Form 16 A

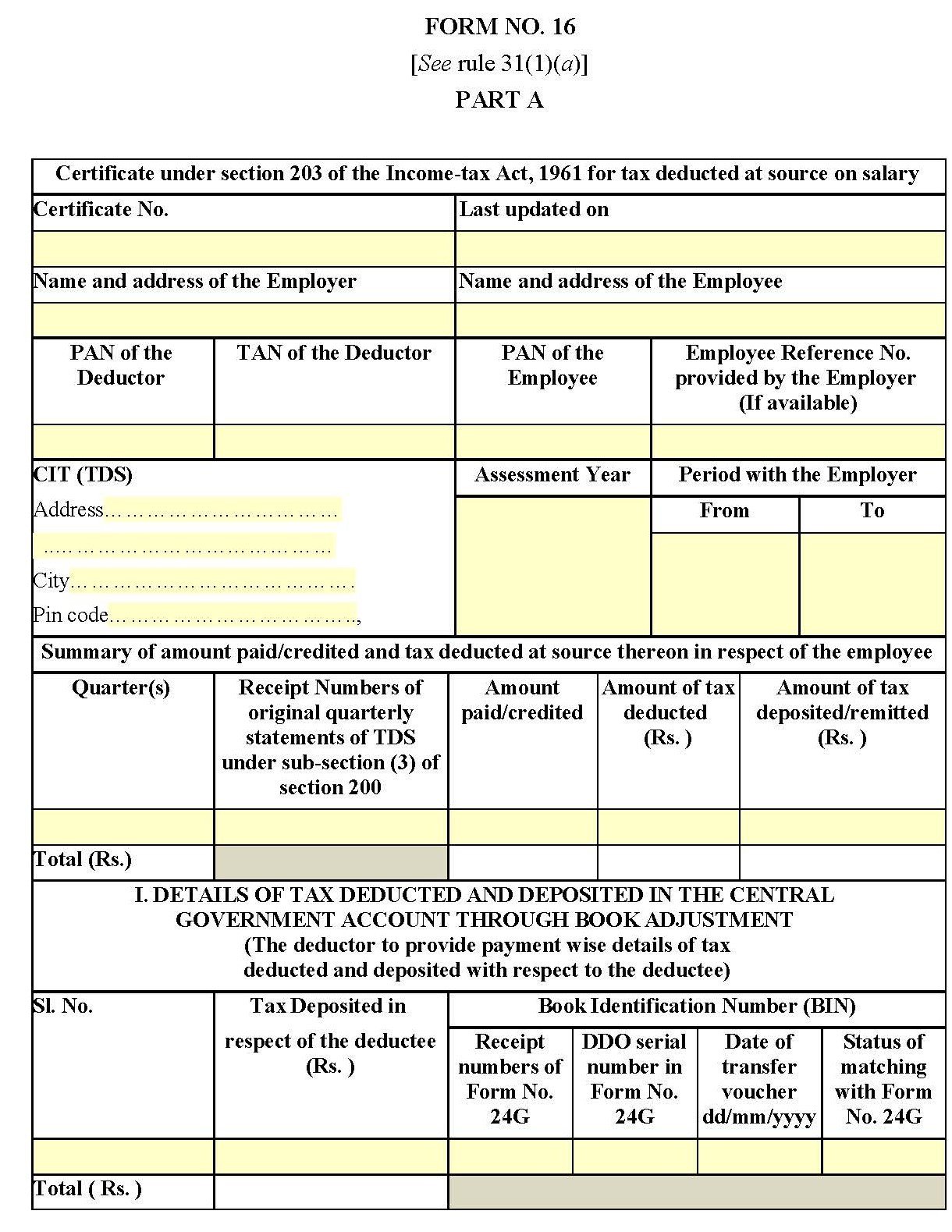

Form 16 A - Form 16/ 16a is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. Find out the types, details. Form 16a is a document issued by the deductor of tax to the deductee, showing the details of tax deducted and deposited.

Form 16/ 16a is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. Form 16a is a document issued by the deductor of tax to the deductee, showing the details of tax deducted and deposited. Find out the types, details.

Form 16/ 16a is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. Form 16a is a document issued by the deductor of tax to the deductee, showing the details of tax deducted and deposited. Find out the types, details.

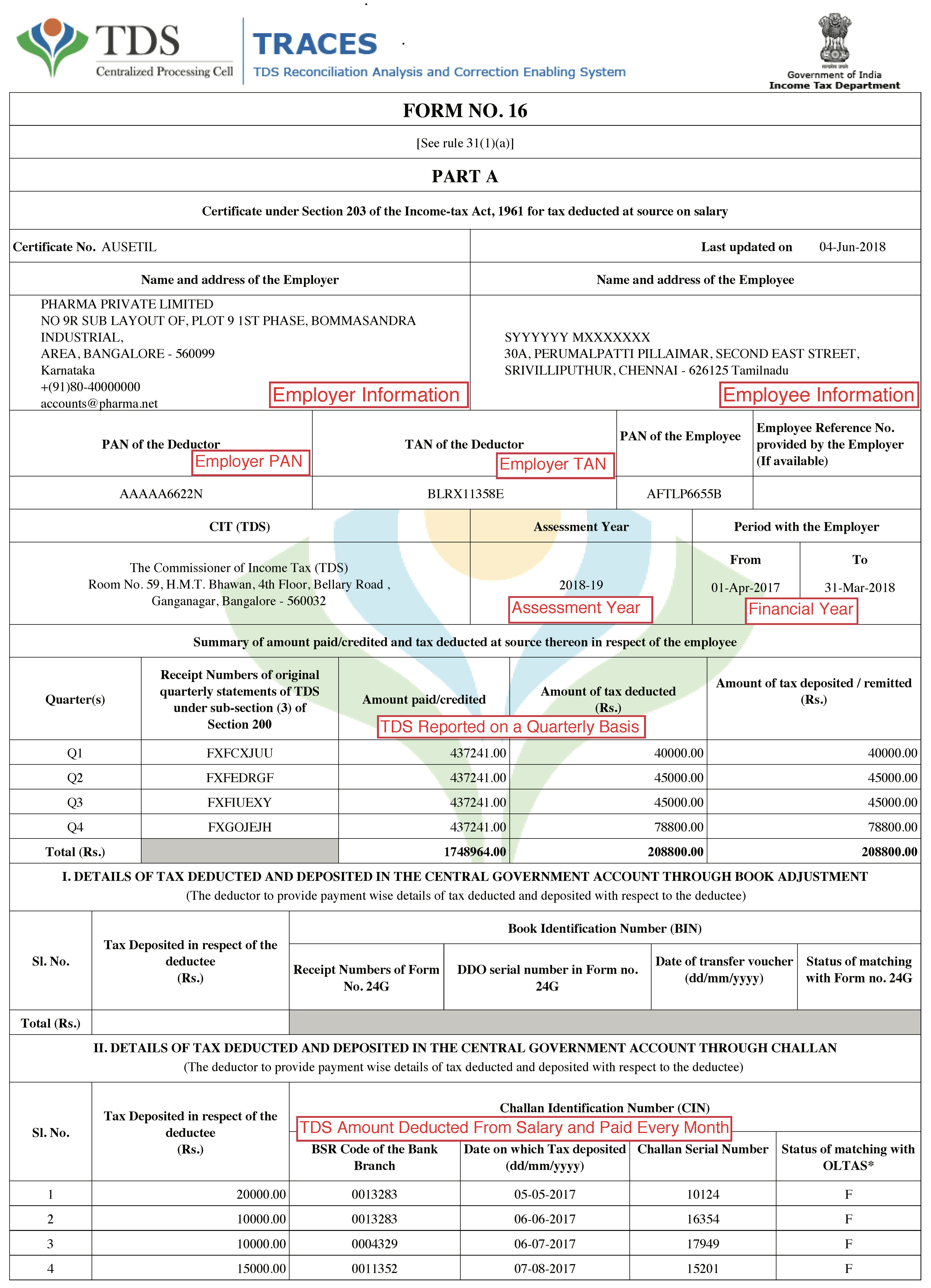

Form 16 How to Download & fill Form No 16A, Form 16B

Form 16/ 16a is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. Find out the types, details. Form 16a is a document issued by the deductor of tax to the deductee, showing the details of tax deducted and deposited.

Form 16A Explained Everything You Need to Know Tax2win

Form 16/ 16a is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. Find out the types, details. Form 16a is a document issued by the deductor of tax to the deductee, showing the details of tax deducted and deposited.

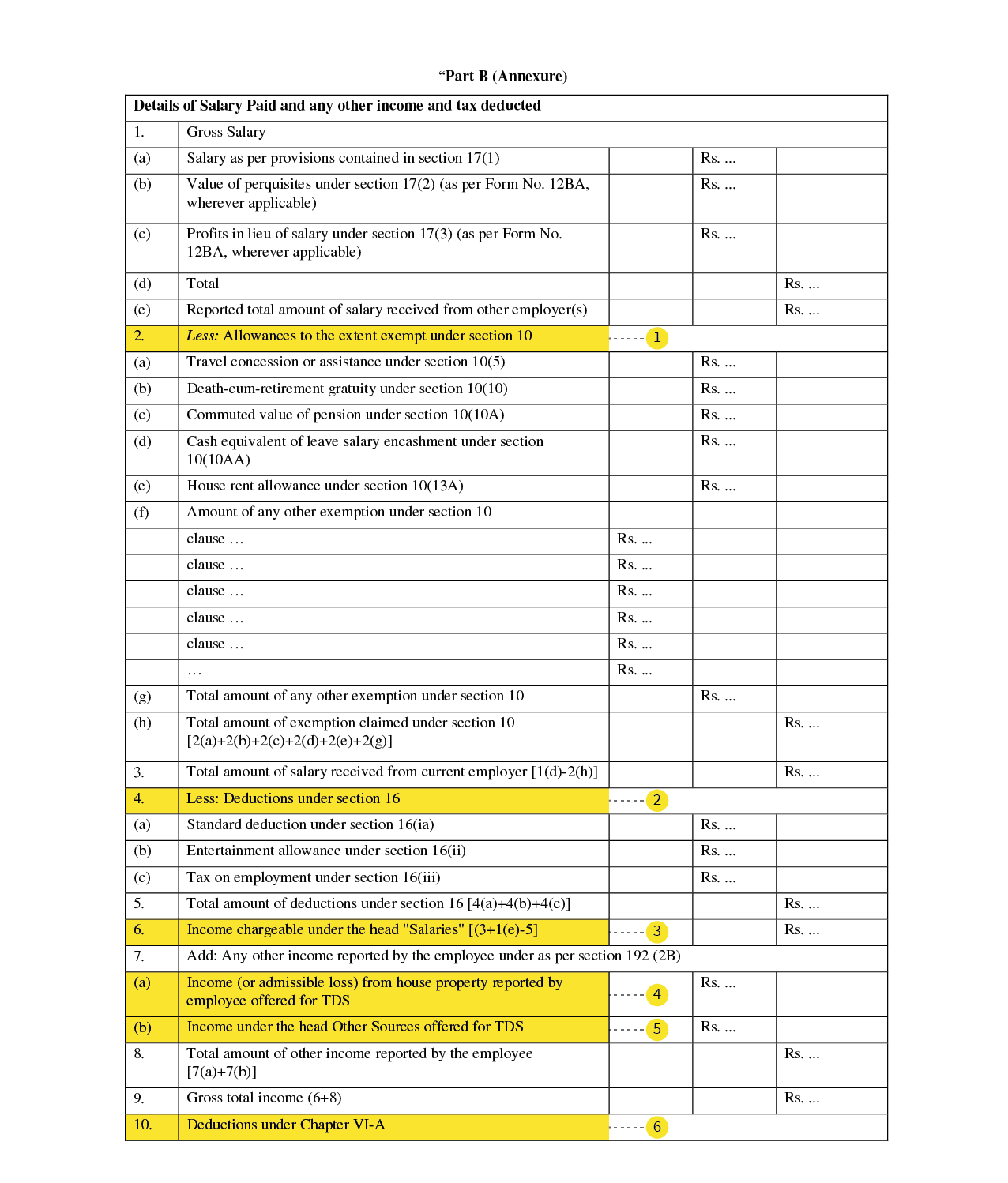

What is Form 16? Why it is important for ITR filing, and how to

Find out the types, details. Form 16/ 16a is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. Form 16a is a document issued by the deductor of tax to the deductee, showing the details of tax deducted and deposited.

What is Form 16 How to Download & Fill Form 16, 16A, 16B

Find out the types, details. Form 16/ 16a is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. Form 16a is a document issued by the deductor of tax to the deductee, showing the details of tax deducted and deposited.

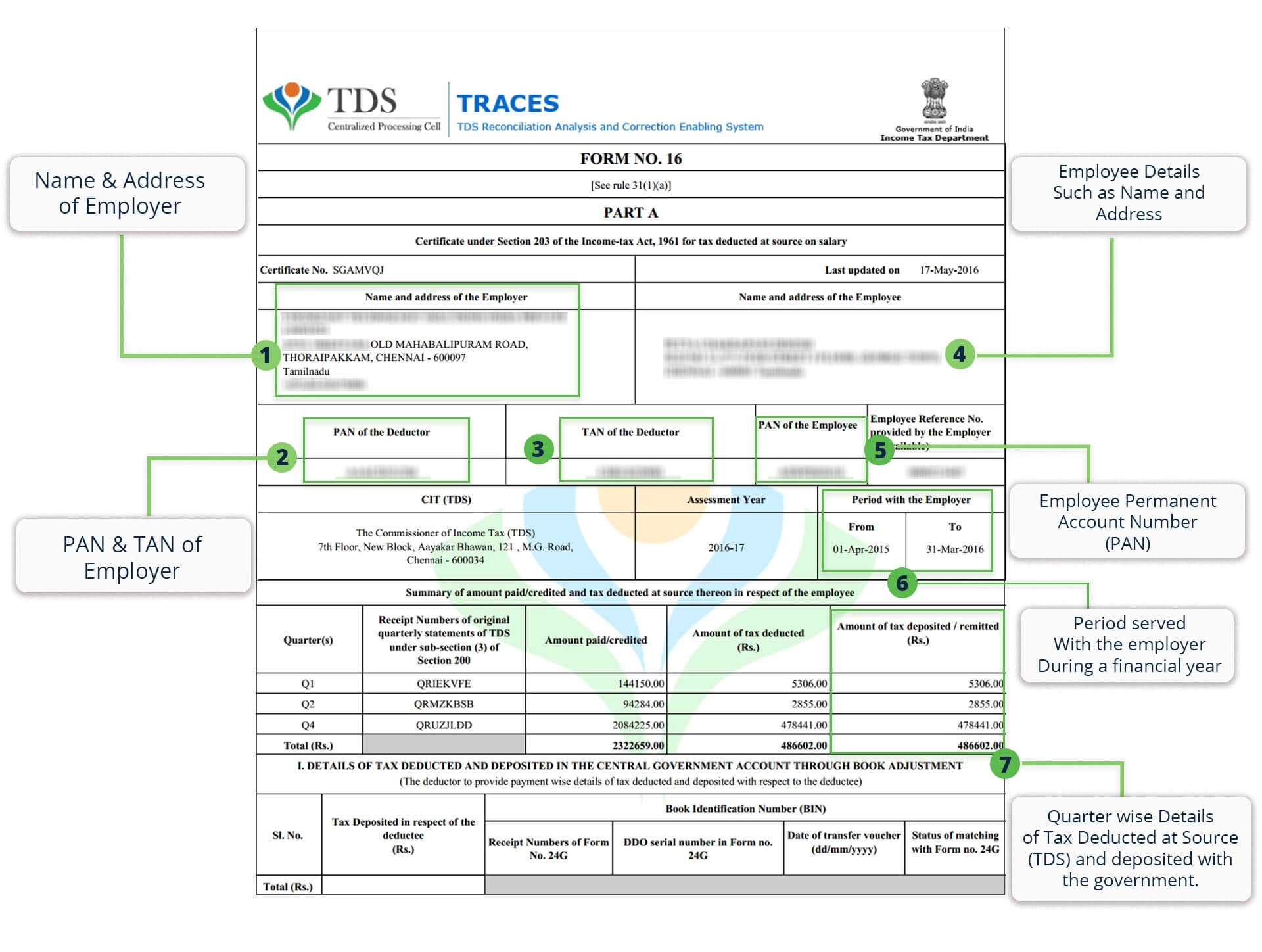

Sample Form 16 Invest in Mutual Funds, Fixed Deposits, Bonds, Online

Find out the types, details. Form 16/ 16a is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. Form 16a is a document issued by the deductor of tax to the deductee, showing the details of tax deducted and deposited.

What is Form 16 Upload Form 16 and File Tax Return Online

Form 16a is a document issued by the deductor of tax to the deductee, showing the details of tax deducted and deposited. Form 16/ 16a is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. Find out the types, details.

What is Form 16 How to Download & Upload Form 16 File Tax

Form 16a is a document issued by the deductor of tax to the deductee, showing the details of tax deducted and deposited. Form 16/ 16a is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. Find out the types, details.

Form16 Everything you Need to Know Business League

Form 16/ 16a is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. Find out the types, details. Form 16a is a document issued by the deductor of tax to the deductee, showing the details of tax deducted and deposited.

myfile Form16

Find out the types, details. Form 16/ 16a is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. Form 16a is a document issued by the deductor of tax to the deductee, showing the details of tax deducted and deposited.

Form 16A Definition, Purpose, Types and Usage Guide in India

Find out the types, details. Form 16a is a document issued by the deductor of tax to the deductee, showing the details of tax deducted and deposited. Form 16/ 16a is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees.

Form 16A Is A Document Issued By The Deductor Of Tax To The Deductee, Showing The Details Of Tax Deducted And Deposited.

Form 16/ 16a is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. Find out the types, details.

)