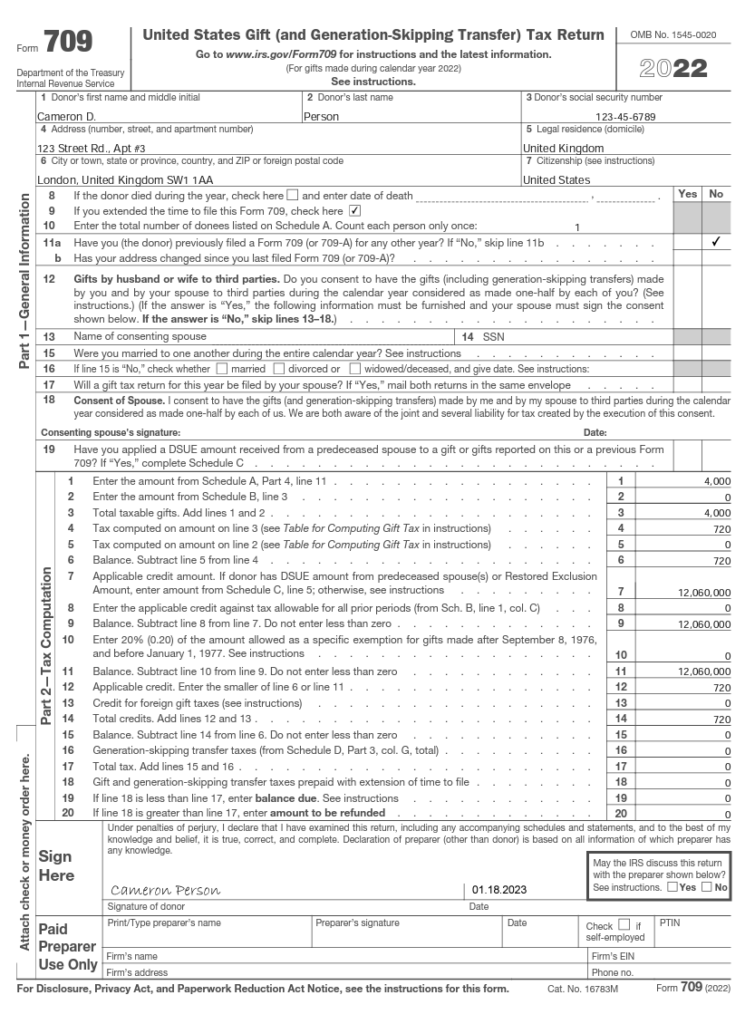

Gift Tax Returns Irs Completed Sample Form 709 Sample

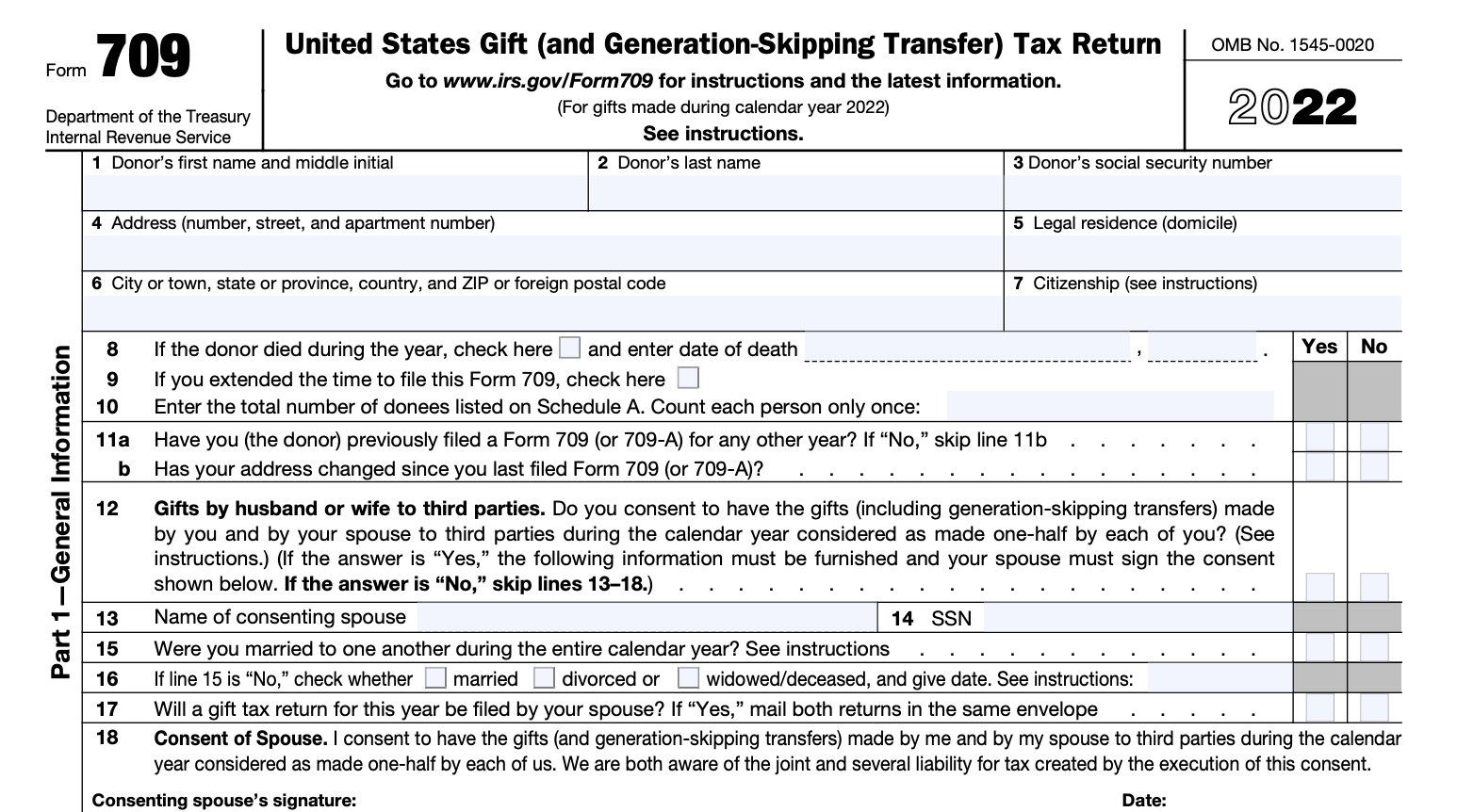

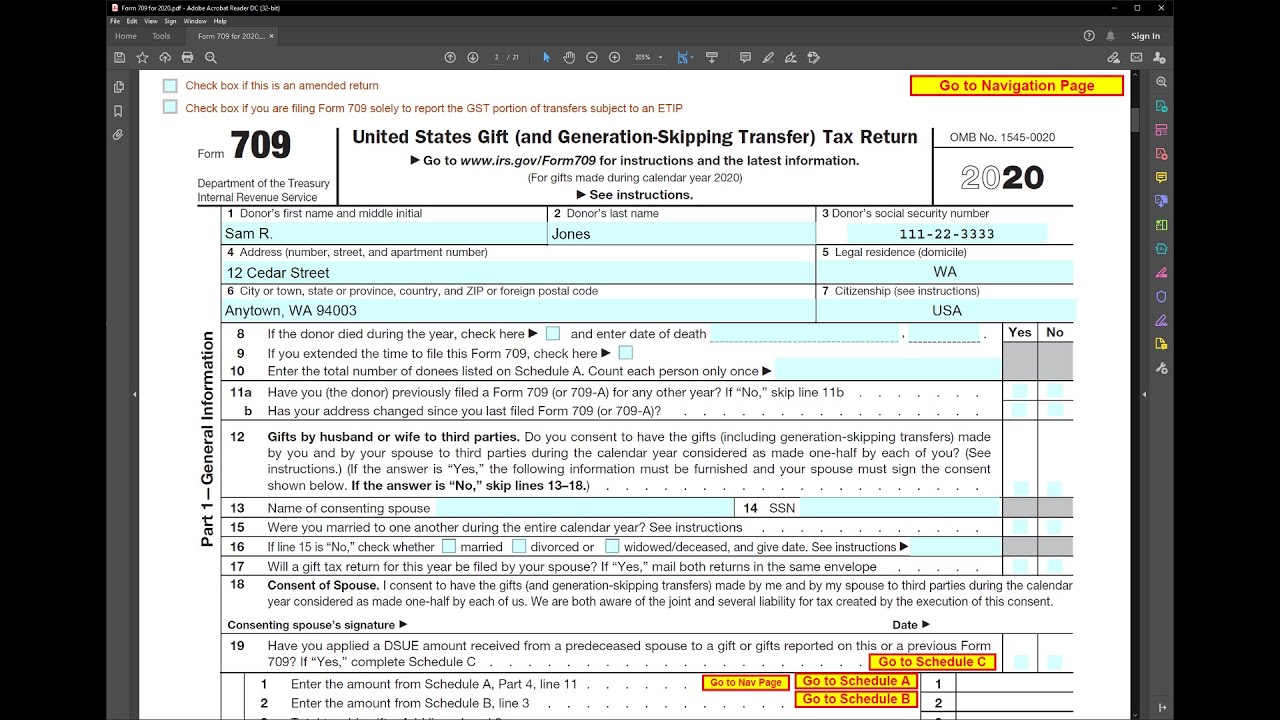

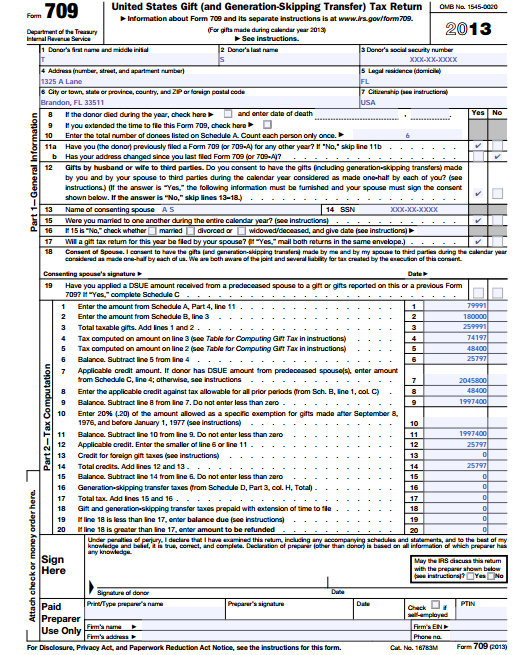

Gift Tax Returns Irs Completed Sample Form 709 Sample - This guide breaks down the steps for reporting gift taxes. These informational materials are not intended, and should not be taken as tax, financial, investment, or legal advice. If you made substantial gifts this year, you may need to fill out form 709. You must file a gift tax return to split gifts with your spouse (regardless of their amount) as described in part iii spouse's consent on gifts.

This guide breaks down the steps for reporting gift taxes. These informational materials are not intended, and should not be taken as tax, financial, investment, or legal advice. You must file a gift tax return to split gifts with your spouse (regardless of their amount) as described in part iii spouse's consent on gifts. If you made substantial gifts this year, you may need to fill out form 709.

You must file a gift tax return to split gifts with your spouse (regardless of their amount) as described in part iii spouse's consent on gifts. If you made substantial gifts this year, you may need to fill out form 709. These informational materials are not intended, and should not be taken as tax, financial, investment, or legal advice. This guide breaks down the steps for reporting gift taxes.

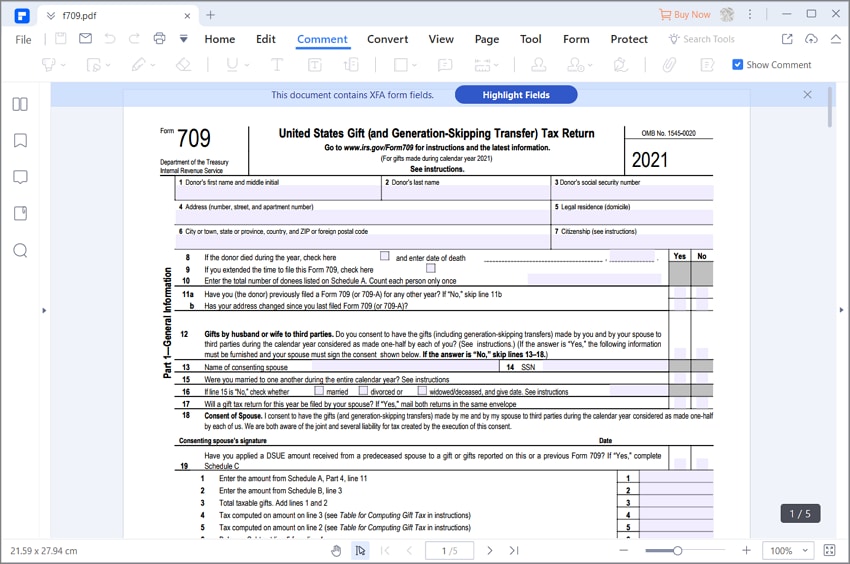

2023 Form 709 Instructions Printable Forms Free Online

If you made substantial gifts this year, you may need to fill out form 709. You must file a gift tax return to split gifts with your spouse (regardless of their amount) as described in part iii spouse's consent on gifts. This guide breaks down the steps for reporting gift taxes. These informational materials are not intended, and should not.

2023 Irs Form 709 Instructions Printable Forms Free Online

If you made substantial gifts this year, you may need to fill out form 709. This guide breaks down the steps for reporting gift taxes. These informational materials are not intended, and should not be taken as tax, financial, investment, or legal advice. You must file a gift tax return to split gifts with your spouse (regardless of their amount).

How to Fill Out Form 709 Nasdaq

If you made substantial gifts this year, you may need to fill out form 709. You must file a gift tax return to split gifts with your spouse (regardless of their amount) as described in part iii spouse's consent on gifts. These informational materials are not intended, and should not be taken as tax, financial, investment, or legal advice. This.

What Is Form 709? (2024)

If you made substantial gifts this year, you may need to fill out form 709. These informational materials are not intended, and should not be taken as tax, financial, investment, or legal advice. You must file a gift tax return to split gifts with your spouse (regardless of their amount) as described in part iii spouse's consent on gifts. This.

Irs Form 709 For 2023 Printable Forms Free Online

These informational materials are not intended, and should not be taken as tax, financial, investment, or legal advice. This guide breaks down the steps for reporting gift taxes. You must file a gift tax return to split gifts with your spouse (regardless of their amount) as described in part iii spouse's consent on gifts. If you made substantial gifts this.

2023 Irs Form 709 Printable Forms Free Online

If you made substantial gifts this year, you may need to fill out form 709. These informational materials are not intended, and should not be taken as tax, financial, investment, or legal advice. This guide breaks down the steps for reporting gift taxes. You must file a gift tax return to split gifts with your spouse (regardless of their amount).

IRS Form 709, Gift and GST Tax YouTube

These informational materials are not intended, and should not be taken as tax, financial, investment, or legal advice. You must file a gift tax return to split gifts with your spouse (regardless of their amount) as described in part iii spouse's consent on gifts. This guide breaks down the steps for reporting gift taxes. If you made substantial gifts this.

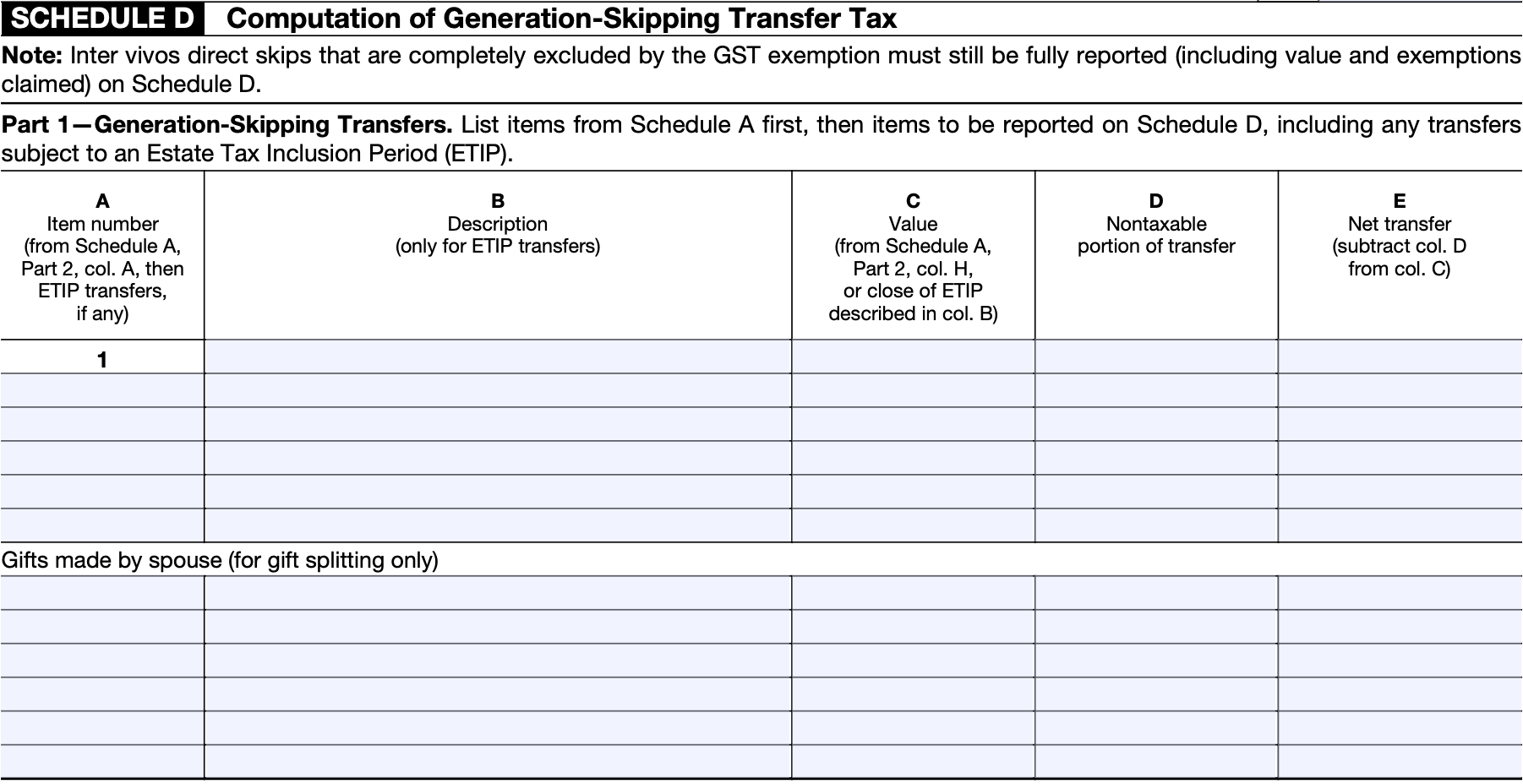

Solved Chapter 12.C Problem 58TFP Solution Prentice Hall's Federal

You must file a gift tax return to split gifts with your spouse (regardless of their amount) as described in part iii spouse's consent on gifts. This guide breaks down the steps for reporting gift taxes. These informational materials are not intended, and should not be taken as tax, financial, investment, or legal advice. If you made substantial gifts this.

Completed Sample IRS Form 709 Gift Tax Return for 529 Superfunding

This guide breaks down the steps for reporting gift taxes. You must file a gift tax return to split gifts with your spouse (regardless of their amount) as described in part iii spouse's consent on gifts. If you made substantial gifts this year, you may need to fill out form 709. These informational materials are not intended, and should not.

2023 Form 709 Instructions Printable Forms Free Online

These informational materials are not intended, and should not be taken as tax, financial, investment, or legal advice. This guide breaks down the steps for reporting gift taxes. You must file a gift tax return to split gifts with your spouse (regardless of their amount) as described in part iii spouse's consent on gifts. If you made substantial gifts this.

This Guide Breaks Down The Steps For Reporting Gift Taxes.

These informational materials are not intended, and should not be taken as tax, financial, investment, or legal advice. If you made substantial gifts this year, you may need to fill out form 709. You must file a gift tax return to split gifts with your spouse (regardless of their amount) as described in part iii spouse's consent on gifts.

:max_bytes(150000):strip_icc()/ScreenShot2023-01-18at10.29.18AM-e267e40858b8414fb34572a6eb3d7594.png)