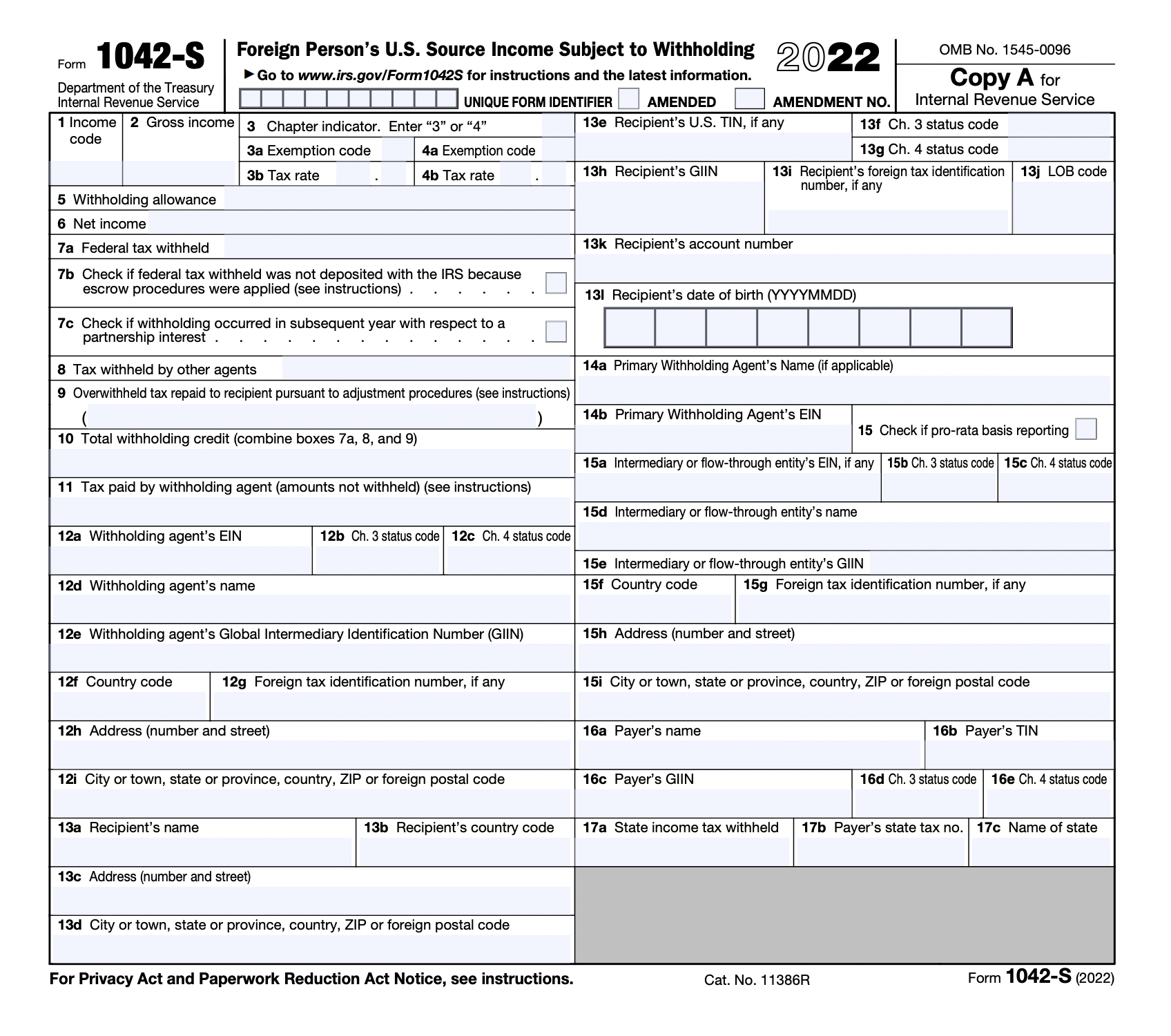

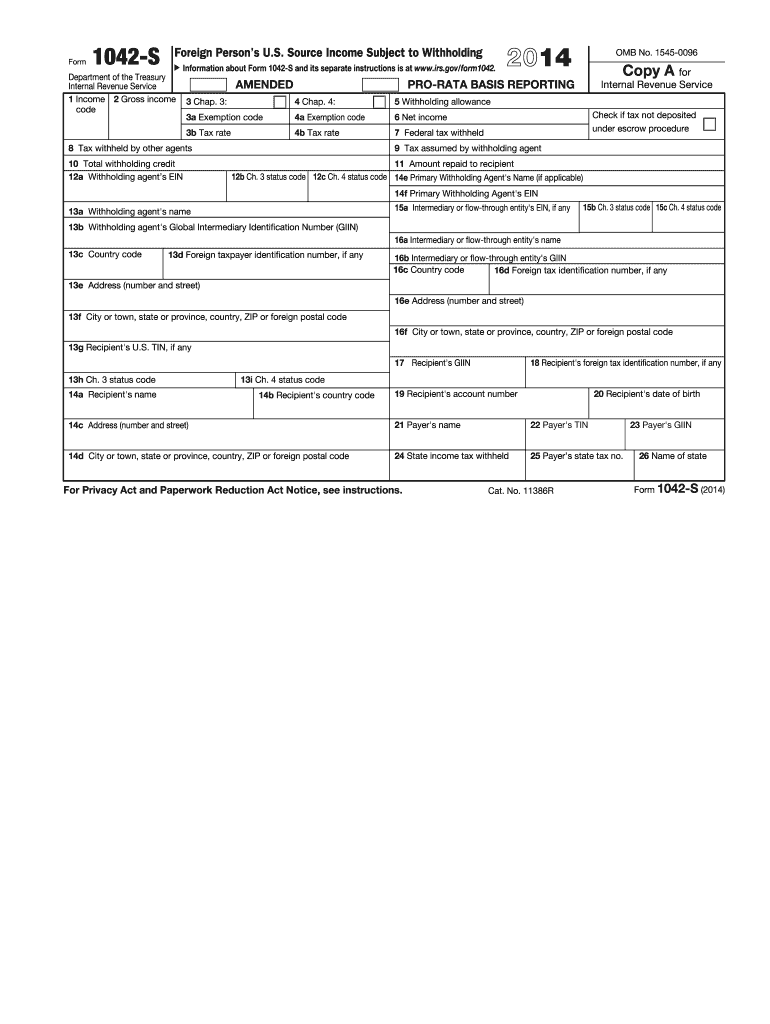

Form 1042 S

Form 1042 S - I'm resident alien for tax purposes. Should i report it as an. However, i still received 1042s with income code 29, exemption code 02, and tax rate 0%. Is the interest income taxable? I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for tax purposes. I am a resident alien on f1 visa. Hello, i am a us citizen and i married my wife last year, who is working as a postdoc.

I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for tax purposes. Hello, i am a us citizen and i married my wife last year, who is working as a postdoc. However, i still received 1042s with income code 29, exemption code 02, and tax rate 0%. Should i report it as an. I'm resident alien for tax purposes. I am a resident alien on f1 visa. Is the interest income taxable?

Is the interest income taxable? Should i report it as an. I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for tax purposes. Hello, i am a us citizen and i married my wife last year, who is working as a postdoc. I'm resident alien for tax purposes. I am a resident alien on f1 visa. However, i still received 1042s with income code 29, exemption code 02, and tax rate 0%.

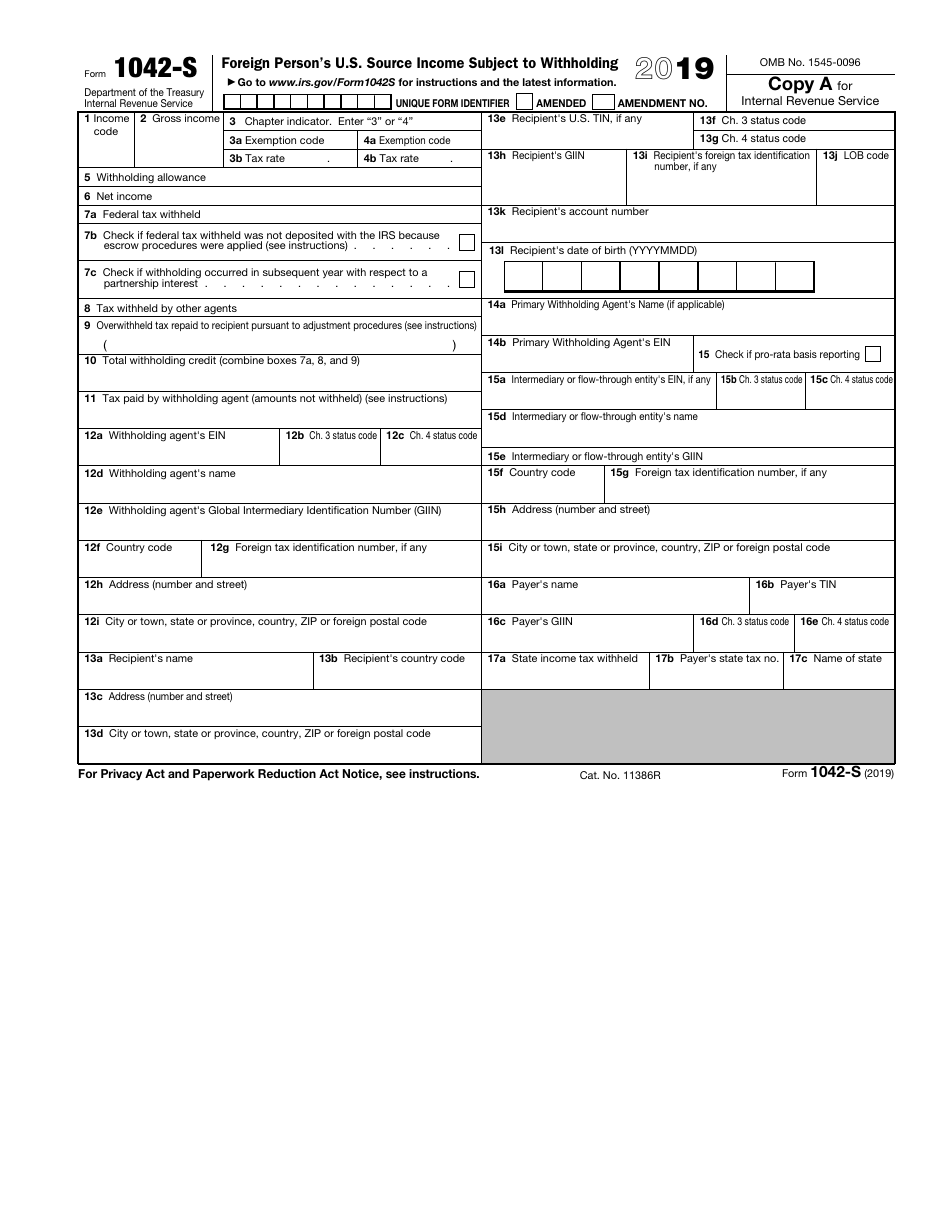

Irs 1042 s instructions 2019

I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for tax purposes. I'm resident alien for tax purposes. Is the interest income taxable? Hello, i am a us citizen and i married my wife last year, who is working as a postdoc. I am a resident.

Fillable Form 1042 S Printable Forms Free Online

I'm resident alien for tax purposes. I am a resident alien on f1 visa. However, i still received 1042s with income code 29, exemption code 02, and tax rate 0%. I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for tax purposes. Is the interest income.

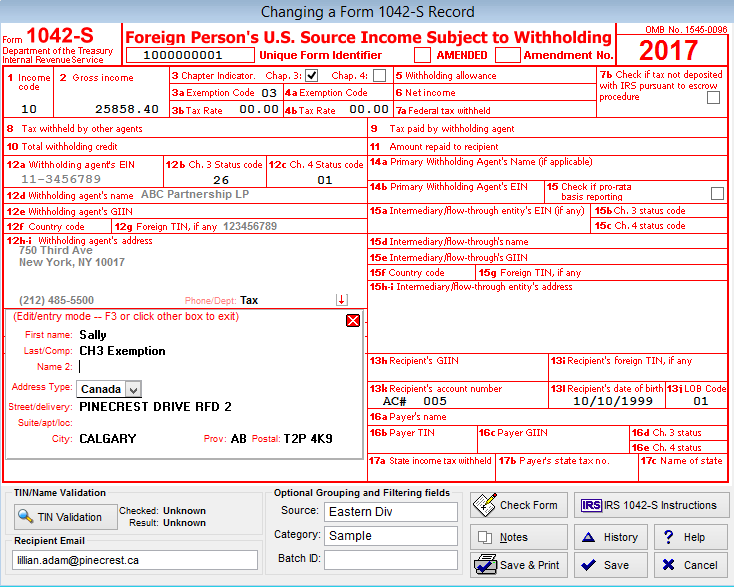

Form 1042S USEReady

Is the interest income taxable? I am a resident alien on f1 visa. However, i still received 1042s with income code 29, exemption code 02, and tax rate 0%. I'm resident alien for tax purposes. I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for tax.

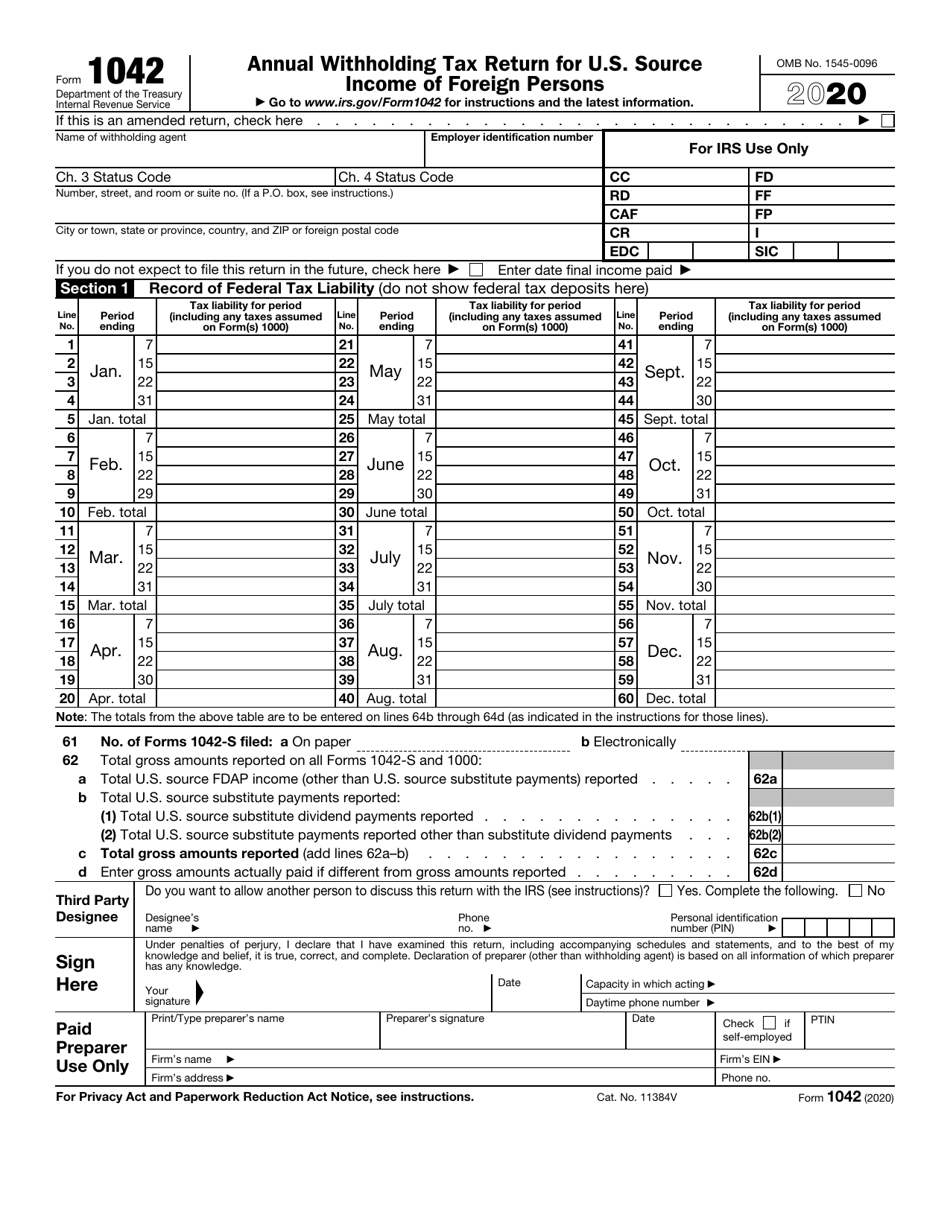

Instructions for IRS Form 1042S How to Report Your Annual

Hello, i am a us citizen and i married my wife last year, who is working as a postdoc. I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for tax purposes. Is the interest income taxable? I'm resident alien for tax purposes. However, i still received.

Understanding your 1042S » Payroll Boston University

Hello, i am a us citizen and i married my wife last year, who is working as a postdoc. I am a resident alien on f1 visa. However, i still received 1042s with income code 29, exemption code 02, and tax rate 0%. I'm resident alien for tax purposes. I am an international student, but have stayed in u.s for.

IRS Form 1042S 2019 Fill Out, Sign Online and Download Fillable

Should i report it as an. I am a resident alien on f1 visa. Hello, i am a us citizen and i married my wife last year, who is working as a postdoc. I'm resident alien for tax purposes. Is the interest income taxable?

What is Form 1042S? Tax reporting for foreign contractors Trolley

Is the interest income taxable? However, i still received 1042s with income code 29, exemption code 02, and tax rate 0%. I am a resident alien on f1 visa. I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for tax purposes. Should i report it as.

The Newly Issued Form 1042S Foreign Person's U.S. Source

I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for tax purposes. I am a resident alien on f1 visa. Is the interest income taxable? Should i report it as an. Hello, i am a us citizen and i married my wife last year, who is.

Form 1042 S Fill Out and Sign Printable PDF Template airSlate SignNow

However, i still received 1042s with income code 29, exemption code 02, and tax rate 0%. I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for tax purposes. I'm resident alien for tax purposes. I am a resident alien on f1 visa. Hello, i am a.

1042 S Form slideshare

Is the interest income taxable? Should i report it as an. I am a resident alien on f1 visa. I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for tax purposes. Hello, i am a us citizen and i married my wife last year, who is.

Is The Interest Income Taxable?

However, i still received 1042s with income code 29, exemption code 02, and tax rate 0%. Should i report it as an. Hello, i am a us citizen and i married my wife last year, who is working as a postdoc. I am a resident alien on f1 visa.

I Am An International Student, But Have Stayed In U.s For More Than 5 Years, And I Am Now Considered A Resident Alien For Tax Purposes.

I'm resident alien for tax purposes.