Ct State Tax Form

Ct State Tax Form - Select to register for the upcoming withholding forms w. Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue. Benefits to electronic filing include: File your 2023 connecticut income tax return online! Simple, secure, and can be completed from the. Connecticut state department of revenue services upcoming ct drs webinar :

Connecticut state department of revenue services upcoming ct drs webinar : Simple, secure, and can be completed from the. Select to register for the upcoming withholding forms w. Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue. Benefits to electronic filing include: File your 2023 connecticut income tax return online!

File your 2023 connecticut income tax return online! Connecticut state department of revenue services upcoming ct drs webinar : Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue. Simple, secure, and can be completed from the. Benefits to electronic filing include: Select to register for the upcoming withholding forms w.

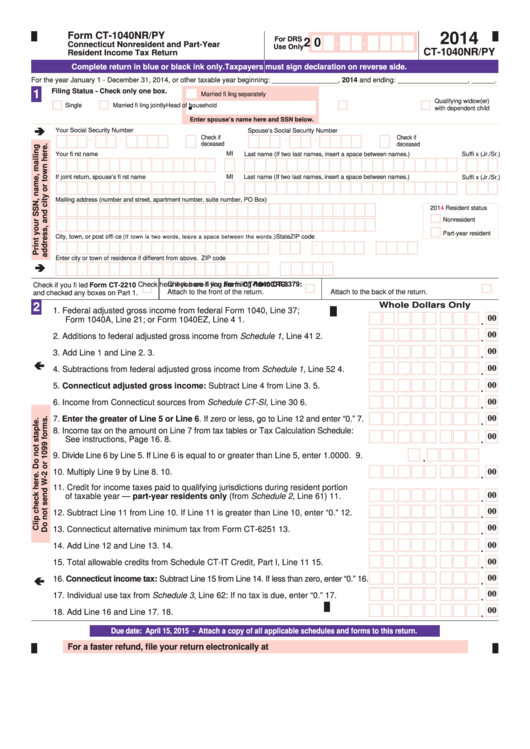

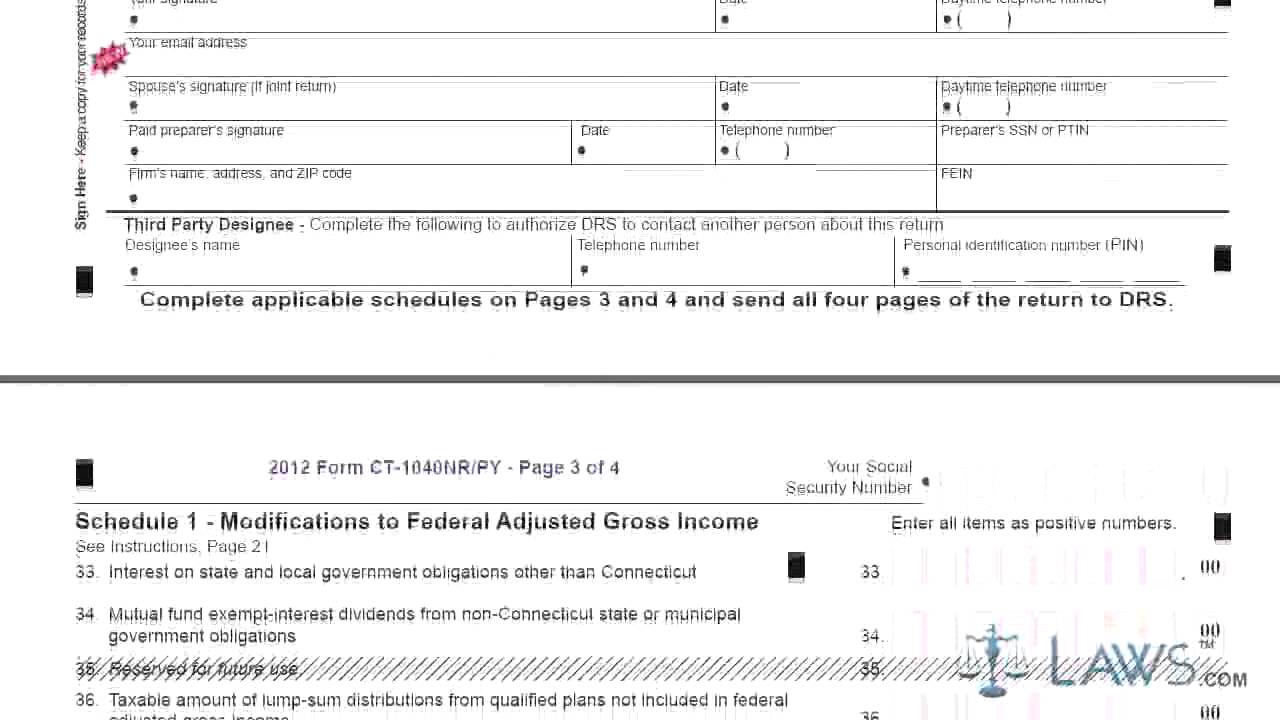

Fillable Form Ct1040nr/py Connecticut Nonresident And PartYear

Select to register for the upcoming withholding forms w. Benefits to electronic filing include: File your 2023 connecticut income tax return online! Simple, secure, and can be completed from the. Connecticut state department of revenue services upcoming ct drs webinar :

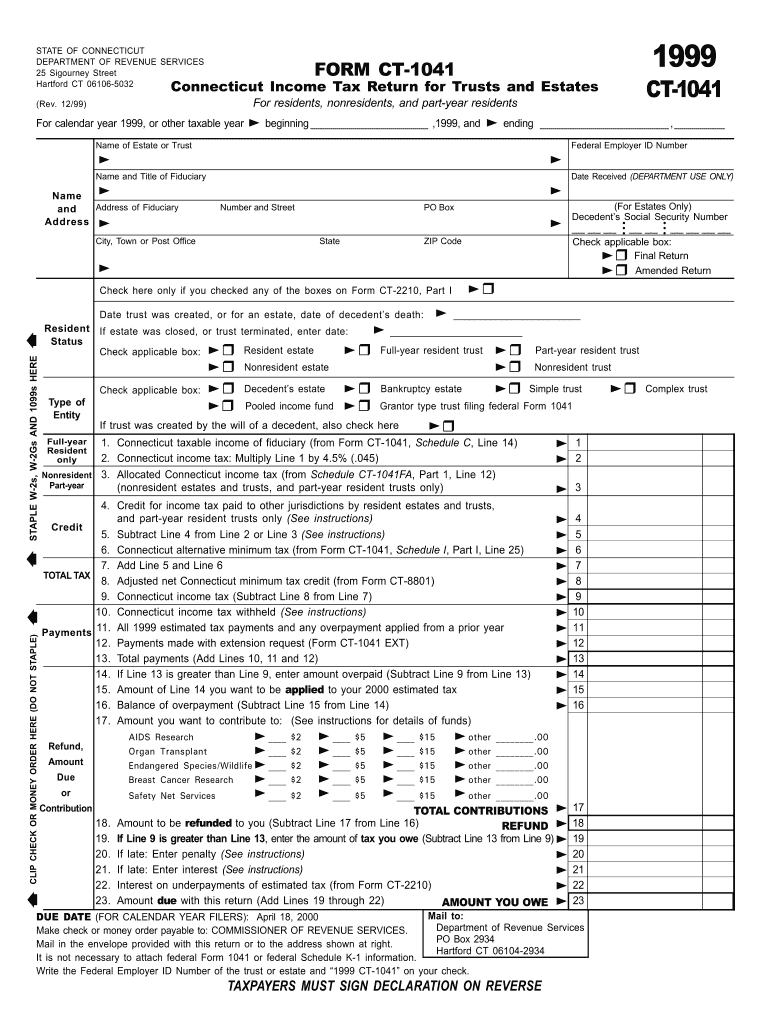

Where Do I Mail Ct 1041 airSlate SignNow

Benefits to electronic filing include: Simple, secure, and can be completed from the. Select to register for the upcoming withholding forms w. Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue. File your 2023 connecticut income tax return online!

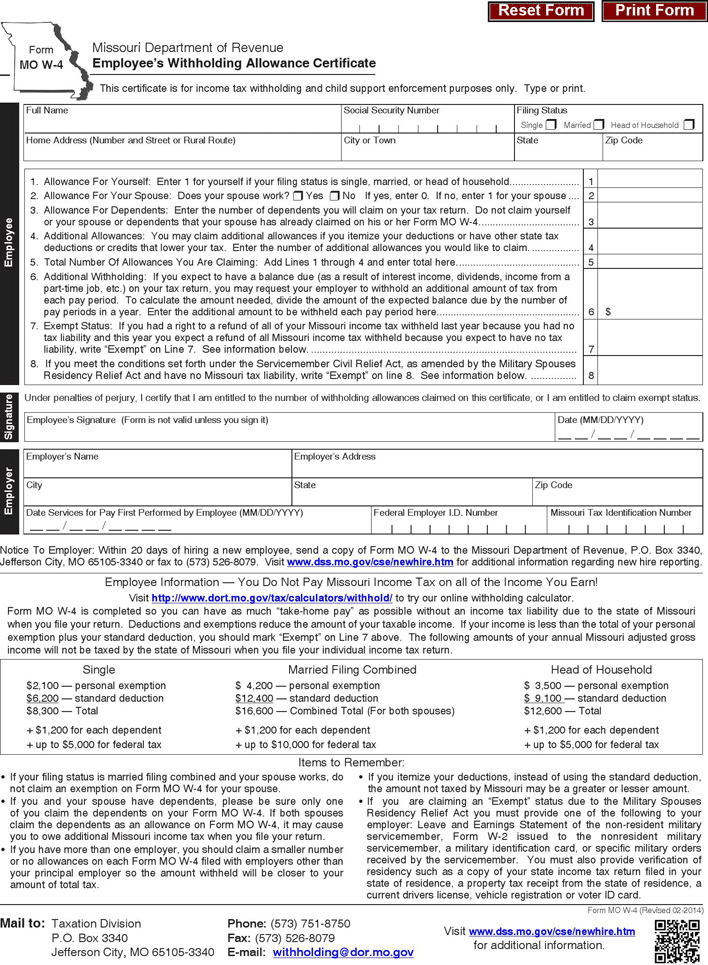

2023 Missouri W4 Form Printable Forms Free Online

File your 2023 connecticut income tax return online! Select to register for the upcoming withholding forms w. Connecticut state department of revenue services upcoming ct drs webinar : Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue. Benefits to electronic filing include:

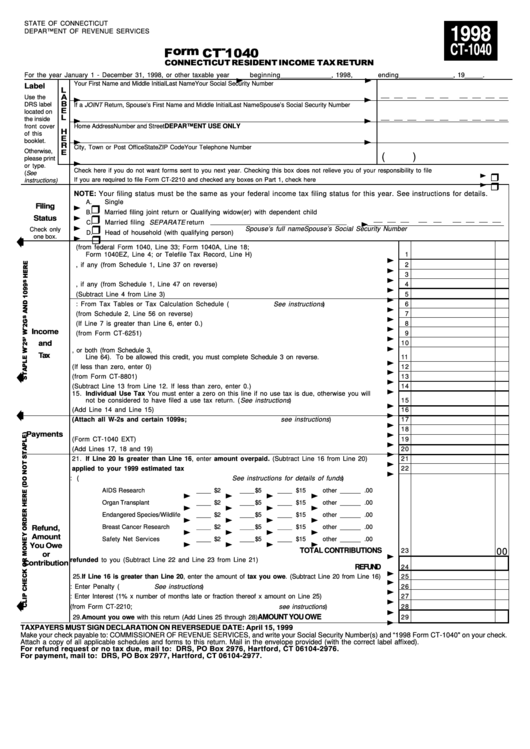

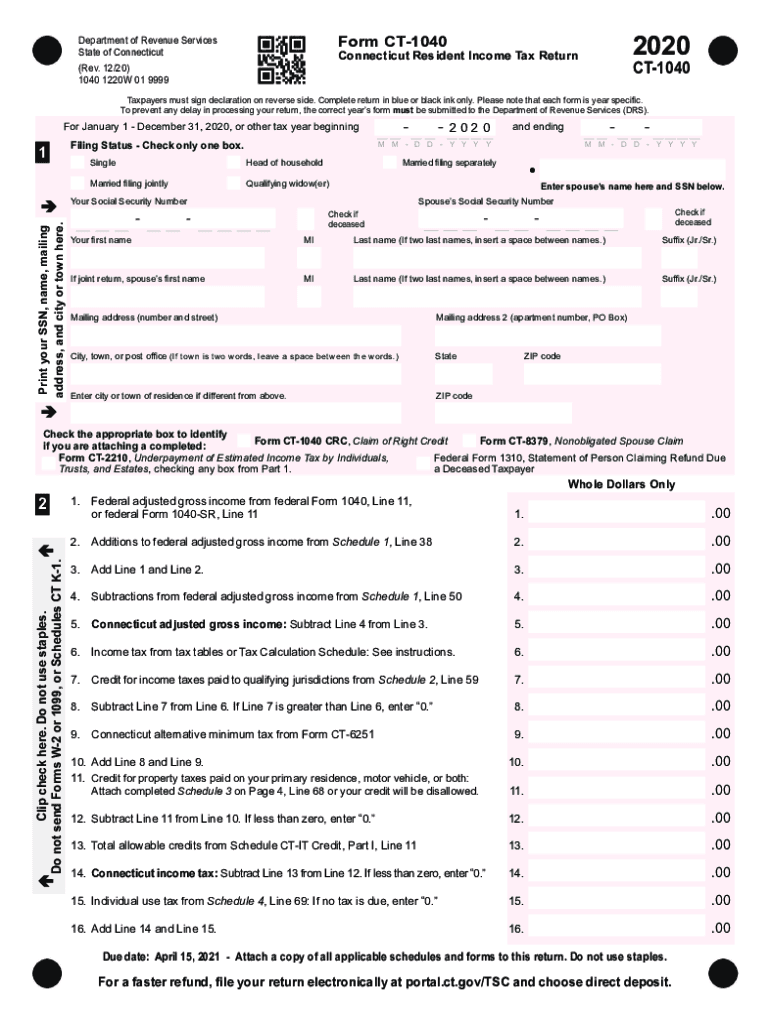

Fillable Form Ct 1040 Connecticut Resident Tax 2021 Tax Forms

File your 2023 connecticut income tax return online! Simple, secure, and can be completed from the. Select to register for the upcoming withholding forms w. Benefits to electronic filing include: Connecticut state department of revenue services upcoming ct drs webinar :

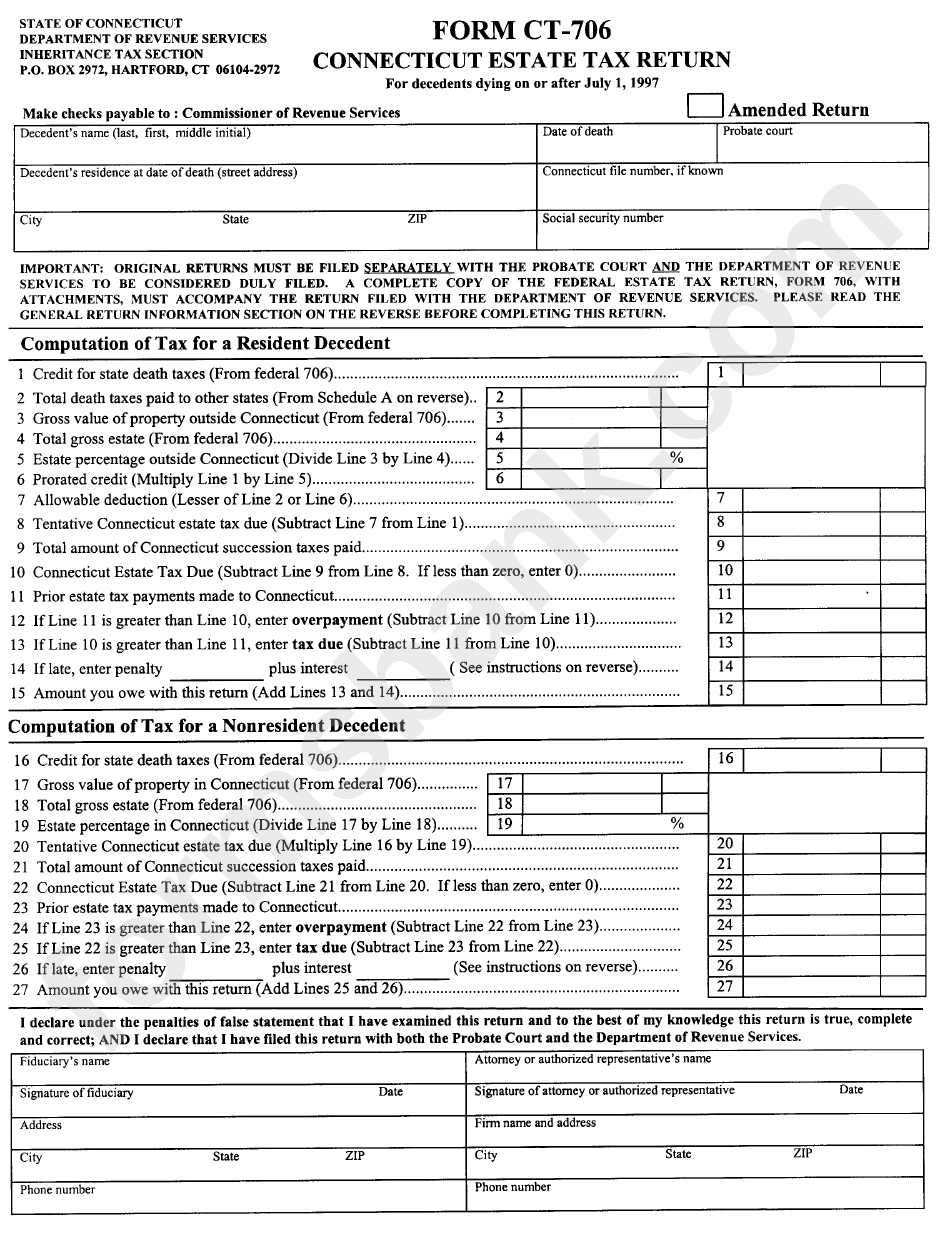

Fillable Form Ct 706 Nt Ext Printable Forms Free Online

Benefits to electronic filing include: Simple, secure, and can be completed from the. Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue. File your 2023 connecticut income tax return online! Connecticut state department of revenue services upcoming ct drs webinar :

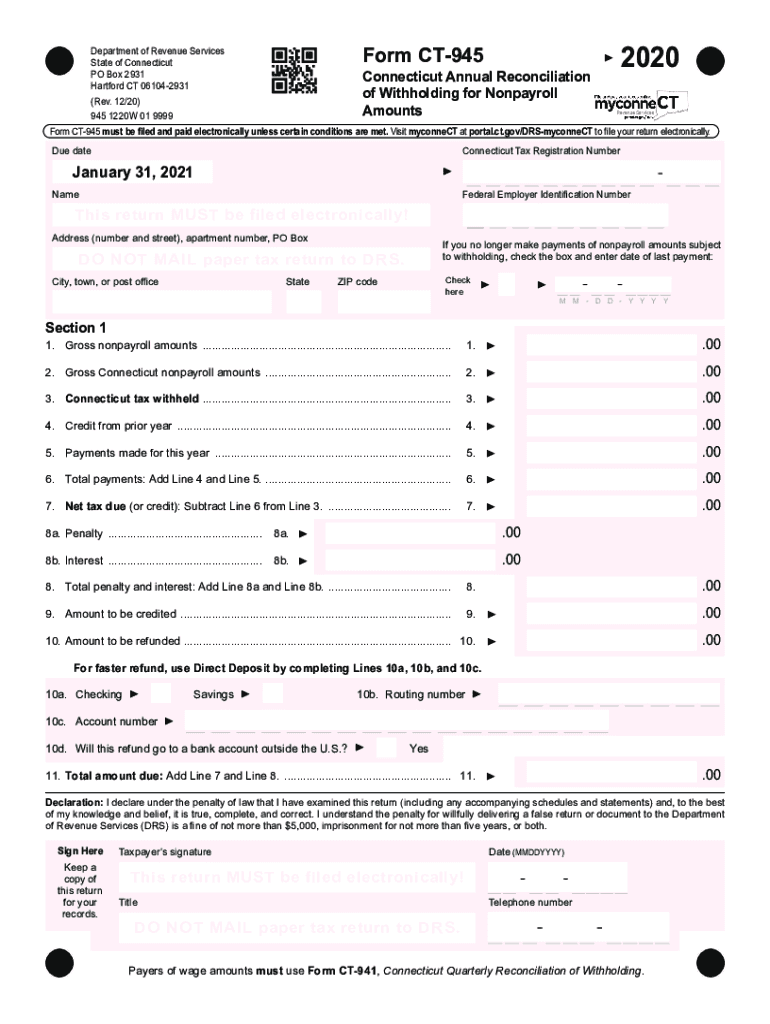

CT DRS CT945 20202022 Fill out Tax Template Online US Legal Forms

Select to register for the upcoming withholding forms w. Connecticut state department of revenue services upcoming ct drs webinar : Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue. File your 2023 connecticut income tax return online! Simple, secure, and can be completed from the.

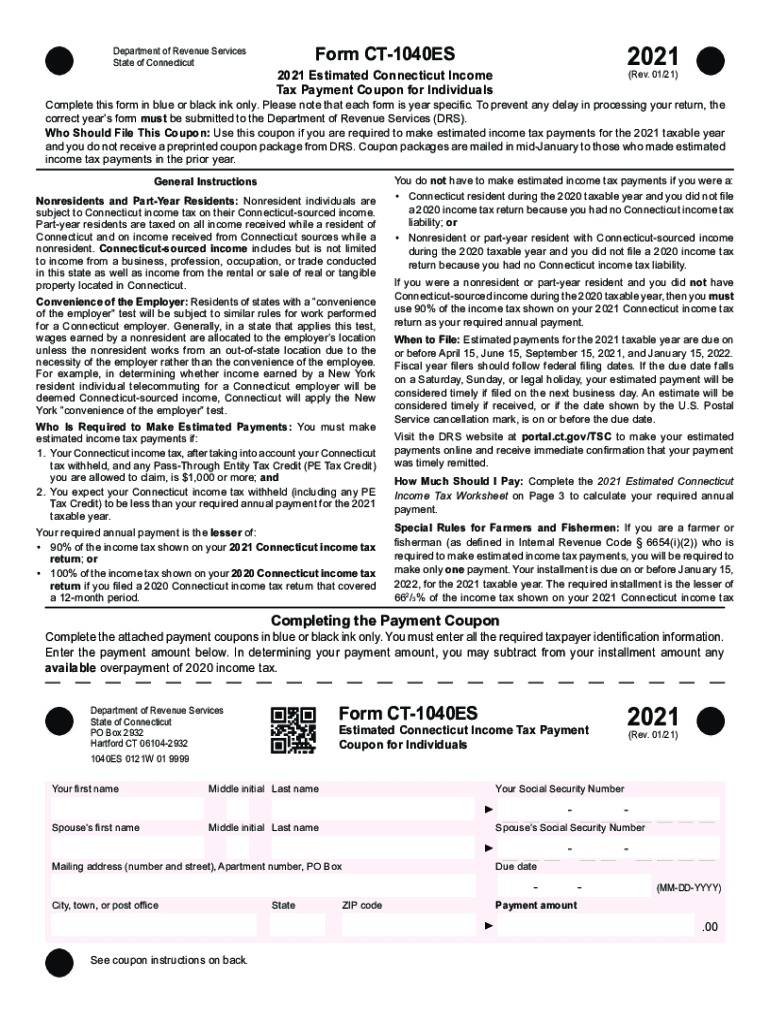

2021 Form CT DRS CT1040ES Fill Online, Printable, Fillable, Blank

Connecticut state department of revenue services upcoming ct drs webinar : Simple, secure, and can be completed from the. Select to register for the upcoming withholding forms w. File your 2023 connecticut income tax return online! Benefits to electronic filing include:

Fillable Ct State Tax Form 1040 Printable Forms Free Online

File your 2023 connecticut income tax return online! Simple, secure, and can be completed from the. Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue. Benefits to electronic filing include: Select to register for the upcoming withholding forms w.

Ct Drs Op 236 Fill Online, Printable, Fillable, Blank pdfFiller

Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue. Select to register for the upcoming withholding forms w. Simple, secure, and can be completed from the. File your 2023 connecticut income tax return online! Connecticut state department of revenue services upcoming ct drs webinar :

Form CT 1040NR PY Connecticut Nonresident and Part Year Resident

Connecticut state department of revenue services upcoming ct drs webinar : File your 2023 connecticut income tax return online! Select to register for the upcoming withholding forms w. Benefits to electronic filing include: Simple, secure, and can be completed from the.

Connecticut Has A State Income Tax That Ranges Between 2% And 6.99%, Which Is Administered By The Connecticut Department Of Revenue.

Select to register for the upcoming withholding forms w. File your 2023 connecticut income tax return online! Benefits to electronic filing include: Connecticut state department of revenue services upcoming ct drs webinar :