Form 2290 Due Date

Form 2290 Due Date - What is the irs form 2290 due date? Deadlines for form 2290 renewal. Information about form 2290, heavy highway vehicle use tax return, including. If you have vehicles with a combined gross weight of. Use the table below to determine your filing deadline. You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. The current period begins july 1, 2024, and ends june 30, 2025. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). Every year, form 2290’s tax year runs from july 1 to june 30.

Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). If you have vehicles with a combined gross weight of. You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Every year, form 2290’s tax year runs from july 1 to june 30. The current period begins july 1, 2024, and ends june 30, 2025. Information about form 2290, heavy highway vehicle use tax return, including. Deadlines for form 2290 renewal. What is the irs form 2290 due date? Use the table below to determine your filing deadline. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles.

Use the table below to determine your filing deadline. Every year, form 2290’s tax year runs from july 1 to june 30. What is the irs form 2290 due date? Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). If you have vehicles with a combined gross weight of. You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. The current period begins july 1, 2024, and ends june 30, 2025. Information about form 2290, heavy highway vehicle use tax return, including. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Deadlines for form 2290 renewal.

IRS Form 2290 due date for the year 202223 by trucktax online Issuu

Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). Use the table below to determine your filing deadline. The current period begins july 1, 2024, and ends june 30, 2025. Deadlines for form 2290 renewal. Form 2290 is used to figure and pay the tax.

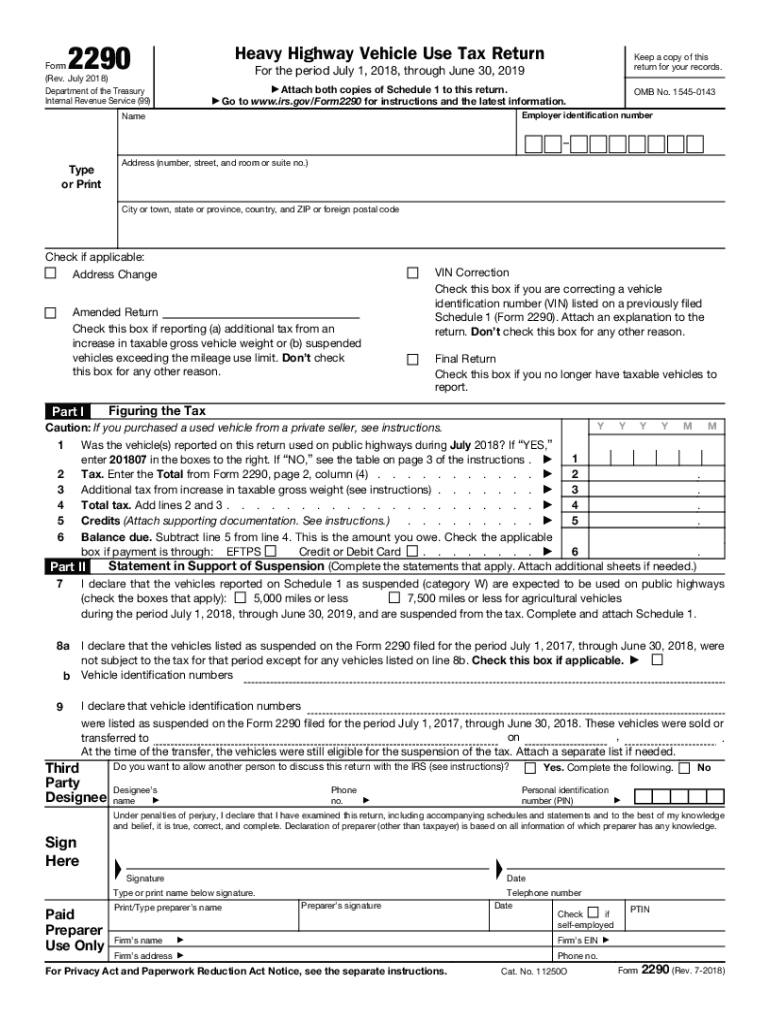

Irs Gov 2290 20182024 Form Fill Out and Sign Printable PDF Template

Information about form 2290, heavy highway vehicle use tax return, including. You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Use the table below to determine your filing deadline. If you have vehicles with a combined gross weight of. Deadlines for form 2290.

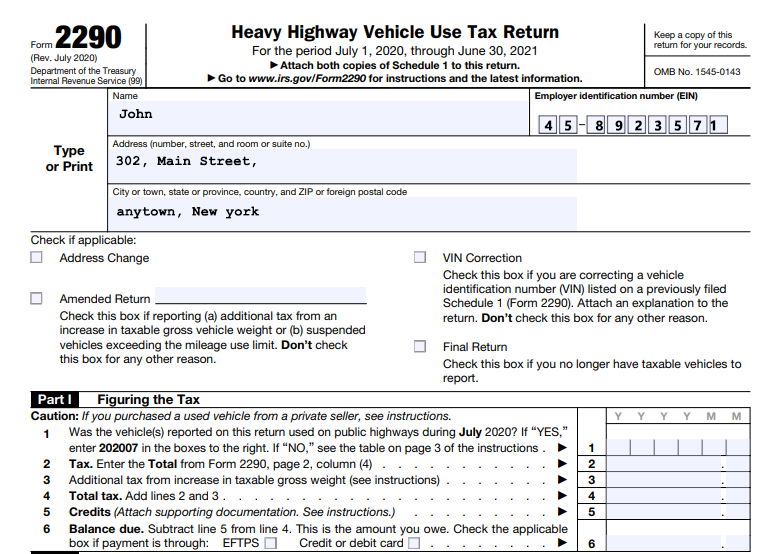

What Is The Form 2290 Due Date? YouTube

Information about form 2290, heavy highway vehicle use tax return, including. What is the irs form 2290 due date? Deadlines for form 2290 renewal. Use the table below to determine your filing deadline. Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later).

Irs Form 2290 Due Date Form Resume Examples EY392gD82V

If you have vehicles with a combined gross weight of. The current period begins july 1, 2024, and ends june 30, 2025. Every year, form 2290’s tax year runs from july 1 to june 30. Deadlines for form 2290 renewal. Information about form 2290, heavy highway vehicle use tax return, including.

Irs 2290 Form 2025 Due Date Peter Wright

Deadlines for form 2290 renewal. Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). What is the irs form 2290 due date? Information about form 2290, heavy highway vehicle use tax return, including. The current period begins july 1, 2024, and ends june 30, 2025.

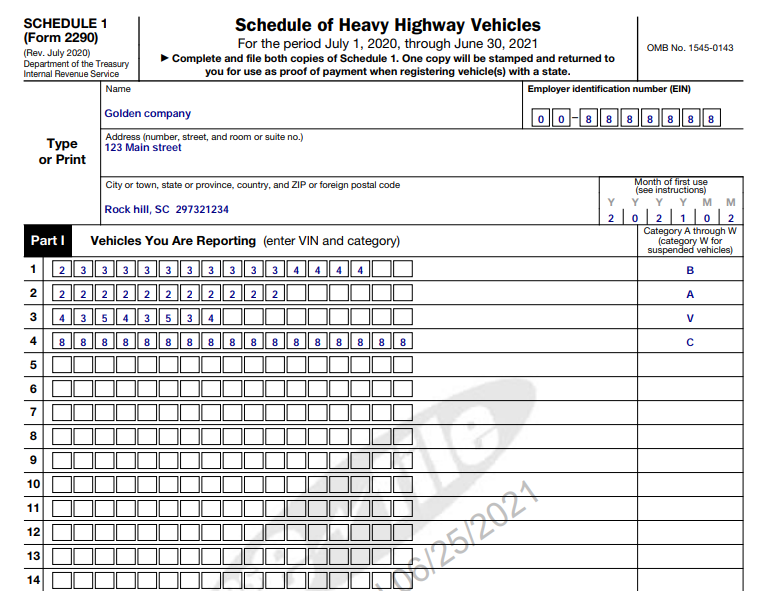

Printable Schedule 1 Form 2290 Printable Form 2024

Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. If you have vehicles with a combined gross weight of. Every year, form 2290’s tax year runs from july 1 to june 30. You must file form 2290 for these trucks by the last day of the month following the month the vehicle.

Tax Form 2290 Due Date Form Resume Examples wRYPmOEV4a

Every year, form 2290’s tax year runs from july 1 to june 30. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Deadlines for form 2290 renewal. Use the table below to determine your filing deadline. Information about form 2290, heavy highway vehicle use tax return, including.

Printable 2290 Form

Use the table below to determine your filing deadline. Deadlines for form 2290 renewal. Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Information about form 2290, heavy.

Irs Form 2290 Due Date Form Resume Examples

The current period begins july 1, 2024, and ends june 30, 2025. Use the table below to determine your filing deadline. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Information about form 2290, heavy highway vehicle use tax return, including. Every year, form 2290’s tax year runs from july 1 to.

Form 2290 Due Date 2023 Printable Forms Free Online

You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Use the table below to determine your filing deadline. Information about form 2290, heavy highway vehicle use.

Use The Table Below To Determine Your Filing Deadline.

The current period begins july 1, 2024, and ends june 30, 2025. You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. What is the irs form 2290 due date? Information about form 2290, heavy highway vehicle use tax return, including.

If You Have Vehicles With A Combined Gross Weight Of.

Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). Every year, form 2290’s tax year runs from july 1 to june 30. Deadlines for form 2290 renewal.