Converting C Corp To S Corp

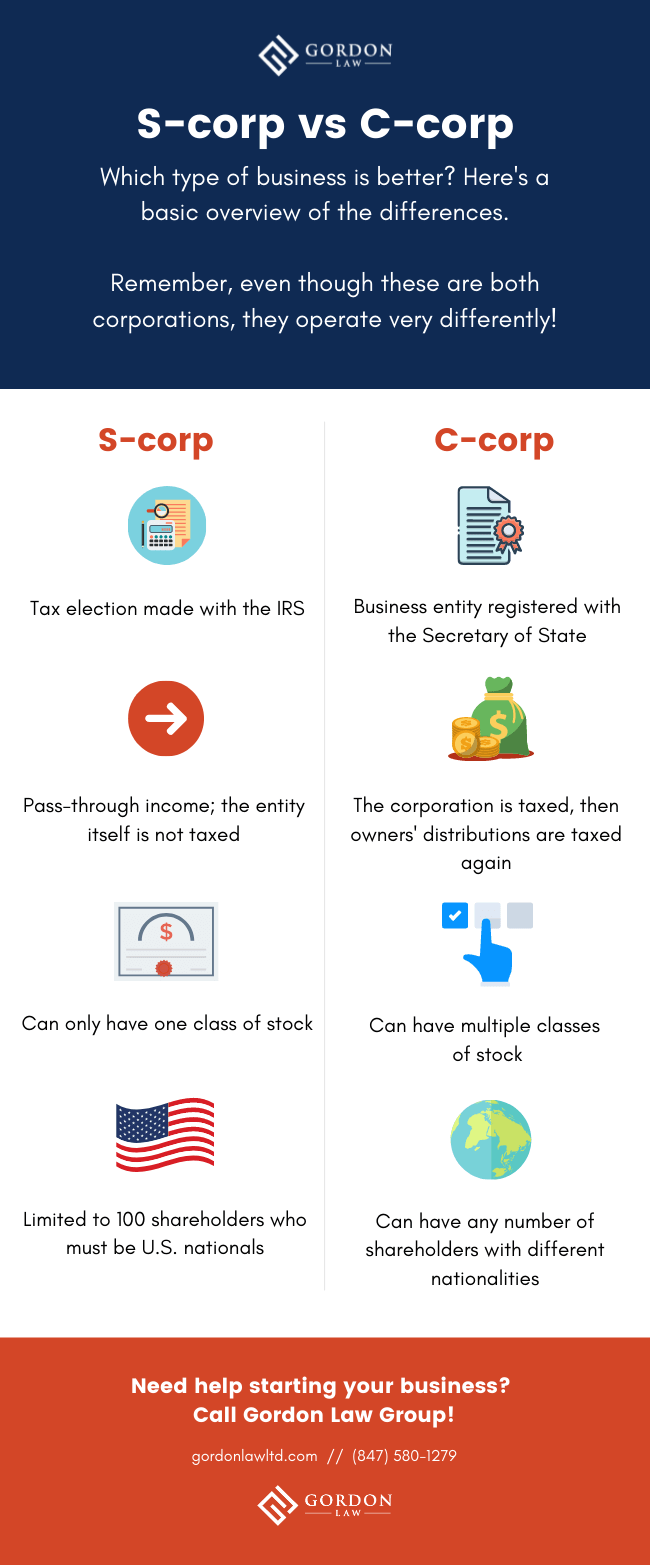

Converting C Corp To S Corp - The case involved a dispute between taxpayers and the irs over the fmv of shares of stock in an s corporation for gift tax purposes. Before you convert a c corp to an s corp, understand how they differ, whether your company is eligible, and tax implications for the entity and shareholders. Although s corporations may provide tax advantages over c corporations, there are some potentially costly tax issues that you should assess before making a decision to switch. Valuation experts for both the taxpayer and the.

Valuation experts for both the taxpayer and the. Although s corporations may provide tax advantages over c corporations, there are some potentially costly tax issues that you should assess before making a decision to switch. Before you convert a c corp to an s corp, understand how they differ, whether your company is eligible, and tax implications for the entity and shareholders. The case involved a dispute between taxpayers and the irs over the fmv of shares of stock in an s corporation for gift tax purposes.

Valuation experts for both the taxpayer and the. Although s corporations may provide tax advantages over c corporations, there are some potentially costly tax issues that you should assess before making a decision to switch. Before you convert a c corp to an s corp, understand how they differ, whether your company is eligible, and tax implications for the entity and shareholders. The case involved a dispute between taxpayers and the irs over the fmv of shares of stock in an s corporation for gift tax purposes.

Delaware C Corp and S Corp How to determine? HazelNews

Valuation experts for both the taxpayer and the. Before you convert a c corp to an s corp, understand how they differ, whether your company is eligible, and tax implications for the entity and shareholders. Although s corporations may provide tax advantages over c corporations, there are some potentially costly tax issues that you should assess before making a decision.

What You Need to Know About Converting an S Corp to a C Corp

Valuation experts for both the taxpayer and the. Although s corporations may provide tax advantages over c corporations, there are some potentially costly tax issues that you should assess before making a decision to switch. Before you convert a c corp to an s corp, understand how they differ, whether your company is eligible, and tax implications for the entity.

s corp vs c corpdifference between s corp and c corps corp and c corp

Before you convert a c corp to an s corp, understand how they differ, whether your company is eligible, and tax implications for the entity and shareholders. The case involved a dispute between taxpayers and the irs over the fmv of shares of stock in an s corporation for gift tax purposes. Valuation experts for both the taxpayer and the..

Converting From an LLC to a Ccorp Tax Implications to Consider Shay CPA

Before you convert a c corp to an s corp, understand how they differ, whether your company is eligible, and tax implications for the entity and shareholders. Although s corporations may provide tax advantages over c corporations, there are some potentially costly tax issues that you should assess before making a decision to switch. The case involved a dispute between.

LLC, Scorp, or Ccorp? Guide to Choosing a Business Structure

Valuation experts for both the taxpayer and the. The case involved a dispute between taxpayers and the irs over the fmv of shares of stock in an s corporation for gift tax purposes. Although s corporations may provide tax advantages over c corporations, there are some potentially costly tax issues that you should assess before making a decision to switch..

What You Need To Know About Converting An S Corp To A C Corp

The case involved a dispute between taxpayers and the irs over the fmv of shares of stock in an s corporation for gift tax purposes. Valuation experts for both the taxpayer and the. Before you convert a c corp to an s corp, understand how they differ, whether your company is eligible, and tax implications for the entity and shareholders..

WHAT YOU NEED TO KNOW ABOUT CONVERTING AN S CORP TO A C CORP

Valuation experts for both the taxpayer and the. The case involved a dispute between taxpayers and the irs over the fmv of shares of stock in an s corporation for gift tax purposes. Although s corporations may provide tax advantages over c corporations, there are some potentially costly tax issues that you should assess before making a decision to switch..

c corp and s corp, 7 Differences Between

Although s corporations may provide tax advantages over c corporations, there are some potentially costly tax issues that you should assess before making a decision to switch. The case involved a dispute between taxpayers and the irs over the fmv of shares of stock in an s corporation for gift tax purposes. Valuation experts for both the taxpayer and the..

Converting from a CCorp to an SCorp Northwest Registered Agent

Although s corporations may provide tax advantages over c corporations, there are some potentially costly tax issues that you should assess before making a decision to switch. Valuation experts for both the taxpayer and the. The case involved a dispute between taxpayers and the irs over the fmv of shares of stock in an s corporation for gift tax purposes..

S Corp vs C Corp Differences & Benefits Wolters Kluwer

Before you convert a c corp to an s corp, understand how they differ, whether your company is eligible, and tax implications for the entity and shareholders. Although s corporations may provide tax advantages over c corporations, there are some potentially costly tax issues that you should assess before making a decision to switch. The case involved a dispute between.

The Case Involved A Dispute Between Taxpayers And The Irs Over The Fmv Of Shares Of Stock In An S Corporation For Gift Tax Purposes.

Before you convert a c corp to an s corp, understand how they differ, whether your company is eligible, and tax implications for the entity and shareholders. Although s corporations may provide tax advantages over c corporations, there are some potentially costly tax issues that you should assess before making a decision to switch. Valuation experts for both the taxpayer and the.