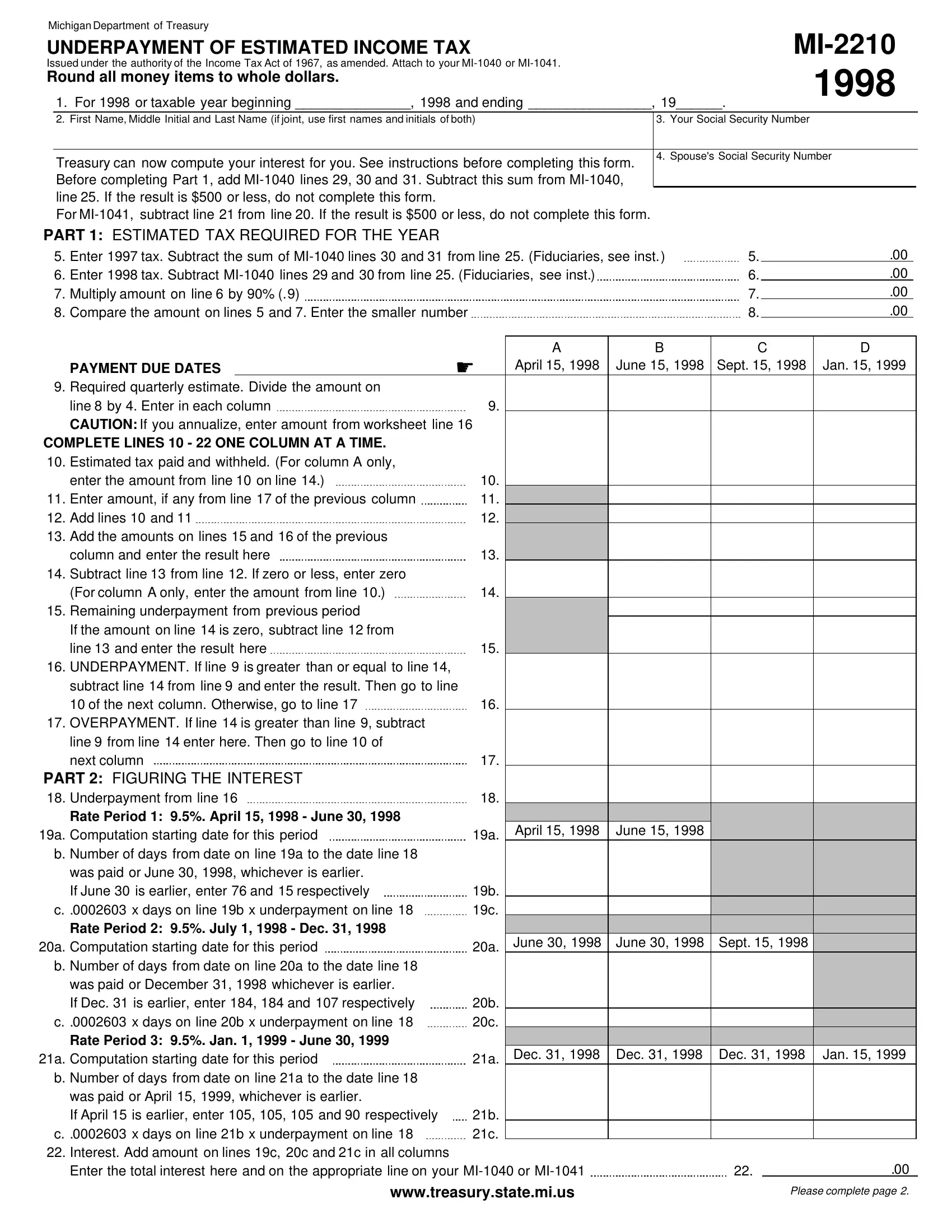

Form Mi 2210

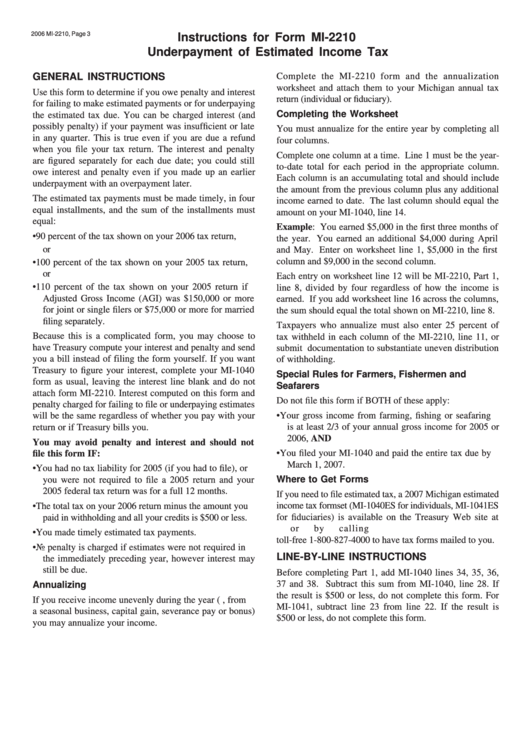

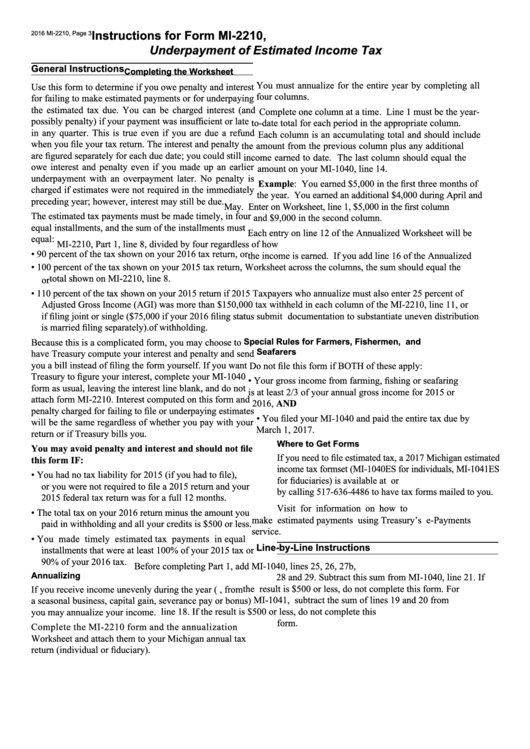

Form Mi 2210 - The state's instructions for form mi. To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app. If you select to annualize your income then you'll enter the amount you earned each quarter. Use form 2210 to see if you. Download or print the 2023 michigan (underpayment of estimated income tax) (2023) and other income tax forms from the michigan.

The state's instructions for form mi. Download or print the 2023 michigan (underpayment of estimated income tax) (2023) and other income tax forms from the michigan. If you select to annualize your income then you'll enter the amount you earned each quarter. To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app. Use form 2210 to see if you.

Download or print the 2023 michigan (underpayment of estimated income tax) (2023) and other income tax forms from the michigan. If you select to annualize your income then you'll enter the amount you earned each quarter. Use form 2210 to see if you. The state's instructions for form mi. To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app.

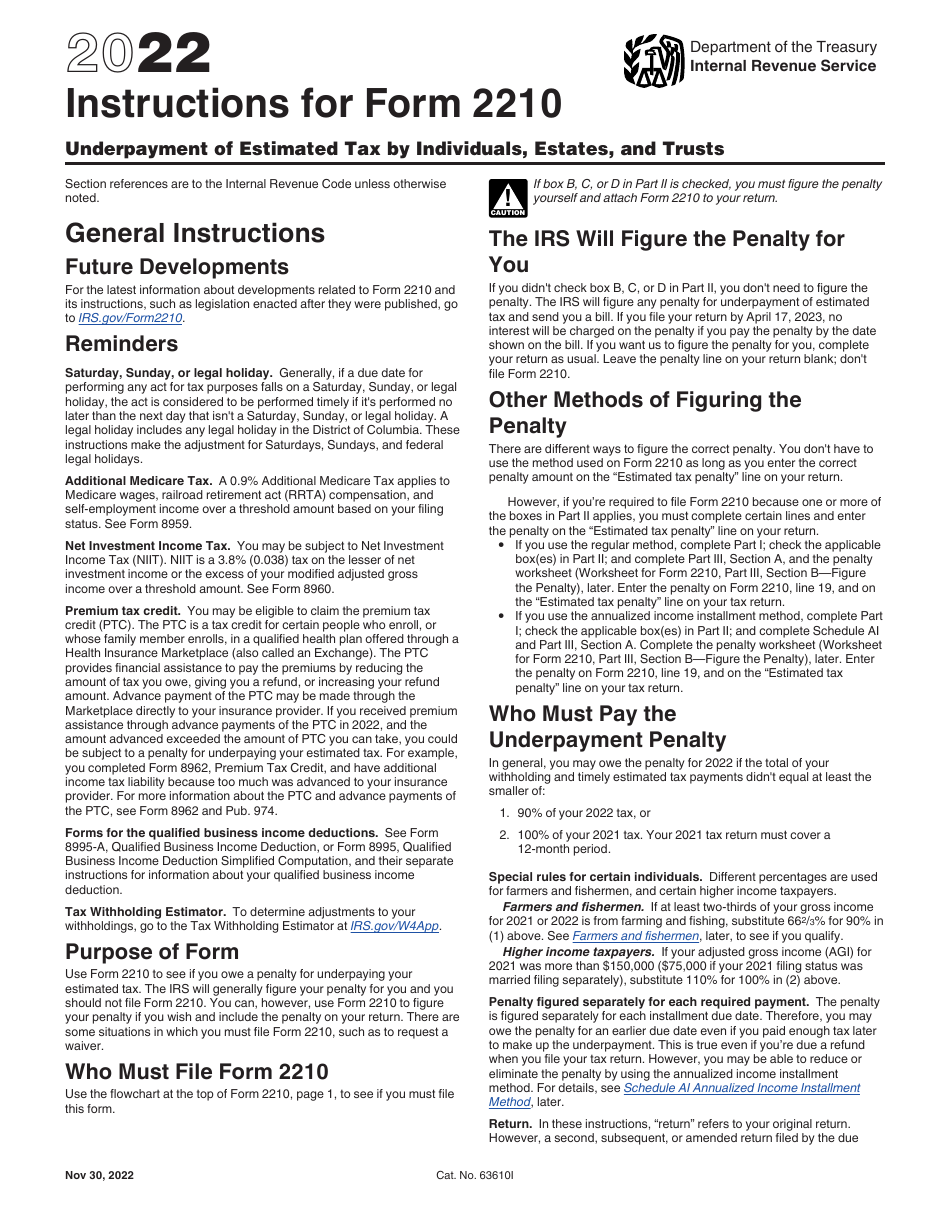

Irs Form 2210 Printable Printable Forms Free Online

Download or print the 2023 michigan (underpayment of estimated income tax) (2023) and other income tax forms from the michigan. To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app. If you select to annualize your income then you'll enter the amount you earned each quarter. The state's instructions for form mi. Use form 2210 to.

Michigan Mi 2210 Form ≡ Fill Out Printable PDF Forms Online

Use form 2210 to see if you. Download or print the 2023 michigan (underpayment of estimated income tax) (2023) and other income tax forms from the michigan. If you select to annualize your income then you'll enter the amount you earned each quarter. The state's instructions for form mi. To determine adjustments to your withholdings, go to the tax withholding.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app. Use form 2210 to see if you. If you select to annualize your income then you'll enter the amount you earned each quarter. The state's instructions for form mi. Download or print the 2023 michigan (underpayment of estimated income tax) (2023) and other income tax forms.

Ssurvivor Irs Form 2210 Instructions 2020

Use form 2210 to see if you. To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app. Download or print the 2023 michigan (underpayment of estimated income tax) (2023) and other income tax forms from the michigan. The state's instructions for form mi. If you select to annualize your income then you'll enter the amount you.

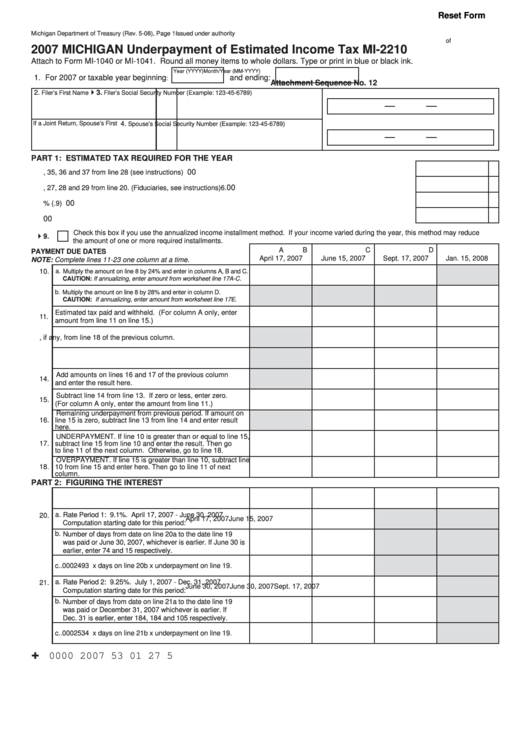

Instructions For Form Mi2210 Underpayment Of Estimated Tax

Use form 2210 to see if you. If you select to annualize your income then you'll enter the amount you earned each quarter. To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app. The state's instructions for form mi. Download or print the 2023 michigan (underpayment of estimated income tax) (2023) and other income tax forms.

Instructions For Form Mi2210, Underpayment Of Estimated Tax

If you select to annualize your income then you'll enter the amount you earned each quarter. Download or print the 2023 michigan (underpayment of estimated income tax) (2023) and other income tax forms from the michigan. The state's instructions for form mi. To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app. Use form 2210 to.

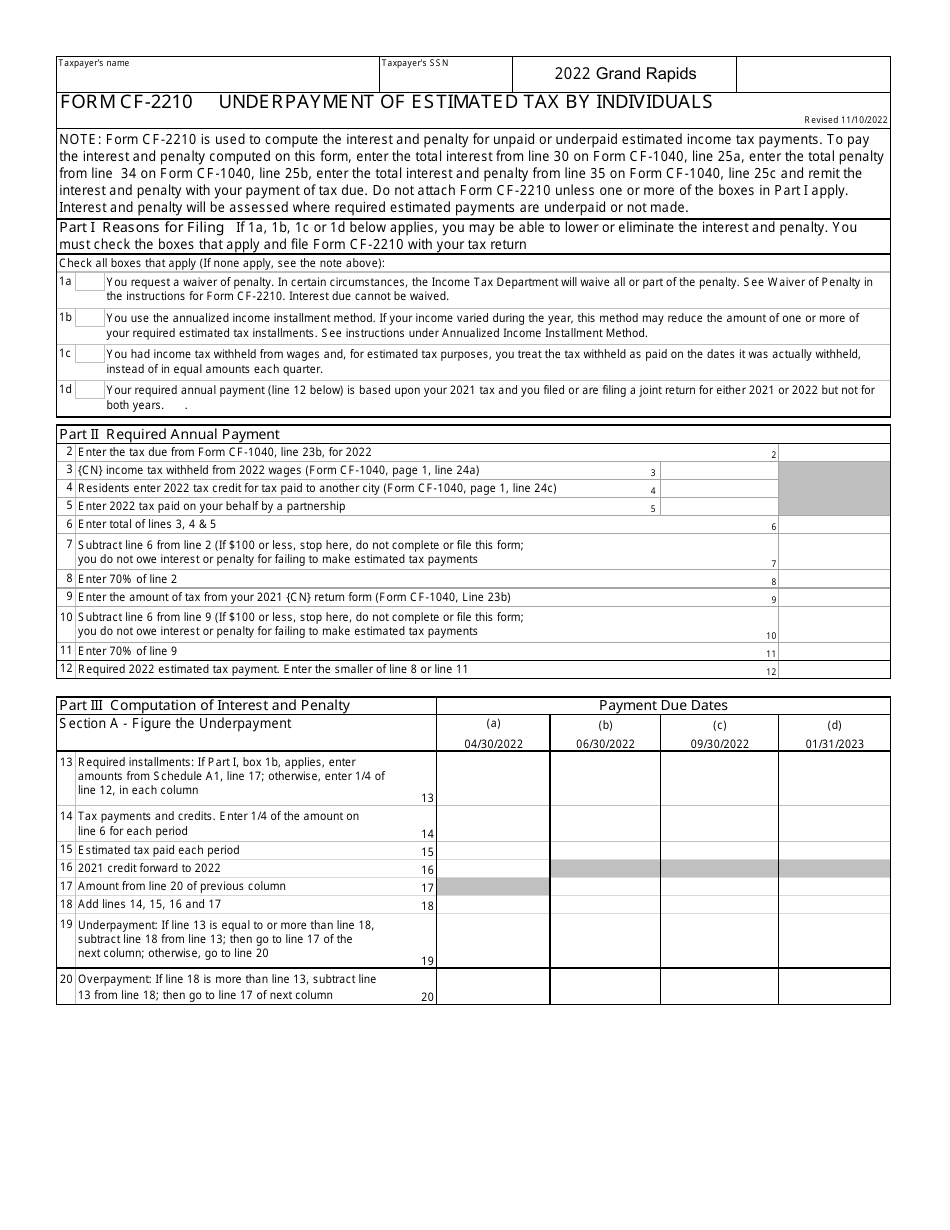

Form CF2210 2022 Fill Out, Sign Online and Download Printable PDF

If you select to annualize your income then you'll enter the amount you earned each quarter. Use form 2210 to see if you. Download or print the 2023 michigan (underpayment of estimated income tax) (2023) and other income tax forms from the michigan. To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app. The state's instructions.

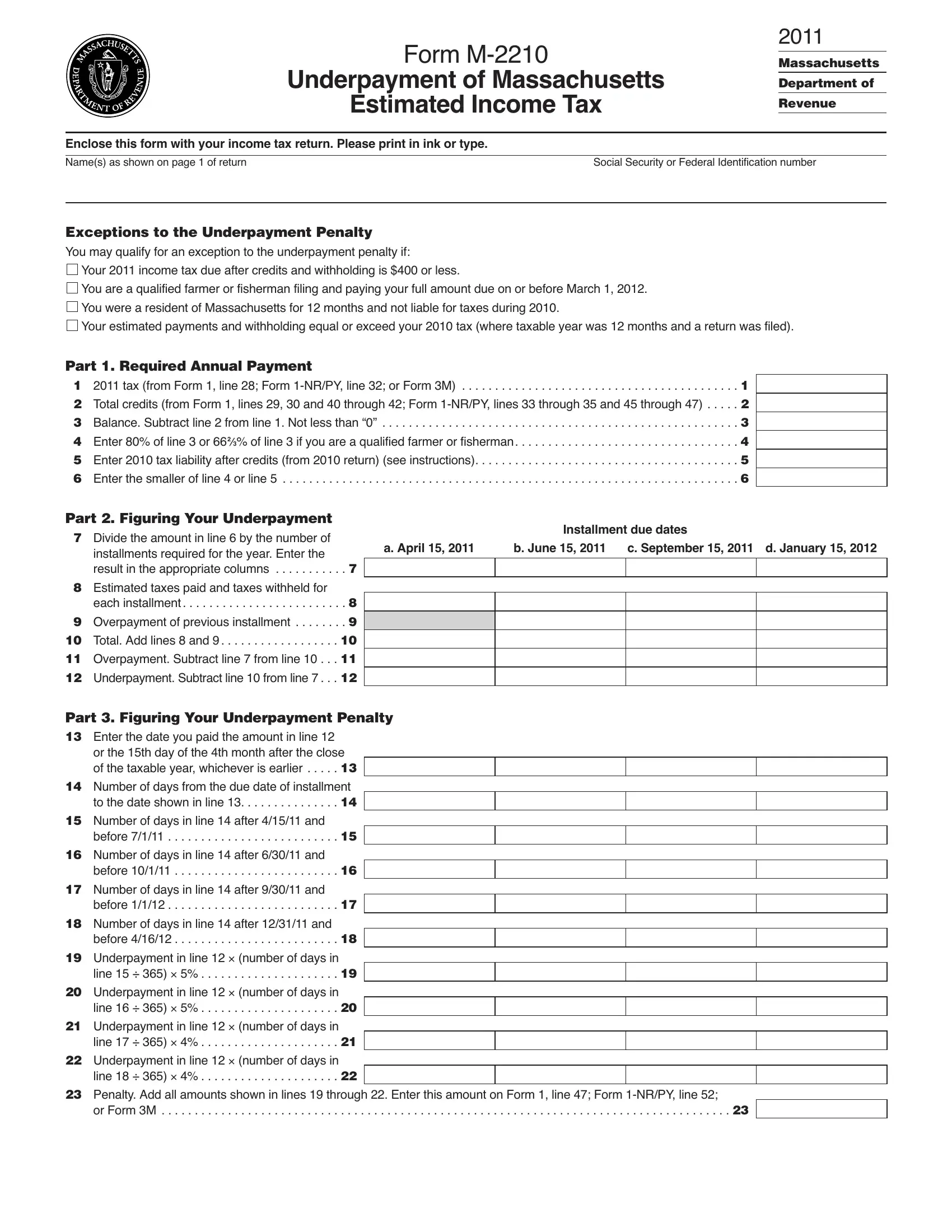

Form M 2210 ≡ Fill Out Printable PDF Forms Online

Use form 2210 to see if you. To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app. The state's instructions for form mi. If you select to annualize your income then you'll enter the amount you earned each quarter. Download or print the 2023 michigan (underpayment of estimated income tax) (2023) and other income tax forms.

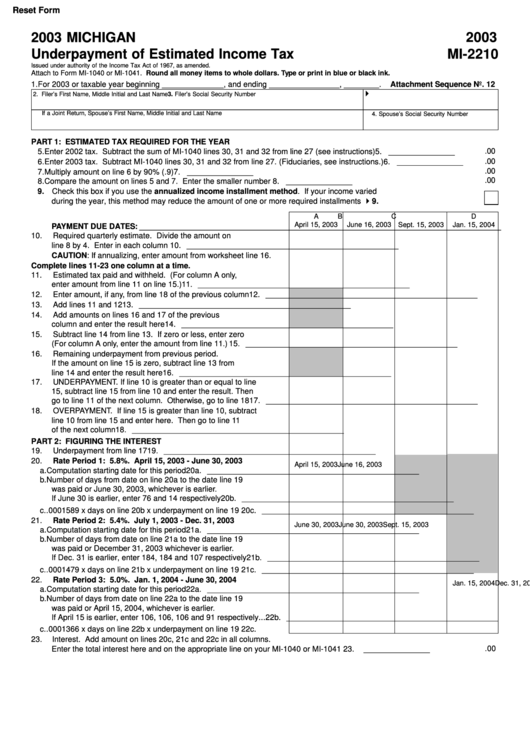

Fillable Form Mi2210 Michigan Underpayment Of Estimated Tax

The state's instructions for form mi. To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app. Use form 2210 to see if you. Download or print the 2023 michigan (underpayment of estimated income tax) (2023) and other income tax forms from the michigan. If you select to annualize your income then you'll enter the amount you.

Fillable Form Mi2210 Underpayment Of Estimated Tax printable

Download or print the 2023 michigan (underpayment of estimated income tax) (2023) and other income tax forms from the michigan. If you select to annualize your income then you'll enter the amount you earned each quarter. To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app. Use form 2210 to see if you. The state's instructions.

Download Or Print The 2023 Michigan (Underpayment Of Estimated Income Tax) (2023) And Other Income Tax Forms From The Michigan.

Use form 2210 to see if you. The state's instructions for form mi. If you select to annualize your income then you'll enter the amount you earned each quarter. To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app.