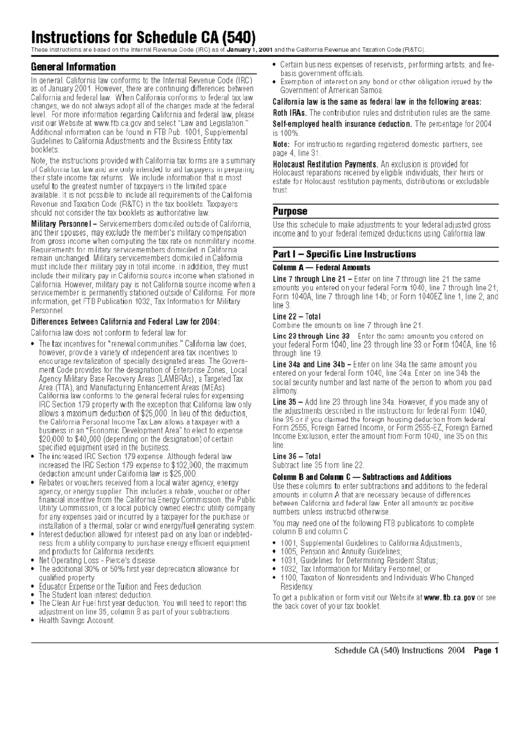

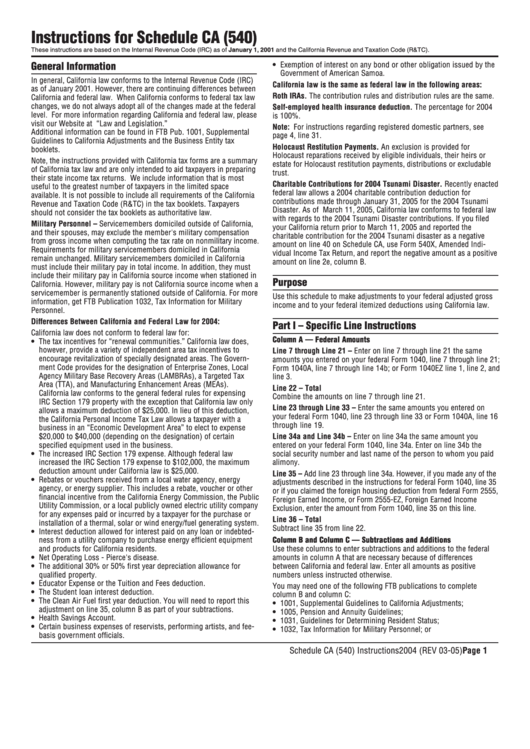

Instructions For Schedule Ca (540) 2004 State Of California printable

Download or print the 2023 california (instructions and forms for schedule ca (540)) (2023) and other income tax forms from the california franchise. Your california itemized deductions from schedule ca (540), part ii, line 30; Attach this schedule behind form 540, side 6 as a supporting california schedule. Form 540, california resident income tax return, line 76, and get form.

Printable Pdf File Form Californian 540 Tax Return Printable Forms

California adjustments — residents important: If there are differences between your federal and california deductions, complete schedule ca (540). Form 540, california resident income tax return, line 76, and get form ftb 3514, or go to ftb.ca.gov and search for yctc. Your california itemized deductions from schedule ca (540), part ii, line 30; Download or print the 2023 california (instructions.

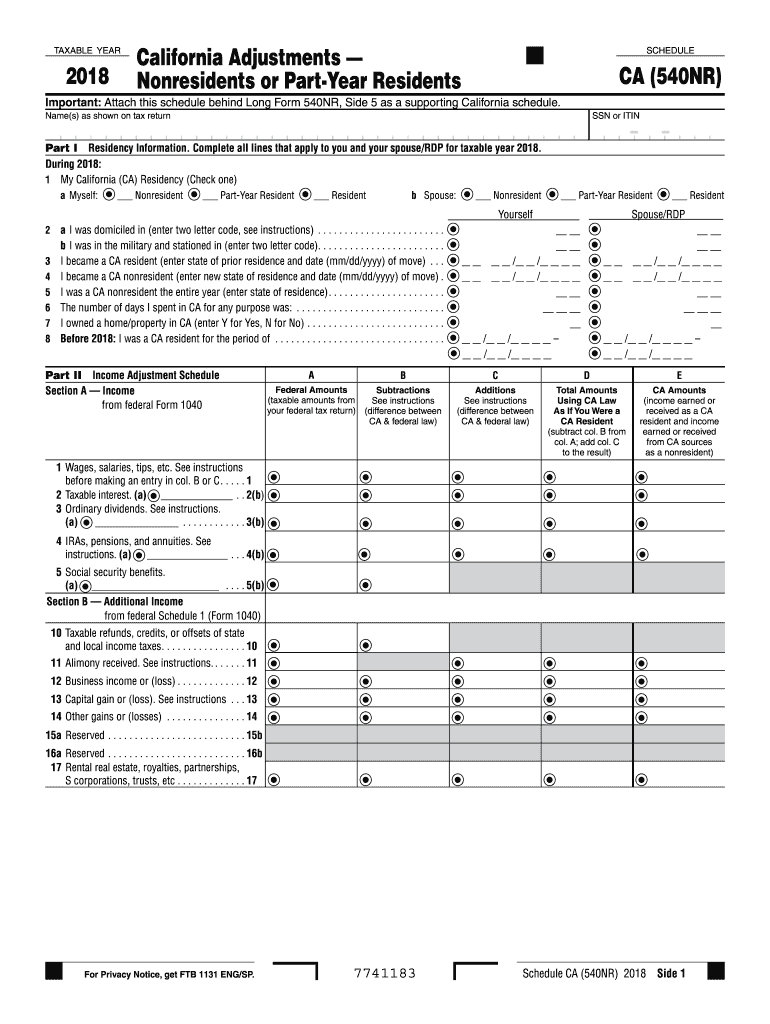

2018 Form CA FTB 540NR Schedule CA Fill Online, Printable, Fillable

For more information, see specific line instructions for schedule ca (540) in part i, section b, line 3 or r&tc section 17131.8 or go. Or your california standard deduction shown below for your filing. Your california itemized deductions from schedule ca (540), part ii, line 30; If there are differences between your federal and california deductions, complete schedule ca (540)..

Fillable Online Instructions For California Form 540 Schedule Ca

For more information, see specific line instructions for schedule ca (540) in part i, section b, line 3 or r&tc section 17131.8 or go. Attach this schedule behind form 540, side 6 as a supporting california schedule. • foster youth tax credit. Or your california standard deduction shown below for your filing. California adjustments — residents important:

Instructions For Schedule Ca (540) State Of California Franchise Tax

Or your california standard deduction shown below for your filing. Attach this schedule behind form 540, side 6 as a supporting california schedule. • foster youth tax credit. Form 540, california resident income tax return, line 76, and get form ftb 3514, or go to ftb.ca.gov and search for yctc. Download or print the 2023 california (instructions and forms for.

Form 540 Fill and Sign Printable Template Online US Legal Forms

• see form 540, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can claim. Or your california standard deduction shown below for your filing. Your california itemized deductions from schedule ca (540), part ii, line 30; For more information, see specific line instructions for schedule ca (540) in part i, section b, line.

Fillable Online 2021 Instructions for Schedule CA (540), California

California adjustments — residents important: For more information, see specific line instructions for schedule ca (540) in part i, section b, line 3 or r&tc section 17131.8 or go. Form 540, california resident income tax return, line 76, and get form ftb 3514, or go to ftb.ca.gov and search for yctc. If there are differences between your federal and california.

540 Fillable Form Printable Forms Free Online

Form 540, california resident income tax return, line 76, and get form ftb 3514, or go to ftb.ca.gov and search for yctc. Your california itemized deductions from schedule ca (540), part ii, line 30; Or your california standard deduction shown below for your filing. For more information, see specific line instructions for schedule ca (540) in part i, section b,.

Download Instructions for Form 540 Schedule CA California Adjustments

For more information, see specific line instructions for schedule ca (540) in part i, section b, line 3 or r&tc section 17131.8 or go. California adjustments — residents important: Attach this schedule behind form 540, side 6 as a supporting california schedule. Download or print the 2023 california (instructions and forms for schedule ca (540)) (2023) and other income tax.

• See Form 540, Line 18 Instructions And Worksheets For The Amount Of Standard Deduction Or Itemized Deductions You Can Claim.

If there are differences between your federal and california deductions, complete schedule ca (540). Attach this schedule behind form 540, side 6 as a supporting california schedule. Download or print the 2023 california (instructions and forms for schedule ca (540)) (2023) and other income tax forms from the california franchise. California adjustments — residents important:

For More Information, See Specific Line Instructions For Schedule Ca (540) In Part I, Section B, Line 3 Or R&Tc Section 17131.8 Or Go.

• foster youth tax credit. Form 540, california resident income tax return, line 76, and get form ftb 3514, or go to ftb.ca.gov and search for yctc. Or your california standard deduction shown below for your filing. Your california itemized deductions from schedule ca (540), part ii, line 30;