Form 200 F Oklahoma

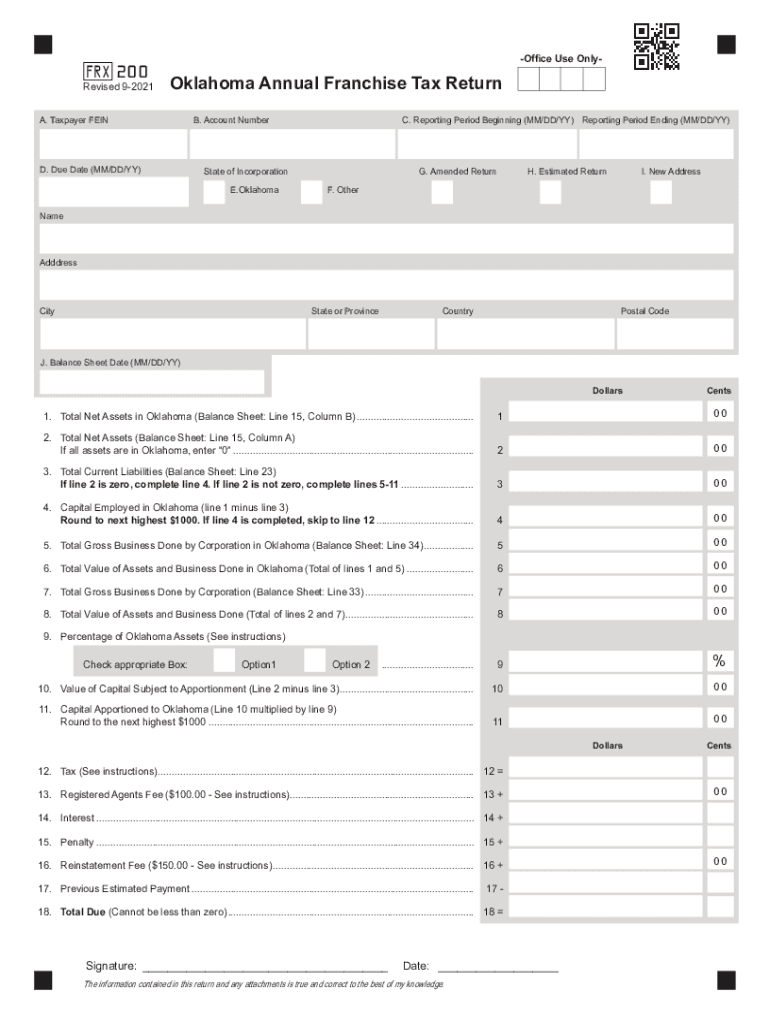

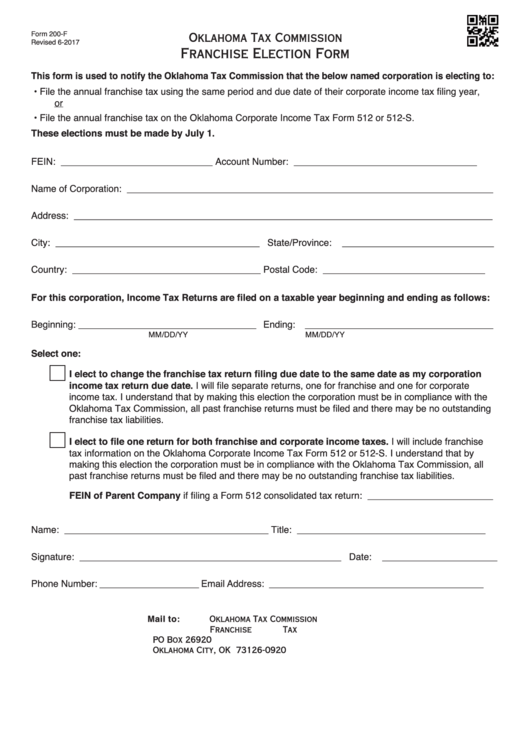

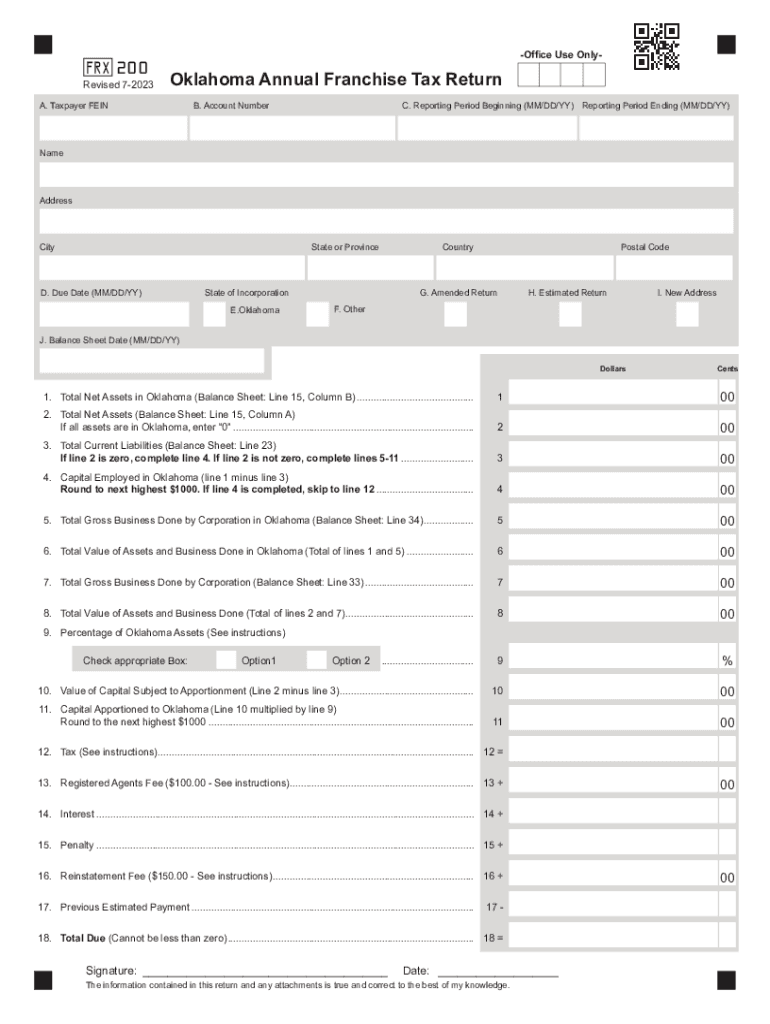

Form 200 F Oklahoma - Oklahoma annual franchise tax return. • file the annual franchise tax using. This form is used to notify the oklahoma tax commission that the below named corporation is electing to: This page contains schedules b, c, and d for the completion of form 200: Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return.

This form is used to notify the oklahoma tax commission that the below named corporation is electing to: • file the annual franchise tax using. This page contains schedules b, c, and d for the completion of form 200: Oklahoma annual franchise tax return. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return.

This form is used to notify the oklahoma tax commission that the below named corporation is electing to: Oklahoma annual franchise tax return. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. This page contains schedules b, c, and d for the completion of form 200: • file the annual franchise tax using.

Fillable Online Form 200F Franchise Election Form Fax Email Print

This form is used to notify the oklahoma tax commission that the below named corporation is electing to: Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. • file the annual franchise tax using. Oklahoma annual franchise tax return. This page contains schedules b, c, and d for the.

Fillable Form 200F Franchise Election Oklahoma Tax Commission

Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. • file the annual franchise tax using. This form is used to notify the oklahoma tax commission that the below named corporation is electing to: This page contains schedules b, c, and d for the completion of form 200: Oklahoma.

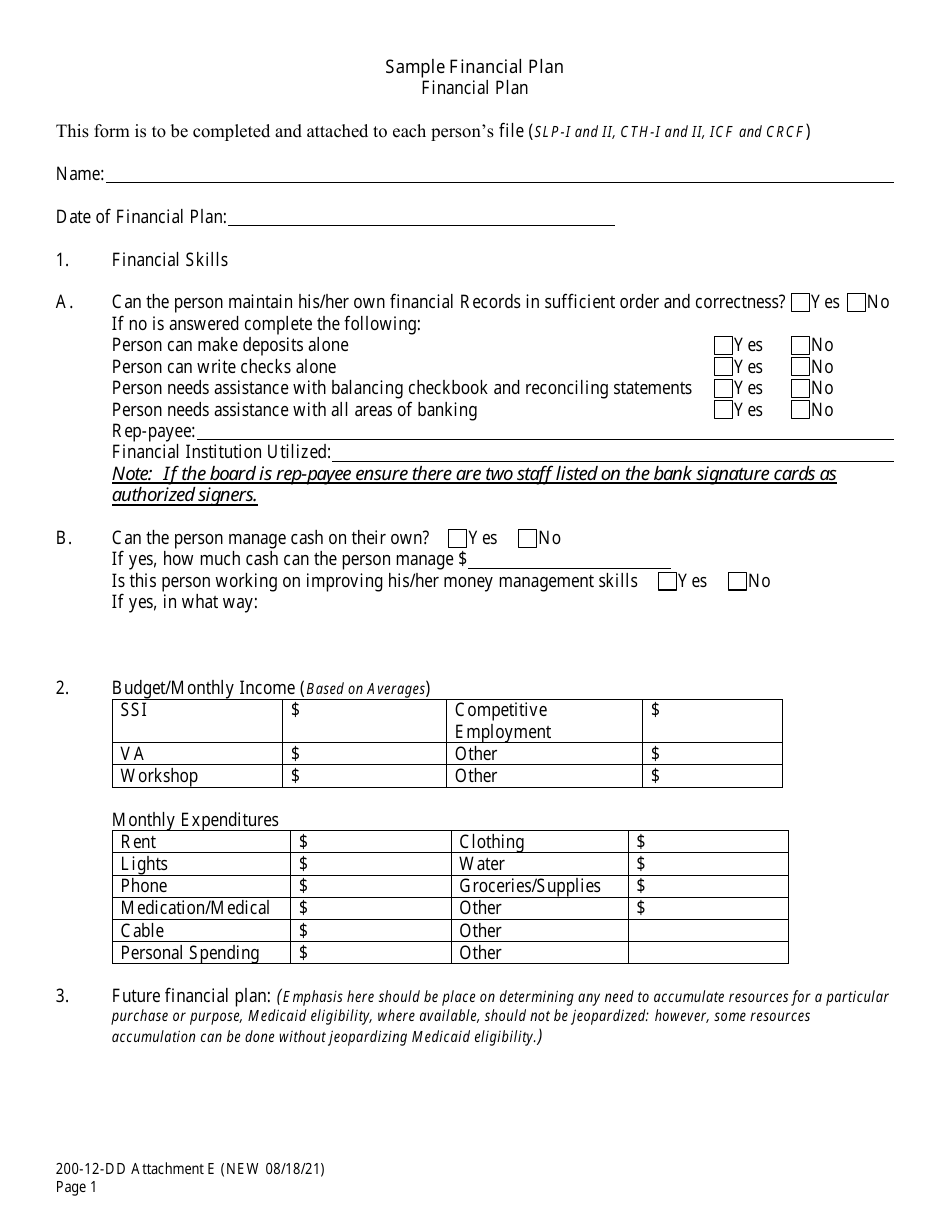

Form 20012DD Attachment E Fill Out, Sign Online and Download

Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. This form is used to notify the oklahoma tax commission that the below named corporation is electing to: • file the annual franchise tax using. Oklahoma annual franchise tax return. This page contains schedules b, c, and d for the.

Form 200 f oklahoma Fill out & sign online DocHub

This page contains schedules b, c, and d for the completion of form 200: Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Oklahoma annual franchise tax return. • file the annual franchise tax using. This form is used to notify the oklahoma tax commission that the below named.

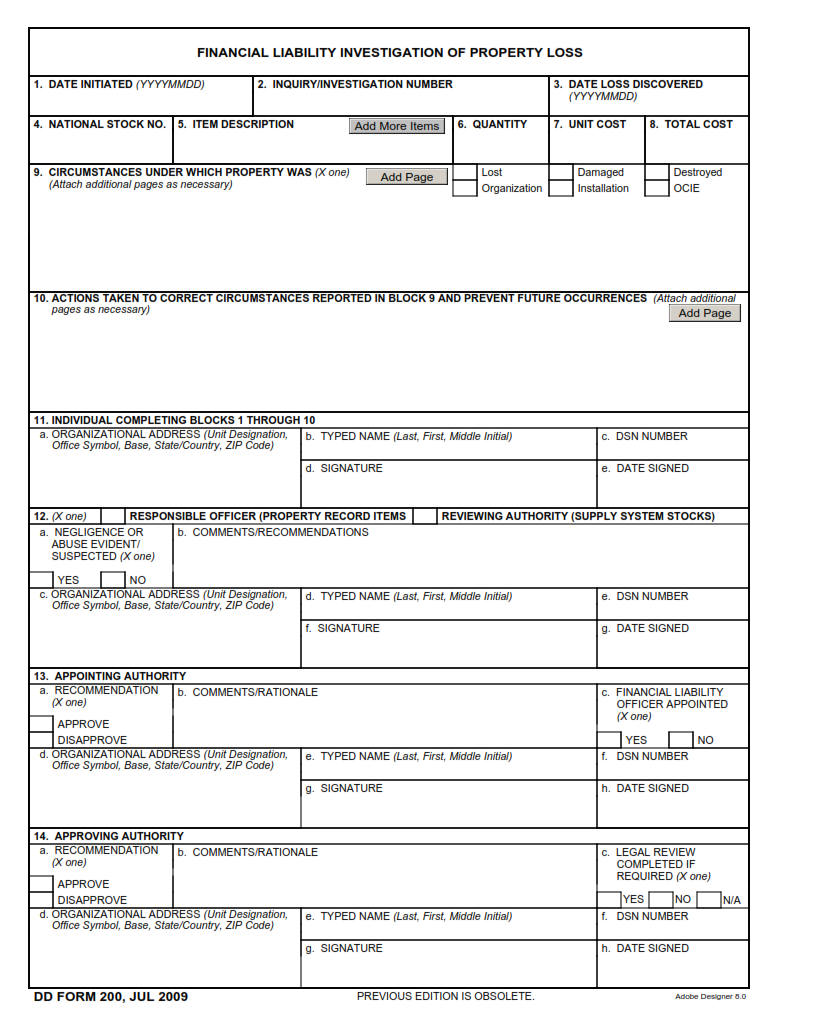

DD Form 200 Financial Liability Investigation of Property Loss

This page contains schedules b, c, and d for the completion of form 200: This form is used to notify the oklahoma tax commission that the below named corporation is electing to: Oklahoma annual franchise tax return. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. • file the.

+GF+ AGIECHARMILLES FORM 200 2017 Die Sinking EDM machine REMIswiss

Oklahoma annual franchise tax return. This page contains schedules b, c, and d for the completion of form 200: • file the annual franchise tax using. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. This form is used to notify the oklahoma tax commission that the below named.

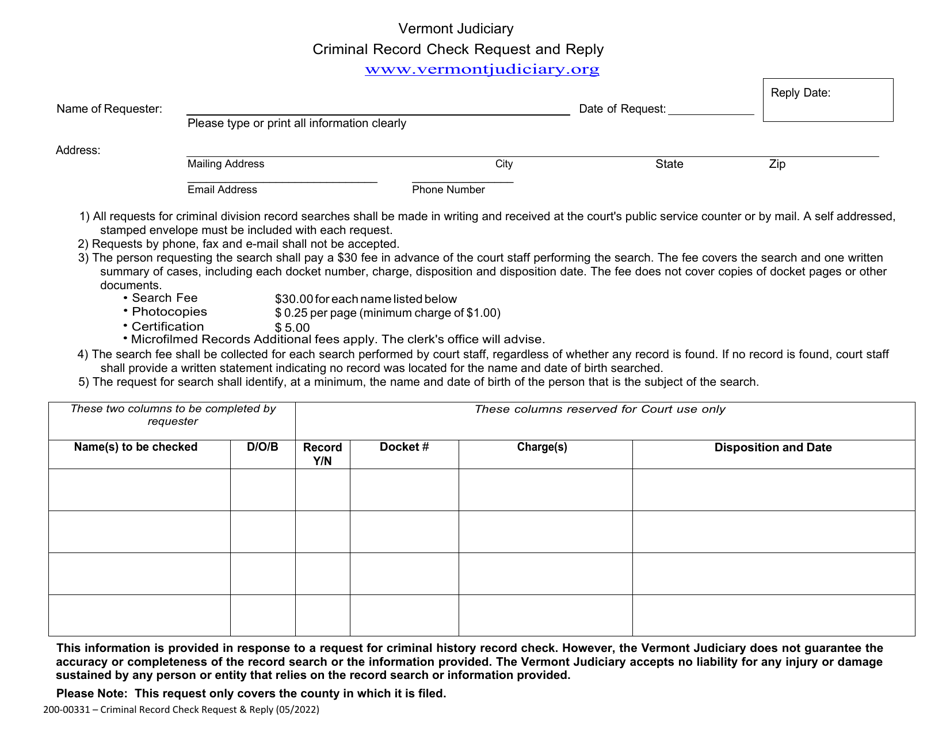

Form 20000331 Download Fillable PDF or Fill Online Criminal Record

Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. • file the annual franchise tax using. This page contains schedules b, c, and d for the completion of form 200: Oklahoma annual franchise tax return. This form is used to notify the oklahoma tax commission that the below named.

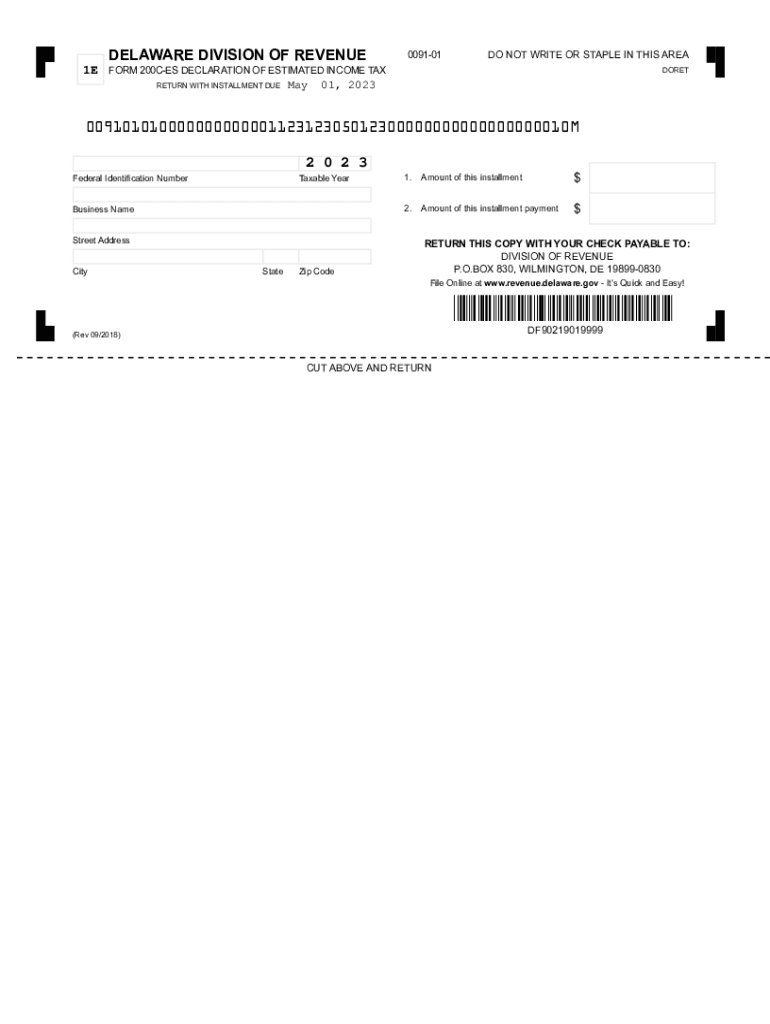

Delaware Form 200ES Declaration of Estimated Tax for Fill out & sign

Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Oklahoma annual franchise tax return. This page contains schedules b, c, and d for the completion of form 200: This form is used to notify the oklahoma tax commission that the below named corporation is electing to: • file the.

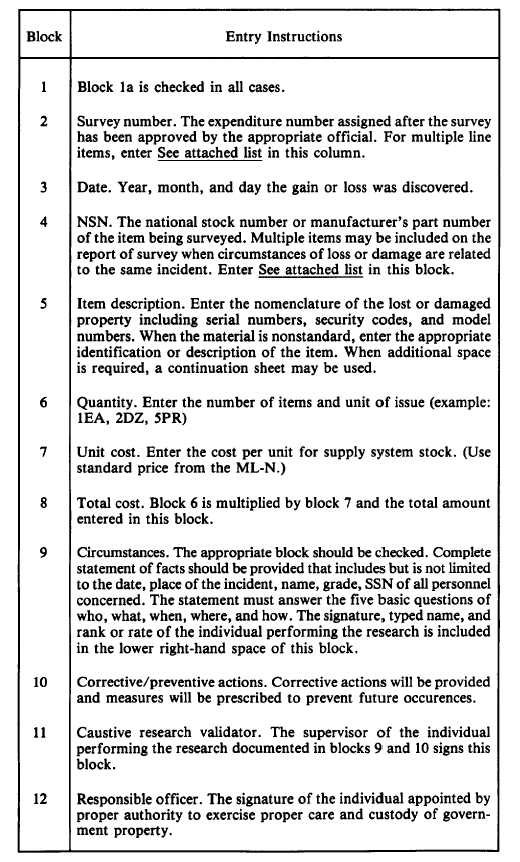

Instructions for Preparation of DD Form 200 12655_69

This page contains schedules b, c, and d for the completion of form 200: This form is used to notify the oklahoma tax commission that the below named corporation is electing to: • file the annual franchise tax using. Oklahoma annual franchise tax return. Corporations required to file a franchise tax return may elect to file a combined corporate income.

Ce 200 Printable Form

This form is used to notify the oklahoma tax commission that the below named corporation is electing to: • file the annual franchise tax using. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Oklahoma annual franchise tax return. This page contains schedules b, c, and d for the.

Corporations Required To File A Franchise Tax Return May Elect To File A Combined Corporate Income And Franchise Tax Return.

This page contains schedules b, c, and d for the completion of form 200: This form is used to notify the oklahoma tax commission that the below named corporation is electing to: Oklahoma annual franchise tax return. • file the annual franchise tax using.