Cfp Board Formula Sheet

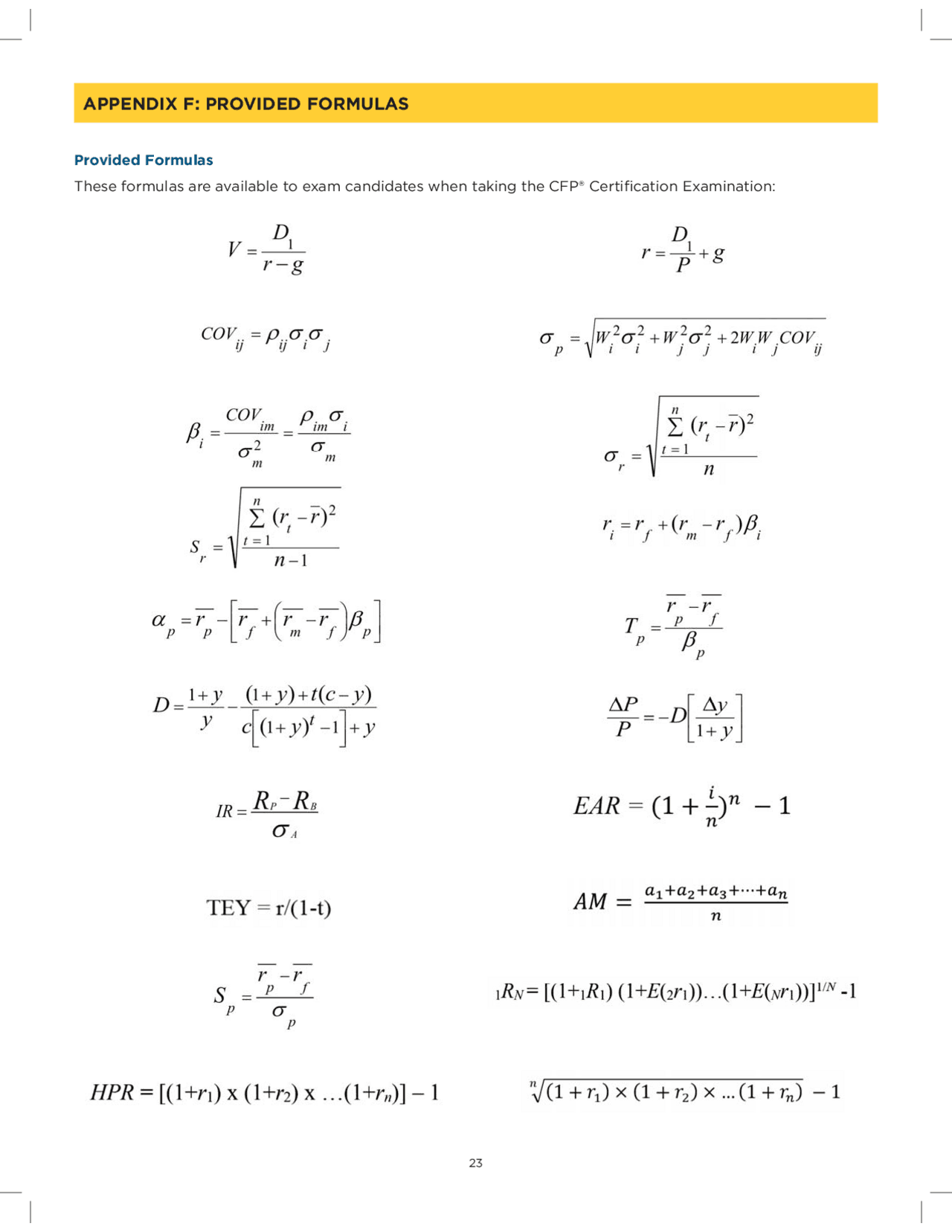

Cfp Board Formula Sheet - The table below outlines the changes to the sheet. Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. 2 2024 married filing separately taxable income over but not over pay + % on excess of the amount over $0 — 11,600 $0 10% $0 11,600 — 47,150 1,160.00 12% 11,600 Tax table and formula materials are provided below to help you prepare for the cfp® exam. Tax table and formula materials are provided to help you prepare for the cfp® exam and are available for download. The tax tables provided for use during the cfp®.

Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. Tax table and formula materials are provided to help you prepare for the cfp® exam and are available for download. The table below outlines the changes to the sheet. 2 2024 married filing separately taxable income over but not over pay + % on excess of the amount over $0 — 11,600 $0 10% $0 11,600 — 47,150 1,160.00 12% 11,600 The tax tables provided for use during the cfp®. Tax table and formula materials are provided below to help you prepare for the cfp® exam.

The tax tables provided for use during the cfp®. 2 2024 married filing separately taxable income over but not over pay + % on excess of the amount over $0 — 11,600 $0 10% $0 11,600 — 47,150 1,160.00 12% 11,600 Tax table and formula materials are provided to help you prepare for the cfp® exam and are available for download. Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. Tax table and formula materials are provided below to help you prepare for the cfp® exam. The table below outlines the changes to the sheet.

CFP BOARD DISCLOSURE GUIDE

Tax table and formula materials are provided below to help you prepare for the cfp® exam. The table below outlines the changes to the sheet. The tax tables provided for use during the cfp®. Tax table and formula materials are provided to help you prepare for the cfp® exam and are available for download. 2 2024 married filing separately taxable.

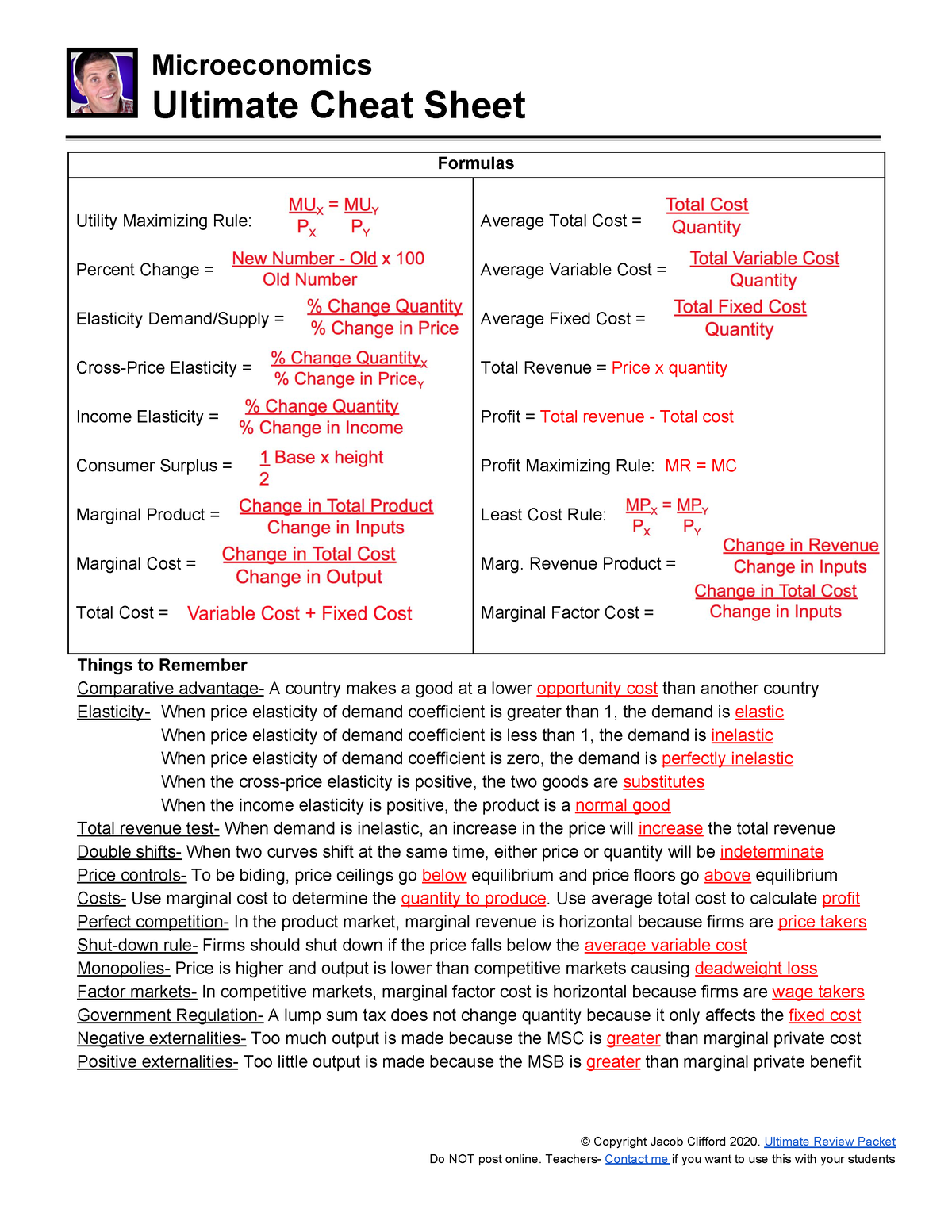

Ap micro ultimate cheat sheet key Microeconomics Ultimate Cheat Sheet

The tax tables provided for use during the cfp®. The table below outlines the changes to the sheet. Tax table and formula materials are provided to help you prepare for the cfp® exam and are available for download. Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. Tax table and formula.

What Is a CFP® and Why Should You Care? Alterra Advisors

The table below outlines the changes to the sheet. The tax tables provided for use during the cfp®. Tax table and formula materials are provided below to help you prepare for the cfp® exam. 2 2024 married filing separately taxable income over but not over pay + % on excess of the amount over $0 — 11,600 $0 10% $0.

CFP formula sheet Cheat Sheet Financial Accounting Docsity

The table below outlines the changes to the sheet. Tax table and formula materials are provided to help you prepare for the cfp® exam and are available for download. Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. 2 2024 married filing separately taxable income over but not over pay +.

Formula sheet

The table below outlines the changes to the sheet. Tax table and formula materials are provided to help you prepare for the cfp® exam and are available for download. Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. The tax tables provided for use during the cfp®. 2 2024 married filing.

CFP Board Fixes Financial Formulas Money Education

Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. 2 2024 married filing separately taxable income over but not over pay + % on excess of the amount over $0 — 11,600 $0 10% $0 11,600 — 47,150 1,160.00 12% 11,600 Tax table and formula materials are provided to help you.

CFP Board Releases SECURE 2.0 Exam Resource

Tax table and formula materials are provided below to help you prepare for the cfp® exam. The table below outlines the changes to the sheet. Tax table and formula materials are provided to help you prepare for the cfp® exam and are available for download. Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking.

Student Resources

2 2024 married filing separately taxable income over but not over pay + % on excess of the amount over $0 — 11,600 $0 10% $0 11,600 — 47,150 1,160.00 12% 11,600 Tax table and formula materials are provided below to help you prepare for the cfp® exam. Tax table and formula materials are provided to help you prepare for.

CFP Board's New Disclosure And Documentation Requirements

The tax tables provided for use during the cfp®. Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. 2 2024 married filing separately taxable income over but not over pay + % on excess of the amount over $0 — 11,600 $0 10% $0 11,600 — 47,150 1,160.00 12% 11,600 Tax.

CFP Board Imposes Interim Suspension on Lee Giobbie of Mount Holly, New

The tax tables provided for use during the cfp®. The table below outlines the changes to the sheet. 2 2024 married filing separately taxable income over but not over pay + % on excess of the amount over $0 — 11,600 $0 10% $0 11,600 — 47,150 1,160.00 12% 11,600 Tax table and formula materials are provided to help you.

Tax Table And Formula Materials Are Provided To Help You Prepare For The Cfp® Exam And Are Available For Download.

Tax table and formula materials are provided below to help you prepare for the cfp® exam. Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. The tax tables provided for use during the cfp®. 2 2024 married filing separately taxable income over but not over pay + % on excess of the amount over $0 — 11,600 $0 10% $0 11,600 — 47,150 1,160.00 12% 11,600