Does The Irs Send Certified Letters

Does The Irs Send Certified Letters - The notice or letter will explain the reason for the contact and gives instructions on what to do. This provides the irs with proof you receive their notice and confirms the identity of the person accepting the mail. Does the irs send certified mail? A certified letter from the irs is often used when they. Is certified mail from the irs. Usually, the irs sends certified letters to inform taxpayers of issues that need attention. Some common reasons for certified letters include an outstanding balance, refund issues, return. Yes, the irs sends certified mail. In fact, the tax code requires the irs to send certain notices via certified mail. Why would the irs send a certified letter instead of regular mail?

Usually, the irs sends certified letters to inform taxpayers of issues that need attention. Some common reasons for certified letters include an outstanding balance, refund issues, return. The notice or letter will explain the reason for the contact and gives instructions on what to do. A certified letter from the irs is often used when they. Most irs letters and notices are about federal tax returns or tax accounts. Why would the irs send a certified letter instead of regular mail? Yes, the irs sends certified mail. This provides the irs with proof you receive their notice and confirms the identity of the person accepting the mail. Irs certified letters require the recipient to sign for the mail. In fact, the tax code requires the irs to send certain notices via certified mail.

A certified letter from the irs is often used when they. Is certified mail from the irs. Usually, the irs sends certified letters to inform taxpayers of issues that need attention. Irs certified letters require the recipient to sign for the mail. This provides the irs with proof you receive their notice and confirms the identity of the person accepting the mail. The notice or letter will explain the reason for the contact and gives instructions on what to do. There are several reasons why the irs sends certified mail: Most irs letters and notices are about federal tax returns or tax accounts. Yes, the irs sends certified mail. In fact, the tax code requires the irs to send certain notices via certified mail.

IRS Letter 5071C Sample 1 Irs taxes, Irs, Lettering

A certified letter from the irs is often used when they. In fact, the tax code requires the irs to send certain notices via certified mail. Some common reasons for certified letters include an outstanding balance, refund issues, return. Is certified mail from the irs. The notice or letter will explain the reason for the contact and gives instructions on.

IRS Letter 2272C Sample 1

The notice or letter will explain the reason for the contact and gives instructions on what to do. Yes, the irs sends certified mail. Why would the irs send a certified letter instead of regular mail? A certified letter from the irs is often used when they. There are several reasons why the irs sends certified mail:

When Does Irs Start Processing Returns 2024 Aleda Aundrea

Yes, the irs sends certified mail. There are several reasons why the irs sends certified mail: Some common reasons for certified letters include an outstanding balance, refund issues, return. Does the irs send certified mail? The notice or letter will explain the reason for the contact and gives instructions on what to do.

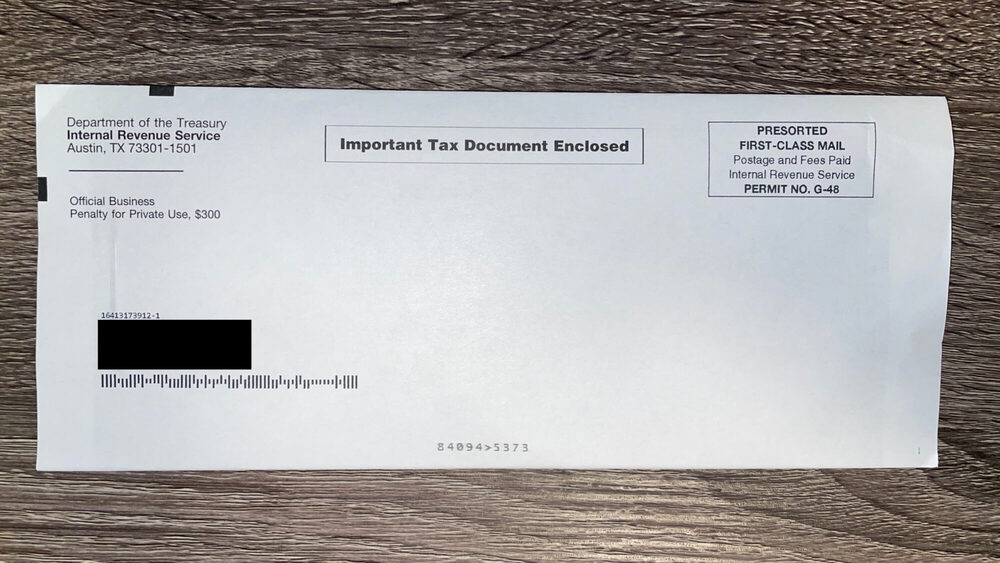

How To Send A Certified Letter Thankyou Letter

There are several reasons why the irs sends certified mail: Most irs letters and notices are about federal tax returns or tax accounts. Irs certified letters require the recipient to sign for the mail. Usually, the irs sends certified letters to inform taxpayers of issues that need attention. A certified letter from the irs is often used when they.

Irs Sending Money 2024 Andra Blanche

Irs certified letters require the recipient to sign for the mail. Does the irs send certified mail? There are several reasons why the irs sends certified mail: Is certified mail from the irs. A certified letter from the irs is often used when they.

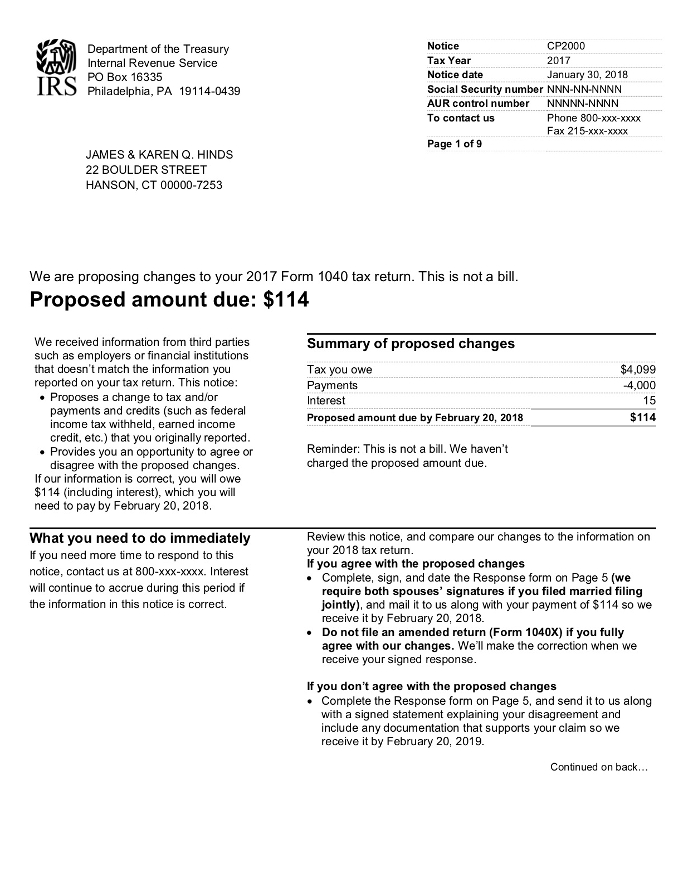

What To Know About IRS Letters and Notices Wheeler Accountants

Irs certified letters require the recipient to sign for the mail. Why would the irs send a certified letter instead of regular mail? Usually, the irs sends certified letters to inform taxpayers of issues that need attention. Most irs letters and notices are about federal tax returns or tax accounts. A certified letter from the irs is often used when.

5+ Irs Audit Letter Envelope NeahSurina

A certified letter from the irs is often used when they. Some common reasons for certified letters include an outstanding balance, refund issues, return. The notice or letter will explain the reason for the contact and gives instructions on what to do. Does the irs send certified mail? This provides the irs with proof you receive their notice and confirms.

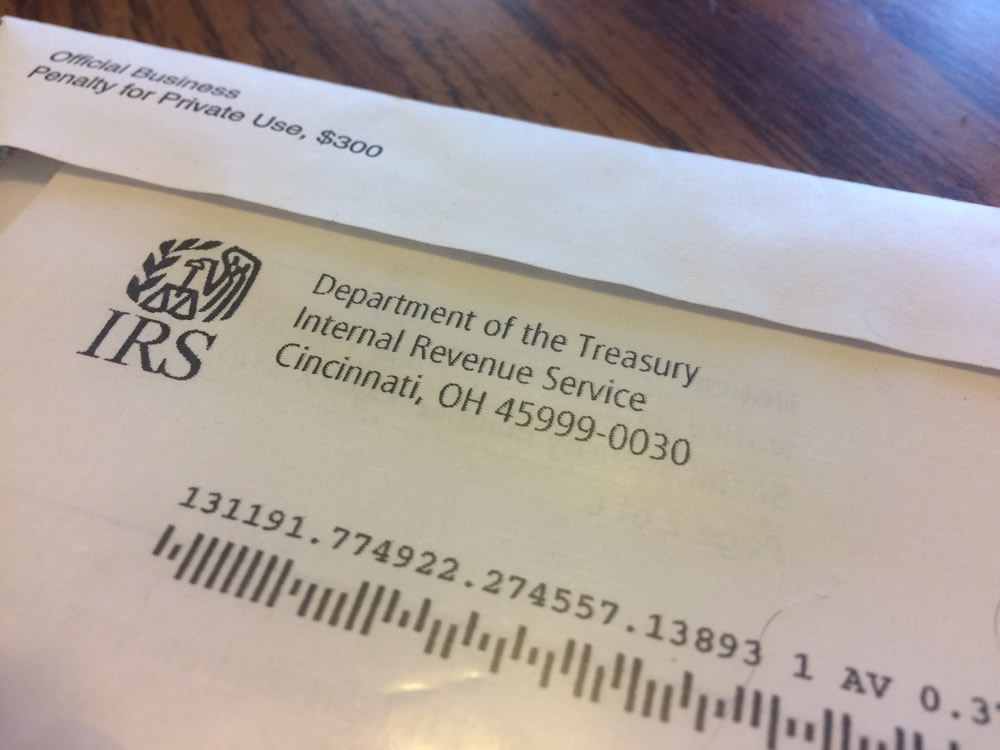

IRS Certified Mail Understanding Your Letter And Responding

The notice or letter will explain the reason for the contact and gives instructions on what to do. Why would the irs send a certified letter instead of regular mail? Yes, the irs sends certified mail. Is certified mail from the irs. In fact, the tax code requires the irs to send certain notices via certified mail.

Notice from IRS(CP11) Tax4ga Tax & Accounting Pros

Irs certified letters require the recipient to sign for the mail. Usually, the irs sends certified letters to inform taxpayers of issues that need attention. There are several reasons why the irs sends certified mail: Some common reasons for certified letters include an outstanding balance, refund issues, return. Does the irs send certified mail?

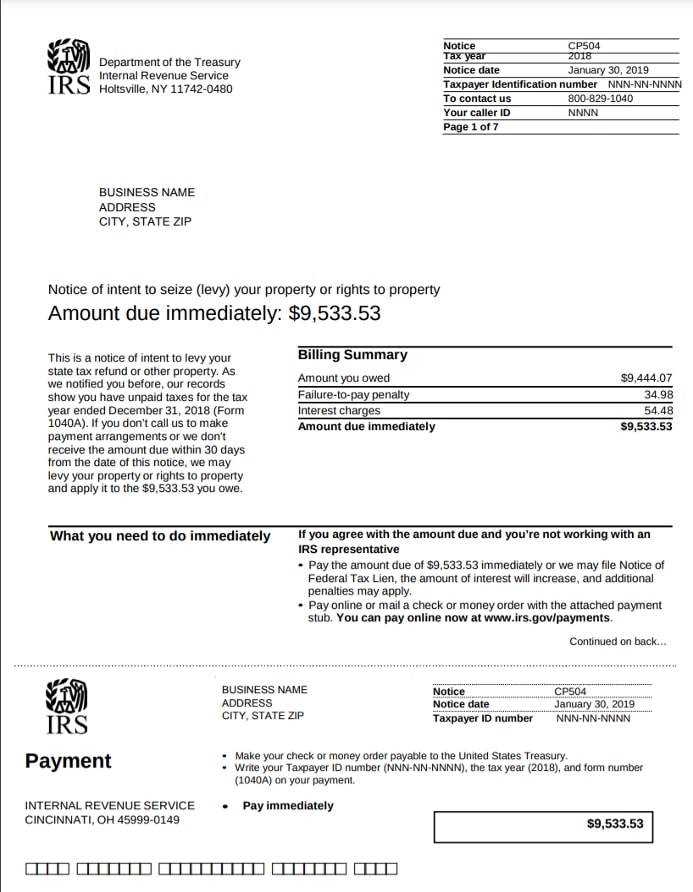

IRS Audit Letter CP504 Sample 1

This provides the irs with proof you receive their notice and confirms the identity of the person accepting the mail. Why would the irs send a certified letter instead of regular mail? In fact, the tax code requires the irs to send certain notices via certified mail. Yes, the irs sends certified mail. Irs certified letters require the recipient to.

Does The Irs Send Certified Mail?

Yes, the irs sends certified mail. Irs certified letters require the recipient to sign for the mail. Some common reasons for certified letters include an outstanding balance, refund issues, return. A certified letter from the irs is often used when they.

Is Certified Mail From The Irs.

In fact, the tax code requires the irs to send certain notices via certified mail. This provides the irs with proof you receive their notice and confirms the identity of the person accepting the mail. The notice or letter will explain the reason for the contact and gives instructions on what to do. Why would the irs send a certified letter instead of regular mail?

Most Irs Letters And Notices Are About Federal Tax Returns Or Tax Accounts.

Usually, the irs sends certified letters to inform taxpayers of issues that need attention. There are several reasons why the irs sends certified mail: