Form For 1031 Exchange

Form For 1031 Exchange - Learn how to postpone paying tax on the gain from selling business or investment property by reinvesting in similar property under section. It figures the amount of. Form 8824 is used to report each exchange of business or investment real property for real property of a like kind.

Learn how to postpone paying tax on the gain from selling business or investment property by reinvesting in similar property under section. Form 8824 is used to report each exchange of business or investment real property for real property of a like kind. It figures the amount of.

Learn how to postpone paying tax on the gain from selling business or investment property by reinvesting in similar property under section. Form 8824 is used to report each exchange of business or investment real property for real property of a like kind. It figures the amount of.

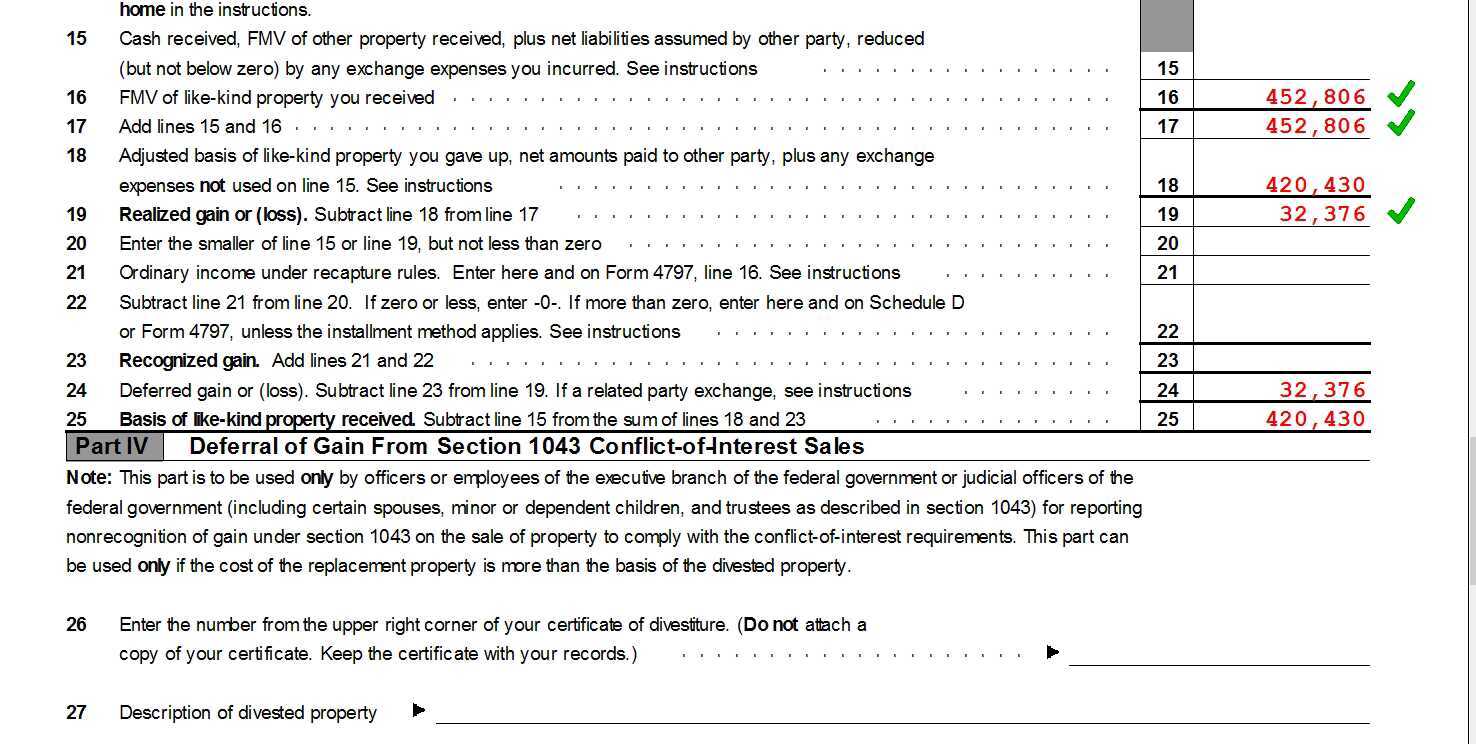

Reporting 1031 Exchanges to the IRS via Form 8824

It figures the amount of. Learn how to postpone paying tax on the gain from selling business or investment property by reinvesting in similar property under section. Form 8824 is used to report each exchange of business or investment real property for real property of a like kind.

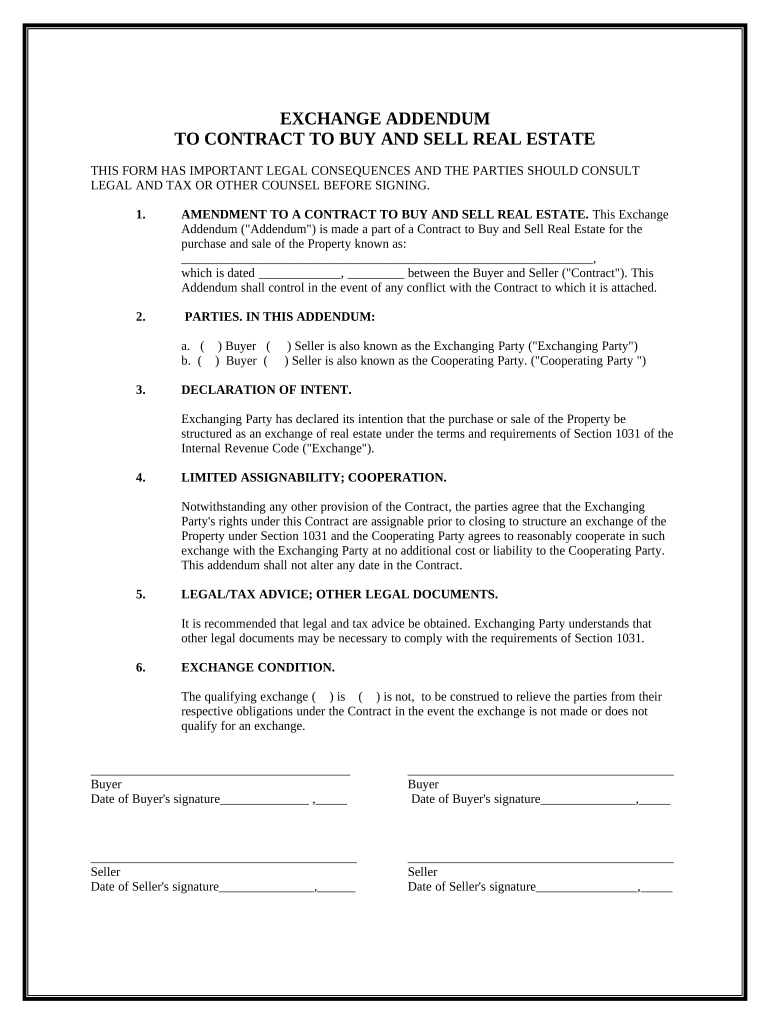

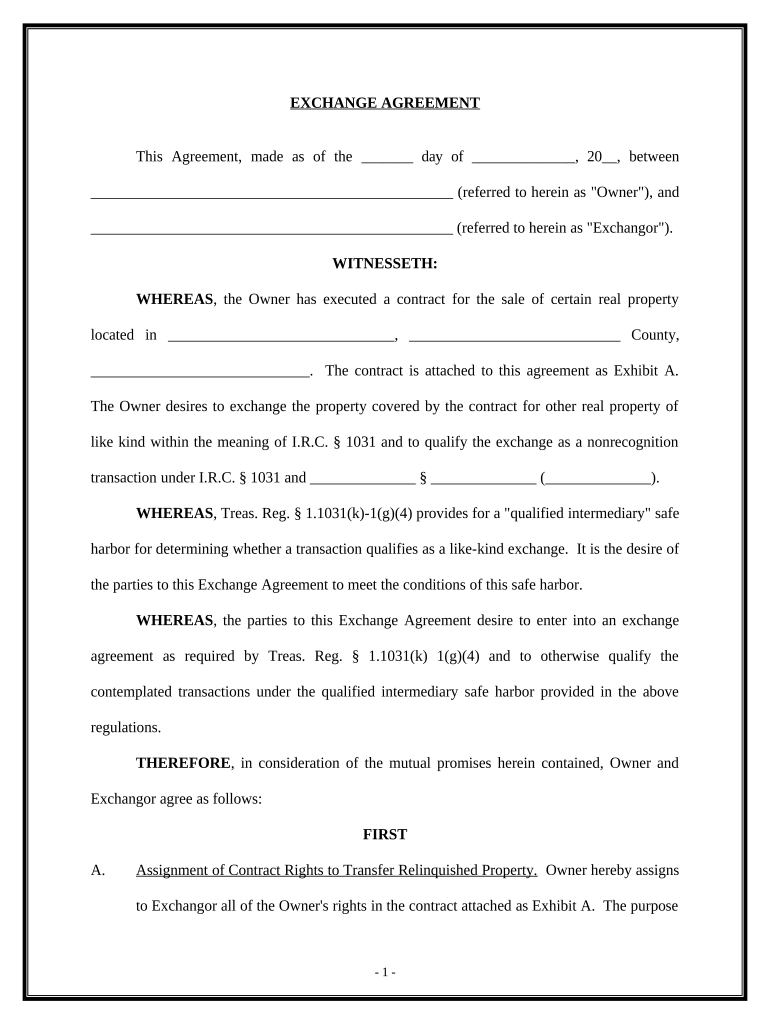

Exchange Addendum to Contract Tax Exchange Section 1031 Form Fill Out

Form 8824 is used to report each exchange of business or investment real property for real property of a like kind. It figures the amount of. Learn how to postpone paying tax on the gain from selling business or investment property by reinvesting in similar property under section.

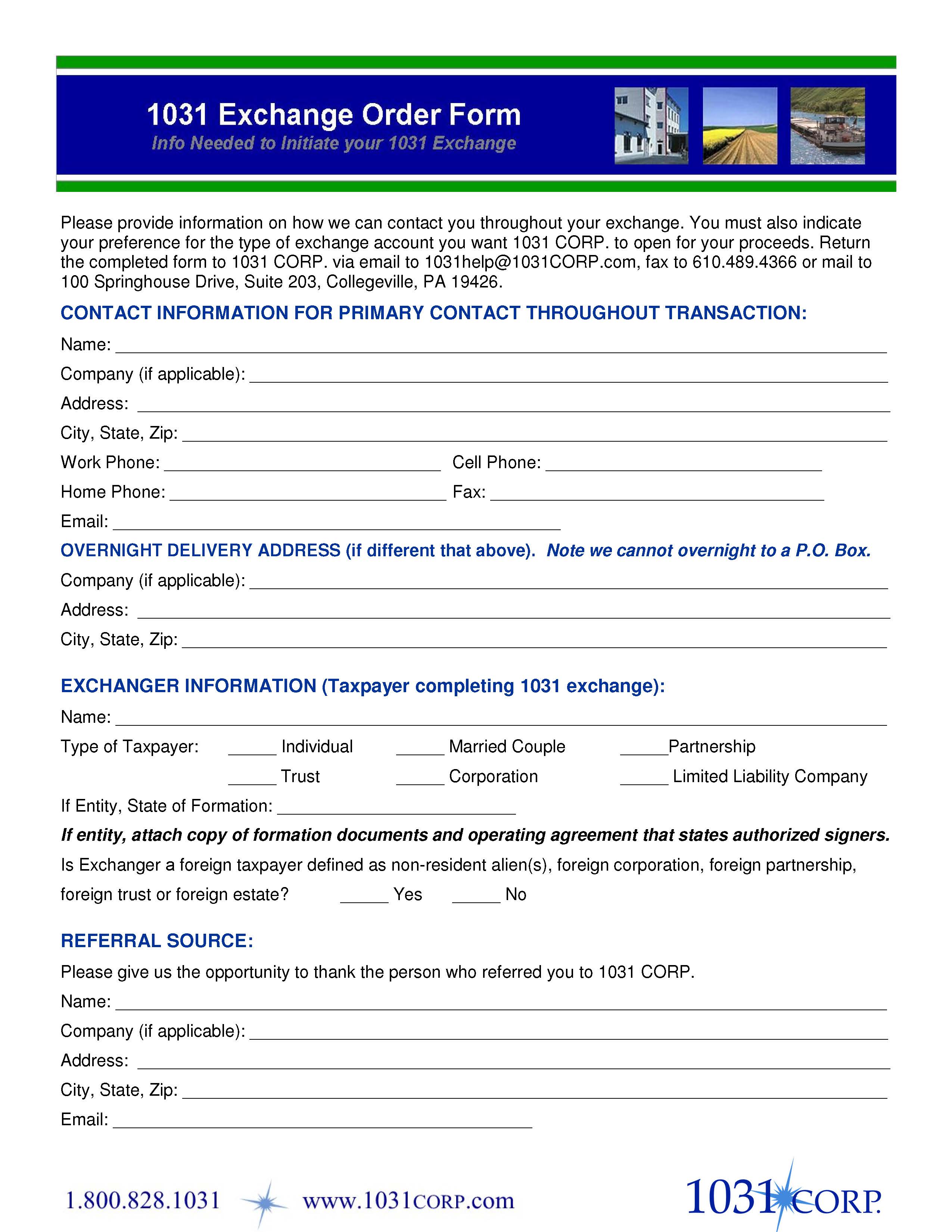

1031 Exchange Order Form

Learn how to postpone paying tax on the gain from selling business or investment property by reinvesting in similar property under section. It figures the amount of. Form 8824 is used to report each exchange of business or investment real property for real property of a like kind.

Paperwork For 1031 Exchange

Form 8824 is used to report each exchange of business or investment real property for real property of a like kind. Learn how to postpone paying tax on the gain from selling business or investment property by reinvesting in similar property under section. It figures the amount of.

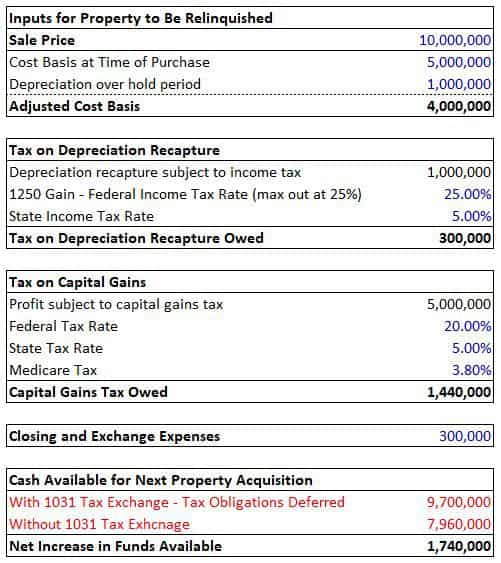

1031 Exchange Calculation Worksheet Math Printing Sheets

It figures the amount of. Form 8824 is used to report each exchange of business or investment real property for real property of a like kind. Learn how to postpone paying tax on the gain from selling business or investment property by reinvesting in similar property under section.

1031 Exchange Order Form

Form 8824 is used to report each exchange of business or investment real property for real property of a like kind. Learn how to postpone paying tax on the gain from selling business or investment property by reinvesting in similar property under section. It figures the amount of.

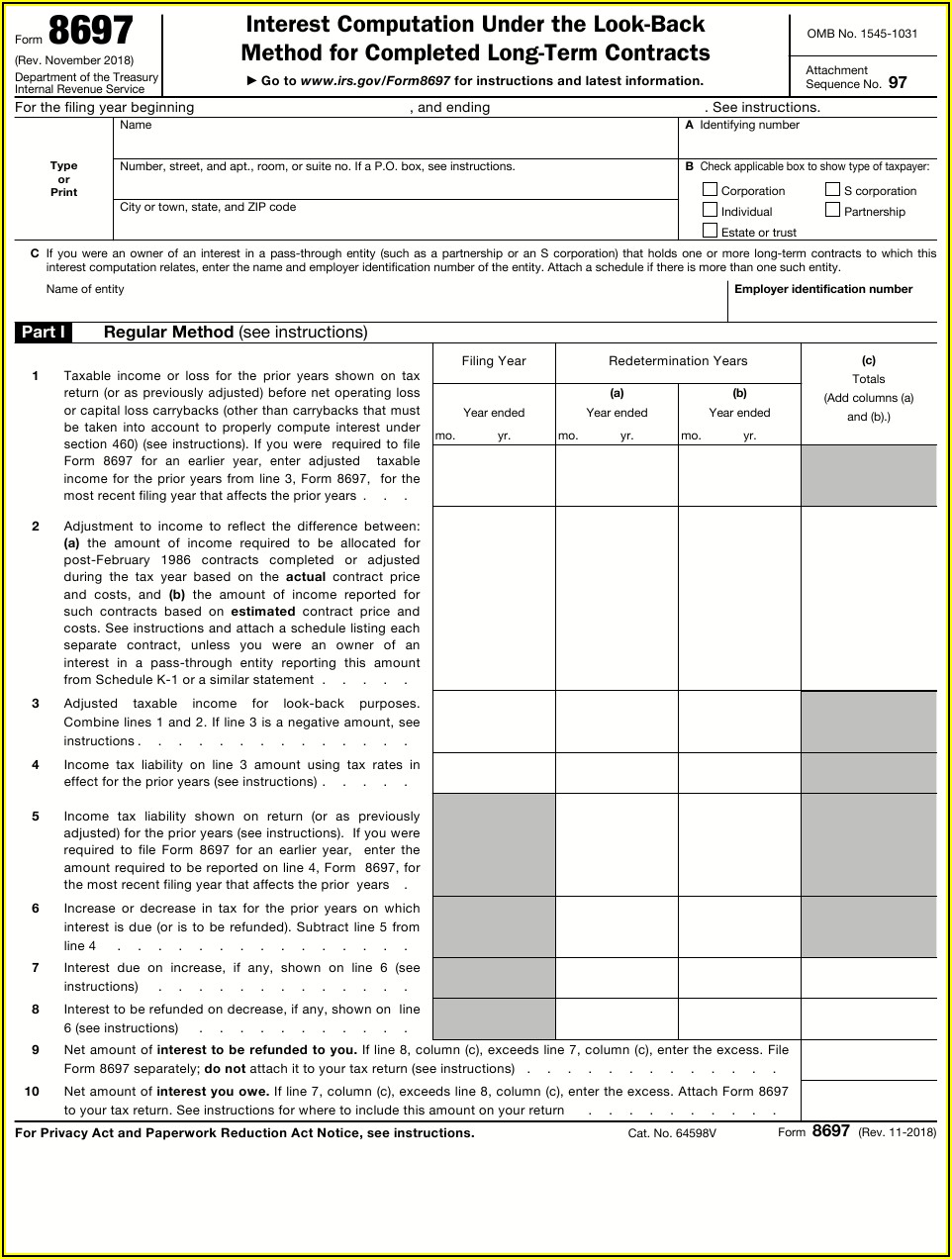

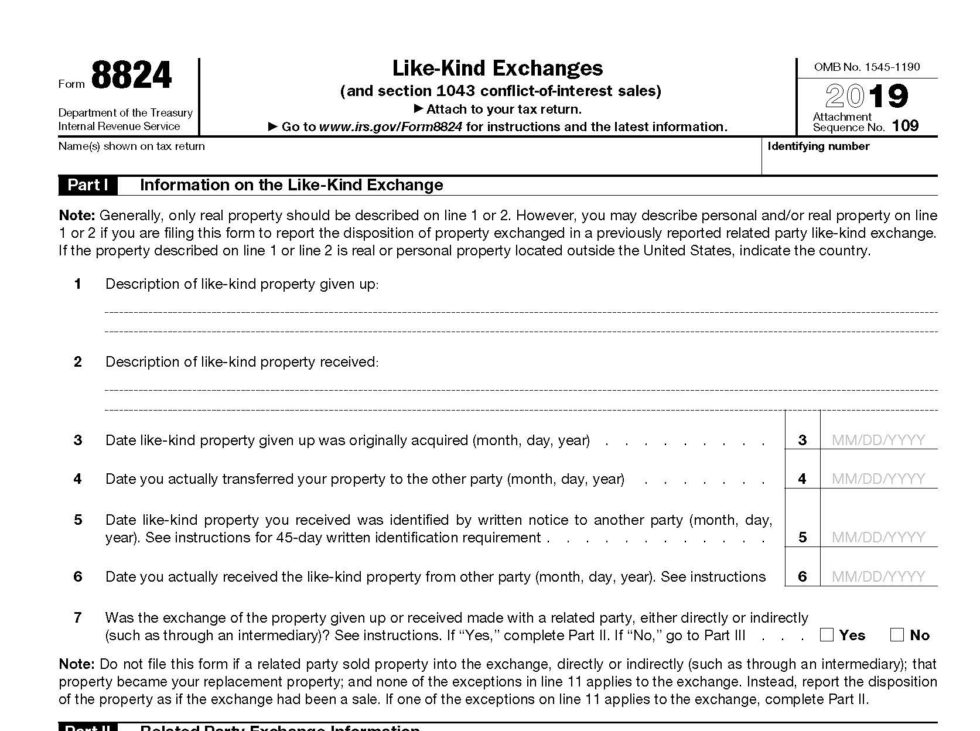

How to file form 8824 1031 Like Kind Exchange

Learn how to postpone paying tax on the gain from selling business or investment property by reinvesting in similar property under section. It figures the amount of. Form 8824 is used to report each exchange of business or investment real property for real property of a like kind.

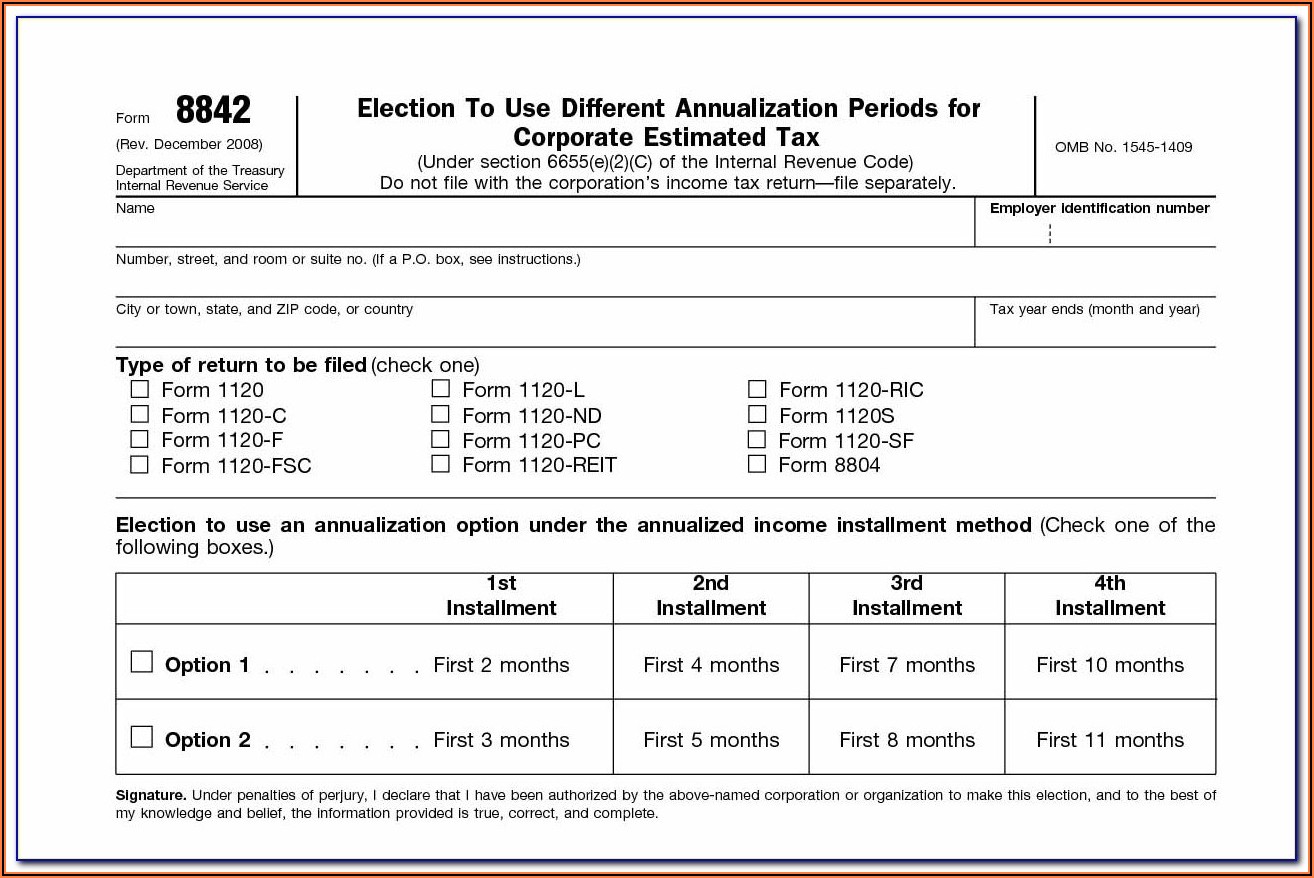

Irs Form 1031 Instructions Form Resume Examples N8VZdE8O9w

It figures the amount of. Form 8824 is used to report each exchange of business or investment real property for real property of a like kind. Learn how to postpone paying tax on the gain from selling business or investment property by reinvesting in similar property under section.

How To Document 1031 Exchange

Learn how to postpone paying tax on the gain from selling business or investment property by reinvesting in similar property under section. It figures the amount of. Form 8824 is used to report each exchange of business or investment real property for real property of a like kind.

Section 1031 Form Complete with ease airSlate SignNow

It figures the amount of. Learn how to postpone paying tax on the gain from selling business or investment property by reinvesting in similar property under section. Form 8824 is used to report each exchange of business or investment real property for real property of a like kind.

It Figures The Amount Of.

Learn how to postpone paying tax on the gain from selling business or investment property by reinvesting in similar property under section. Form 8824 is used to report each exchange of business or investment real property for real property of a like kind.