Does Depreciation Expense Go On The Balance Sheet

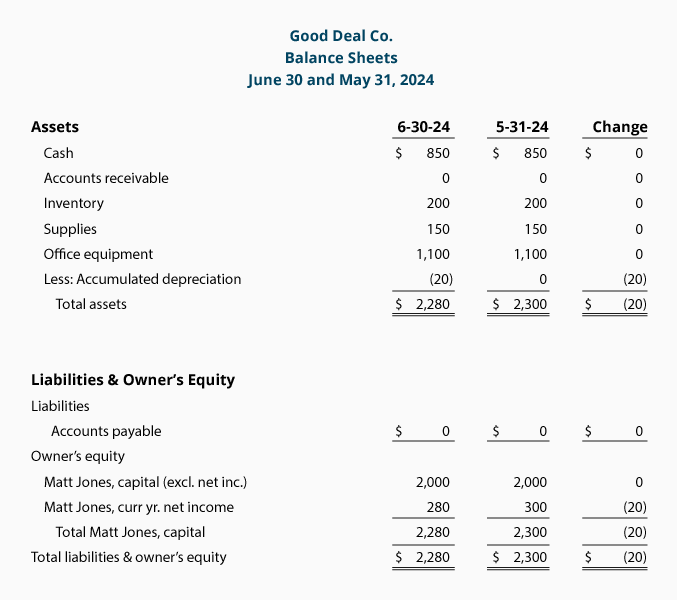

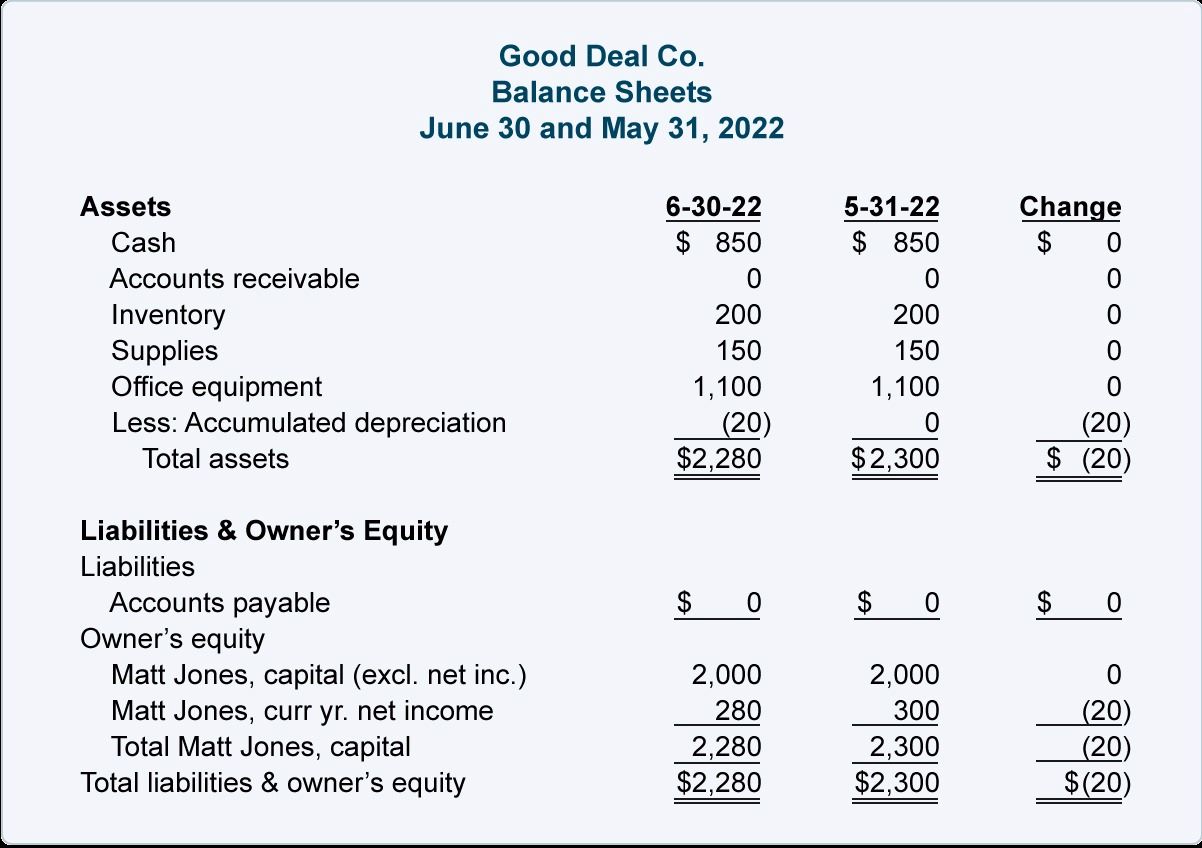

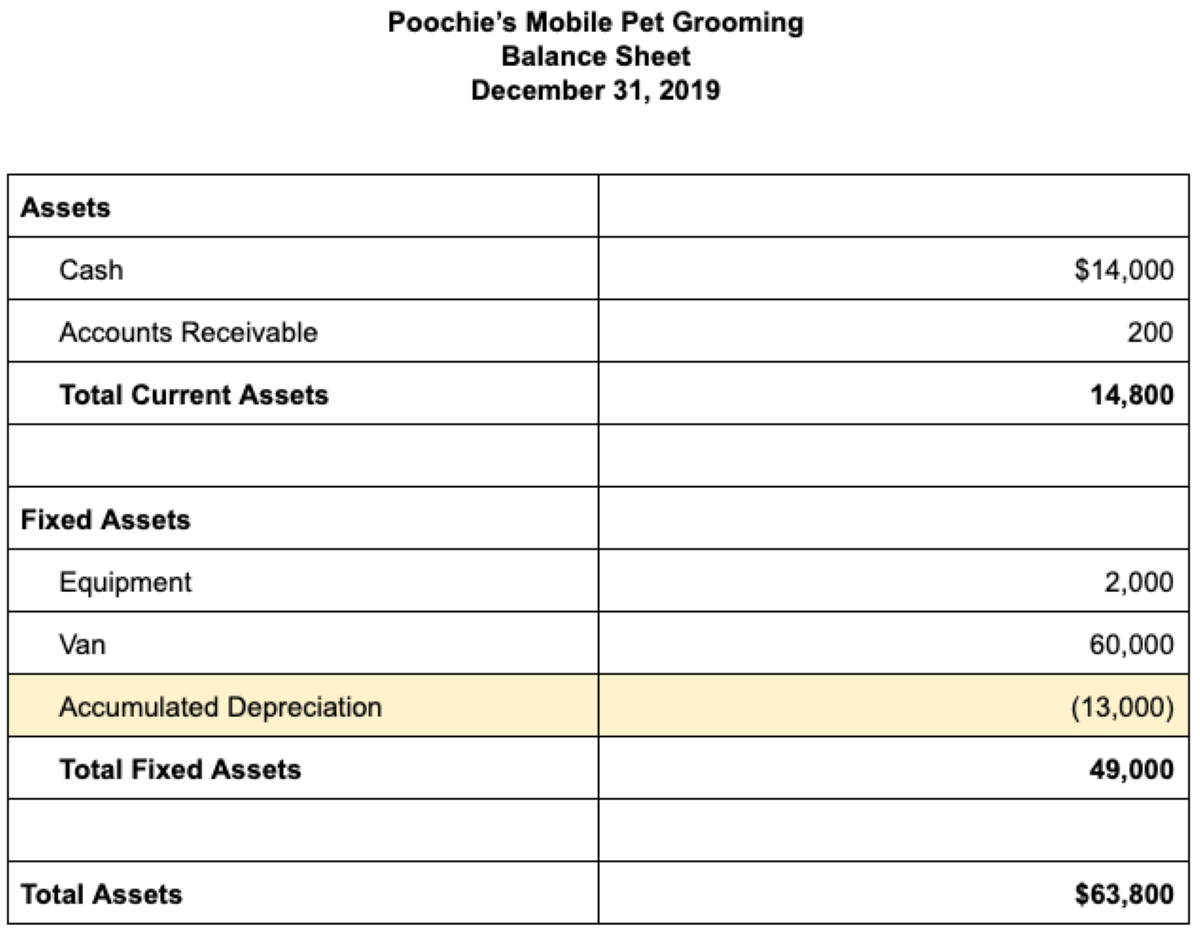

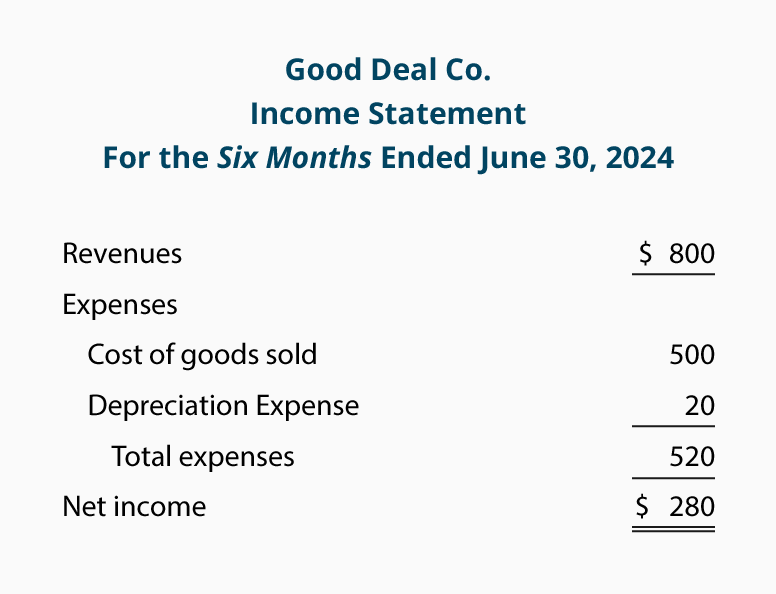

Does Depreciation Expense Go On The Balance Sheet - The good news is that depreciation is a non. Instead, it affects the value of the asset it is allocated to and subsequently impacts the overall financial position of the company. You won't see accumulated depreciation on a business tax form, but depreciation itself is included, as noted above, as an expense on the business profit and loss report. On an income statement or balance sheet. Depreciation is typically tracked one of two places: It accounts for depreciation charged to expense for the income reporting period. Accumulated depreciation is listed on the balance sheet. Depreciation expense is reported on the income statement along with other normal business expenses. Depreciation expense itself does not appear as a separate line item on the balance sheet. The depreciation expense reduces the asset account on the balance sheet, reflecting the actual cash outflow associated with the asset's decreasing value.

Also, cumulative depreciation appears on the balance sheet,. Instead, it affects the value of the asset it is allocated to and subsequently impacts the overall financial position of the company. Depreciation is typically tracked one of two places: The good news is that depreciation is a non. For income statements, depreciation is listed as an expense. Accumulated depreciation is listed on the balance sheet. On an income statement or balance sheet. You won't see accumulated depreciation on a business tax form, but depreciation itself is included, as noted above, as an expense on the business profit and loss report. The depreciation expense reduces the asset account on the balance sheet, reflecting the actual cash outflow associated with the asset's decreasing value. Depreciation expense is reported on the income statement along with other normal business expenses.

Instead, it affects the value of the asset it is allocated to and subsequently impacts the overall financial position of the company. Depreciation expense is reported on the income statement along with other normal business expenses. For income statements, depreciation is listed as an expense. The good news is that depreciation is a non. It accounts for depreciation charged to expense for the income reporting period. You won't see accumulated depreciation on a business tax form, but depreciation itself is included, as noted above, as an expense on the business profit and loss report. Depreciation expense itself does not appear as a separate line item on the balance sheet. Depreciation is typically tracked one of two places: On an income statement or balance sheet. The depreciation expense reduces the asset account on the balance sheet, reflecting the actual cash outflow associated with the asset's decreasing value.

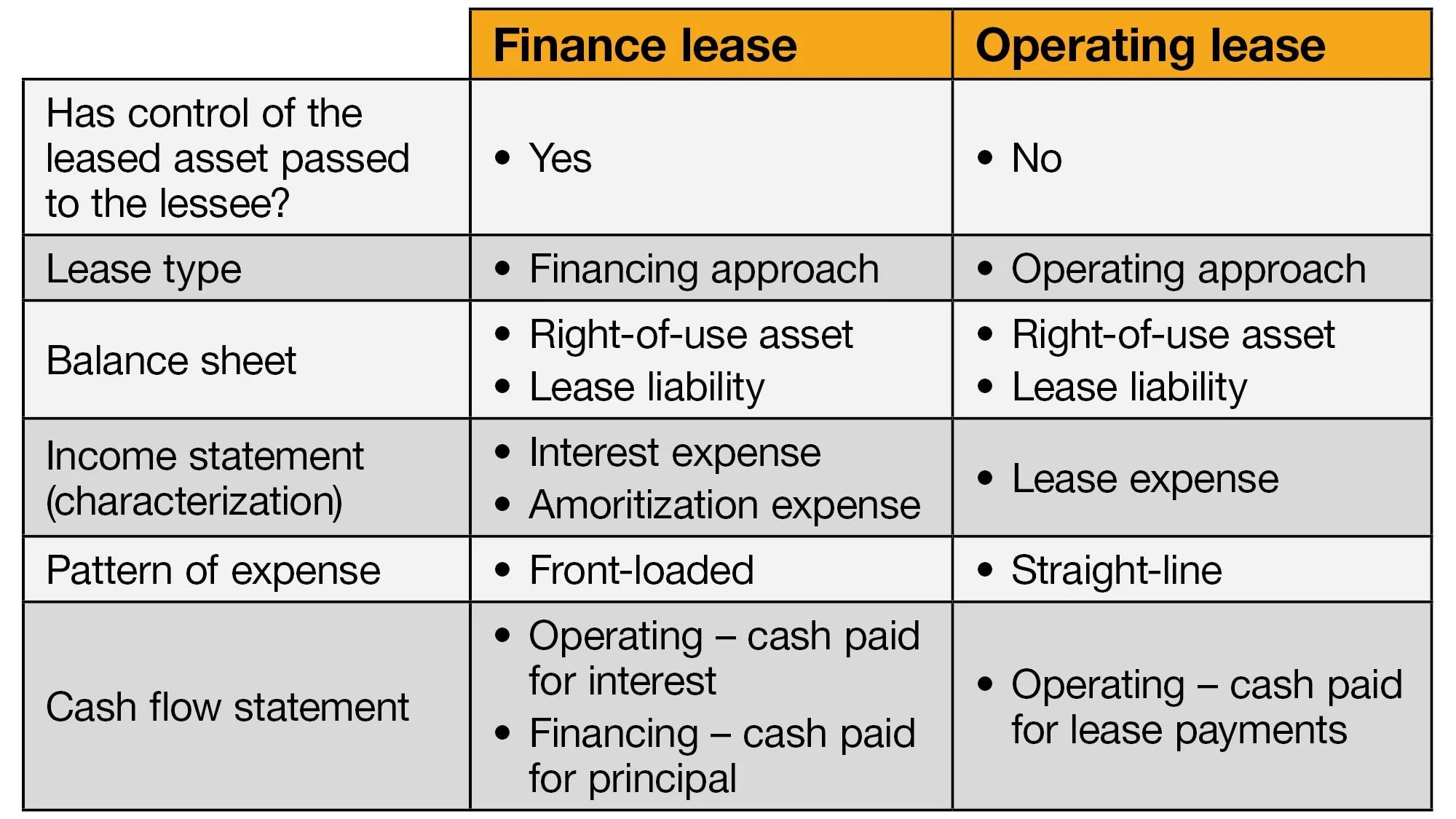

Amortization vs. Depreciation What's the Difference? (2024)

You won't see accumulated depreciation on a business tax form, but depreciation itself is included, as noted above, as an expense on the business profit and loss report. The depreciation expense reduces the asset account on the balance sheet, reflecting the actual cash outflow associated with the asset's decreasing value. Depreciation expense itself does not appear as a separate line.

Where Does Depreciation Expense Go On A Balance Sheet LiveWell

The depreciation expense reduces the asset account on the balance sheet, reflecting the actual cash outflow associated with the asset's decreasing value. Depreciation expense is reported on the income statement along with other normal business expenses. Depreciation is typically tracked one of two places: On an income statement or balance sheet. For income statements, depreciation is listed as an expense.

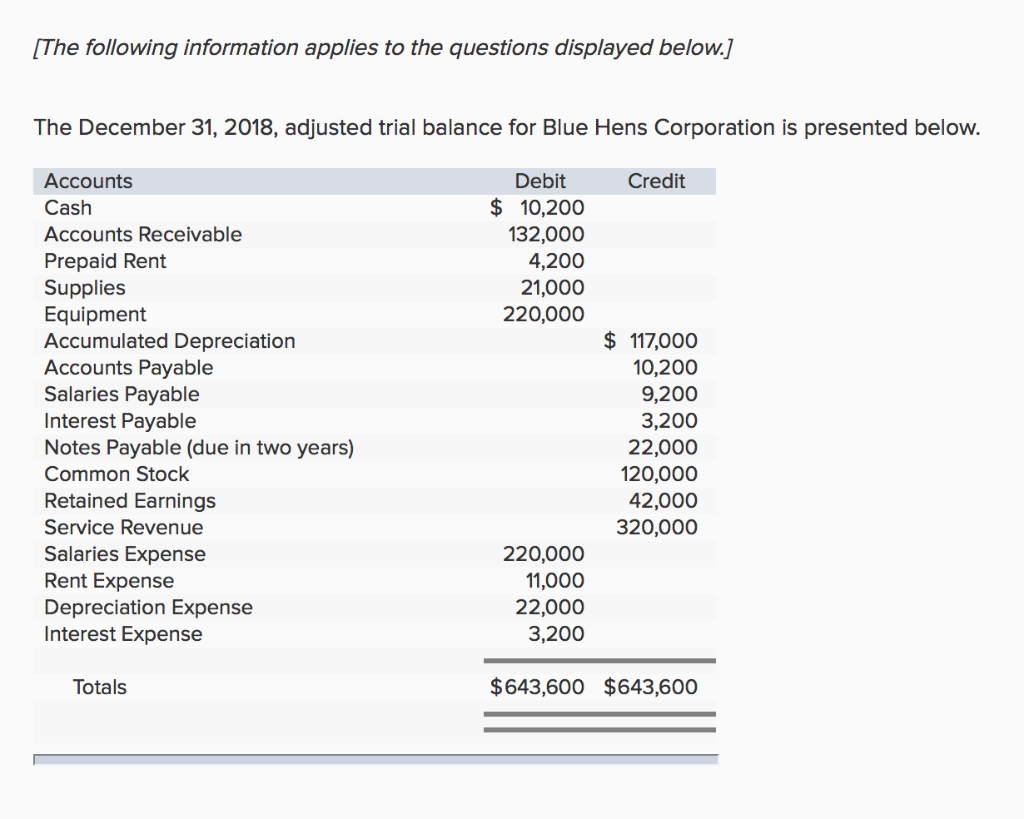

Solved 3. Prepare a classified balance sheet as of December

Accumulated depreciation is listed on the balance sheet. For income statements, depreciation is listed as an expense. Depreciation expense is reported on the income statement along with other normal business expenses. It accounts for depreciation charged to expense for the income reporting period. Also, cumulative depreciation appears on the balance sheet,.

Where Does Accumulated Amortization Go On The Balance Sheet LiveWell

The depreciation expense reduces the asset account on the balance sheet, reflecting the actual cash outflow associated with the asset's decreasing value. Depreciation expense is reported on the income statement along with other normal business expenses. Accumulated depreciation is listed on the balance sheet. Also, cumulative depreciation appears on the balance sheet,. Depreciation is typically tracked one of two places:

buy Soda water In need of acc depreciation on balance sheet Expect it

Accumulated depreciation is listed on the balance sheet. The good news is that depreciation is a non. Depreciation expense is reported on the income statement along with other normal business expenses. For income statements, depreciation is listed as an expense. On an income statement or balance sheet.

Ace Treatment Of Depreciation In Cash Flow Statement Trial Balance

Instead, it affects the value of the asset it is allocated to and subsequently impacts the overall financial position of the company. You won't see accumulated depreciation on a business tax form, but depreciation itself is included, as noted above, as an expense on the business profit and loss report. On an income statement or balance sheet. Depreciation expense itself.

buy Soda water In need of acc depreciation on balance sheet Expect it

On an income statement or balance sheet. For income statements, depreciation is listed as an expense. Depreciation expense is reported on the income statement along with other normal business expenses. Also, cumulative depreciation appears on the balance sheet,. The good news is that depreciation is a non.

Why is accumulated depreciation a credit balance?

Depreciation is typically tracked one of two places: Instead, it affects the value of the asset it is allocated to and subsequently impacts the overall financial position of the company. It accounts for depreciation charged to expense for the income reporting period. Depreciation expense is reported on the income statement along with other normal business expenses. The good news is.

Where Does Accumulated Amortization Go On The Balance Sheet LiveWell

It accounts for depreciation charged to expense for the income reporting period. Depreciation is typically tracked one of two places: The depreciation expense reduces the asset account on the balance sheet, reflecting the actual cash outflow associated with the asset's decreasing value. Depreciation expense itself does not appear as a separate line item on the balance sheet. Accumulated depreciation is.

Depreciation Expense Depreciation AccountingCoach

The depreciation expense reduces the asset account on the balance sheet, reflecting the actual cash outflow associated with the asset's decreasing value. Accumulated depreciation is listed on the balance sheet. Depreciation expense is reported on the income statement along with other normal business expenses. For income statements, depreciation is listed as an expense. You won't see accumulated depreciation on a.

Instead, It Affects The Value Of The Asset It Is Allocated To And Subsequently Impacts The Overall Financial Position Of The Company.

Depreciation expense itself does not appear as a separate line item on the balance sheet. Also, cumulative depreciation appears on the balance sheet,. It accounts for depreciation charged to expense for the income reporting period. The good news is that depreciation is a non.

The Depreciation Expense Reduces The Asset Account On The Balance Sheet, Reflecting The Actual Cash Outflow Associated With The Asset's Decreasing Value.

Accumulated depreciation is listed on the balance sheet. Depreciation is typically tracked one of two places: You won't see accumulated depreciation on a business tax form, but depreciation itself is included, as noted above, as an expense on the business profit and loss report. On an income statement or balance sheet.

Depreciation Expense Is Reported On The Income Statement Along With Other Normal Business Expenses.

For income statements, depreciation is listed as an expense.

:max_bytes(150000):strip_icc()/Amazon1-44e7bd8e358a4b8688093664825b23cd.JPG)

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)