Form 1099 R Code G

Form 1099 R Code G - 30 rows use code g for a direct rollover from a qualified plan, a section 403 (b) plan or a governmental section 457 (b) plan to an eligible. We use these codes and your answers to some. The code g in box 7 is indicating this was a direct rollover from one retirement plan (trustee) to another. A direct rollover is not a.

The code g in box 7 is indicating this was a direct rollover from one retirement plan (trustee) to another. We use these codes and your answers to some. 30 rows use code g for a direct rollover from a qualified plan, a section 403 (b) plan or a governmental section 457 (b) plan to an eligible. A direct rollover is not a.

A direct rollover is not a. We use these codes and your answers to some. 30 rows use code g for a direct rollover from a qualified plan, a section 403 (b) plan or a governmental section 457 (b) plan to an eligible. The code g in box 7 is indicating this was a direct rollover from one retirement plan (trustee) to another.

How to Report your Unemployment Benefits on your Federal Tax Return

A direct rollover is not a. We use these codes and your answers to some. The code g in box 7 is indicating this was a direct rollover from one retirement plan (trustee) to another. 30 rows use code g for a direct rollover from a qualified plan, a section 403 (b) plan or a governmental section 457 (b) plan.

Form 1099r Simplified Method

30 rows use code g for a direct rollover from a qualified plan, a section 403 (b) plan or a governmental section 457 (b) plan to an eligible. The code g in box 7 is indicating this was a direct rollover from one retirement plan (trustee) to another. A direct rollover is not a. We use these codes and your.

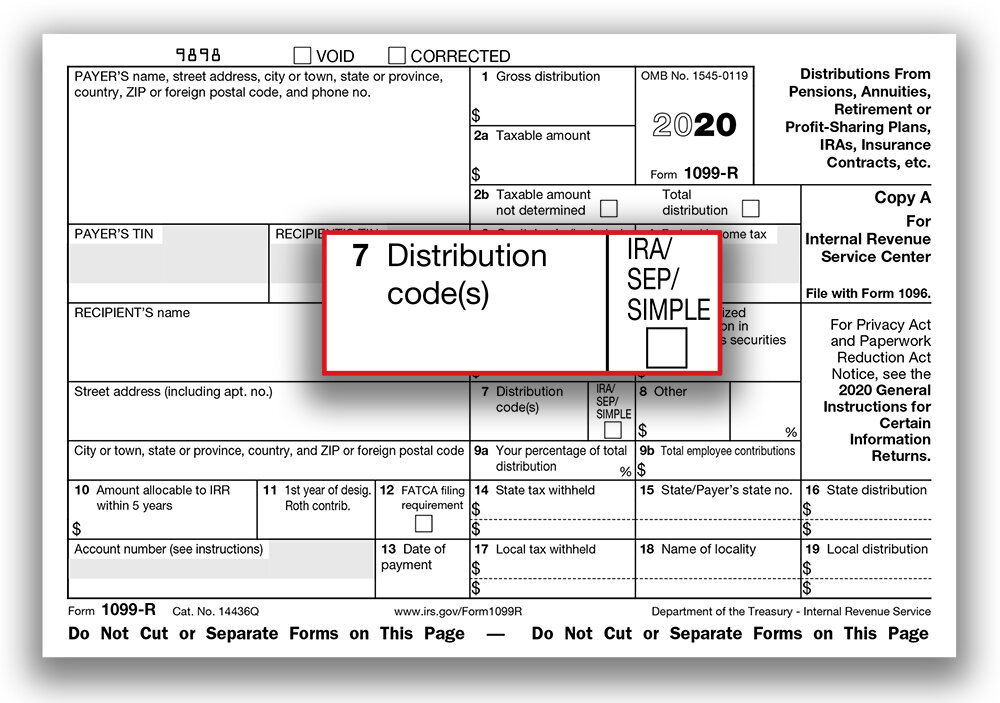

Selecting the Correct IRS Form 1099R Box 7 Distribution Codes — Ascensus

We use these codes and your answers to some. 30 rows use code g for a direct rollover from a qualified plan, a section 403 (b) plan or a governmental section 457 (b) plan to an eligible. A direct rollover is not a. The code g in box 7 is indicating this was a direct rollover from one retirement plan.

2023 Form 1099 R Printable Forms Free Online

We use these codes and your answers to some. The code g in box 7 is indicating this was a direct rollover from one retirement plan (trustee) to another. A direct rollover is not a. 30 rows use code g for a direct rollover from a qualified plan, a section 403 (b) plan or a governmental section 457 (b) plan.

IRS Form 1099R Box 7 Distribution Codes — Ascensus

We use these codes and your answers to some. The code g in box 7 is indicating this was a direct rollover from one retirement plan (trustee) to another. A direct rollover is not a. 30 rows use code g for a direct rollover from a qualified plan, a section 403 (b) plan or a governmental section 457 (b) plan.

1099 Reporting Threshold 2024 Twila Ingeberg

The code g in box 7 is indicating this was a direct rollover from one retirement plan (trustee) to another. We use these codes and your answers to some. 30 rows use code g for a direct rollover from a qualified plan, a section 403 (b) plan or a governmental section 457 (b) plan to an eligible. A direct rollover.

Printable Irs 1099 Form

The code g in box 7 is indicating this was a direct rollover from one retirement plan (trustee) to another. 30 rows use code g for a direct rollover from a qualified plan, a section 403 (b) plan or a governmental section 457 (b) plan to an eligible. A direct rollover is not a. We use these codes and your.

1009r Fillable Form Printable Forms Free Online

30 rows use code g for a direct rollover from a qualified plan, a section 403 (b) plan or a governmental section 457 (b) plan to an eligible. The code g in box 7 is indicating this was a direct rollover from one retirement plan (trustee) to another. A direct rollover is not a. We use these codes and your.

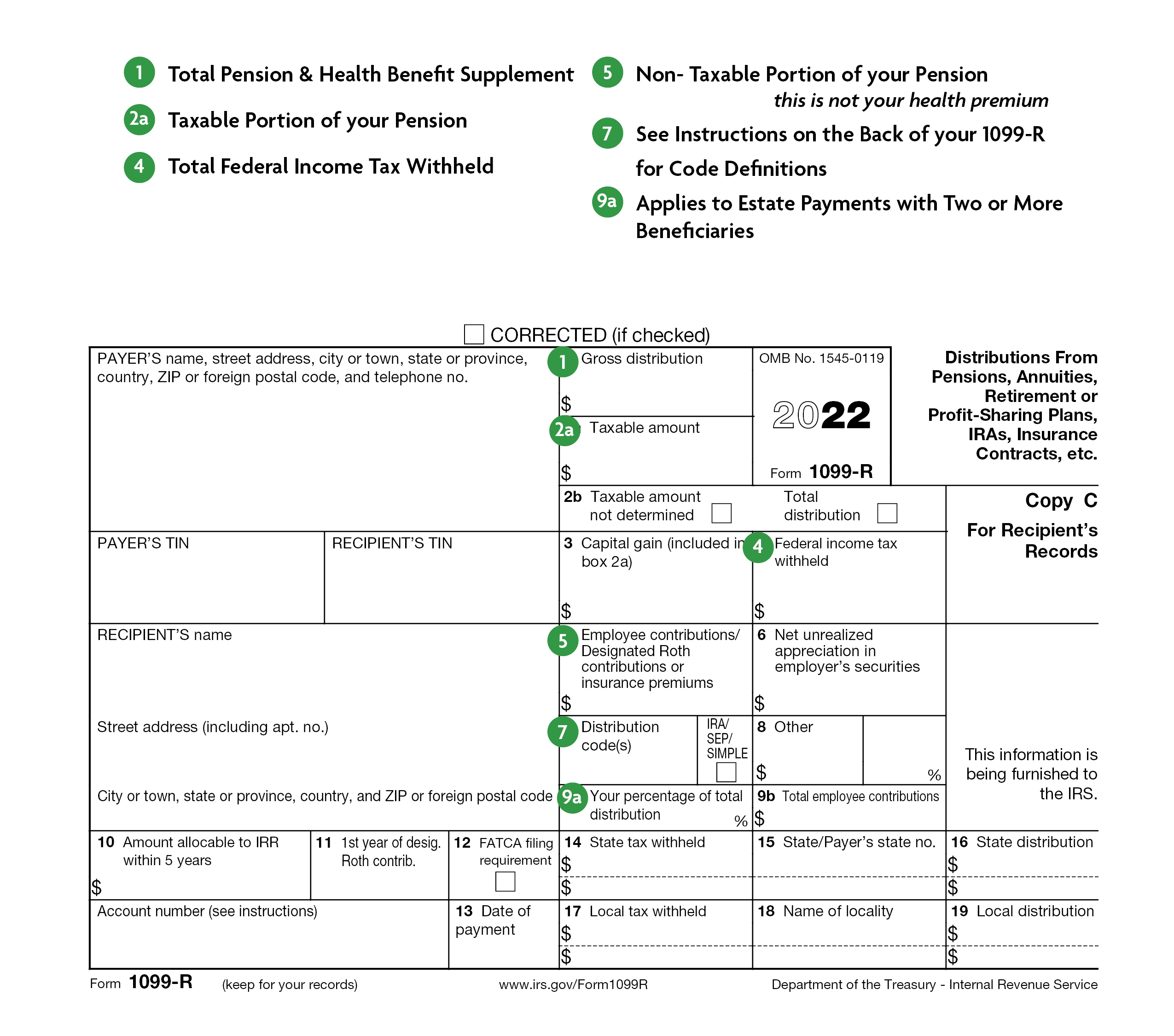

1099 Pension

30 rows use code g for a direct rollover from a qualified plan, a section 403 (b) plan or a governmental section 457 (b) plan to an eligible. A direct rollover is not a. We use these codes and your answers to some. The code g in box 7 is indicating this was a direct rollover from one retirement plan.

Does a 1099R hurt your taxes?

The code g in box 7 is indicating this was a direct rollover from one retirement plan (trustee) to another. 30 rows use code g for a direct rollover from a qualified plan, a section 403 (b) plan or a governmental section 457 (b) plan to an eligible. We use these codes and your answers to some. A direct rollover.

We Use These Codes And Your Answers To Some.

The code g in box 7 is indicating this was a direct rollover from one retirement plan (trustee) to another. A direct rollover is not a. 30 rows use code g for a direct rollover from a qualified plan, a section 403 (b) plan or a governmental section 457 (b) plan to an eligible.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png)

:max_bytes(150000):strip_icc()/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)