Form 480 6C Instructions

Form 480 6C Instructions - Taxes were withheld on gross income but the actual nonresident. The purpose of this publication is to provide the electronic transfer filing instructions for the following informative returns forms:. Yes, you will need amend your return to report this puerto rican bank interest as income on your income tax returns. Se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto rico, tanto si. Our composite substitute tax statement includes reporting on payments consisting of. You'll need to sign in or create an account to connect with an expert. My understanding is that 480.6c is only a withholding certificate;

Taxes were withheld on gross income but the actual nonresident. My understanding is that 480.6c is only a withholding certificate; Yes, you will need amend your return to report this puerto rican bank interest as income on your income tax returns. You'll need to sign in or create an account to connect with an expert. Our composite substitute tax statement includes reporting on payments consisting of. The purpose of this publication is to provide the electronic transfer filing instructions for the following informative returns forms:. Se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto rico, tanto si.

Yes, you will need amend your return to report this puerto rican bank interest as income on your income tax returns. My understanding is that 480.6c is only a withholding certificate; You'll need to sign in or create an account to connect with an expert. Our composite substitute tax statement includes reporting on payments consisting of. Taxes were withheld on gross income but the actual nonresident. Se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto rico, tanto si. The purpose of this publication is to provide the electronic transfer filing instructions for the following informative returns forms:.

Forma 480 Fill out & sign online DocHub

The purpose of this publication is to provide the electronic transfer filing instructions for the following informative returns forms:. You'll need to sign in or create an account to connect with an expert. Yes, you will need amend your return to report this puerto rican bank interest as income on your income tax returns. Taxes were withheld on gross income.

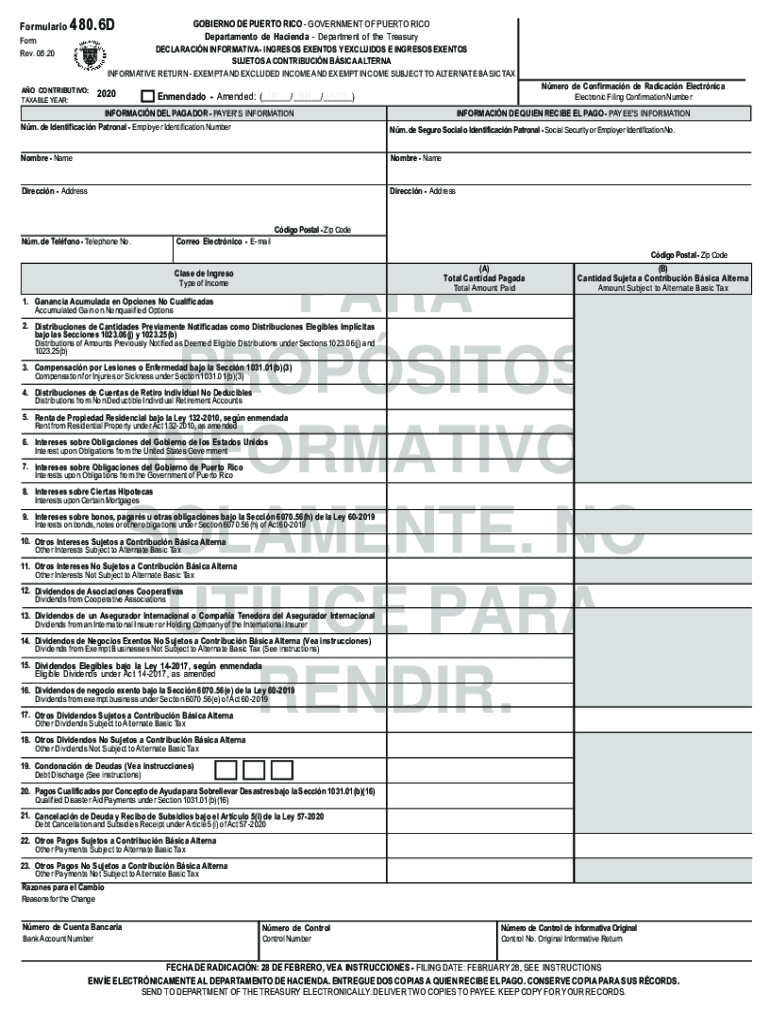

2020 Form PR 480.6D Fill Online, Printable, Fillable, Blank pdfFiller

You'll need to sign in or create an account to connect with an expert. My understanding is that 480.6c is only a withholding certificate; Taxes were withheld on gross income but the actual nonresident. Yes, you will need amend your return to report this puerto rican bank interest as income on your income tax returns. Se requerirá la preparación de.

Form 480 9 Printable Printable Forms Free Online

Taxes were withheld on gross income but the actual nonresident. My understanding is that 480.6c is only a withholding certificate; Our composite substitute tax statement includes reporting on payments consisting of. The purpose of this publication is to provide the electronic transfer filing instructions for the following informative returns forms:. You'll need to sign in or create an account to.

IRS Form 4506C Instructions IVES Request for Tax Transcripts

The purpose of this publication is to provide the electronic transfer filing instructions for the following informative returns forms:. You'll need to sign in or create an account to connect with an expert. Yes, you will need amend your return to report this puerto rican bank interest as income on your income tax returns. Se requerirá la preparación de un.

2008 Form PR 480.70(OE) Fill Online, Printable, Fillable, Blank pdfFiller

Se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto rico, tanto si. My understanding is that 480.6c is only a withholding certificate; The purpose of this publication is to provide the electronic transfer filing instructions for the following informative returns forms:. You'll need to sign in or create an.

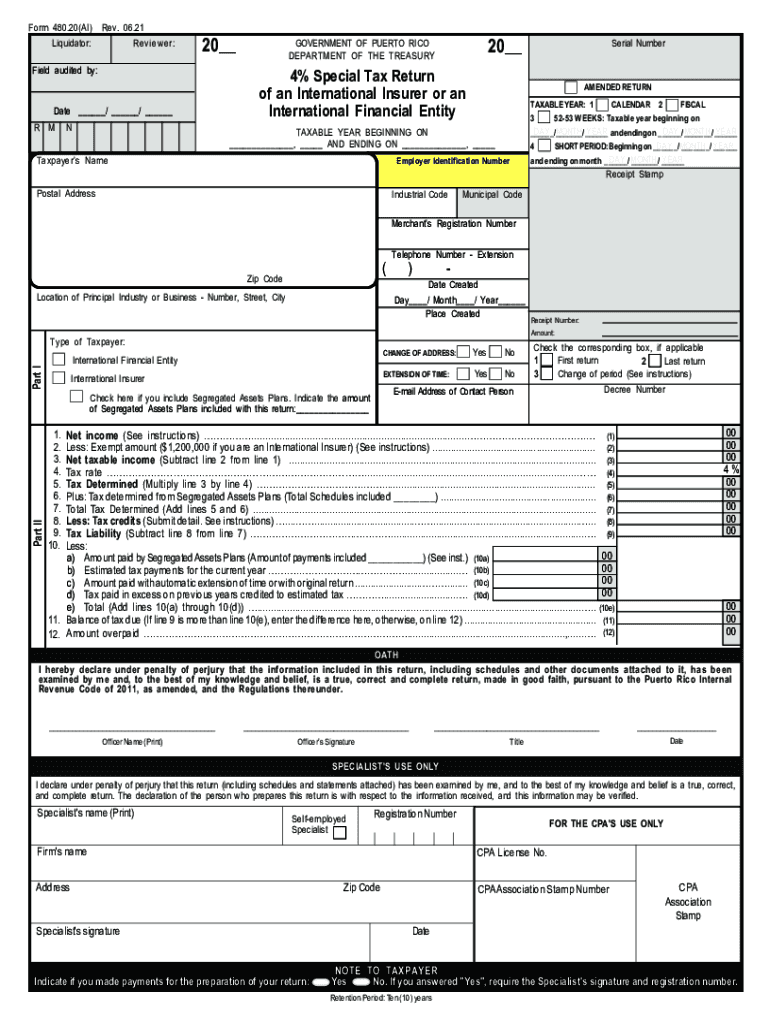

Puerto rico form 480 20 instructions Fill out & sign online DocHub

You'll need to sign in or create an account to connect with an expert. Taxes were withheld on gross income but the actual nonresident. Our composite substitute tax statement includes reporting on payments consisting of. Se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto rico, tanto si. My understanding.

20192024 PR Form 480.20(U) Fill Online, Printable, Fillable, Blank

My understanding is that 480.6c is only a withholding certificate; You'll need to sign in or create an account to connect with an expert. Our composite substitute tax statement includes reporting on payments consisting of. Taxes were withheld on gross income but the actual nonresident. The purpose of this publication is to provide the electronic transfer filing instructions for the.

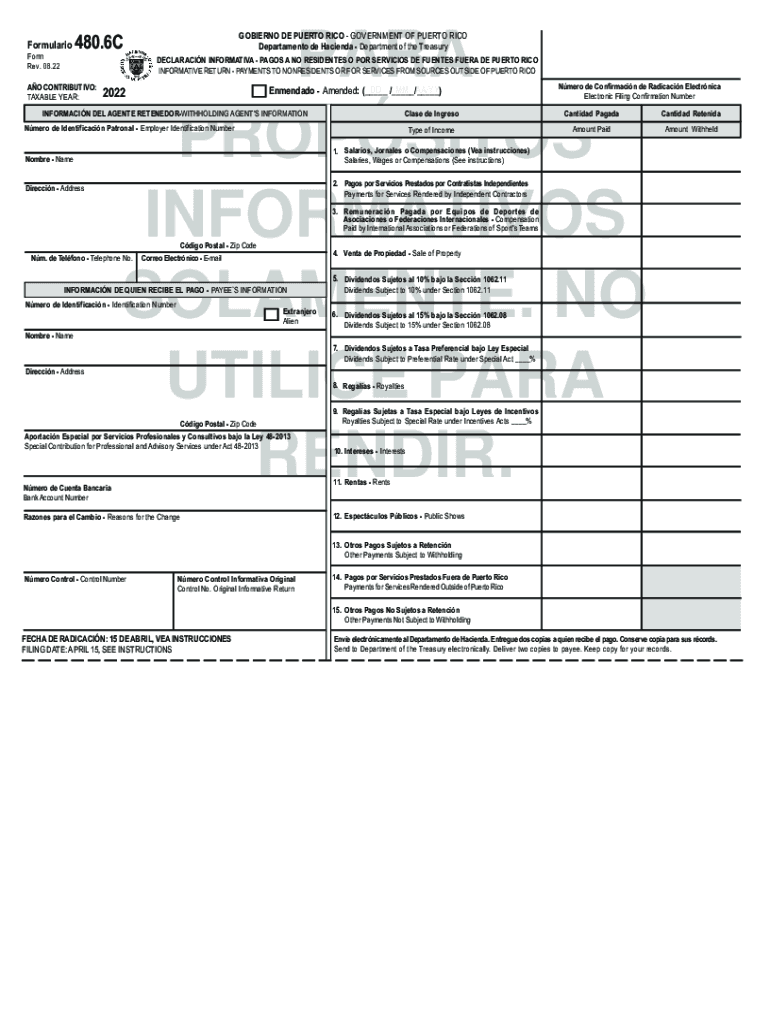

2022 Form PR 480.6C Fill Online, Printable, Fillable, Blank pdfFiller

Yes, you will need amend your return to report this puerto rican bank interest as income on your income tax returns. Se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto rico, tanto si. Our composite substitute tax statement includes reporting on payments consisting of. My understanding is that 480.6c.

2021 Form PR 480.30(II) Fill Online, Printable, Fillable, Blank pdfFiller

My understanding is that 480.6c is only a withholding certificate; Our composite substitute tax statement includes reporting on payments consisting of. Taxes were withheld on gross income but the actual nonresident. You'll need to sign in or create an account to connect with an expert. Se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a.

Form 480 6c Fill out & sign online DocHub

You'll need to sign in or create an account to connect with an expert. Yes, you will need amend your return to report this puerto rican bank interest as income on your income tax returns. Se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto rico, tanto si. Our composite.

Yes, You Will Need Amend Your Return To Report This Puerto Rican Bank Interest As Income On Your Income Tax Returns.

Taxes were withheld on gross income but the actual nonresident. Our composite substitute tax statement includes reporting on payments consisting of. You'll need to sign in or create an account to connect with an expert. My understanding is that 480.6c is only a withholding certificate;

Se Requerirá La Preparación De Un Formulario 480.6C Para Informar Todos Los Pagos Hechos A Personas No Residentes De Puerto Rico, Tanto Si.

The purpose of this publication is to provide the electronic transfer filing instructions for the following informative returns forms:.