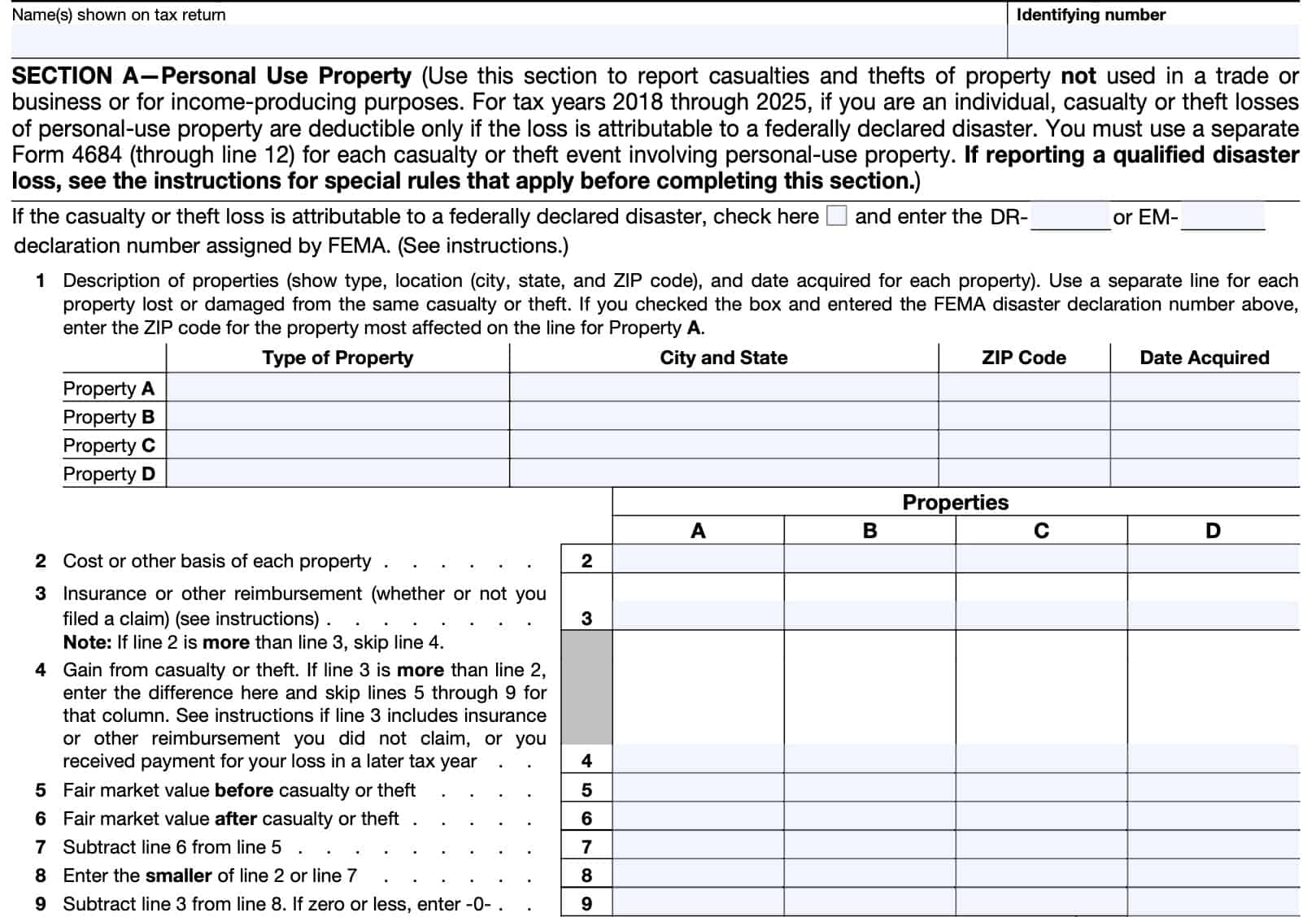

Casualty And Theft Losses Form

Casualty And Theft Losses Form - If you suffered a qualified disaster loss, you are eligible to claim a casualty loss deduction, to elect to claim the loss in the preceding tax. Information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. The taxact program uses form.

Information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. The taxact program uses form. If you suffered a qualified disaster loss, you are eligible to claim a casualty loss deduction, to elect to claim the loss in the preceding tax.

If you suffered a qualified disaster loss, you are eligible to claim a casualty loss deduction, to elect to claim the loss in the preceding tax. Information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. The taxact program uses form.

Rising from the Ashes Casualty, Disaster, and Theft Losses

Information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. The taxact program uses form. If you suffered a qualified disaster loss, you are eligible to claim a casualty loss deduction, to elect to claim the loss in the preceding tax.

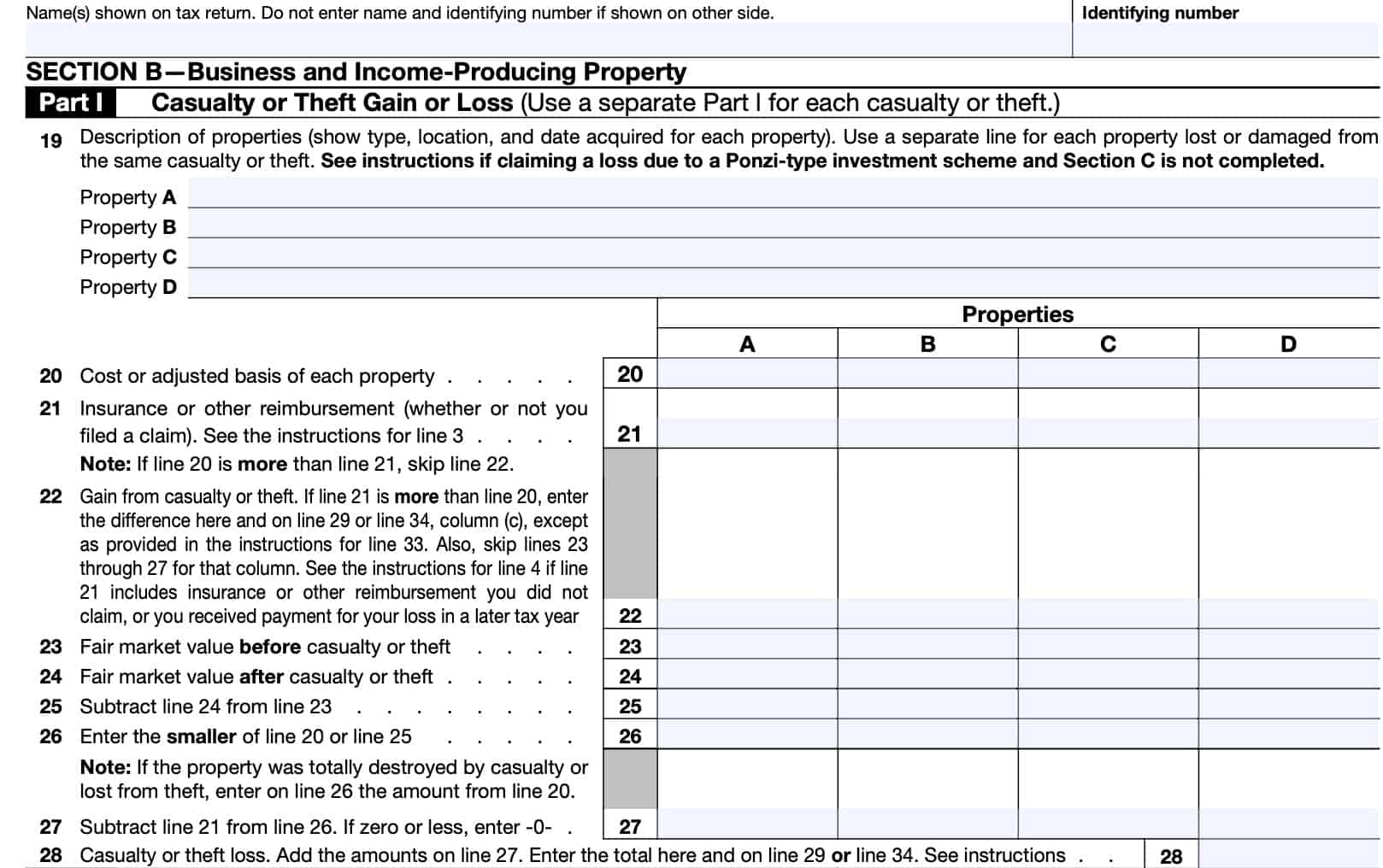

IRS Form 4684 Instructions Deducting Casualty & Theft Losses

Information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. The taxact program uses form. If you suffered a qualified disaster loss, you are eligible to claim a casualty loss deduction, to elect to claim the loss in the preceding tax.

Form to File for Casualty & Theft Losses Tax 2023 YouTube

The taxact program uses form. Information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. If you suffered a qualified disaster loss, you are eligible to claim a casualty loss deduction, to elect to claim the loss in the preceding tax.

Casualty And Theft Losses Група компаній «Віст»

Information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. If you suffered a qualified disaster loss, you are eligible to claim a casualty loss deduction, to elect to claim the loss in the preceding tax. The taxact program uses form.

Casualty, Disaster and Theft Losses Affect Taxes Conner Ash

If you suffered a qualified disaster loss, you are eligible to claim a casualty loss deduction, to elect to claim the loss in the preceding tax. Information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. The taxact program uses form.

Details and Understanding for Casualty and Theft Losses

The taxact program uses form. If you suffered a qualified disaster loss, you are eligible to claim a casualty loss deduction, to elect to claim the loss in the preceding tax. Information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file.

Form 4684 Theft and Casualty Loss Deduction H&R Block

If you suffered a qualified disaster loss, you are eligible to claim a casualty loss deduction, to elect to claim the loss in the preceding tax. Information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. The taxact program uses form.

Casualty, Theft and Disaster Losses AZ Money Guy

If you suffered a qualified disaster loss, you are eligible to claim a casualty loss deduction, to elect to claim the loss in the preceding tax. Information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. The taxact program uses form.

ITEMIZED DEDUCTIONS — CASUALTY AND THEFT LOSSES 2021 Casualty

Information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. The taxact program uses form. If you suffered a qualified disaster loss, you are eligible to claim a casualty loss deduction, to elect to claim the loss in the preceding tax.

IRS Form 4684 Instructions Deducting Casualty & Theft Losses

If you suffered a qualified disaster loss, you are eligible to claim a casualty loss deduction, to elect to claim the loss in the preceding tax. Information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. The taxact program uses form.

If You Suffered A Qualified Disaster Loss, You Are Eligible To Claim A Casualty Loss Deduction, To Elect To Claim The Loss In The Preceding Tax.

Information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. The taxact program uses form.