Form 8971 Instructions 2022

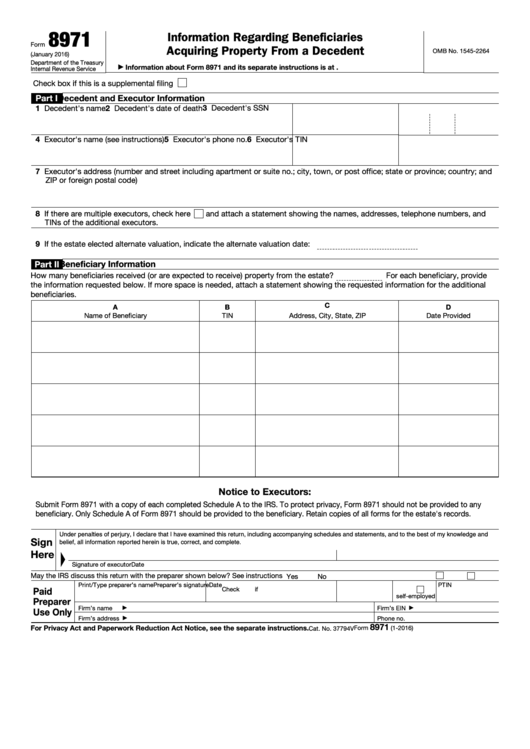

Form 8971 Instructions 2022 - We received a form 8971 in 2022 for a cash inheritance. Complete form 8971 and each attached schedule a in its entirety. That form is filed along with a form 706. Do we claim this on our 2022 return? One schedule a is provided to each. Form 8971, along with a copy of every schedule a, is used to report values to the irs. One schedule a is provided to each beneficiary receiving. A form or schedule filed with the irs without entries in. Form 8971, along with a copy of every schedule a, is used to report values to the irs.

Form 8971, along with a copy of every schedule a, is used to report values to the irs. Form 8971, along with a copy of every schedule a, is used to report values to the irs. One schedule a is provided to each beneficiary receiving. One schedule a is provided to each. A form or schedule filed with the irs without entries in. We received a form 8971 in 2022 for a cash inheritance. Complete form 8971 and each attached schedule a in its entirety. That form is filed along with a form 706. Do we claim this on our 2022 return?

One schedule a is provided to each. We received a form 8971 in 2022 for a cash inheritance. Do we claim this on our 2022 return? One schedule a is provided to each beneficiary receiving. Complete form 8971 and each attached schedule a in its entirety. That form is filed along with a form 706. Form 8971, along with a copy of every schedule a, is used to report values to the irs. A form or schedule filed with the irs without entries in. Form 8971, along with a copy of every schedule a, is used to report values to the irs.

IRS Form 8971 Instructions Reporting a Decedent's Property

Complete form 8971 and each attached schedule a in its entirety. That form is filed along with a form 706. Form 8971, along with a copy of every schedule a, is used to report values to the irs. A form or schedule filed with the irs without entries in. Form 8971, along with a copy of every schedule a, is.

IRS Form 8971 Instructions Reporting a Decedent's Property

Complete form 8971 and each attached schedule a in its entirety. One schedule a is provided to each. Form 8971, along with a copy of every schedule a, is used to report values to the irs. Form 8971, along with a copy of every schedule a, is used to report values to the irs. Do we claim this on our.

Fillable Form 8971 Information Regarding Beneficiaries Acquiring

Complete form 8971 and each attached schedule a in its entirety. Form 8971, along with a copy of every schedule a, is used to report values to the irs. One schedule a is provided to each. We received a form 8971 in 2022 for a cash inheritance. That form is filed along with a form 706.

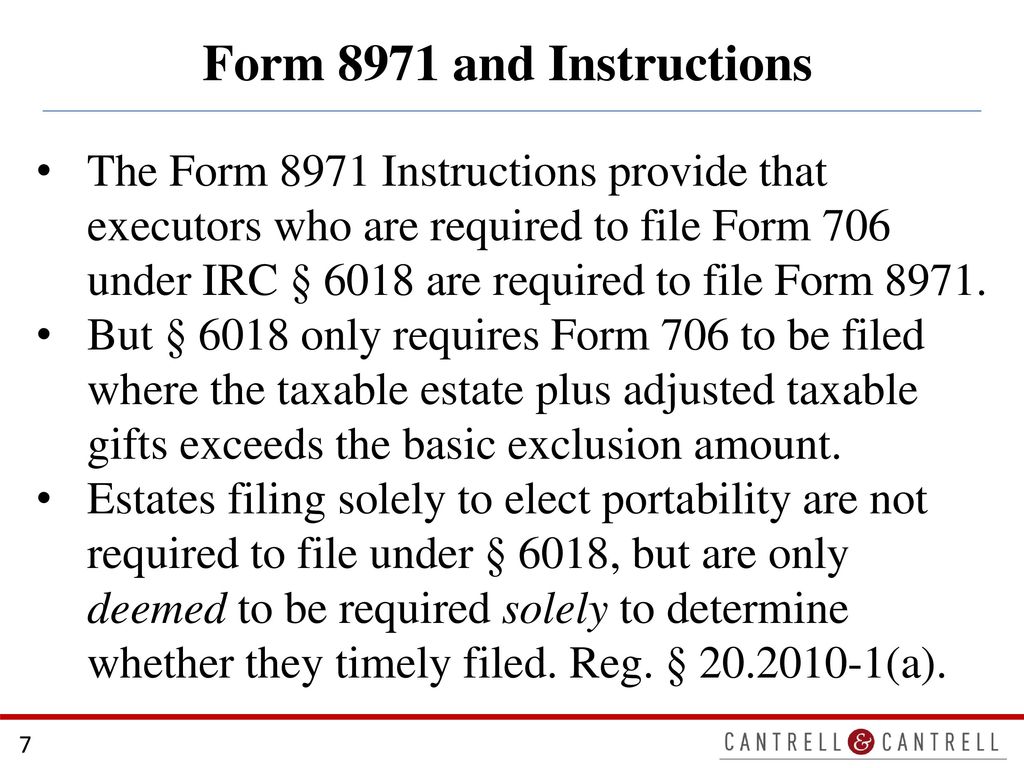

Cantrell & Cantrell, PLLC ppt download

That form is filed along with a form 706. Complete form 8971 and each attached schedule a in its entirety. Form 8971, along with a copy of every schedule a, is used to report values to the irs. One schedule a is provided to each beneficiary receiving. Do we claim this on our 2022 return?

IRS Form 8971 Instructions Reporting a Decedent's Property

A form or schedule filed with the irs without entries in. One schedule a is provided to each. We received a form 8971 in 2022 for a cash inheritance. Do we claim this on our 2022 return? Form 8971, along with a copy of every schedule a, is used to report values to the irs.

IRS Form 8978 Instructions Reporting Partner's Additional Taxes

We received a form 8971 in 2022 for a cash inheritance. Form 8971, along with a copy of every schedule a, is used to report values to the irs. One schedule a is provided to each beneficiary receiving. One schedule a is provided to each. Form 8971, along with a copy of every schedule a, is used to report values.

New Basis Reporting Requirements for Estates Meeting Form 8971

Do we claim this on our 2022 return? Form 8971, along with a copy of every schedule a, is used to report values to the irs. That form is filed along with a form 706. We received a form 8971 in 2022 for a cash inheritance. One schedule a is provided to each beneficiary receiving.

IRS Form 8971 walkthrough (Information Regarding Beneficiaries

We received a form 8971 in 2022 for a cash inheritance. Form 8971, along with a copy of every schedule a, is used to report values to the irs. Complete form 8971 and each attached schedule a in its entirety. That form is filed along with a form 706. A form or schedule filed with the irs without entries in.

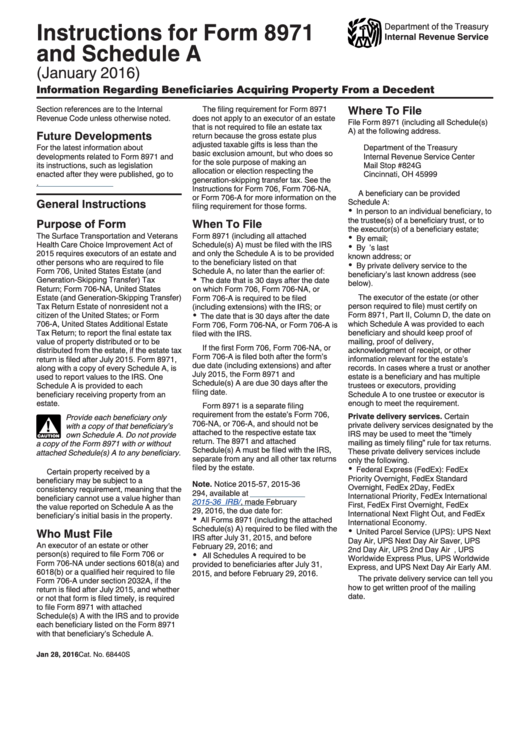

Instructions For Form 8971 And Schedule A 2016 printable pdf download

That form is filed along with a form 706. Form 8971, along with a copy of every schedule a, is used to report values to the irs. A form or schedule filed with the irs without entries in. Complete form 8971 and each attached schedule a in its entirety. One schedule a is provided to each.

IRS Form 15107 Instructions Information Request for a Decedent

Form 8971, along with a copy of every schedule a, is used to report values to the irs. One schedule a is provided to each. Form 8971, along with a copy of every schedule a, is used to report values to the irs. We received a form 8971 in 2022 for a cash inheritance. Complete form 8971 and each attached.

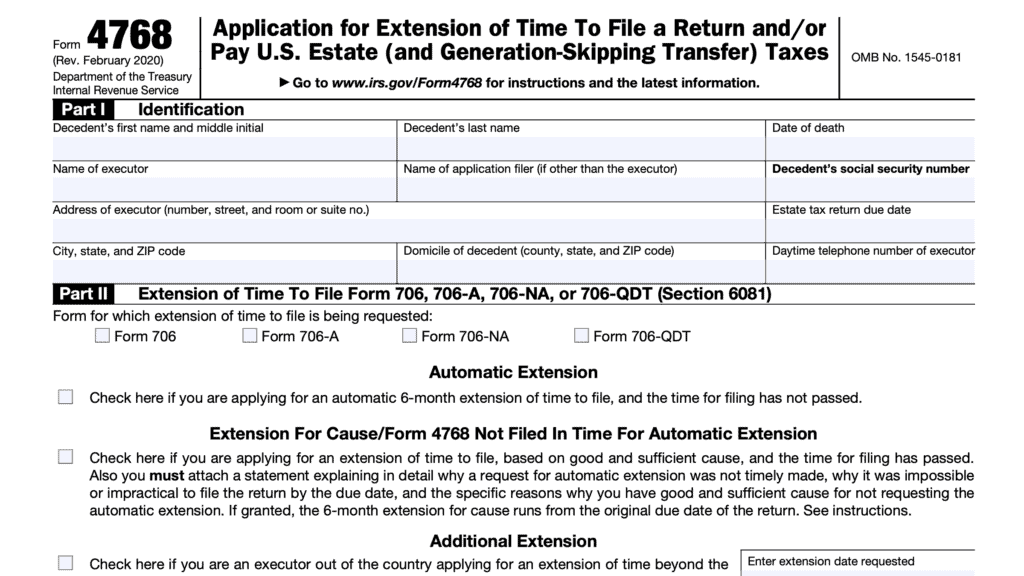

That Form Is Filed Along With A Form 706.

One schedule a is provided to each beneficiary receiving. Do we claim this on our 2022 return? One schedule a is provided to each. Complete form 8971 and each attached schedule a in its entirety.

Form 8971, Along With A Copy Of Every Schedule A, Is Used To Report Values To The Irs.

A form or schedule filed with the irs without entries in. We received a form 8971 in 2022 for a cash inheritance. Form 8971, along with a copy of every schedule a, is used to report values to the irs.