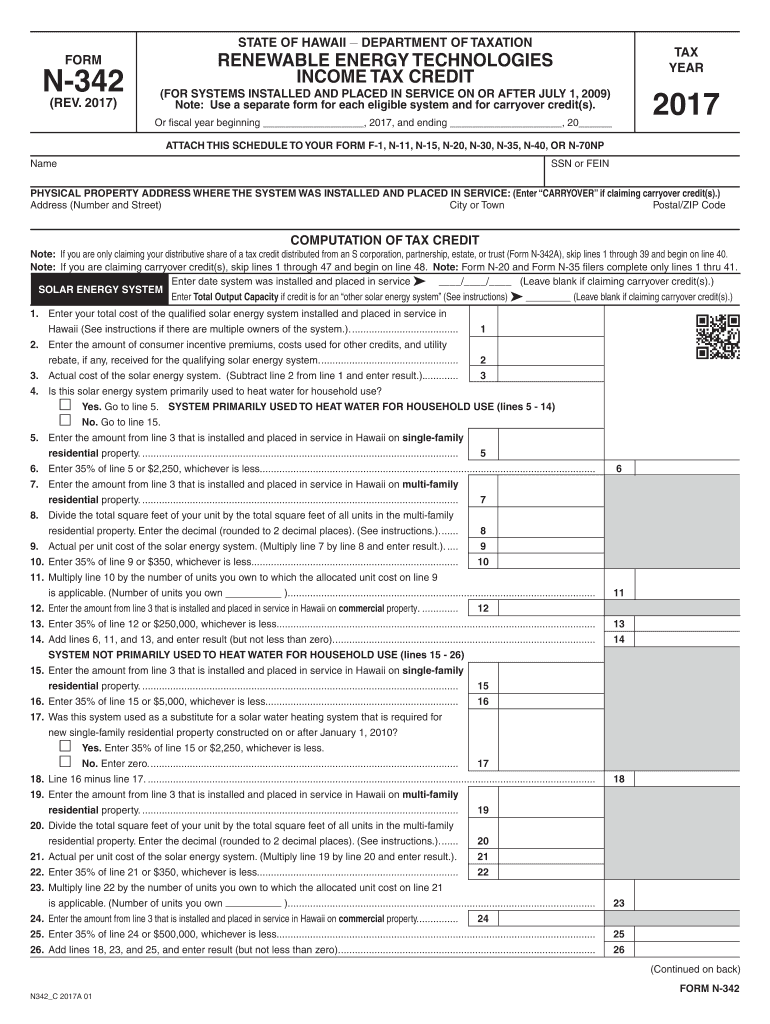

Hawaii Tax Form N 342

Hawaii Tax Form N 342 - This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on. Fillable form generates a taxpayer specific 2d. 2023 form for taxable periods beginning on or after january 1, 2024.

2023 form for taxable periods beginning on or after january 1, 2024. Fillable form generates a taxpayer specific 2d. This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on.

Fillable form generates a taxpayer specific 2d. This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on. 2023 form for taxable periods beginning on or after january 1, 2024.

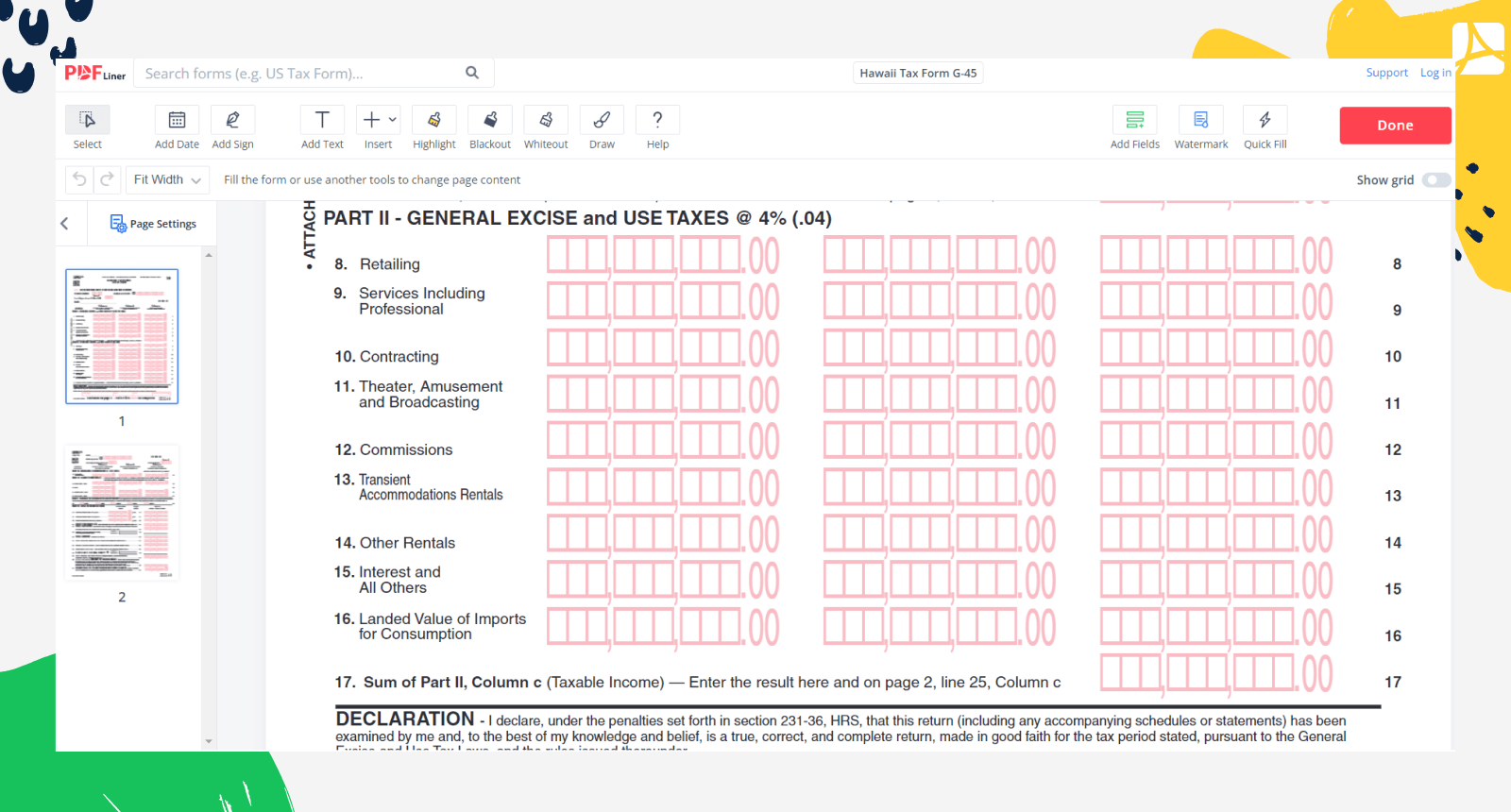

What is Hawaii’s general excise tax? Grassroot Institute of Hawaii

This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on. 2023 form for taxable periods beginning on or after january 1, 2024. Fillable form generates a taxpayer specific 2d.

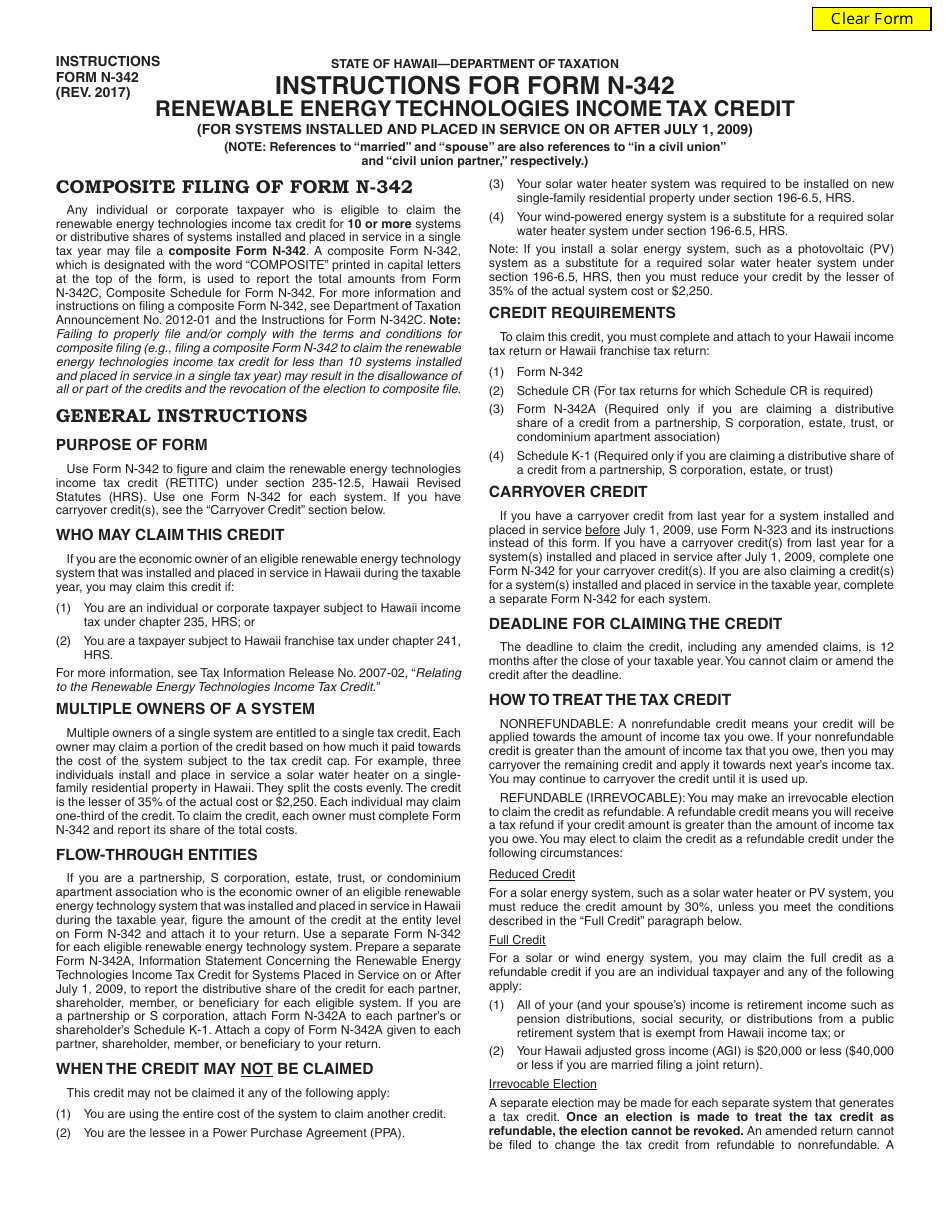

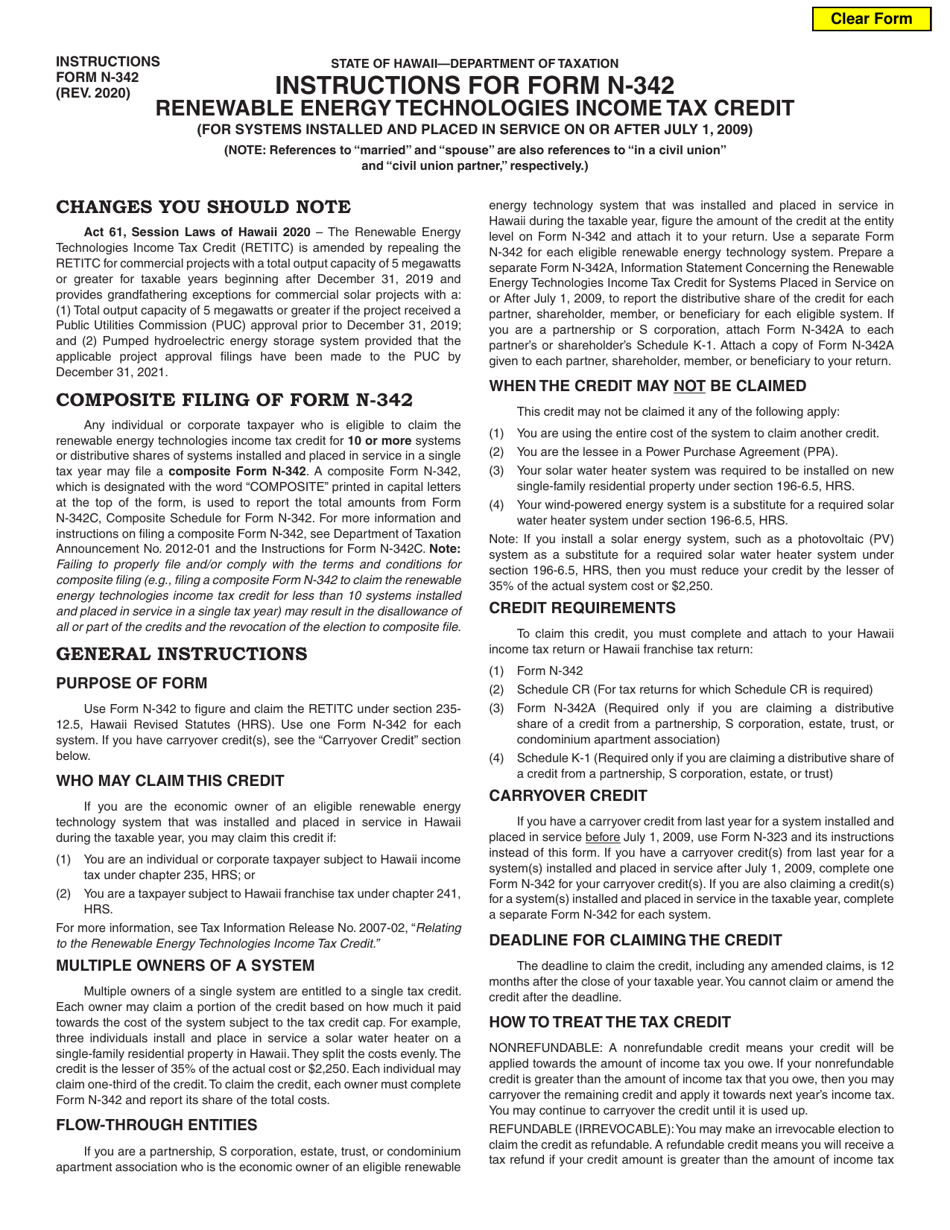

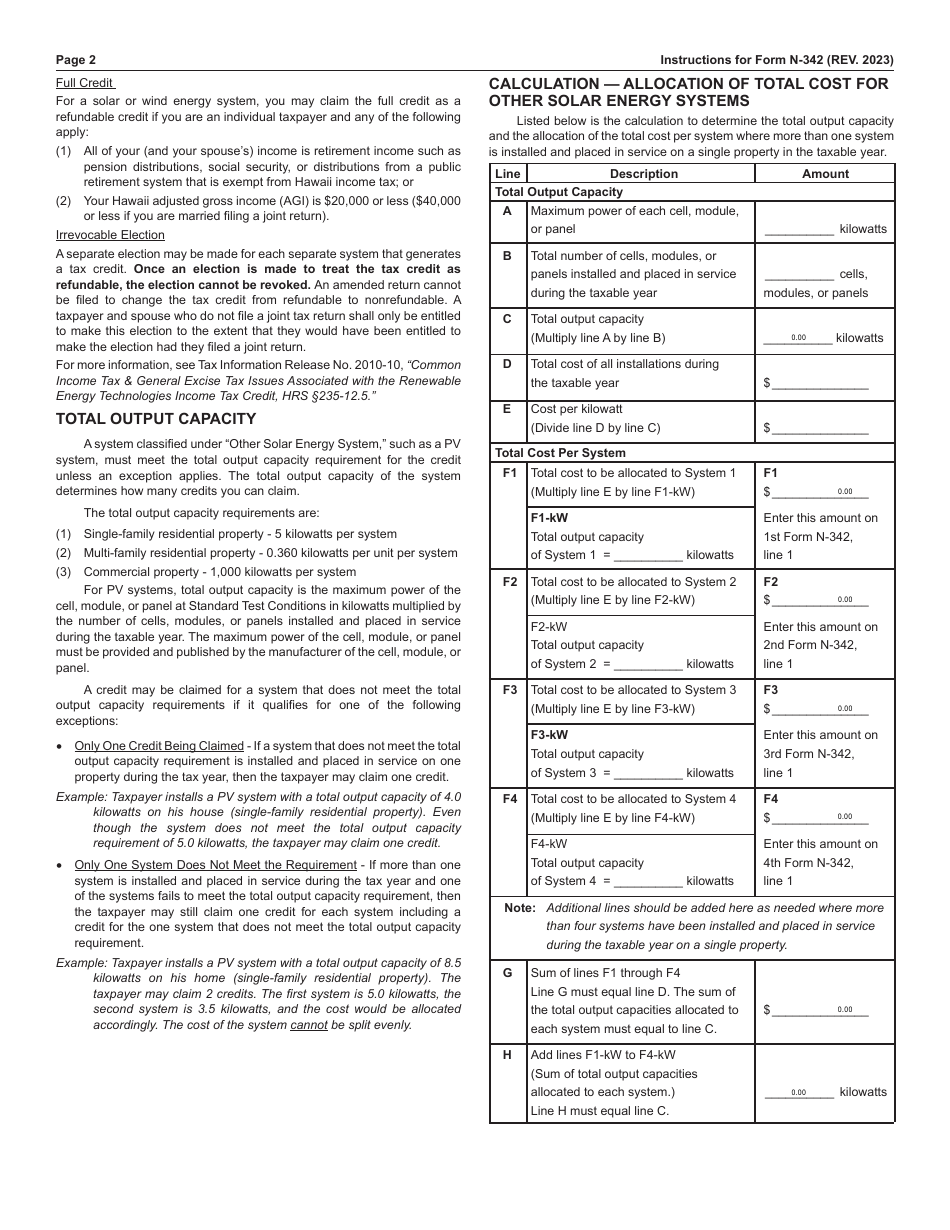

Download Instructions for Form N342 Renewable Energy Technologies

2023 form for taxable periods beginning on or after january 1, 2024. This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on. Fillable form generates a taxpayer specific 2d.

Hawaii Form N 11 ≡ Fill Out Printable PDF Forms Online

Fillable form generates a taxpayer specific 2d. 2023 form for taxable periods beginning on or after january 1, 2024. This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on.

Download Instructions for Form N342 Renewable Energy Technologies

2023 form for taxable periods beginning on or after january 1, 2024. This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on. Fillable form generates a taxpayer specific 2d.

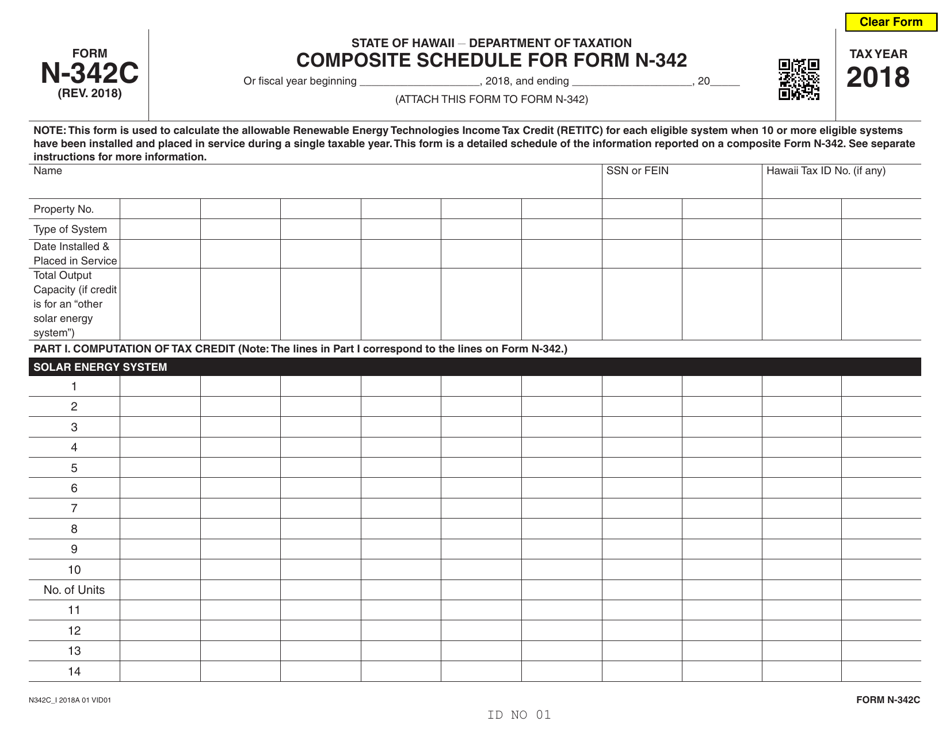

Form N342C Download Fillable PDF or Fill Online Composite Schedule for

This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on. 2023 form for taxable periods beginning on or after january 1, 2024. Fillable form generates a taxpayer specific 2d.

Hawaii Form N 11 Fillable Printable Forms Free Online

Fillable form generates a taxpayer specific 2d. 2023 form for taxable periods beginning on or after january 1, 2024. This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on.

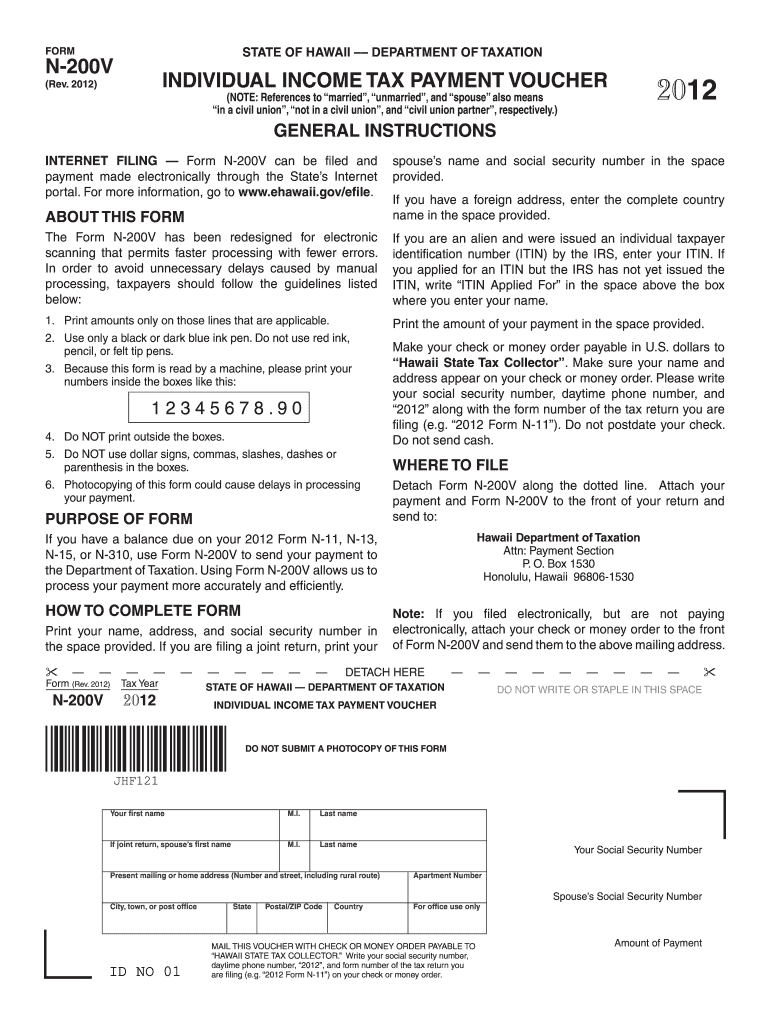

Form N200V, Rev. 2012, Individual Tax Hawaii.gov state

Fillable form generates a taxpayer specific 2d. This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on. 2023 form for taxable periods beginning on or after january 1, 2024.

Hawaii State Tax S N342 20172024 Form Fill Out and Sign Printable

2023 form for taxable periods beginning on or after january 1, 2024. Fillable form generates a taxpayer specific 2d. This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on.

Download Instructions for Form N342 Renewable Energy Technologies

2023 form for taxable periods beginning on or after january 1, 2024. This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on. Fillable form generates a taxpayer specific 2d.

Fillable G 45 Form For Apple Computer Printable Forms Free Online

This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on. Fillable form generates a taxpayer specific 2d. 2023 form for taxable periods beginning on or after january 1, 2024.

Fillable Form Generates A Taxpayer Specific 2D.

This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on. 2023 form for taxable periods beginning on or after january 1, 2024.