Form 8283 Instructions 2023

Form 8283 Instructions 2023 - For significant noncash contributions, taxpayers use irs form 8283 to report the value of their donations to the. Find the current and previous revisions, instructions, and related. Learn how to file form 8283 to report noncash gifts worth more than $500.

For significant noncash contributions, taxpayers use irs form 8283 to report the value of their donations to the. Find the current and previous revisions, instructions, and related. Learn how to file form 8283 to report noncash gifts worth more than $500.

Learn how to file form 8283 to report noncash gifts worth more than $500. For significant noncash contributions, taxpayers use irs form 8283 to report the value of their donations to the. Find the current and previous revisions, instructions, and related.

Form 8283 Instructions 2022 2023

Find the current and previous revisions, instructions, and related. For significant noncash contributions, taxpayers use irs form 8283 to report the value of their donations to the. Learn how to file form 8283 to report noncash gifts worth more than $500.

Irs Form 8283 Printable Master of Documents

Learn how to file form 8283 to report noncash gifts worth more than $500. Find the current and previous revisions, instructions, and related. For significant noncash contributions, taxpayers use irs form 8283 to report the value of their donations to the.

Form 8283V Investor's wiki

Find the current and previous revisions, instructions, and related. For significant noncash contributions, taxpayers use irs form 8283 to report the value of their donations to the. Learn how to file form 8283 to report noncash gifts worth more than $500.

Form 8283 Instructions 2024 2025

For significant noncash contributions, taxpayers use irs form 8283 to report the value of their donations to the. Learn how to file form 8283 to report noncash gifts worth more than $500. Find the current and previous revisions, instructions, and related.

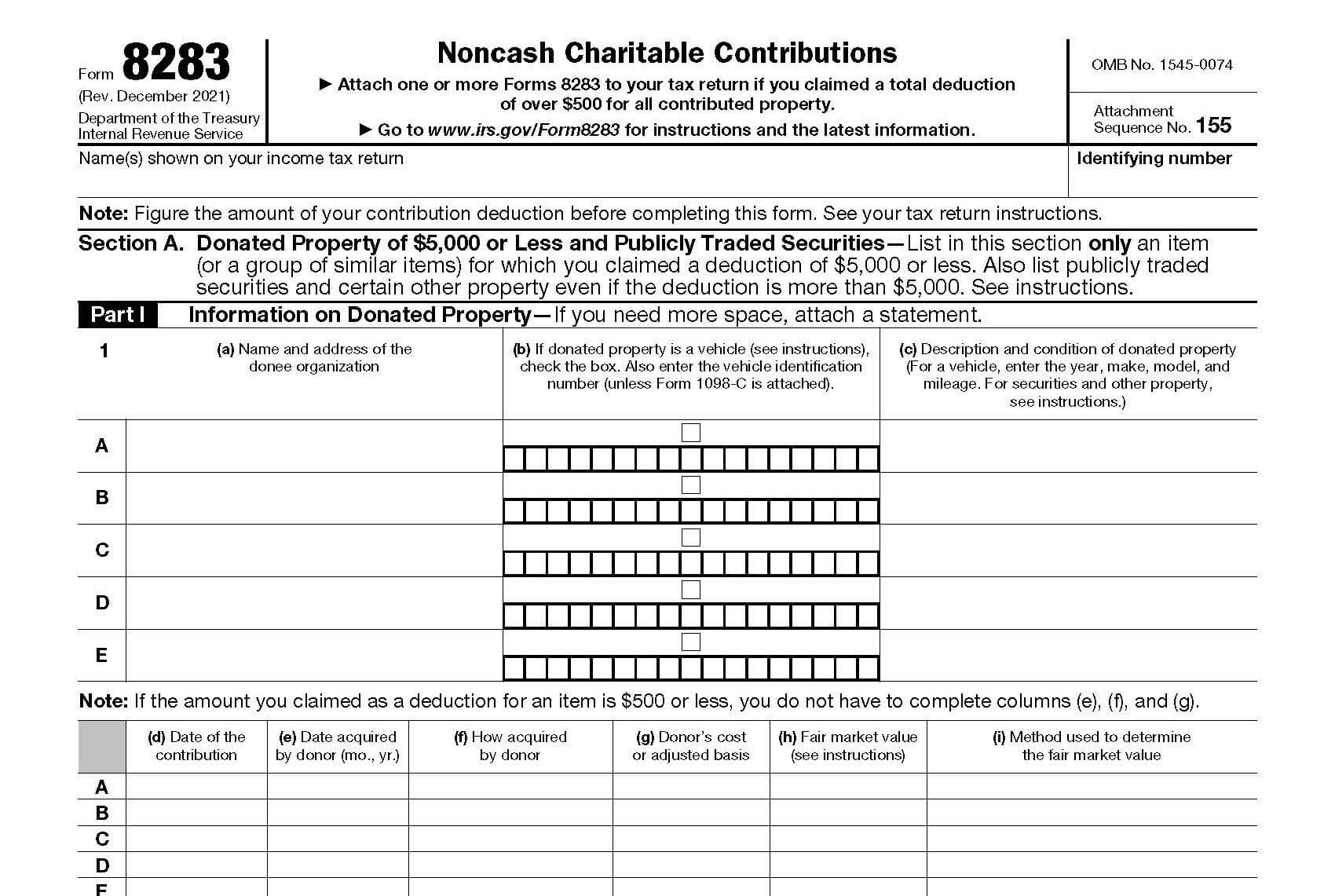

IRS Form 8283 Instructions Noncash Charitable Contributions

Find the current and previous revisions, instructions, and related. For significant noncash contributions, taxpayers use irs form 8283 to report the value of their donations to the. Learn how to file form 8283 to report noncash gifts worth more than $500.

Irs Form 8283 Printable Printable Forms Free Online

For significant noncash contributions, taxpayers use irs form 8283 to report the value of their donations to the. Find the current and previous revisions, instructions, and related. Learn how to file form 8283 to report noncash gifts worth more than $500.

IRS Form 8283 Simplifying Charitable Donations for Deductions

Find the current and previous revisions, instructions, and related. Learn how to file form 8283 to report noncash gifts worth more than $500. For significant noncash contributions, taxpayers use irs form 8283 to report the value of their donations to the.

How to Complete IRS Form 8283

For significant noncash contributions, taxpayers use irs form 8283 to report the value of their donations to the. Find the current and previous revisions, instructions, and related. Learn how to file form 8283 to report noncash gifts worth more than $500.

2024 form 8283 Fill online, Printable, Fillable Blank

For significant noncash contributions, taxpayers use irs form 8283 to report the value of their donations to the. Find the current and previous revisions, instructions, and related. Learn how to file form 8283 to report noncash gifts worth more than $500.

Fillable Online Instructions for Form 8283 (Rev. December 2023) Fax

For significant noncash contributions, taxpayers use irs form 8283 to report the value of their donations to the. Learn how to file form 8283 to report noncash gifts worth more than $500. Find the current and previous revisions, instructions, and related.

Find The Current And Previous Revisions, Instructions, And Related.

Learn how to file form 8283 to report noncash gifts worth more than $500. For significant noncash contributions, taxpayers use irs form 8283 to report the value of their donations to the.