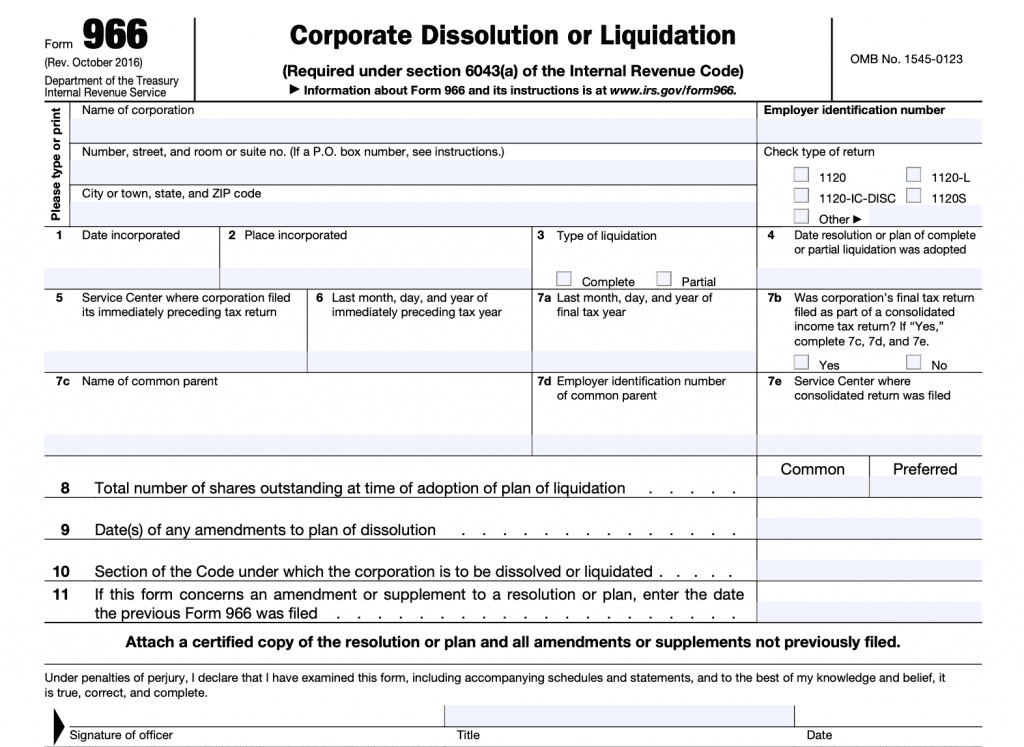

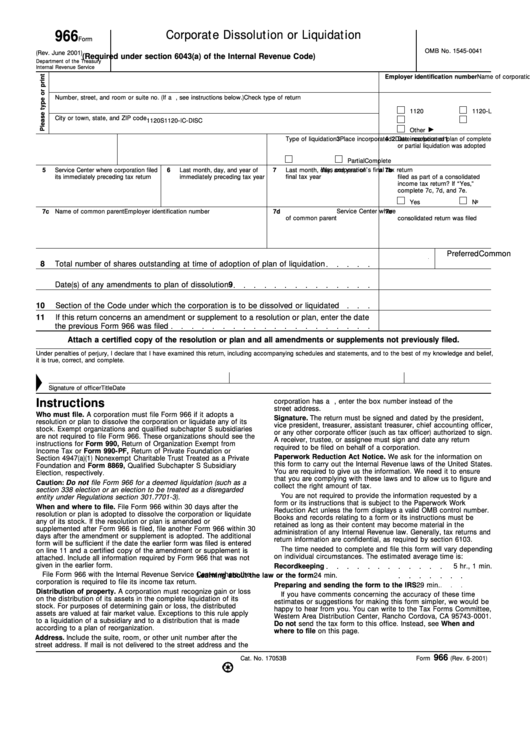

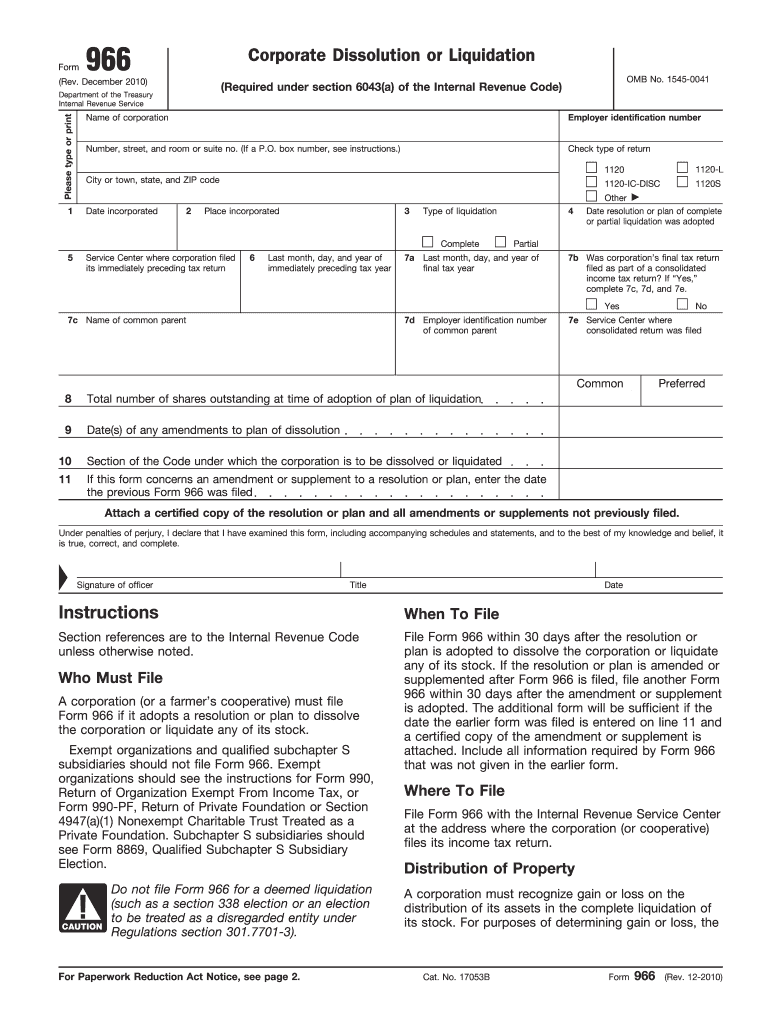

Form 966 Irs

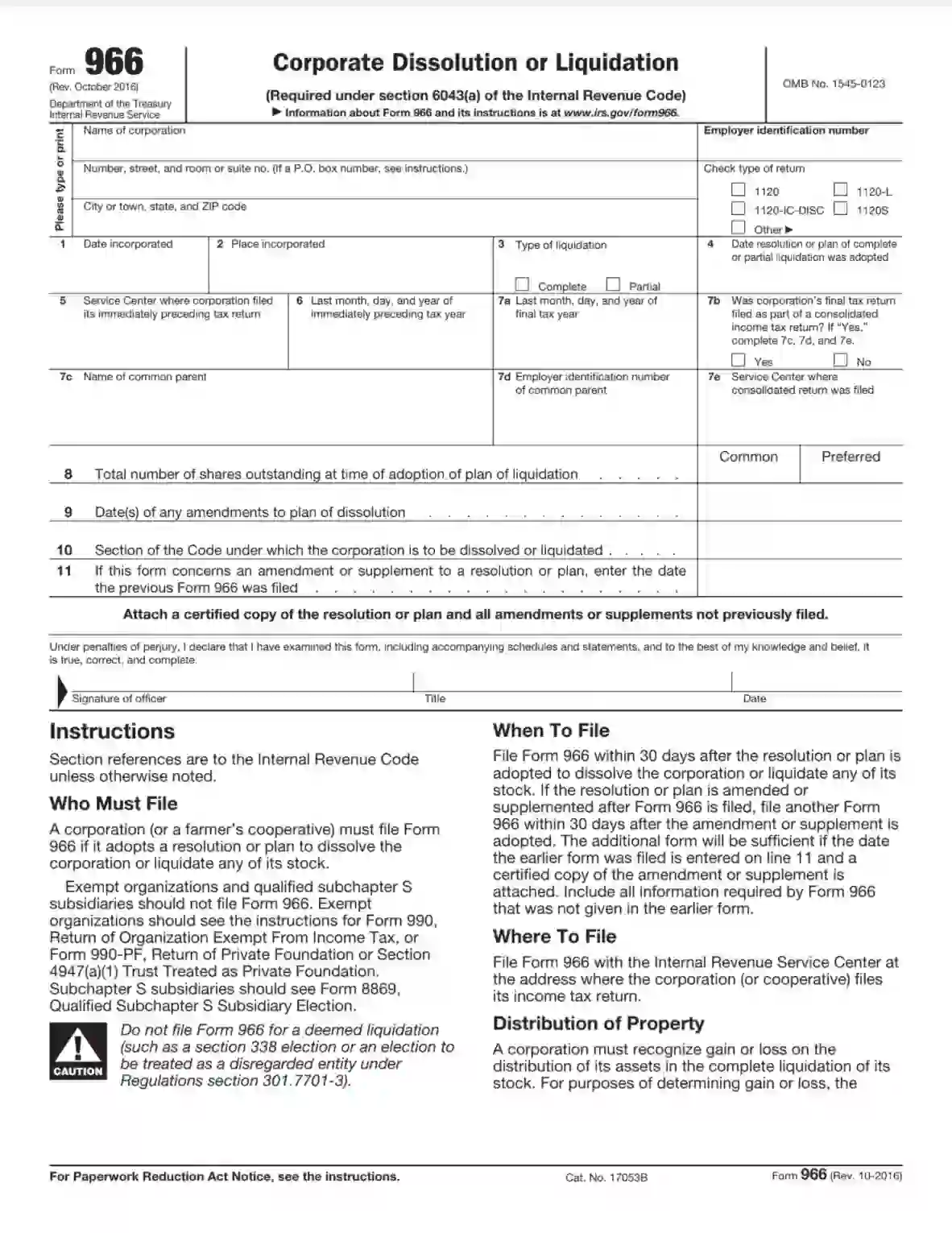

Form 966 Irs - Find the current revision, pdf,. Learn how to apply secs. Form 966 is a tax form that corporations or cooperatives must file if they adopt a resolution or plan to dissolve or liquidate any of their stock. The form is supposed to be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate. Learn how to file form 966 if your corporation or farmer's cooperative plans to dissolve or liquidate any of its stock. Irs form 966, also known as the “corporate dissolution or liquidation” form, is a document that must be filed with the internal. When corporate entities completely liquidate their stock, they must recognize the gain or loss on the. What is irs form 966?

Form 966 is a tax form that corporations or cooperatives must file if they adopt a resolution or plan to dissolve or liquidate any of their stock. Learn how to file form 966 if your corporation or farmer's cooperative plans to dissolve or liquidate any of its stock. Irs form 966, also known as the “corporate dissolution or liquidation” form, is a document that must be filed with the internal. Learn how to apply secs. Find the current revision, pdf,. The form is supposed to be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate. What is irs form 966? When corporate entities completely liquidate their stock, they must recognize the gain or loss on the.

Learn how to apply secs. Learn how to file form 966 if your corporation or farmer's cooperative plans to dissolve or liquidate any of its stock. The form is supposed to be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate. Form 966 is a tax form that corporations or cooperatives must file if they adopt a resolution or plan to dissolve or liquidate any of their stock. Irs form 966, also known as the “corporate dissolution or liquidation” form, is a document that must be filed with the internal. What is irs form 966? When corporate entities completely liquidate their stock, they must recognize the gain or loss on the. Find the current revision, pdf,.

IRS Form 966 Instructions Corporate Dissolutions & Liquidations

What is irs form 966? Irs form 966, also known as the “corporate dissolution or liquidation” form, is a document that must be filed with the internal. Learn how to file form 966 if your corporation or farmer's cooperative plans to dissolve or liquidate any of its stock. The form is supposed to be filed within 30 days after the.

Form 966 Corporate Dissolution Or Liquidation Department Of The

Find the current revision, pdf,. Learn how to file form 966 if your corporation or farmer's cooperative plans to dissolve or liquidate any of its stock. The form is supposed to be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate. When corporate entities completely liquidate their stock, they must recognize the.

How to File IRS Form 966 for a Corporate Dissolution or Liquidation

Form 966 is a tax form that corporations or cooperatives must file if they adopt a resolution or plan to dissolve or liquidate any of their stock. When corporate entities completely liquidate their stock, they must recognize the gain or loss on the. What is irs form 966? Learn how to file form 966 if your corporation or farmer's cooperative.

IRS Form 966 Instructions Corporate Dissolutions & Liquidations

Form 966 is a tax form that corporations or cooperatives must file if they adopt a resolution or plan to dissolve or liquidate any of their stock. Irs form 966, also known as the “corporate dissolution or liquidation” form, is a document that must be filed with the internal. Learn how to file form 966 if your corporation or farmer's.

Fillable Online Form 966 (Rev. June 2001), ( Fill in Version) Fax

What is irs form 966? Learn how to apply secs. When corporate entities completely liquidate their stock, they must recognize the gain or loss on the. Irs form 966, also known as the “corporate dissolution or liquidation” form, is a document that must be filed with the internal. Find the current revision, pdf,.

2010 Form IRS 966 Fill Online, Printable, Fillable, Blank pdfFiller

Form 966 is a tax form that corporations or cooperatives must file if they adopt a resolution or plan to dissolve or liquidate any of their stock. The form is supposed to be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate. Find the current revision, pdf,. Learn how to apply secs..

IRS Form 966 Instructions Corporate Dissolutions & Liquidations

When corporate entities completely liquidate their stock, they must recognize the gain or loss on the. The form is supposed to be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate. Form 966 is a tax form that corporations or cooperatives must file if they adopt a resolution or plan to dissolve.

IRS Form 966 ≡ Fill Out Printable PDF Forms Online

Learn how to file form 966 if your corporation or farmer's cooperative plans to dissolve or liquidate any of its stock. Learn how to apply secs. The form is supposed to be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate. Irs form 966, also known as the “corporate dissolution or liquidation”.

IRS Form 966 Instructions Corporate Dissolutions & Liquidations

Find the current revision, pdf,. What is irs form 966? Form 966 is a tax form that corporations or cooperatives must file if they adopt a resolution or plan to dissolve or liquidate any of their stock. The form is supposed to be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate..

IRS Form 966 For New Banker YouTube

What is irs form 966? When corporate entities completely liquidate their stock, they must recognize the gain or loss on the. The form is supposed to be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate. Find the current revision, pdf,. Form 966 is a tax form that corporations or cooperatives must.

The Form Is Supposed To Be Filed Within 30 Days After The Resolution Or Plan Is Adopted To Dissolve The Corporation Or Liquidate.

Form 966 is a tax form that corporations or cooperatives must file if they adopt a resolution or plan to dissolve or liquidate any of their stock. What is irs form 966? Learn how to file form 966 if your corporation or farmer's cooperative plans to dissolve or liquidate any of its stock. Find the current revision, pdf,.

When Corporate Entities Completely Liquidate Their Stock, They Must Recognize The Gain Or Loss On The.

Irs form 966, also known as the “corporate dissolution or liquidation” form, is a document that must be filed with the internal. Learn how to apply secs.