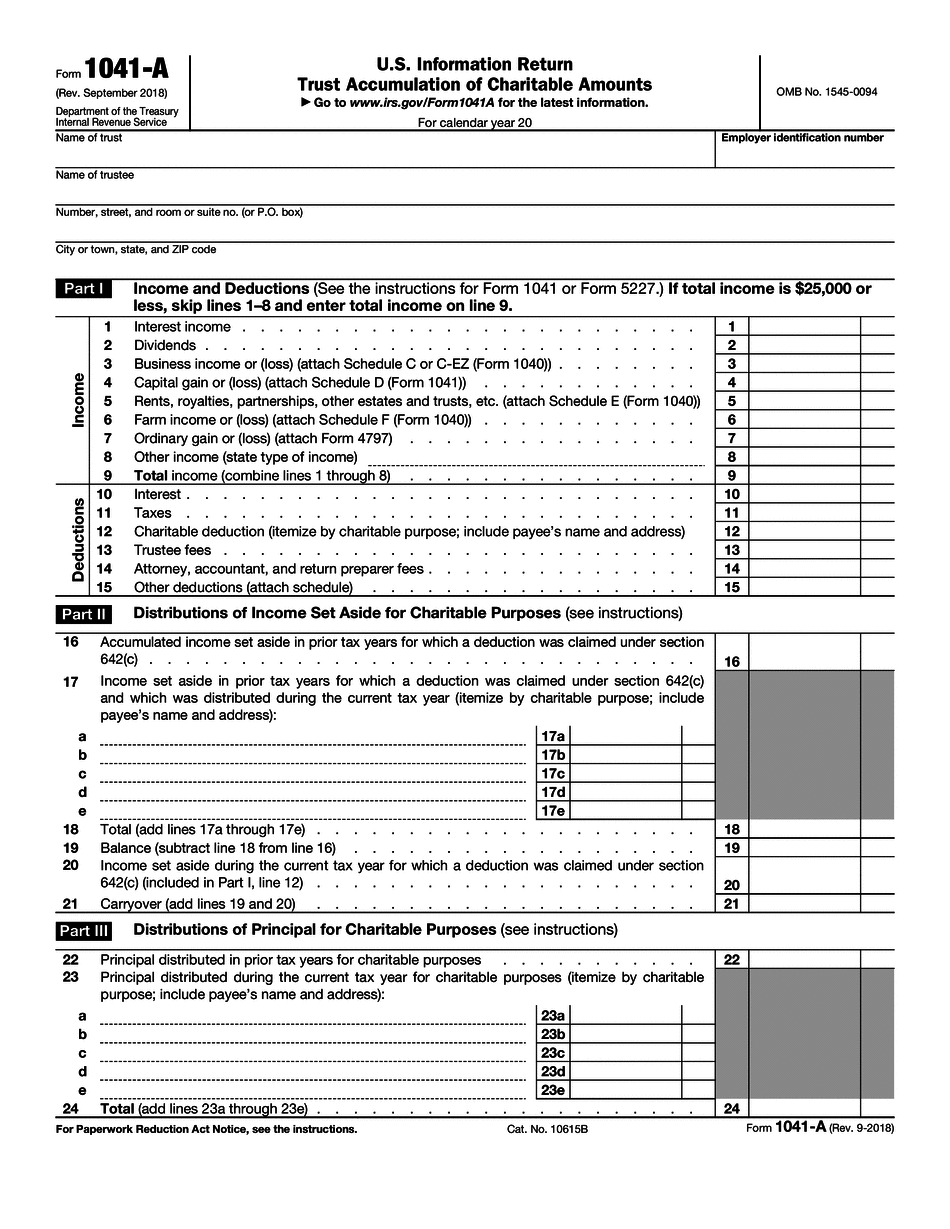

Extension Form For 1041

Extension Form For 1041 - Learn how to file form 1041, u.s. File request for extension by the due date of the return. Income tax return for estates and trusts, and its related schedules. Part i automatic extension for certain. In the case of a 1041, this is by the 15th day of the 4th month after the end of the tax year for the return. For the 2023 tax year, you can file 2023, 2022, and 2021 tax year returns. See instructions before completing this form. Learn how to extend the deadline for filing form 1041, the u.s. Find out the latest updates,. Income tax return for estates and trusts, using form 7004.

See instructions before completing this form. Part i automatic extension for certain. Income tax return for estates and trusts, and its related schedules. File request for extension by the due date of the return. Find out the latest updates,. Learn how to file form 1041, u.s. Income tax return for estates and trusts, using form 7004. In the case of a 1041, this is by the 15th day of the 4th month after the end of the tax year for the return. For the 2023 tax year, you can file 2023, 2022, and 2021 tax year returns. Learn how to extend the deadline for filing form 1041, the u.s.

For the 2023 tax year, you can file 2023, 2022, and 2021 tax year returns. In the case of a 1041, this is by the 15th day of the 4th month after the end of the tax year for the return. Learn how to extend the deadline for filing form 1041, the u.s. Income tax return for estates and trusts, using form 7004. See instructions before completing this form. Part i automatic extension for certain. Learn how to file form 1041, u.s. File request for extension by the due date of the return. Find out the latest updates,. Income tax return for estates and trusts, and its related schedules.

2024 Form 1041 Tedi Abagael

Learn how to extend the deadline for filing form 1041, the u.s. See instructions before completing this form. Income tax return for estates and trusts, using form 7004. Learn how to file form 1041, u.s. File request for extension by the due date of the return.

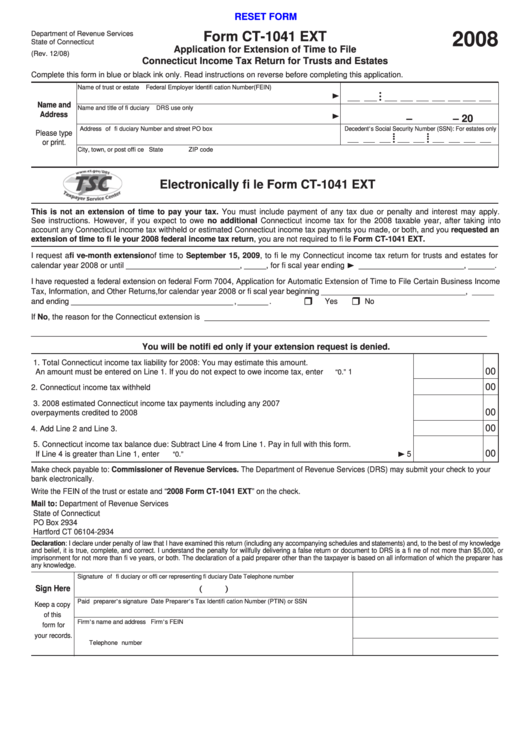

Fillable Form Ct1041 Ext Application For Extension Of Time To File

Learn how to file form 1041, u.s. Learn how to extend the deadline for filing form 1041, the u.s. For the 2023 tax year, you can file 2023, 2022, and 2021 tax year returns. Part i automatic extension for certain. Find out the latest updates,.

1041 Qft informacionpublica.svet.gob.gt

Income tax return for estates and trusts, and its related schedules. File request for extension by the due date of the return. Learn how to file form 1041, u.s. For the 2023 tax year, you can file 2023, 2022, and 2021 tax year returns. See instructions before completing this form.

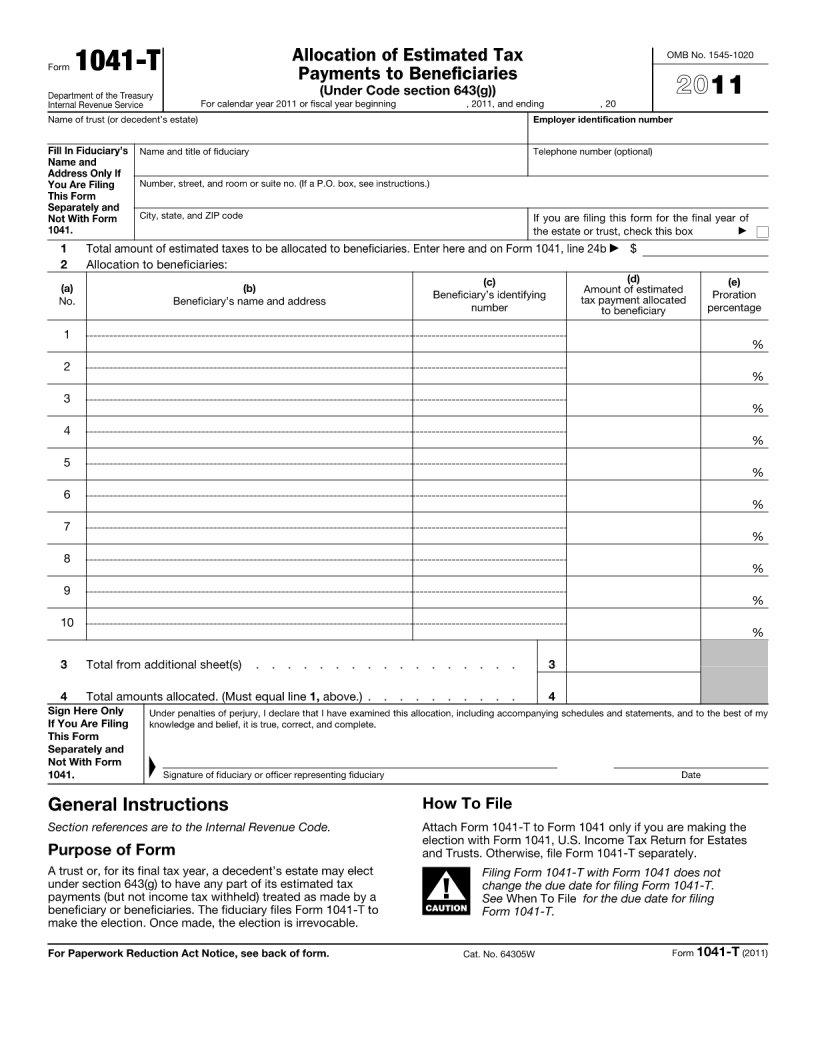

form 1041t extension Fill Online, Printable, Fillable Blank form

Part i automatic extension for certain. In the case of a 1041, this is by the 15th day of the 4th month after the end of the tax year for the return. See instructions before completing this form. For the 2023 tax year, you can file 2023, 2022, and 2021 tax year returns. Income tax return for estates and trusts,.

1041 Extension Due Date 2025 Aaren Annalee

Find out the latest updates,. For the 2023 tax year, you can file 2023, 2022, and 2021 tax year returns. Part i automatic extension for certain. File request for extension by the due date of the return. In the case of a 1041, this is by the 15th day of the 4th month after the end of the tax year.

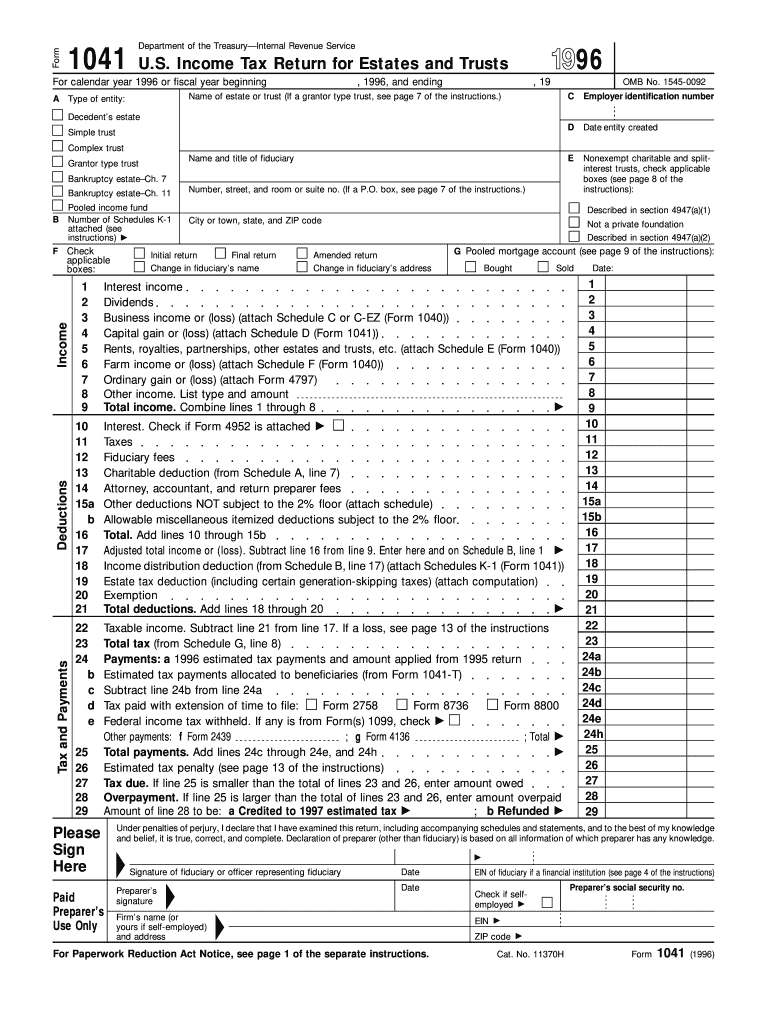

1996 Form IRS 1041 Fill Online, Printable, Fillable, Blank pdfFiller

Income tax return for estates and trusts, using form 7004. In the case of a 1041, this is by the 15th day of the 4th month after the end of the tax year for the return. Learn how to file form 1041, u.s. For the 2023 tax year, you can file 2023, 2022, and 2021 tax year returns. See instructions.

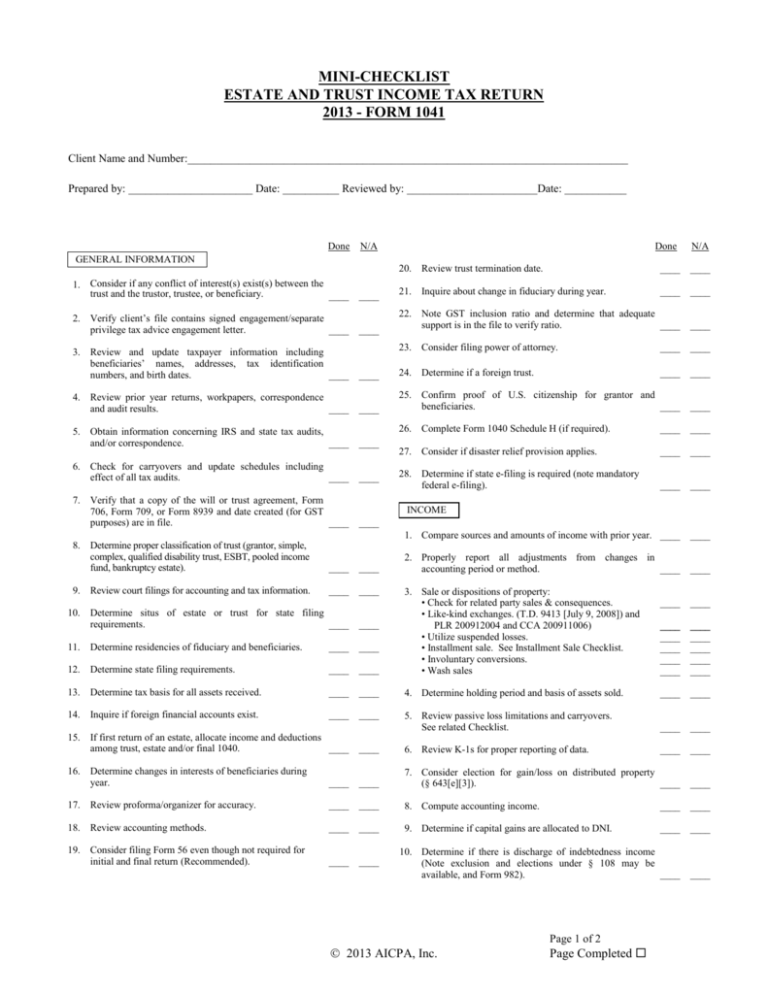

Form 1041, Tax return for Trusts and Estates Mini Checklist

Part i automatic extension for certain. Find out the latest updates,. Income tax return for estates and trusts, using form 7004. See instructions before completing this form. For the 2023 tax year, you can file 2023, 2022, and 2021 tax year returns.

Form 1041 Extension Due Date 2019 justgoing 2020

File request for extension by the due date of the return. Part i automatic extension for certain. Income tax return for estates and trusts, using form 7004. Income tax return for estates and trusts, and its related schedules. In the case of a 1041, this is by the 15th day of the 4th month after the end of the tax.

2023 Instructions for Schedule D (Form 1041) Internal Fill Online

Part i automatic extension for certain. In the case of a 1041, this is by the 15th day of the 4th month after the end of the tax year for the return. Learn how to extend the deadline for filing form 1041, the u.s. For the 2023 tax year, you can file 2023, 2022, and 2021 tax year returns. Income.

1041 Qft informacionpublica.svet.gob.gt

Learn how to extend the deadline for filing form 1041, the u.s. In the case of a 1041, this is by the 15th day of the 4th month after the end of the tax year for the return. See instructions before completing this form. Income tax return for estates and trusts, using form 7004. Income tax return for estates and.

Learn How To File Form 1041, U.s.

In the case of a 1041, this is by the 15th day of the 4th month after the end of the tax year for the return. File request for extension by the due date of the return. Income tax return for estates and trusts, using form 7004. Income tax return for estates and trusts, and its related schedules.

Part I Automatic Extension For Certain.

Find out the latest updates,. Learn how to extend the deadline for filing form 1041, the u.s. For the 2023 tax year, you can file 2023, 2022, and 2021 tax year returns. See instructions before completing this form.