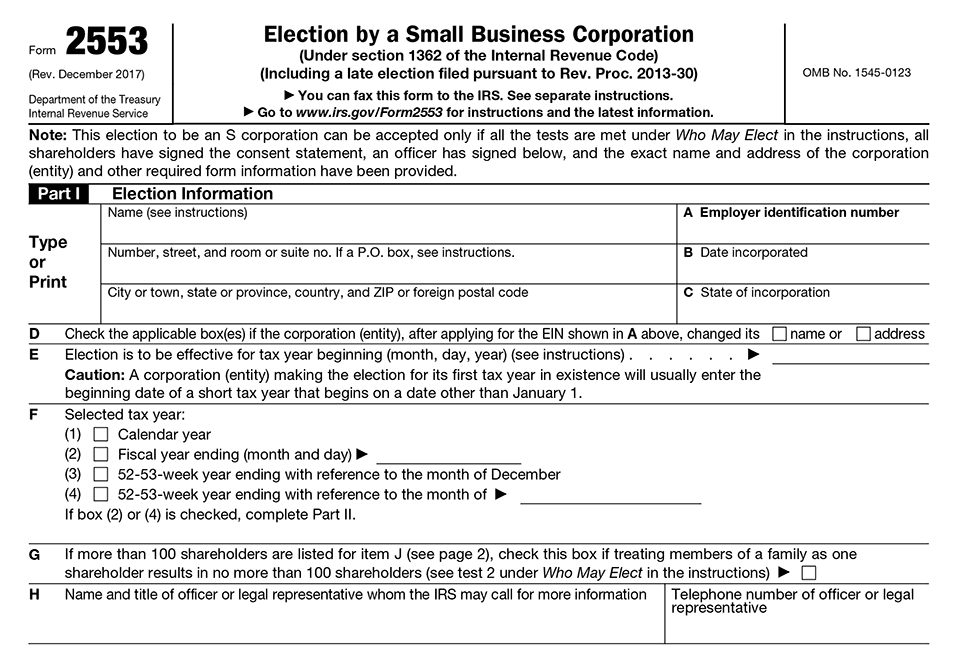

Form 2553 Election

Form 2553 Election - Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Election is to be effective for tax year beginning (month, day, year) (see instructions). A corporation (entity) making the.

A corporation (entity) making the. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Election is to be effective for tax year beginning (month, day, year) (see instructions).

Election is to be effective for tax year beginning (month, day, year) (see instructions). Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. A corporation (entity) making the.

Form 2553 Deadline 2023 Printable Forms Free Online

Election is to be effective for tax year beginning (month, day, year) (see instructions). Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. A corporation (entity) making the.

SCorp Election Harbor Compliance

Election is to be effective for tax year beginning (month, day, year) (see instructions). Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. A corporation (entity) making the.

Form 2553 Election by a Small Business Corporation (2014) Free Download

Election is to be effective for tax year beginning (month, day, year) (see instructions). Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. A corporation (entity) making the.

Learn How to Fill the Form 2553 Election by a Small Business

Election is to be effective for tax year beginning (month, day, year) (see instructions). A corporation (entity) making the. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec.

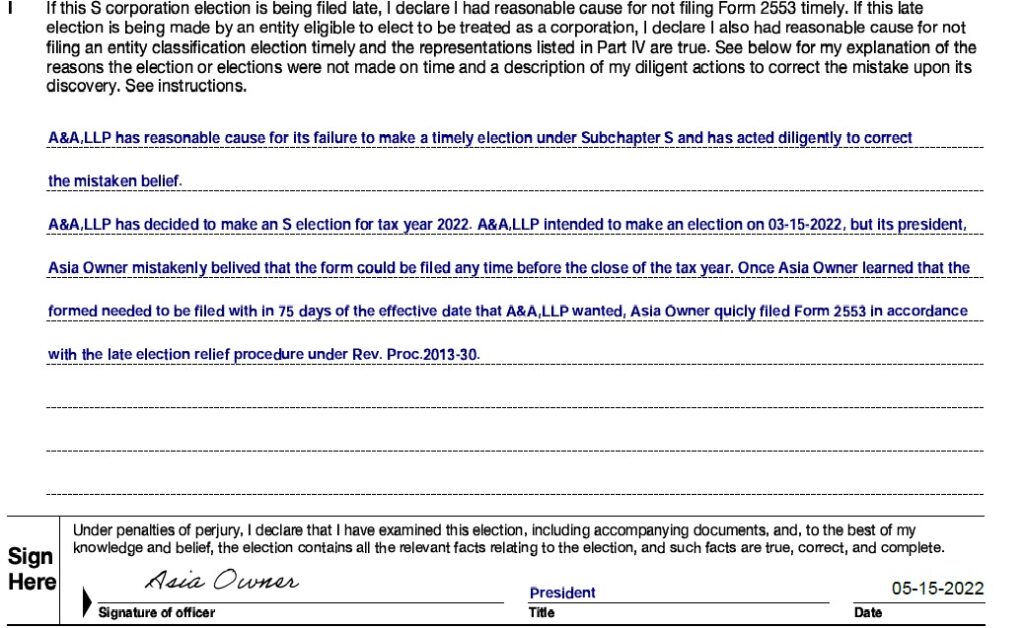

Form 2553 A guide to late filing S Corp elections Block Advisors

Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. A corporation (entity) making the. Election is to be effective for tax year beginning (month, day, year) (see instructions).

How to Fill in Form 2553 Election by a Small Business Corporation S

Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. A corporation (entity) making the. Election is to be effective for tax year beginning (month, day, year) (see instructions).

Form 2553 template

Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. A corporation (entity) making the. Election is to be effective for tax year beginning (month, day, year) (see instructions).

Form 2553 Deadline 2023 Printable Forms Free Online

A corporation (entity) making the. Election is to be effective for tax year beginning (month, day, year) (see instructions). Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec.

How To Fill Out Form 2553 for Scorps and LLCs

Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Election is to be effective for tax year beginning (month, day, year) (see instructions). A corporation (entity) making the.

Form 2553 Election by a Small Business Corporation (2014) Free Download

A corporation (entity) making the. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Election is to be effective for tax year beginning (month, day, year) (see instructions).

A Corporation (Entity) Making The.

Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Election is to be effective for tax year beginning (month, day, year) (see instructions).