Does Zelle Send Tax Forms

Does Zelle Send Tax Forms - Zelle is not obligated to provide irs reports when a user’s income on their platform surpasses just $600, as the $600 income reporting threshold does not. You need to know that zelle itself does not issue. Understanding zelle tax reporting can help you navigate your obligations and avoid potential pitfalls. You must report any and all business income to the irs in your tax return — even if zelle doesn’t send you any tax forms.

Understanding zelle tax reporting can help you navigate your obligations and avoid potential pitfalls. You must report any and all business income to the irs in your tax return — even if zelle doesn’t send you any tax forms. You need to know that zelle itself does not issue. Zelle is not obligated to provide irs reports when a user’s income on their platform surpasses just $600, as the $600 income reporting threshold does not.

Understanding zelle tax reporting can help you navigate your obligations and avoid potential pitfalls. You need to know that zelle itself does not issue. Zelle is not obligated to provide irs reports when a user’s income on their platform surpasses just $600, as the $600 income reporting threshold does not. You must report any and all business income to the irs in your tax return — even if zelle doesn’t send you any tax forms.

CIJ_ICJ On X PRESS RELEASE Canada, Sweden, Ukraine And, 47 OFF

Understanding zelle tax reporting can help you navigate your obligations and avoid potential pitfalls. Zelle is not obligated to provide irs reports when a user’s income on their platform surpasses just $600, as the $600 income reporting threshold does not. You need to know that zelle itself does not issue. You must report any and all business income to the.

Does Current Work with Zelle?

Zelle is not obligated to provide irs reports when a user’s income on their platform surpasses just $600, as the $600 income reporting threshold does not. You need to know that zelle itself does not issue. Understanding zelle tax reporting can help you navigate your obligations and avoid potential pitfalls. You must report any and all business income to the.

How To Receive Money From Zelle Wells Fargo Pagan Satedilly

You need to know that zelle itself does not issue. Understanding zelle tax reporting can help you navigate your obligations and avoid potential pitfalls. Zelle is not obligated to provide irs reports when a user’s income on their platform surpasses just $600, as the $600 income reporting threshold does not. You must report any and all business income to the.

+21 Can U Transfer Money From Zelle To Cash App References

You need to know that zelle itself does not issue. Understanding zelle tax reporting can help you navigate your obligations and avoid potential pitfalls. Zelle is not obligated to provide irs reports when a user’s income on their platform surpasses just $600, as the $600 income reporting threshold does not. You must report any and all business income to the.

📲 ZELLE SET UP (How does ZELLE work) OPEN an ACCOUNT and USE ZELLE to

Zelle is not obligated to provide irs reports when a user’s income on their platform surpasses just $600, as the $600 income reporting threshold does not. Understanding zelle tax reporting can help you navigate your obligations and avoid potential pitfalls. You need to know that zelle itself does not issue. You must report any and all business income to the.

Does Zelle Work Internationally? No, but Here Are the Alternatives

Zelle is not obligated to provide irs reports when a user’s income on their platform surpasses just $600, as the $600 income reporting threshold does not. You need to know that zelle itself does not issue. You must report any and all business income to the irs in your tax return — even if zelle doesn’t send you any tax.

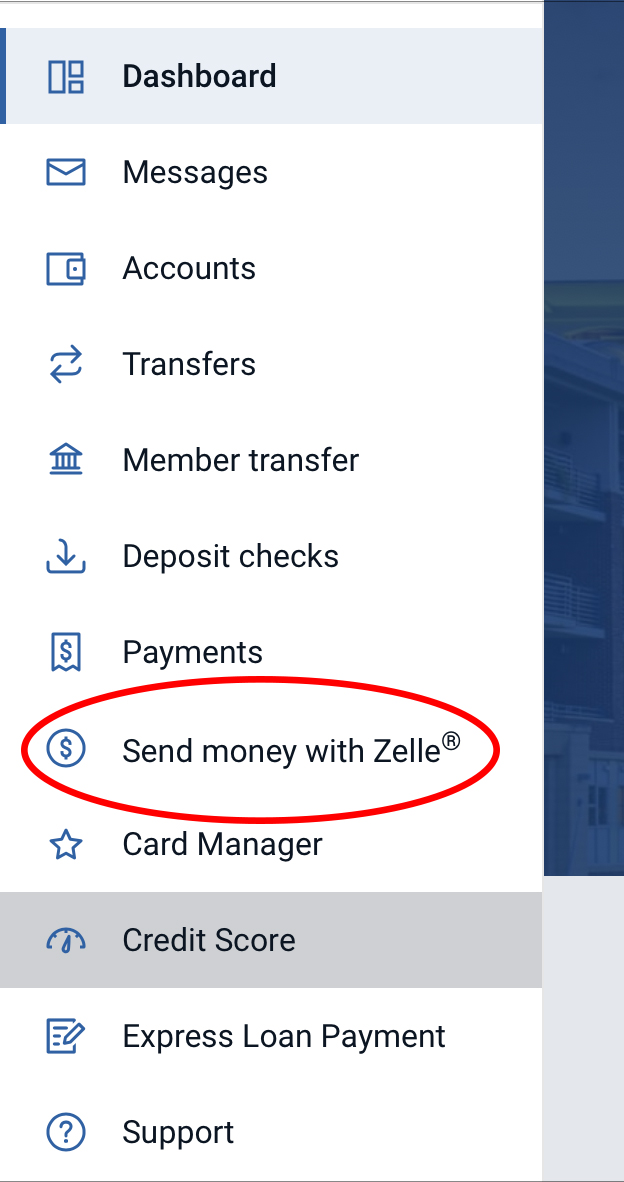

Does State Employees Credit Union have Zelle? Leia aqui Can I use

Zelle is not obligated to provide irs reports when a user’s income on their platform surpasses just $600, as the $600 income reporting threshold does not. You must report any and all business income to the irs in your tax return — even if zelle doesn’t send you any tax forms. Understanding zelle tax reporting can help you navigate your.

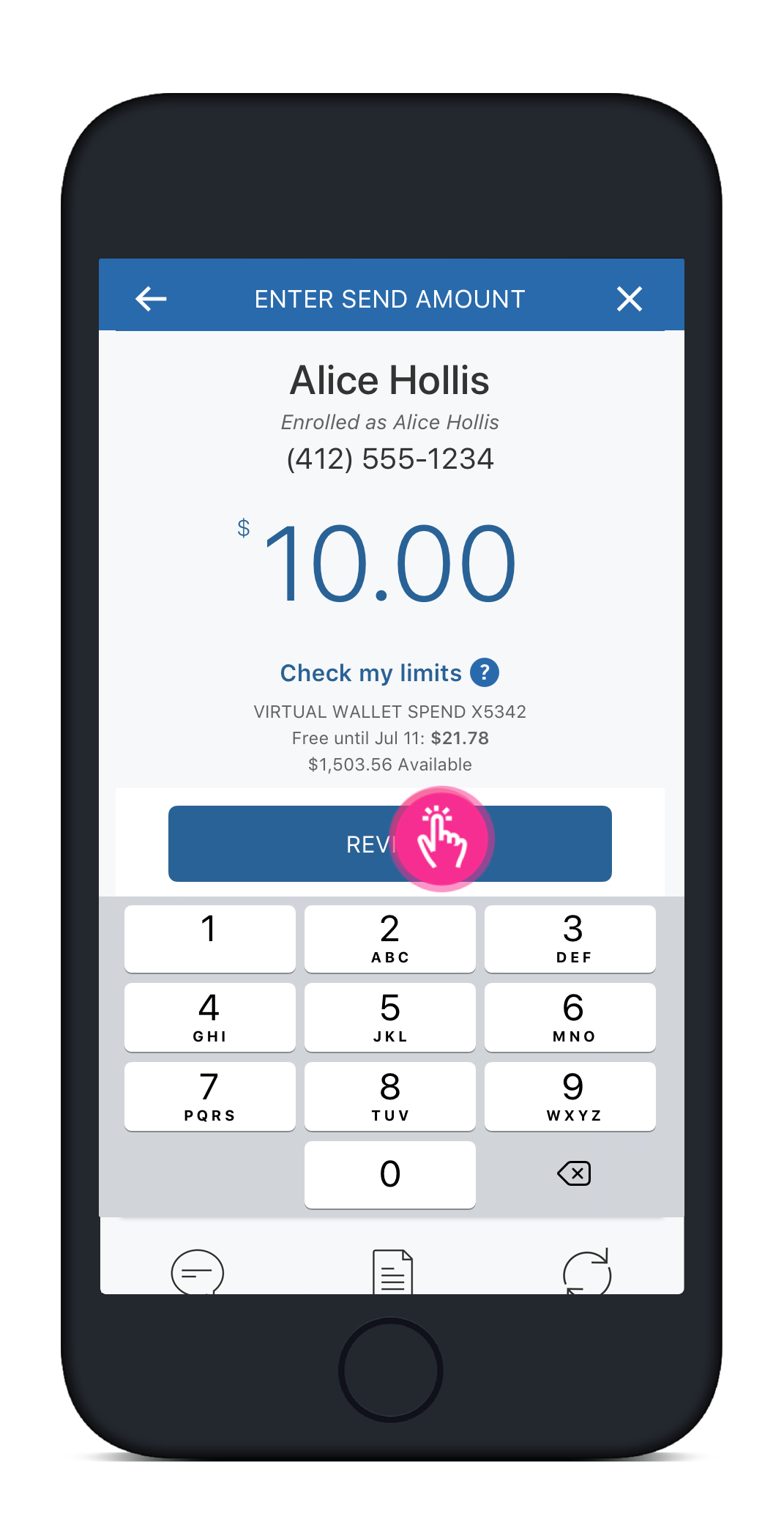

How Does Zelle Work? A Guide to Using Zelle

You need to know that zelle itself does not issue. Understanding zelle tax reporting can help you navigate your obligations and avoid potential pitfalls. Zelle is not obligated to provide irs reports when a user’s income on their platform surpasses just $600, as the $600 income reporting threshold does not. You must report any and all business income to the.

Does Zelle accept credit cards? Leia aqui Can you pay someone with a

You must report any and all business income to the irs in your tax return — even if zelle doesn’t send you any tax forms. You need to know that zelle itself does not issue. Understanding zelle tax reporting can help you navigate your obligations and avoid potential pitfalls. Zelle is not obligated to provide irs reports when a user’s.

How Does Zelle Work? A Guide to Using Zelle

You need to know that zelle itself does not issue. Zelle is not obligated to provide irs reports when a user’s income on their platform surpasses just $600, as the $600 income reporting threshold does not. You must report any and all business income to the irs in your tax return — even if zelle doesn’t send you any tax.

You Need To Know That Zelle Itself Does Not Issue.

Zelle is not obligated to provide irs reports when a user’s income on their platform surpasses just $600, as the $600 income reporting threshold does not. Understanding zelle tax reporting can help you navigate your obligations and avoid potential pitfalls. You must report any and all business income to the irs in your tax return — even if zelle doesn’t send you any tax forms.