Form 656 Offer In Compromise

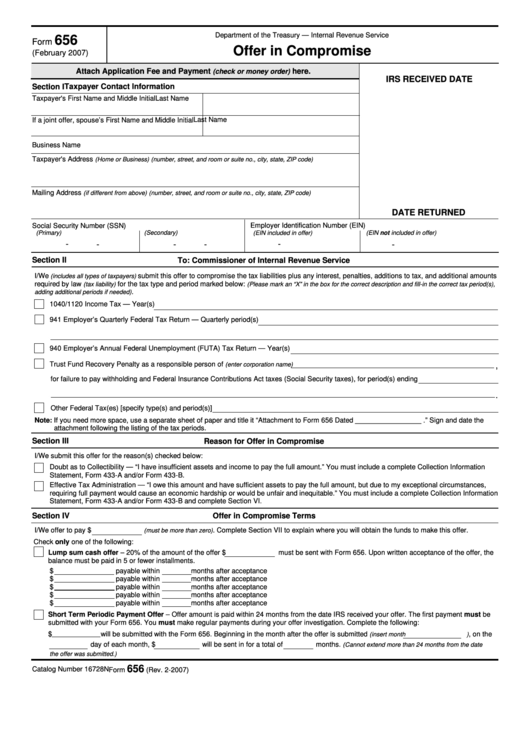

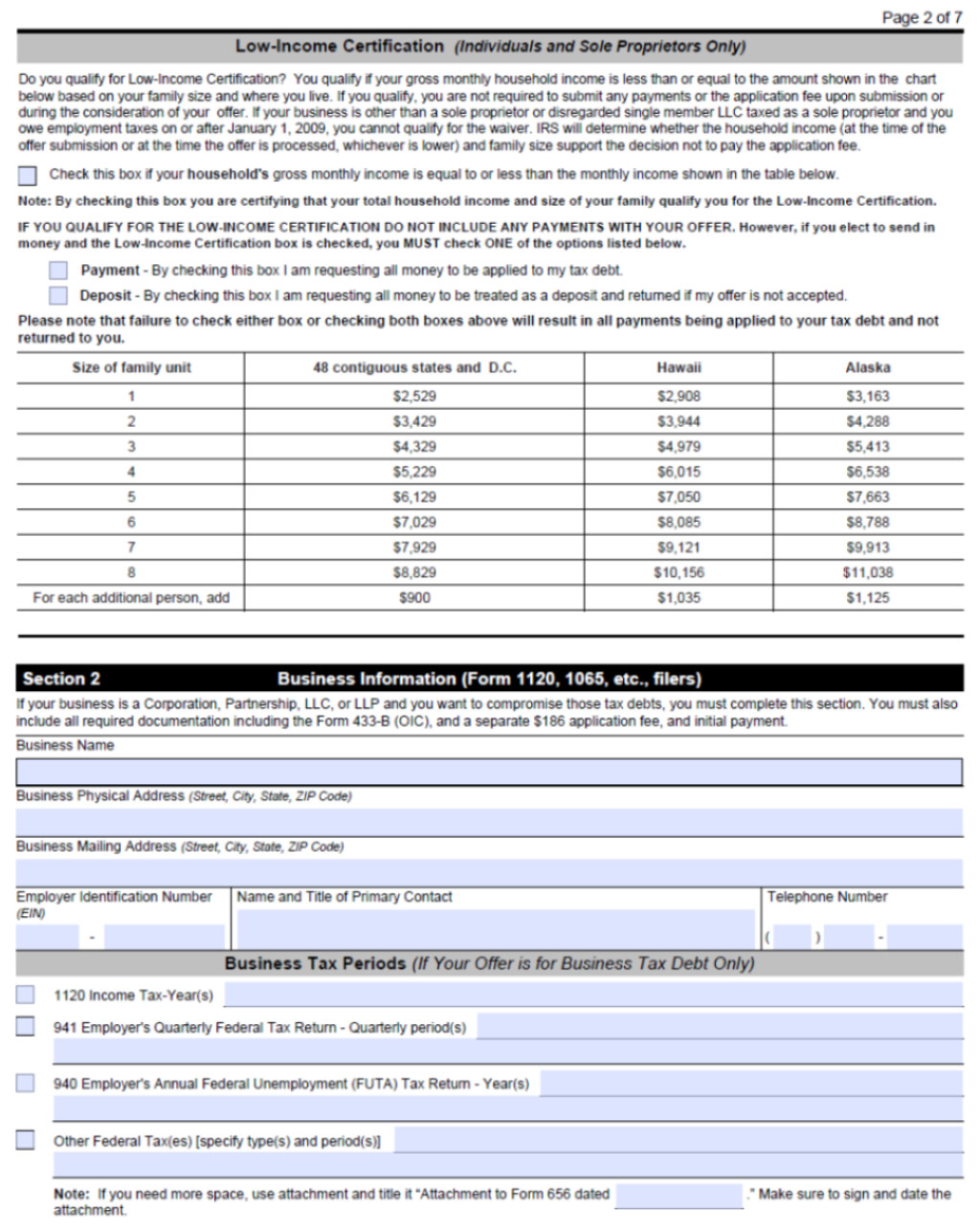

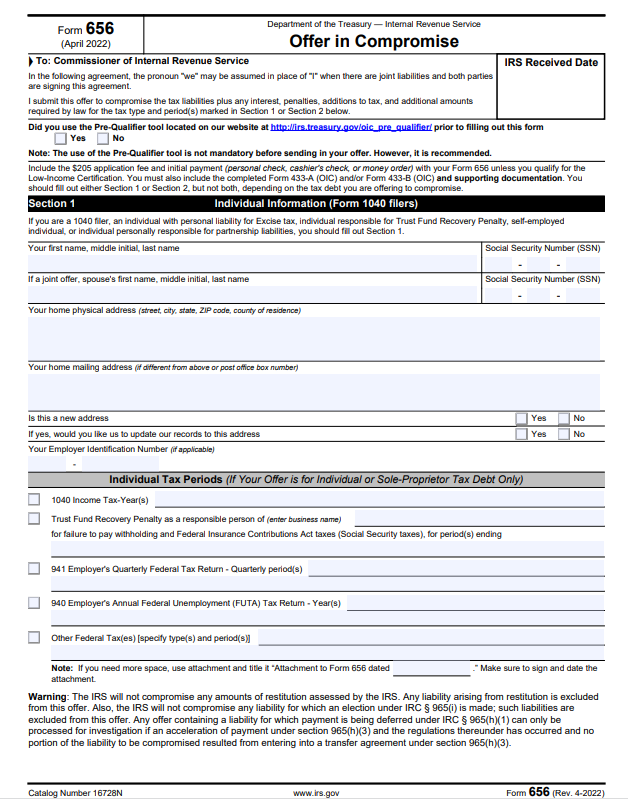

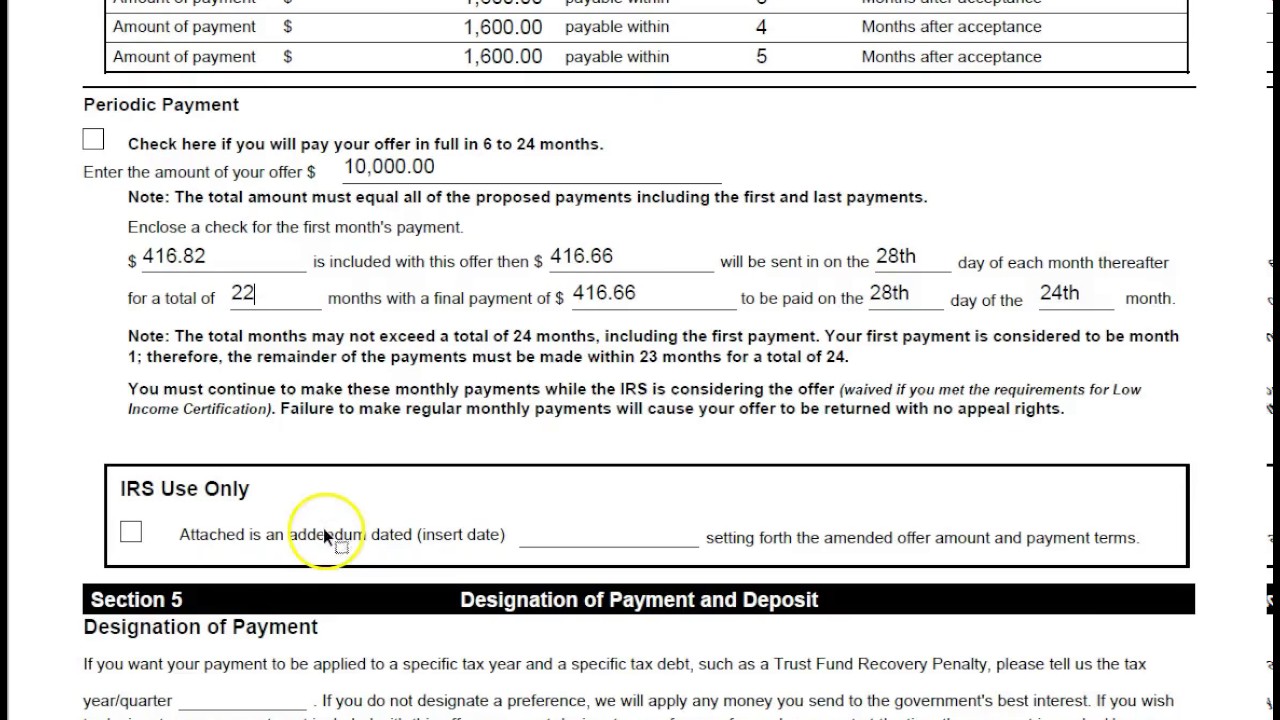

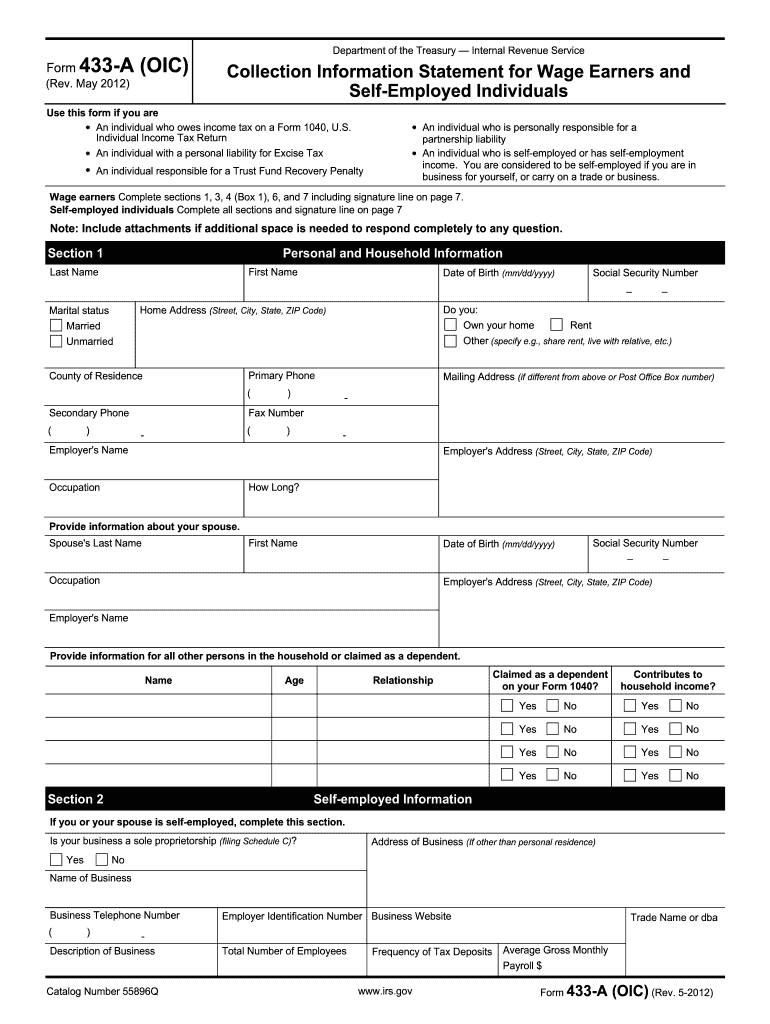

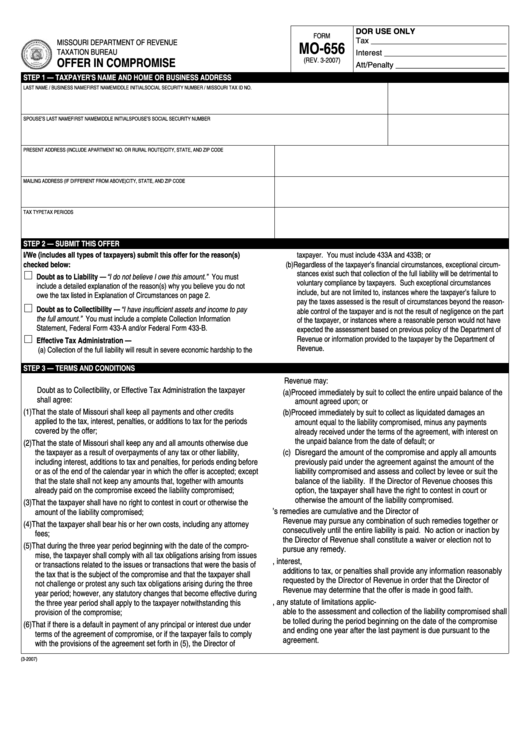

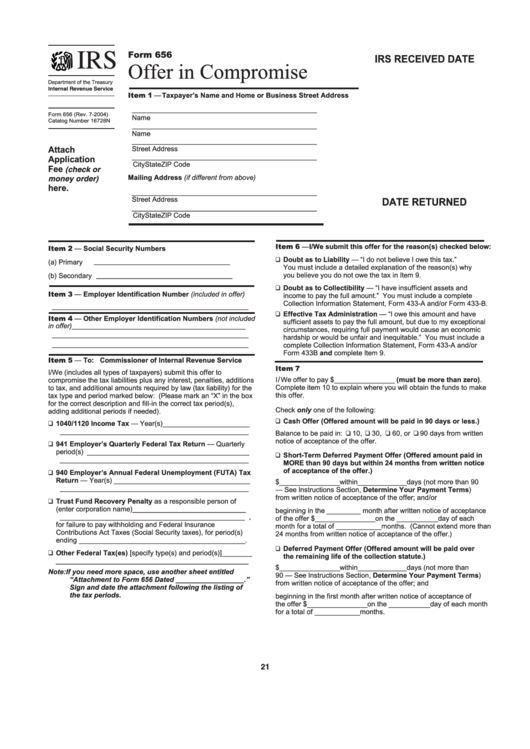

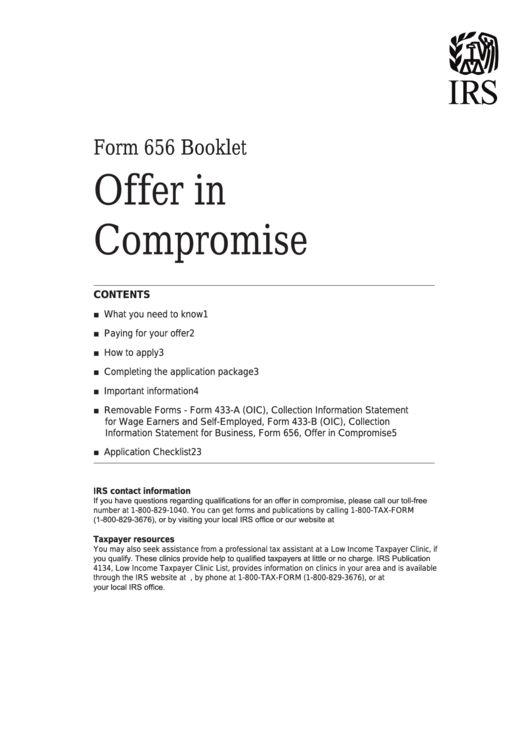

Form 656 Offer In Compromise - Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on www.irs.gov. An offer in compromise (offer) is an agreement between you (the taxpayer) and the irs that settles a tax debt for less than the full amount owed. On these forms, you’ll provide your basic information about you, your tax debt, the. Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities for less than the full amount owed. This guide will explain how to fill out irs form 656, which is used to submit an offer in compromise to the internal revenue service.

On these forms, you’ll provide your basic information about you, your tax debt, the. Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on www.irs.gov. This guide will explain how to fill out irs form 656, which is used to submit an offer in compromise to the internal revenue service. Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities for less than the full amount owed. An offer in compromise (offer) is an agreement between you (the taxpayer) and the irs that settles a tax debt for less than the full amount owed.

This guide will explain how to fill out irs form 656, which is used to submit an offer in compromise to the internal revenue service. On these forms, you’ll provide your basic information about you, your tax debt, the. Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities for less than the full amount owed. An offer in compromise (offer) is an agreement between you (the taxpayer) and the irs that settles a tax debt for less than the full amount owed. Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on www.irs.gov.

Fillable Form 656 Offer In Compromise Department Of The Treasury

On these forms, you’ll provide your basic information about you, your tax debt, the. Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities for less than the full amount owed. An offer in compromise (offer) is an agreement between you (the taxpayer) and the irs that.

Offer in compromise How to Get the IRS to Accept Your Offer Law

This guide will explain how to fill out irs form 656, which is used to submit an offer in compromise to the internal revenue service. On these forms, you’ll provide your basic information about you, your tax debt, the. Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your.

Form 656 Fillable Offer In Compromise Printable Forms Free Online

An offer in compromise (offer) is an agreement between you (the taxpayer) and the irs that settles a tax debt for less than the full amount owed. Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities for less than the full amount owed. Individuals requesting consideration.

Form 656L Offer in Compromise (Doubt as to Liability) (2012) Free

An offer in compromise (offer) is an agreement between you (the taxpayer) and the irs that settles a tax debt for less than the full amount owed. This guide will explain how to fill out irs form 656, which is used to submit an offer in compromise to the internal revenue service. Individuals requesting consideration of an offer must use.

Form 656 Fillable Offer In Compromise Printable Forms Free Online

On these forms, you’ll provide your basic information about you, your tax debt, the. An offer in compromise (offer) is an agreement between you (the taxpayer) and the irs that settles a tax debt for less than the full amount owed. This guide will explain how to fill out irs form 656, which is used to submit an offer in.

Irs 656 Booklet 20122024 Form Fill Out and Sign Printable PDF

This guide will explain how to fill out irs form 656, which is used to submit an offer in compromise to the internal revenue service. An offer in compromise (offer) is an agreement between you (the taxpayer) and the irs that settles a tax debt for less than the full amount owed. On these forms, you’ll provide your basic information.

Form Mo656 Offer In Compromise printable pdf download

Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities for less than the full amount owed. Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on www.irs.gov. On these forms, you’ll provide.

Fillable Form 656 Offer In Compromise printable pdf download

On these forms, you’ll provide your basic information about you, your tax debt, the. Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on www.irs.gov. Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your.

irs offer in compromise tips Fill Online, Printable, Fillable Blank

This guide will explain how to fill out irs form 656, which is used to submit an offer in compromise to the internal revenue service. Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on www.irs.gov. On these forms, you’ll provide your basic information about you,.

Fillable Form 656 Offer In Compromise (Including Form 433A (Oic

Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on www.irs.gov. An offer in compromise (offer) is an agreement between you (the taxpayer) and the irs that settles a tax debt for less than the full amount owed. This guide will explain how to fill out.

An Offer In Compromise (Offer) Is An Agreement Between You (The Taxpayer) And The Irs That Settles A Tax Debt For Less Than The Full Amount Owed.

On these forms, you’ll provide your basic information about you, your tax debt, the. Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on www.irs.gov. Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities for less than the full amount owed. This guide will explain how to fill out irs form 656, which is used to submit an offer in compromise to the internal revenue service.