Iowa Tax Exemption Form

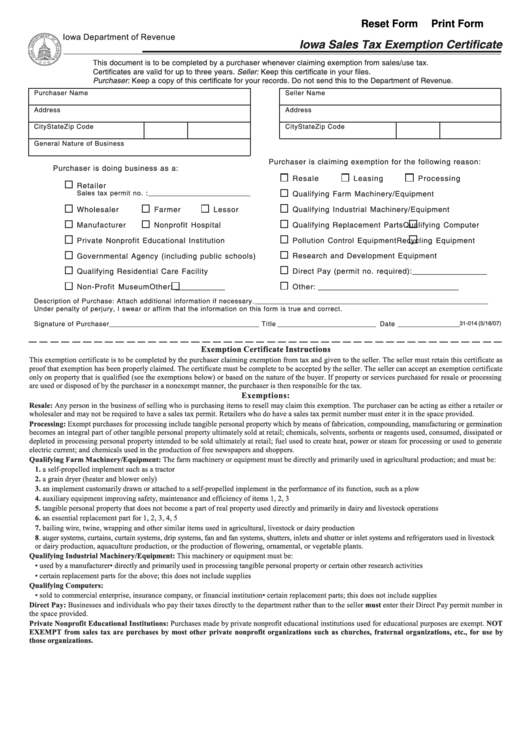

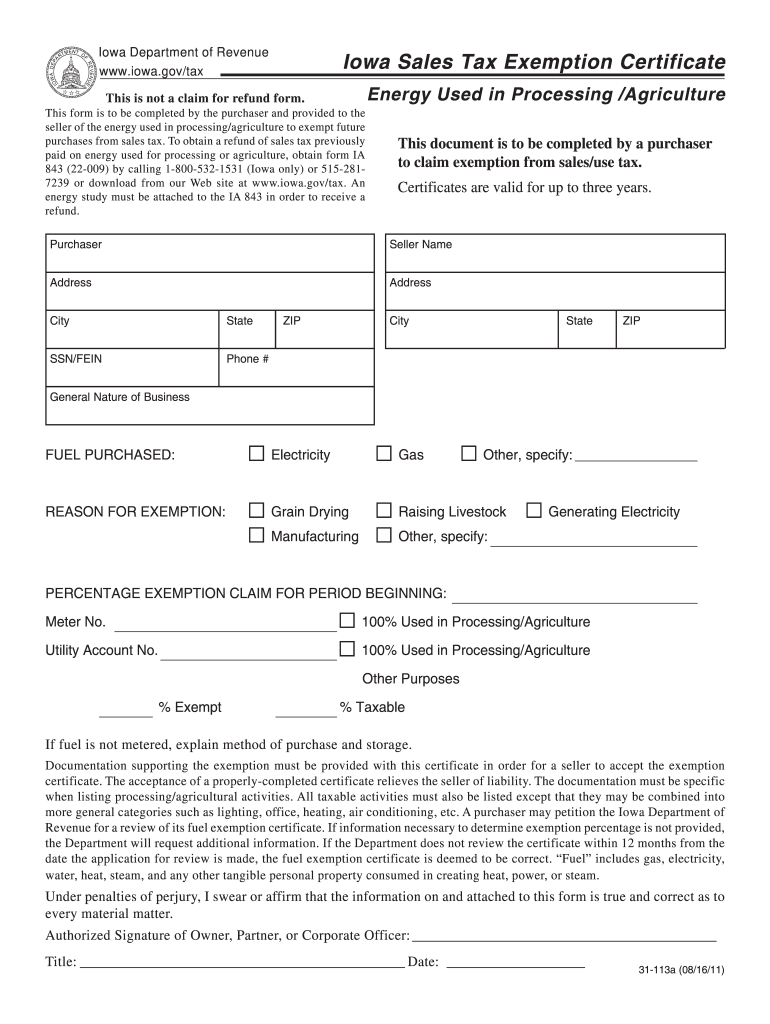

Iowa Tax Exemption Form - An iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. Certificates are valid for up to three years. Certificates are valid for up to three years. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. Usually, these are items for. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. The seller must retain this. The seller must retain this. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax.

This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. Usually, these are items for. The seller must retain this. An iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free. Certificates are valid for up to three years. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. The seller must retain this. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax.

Usually, these are items for. Certificates are valid for up to three years. Certificates are valid for up to three years. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. An iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free. The seller must retain this. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. The seller must retain this.

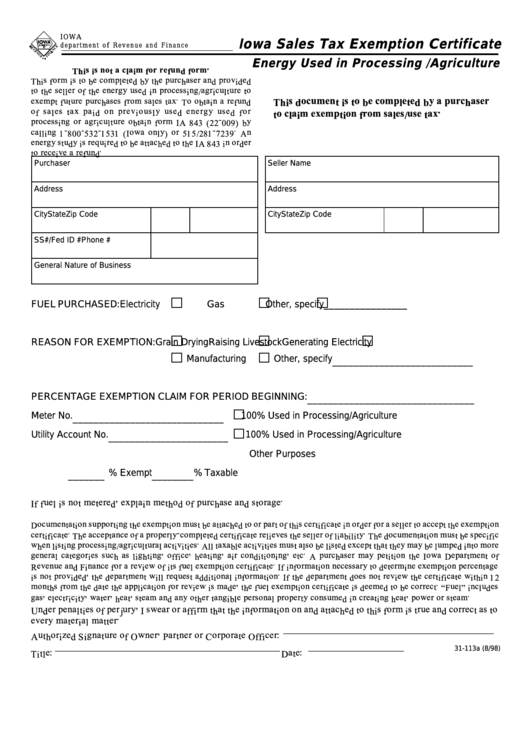

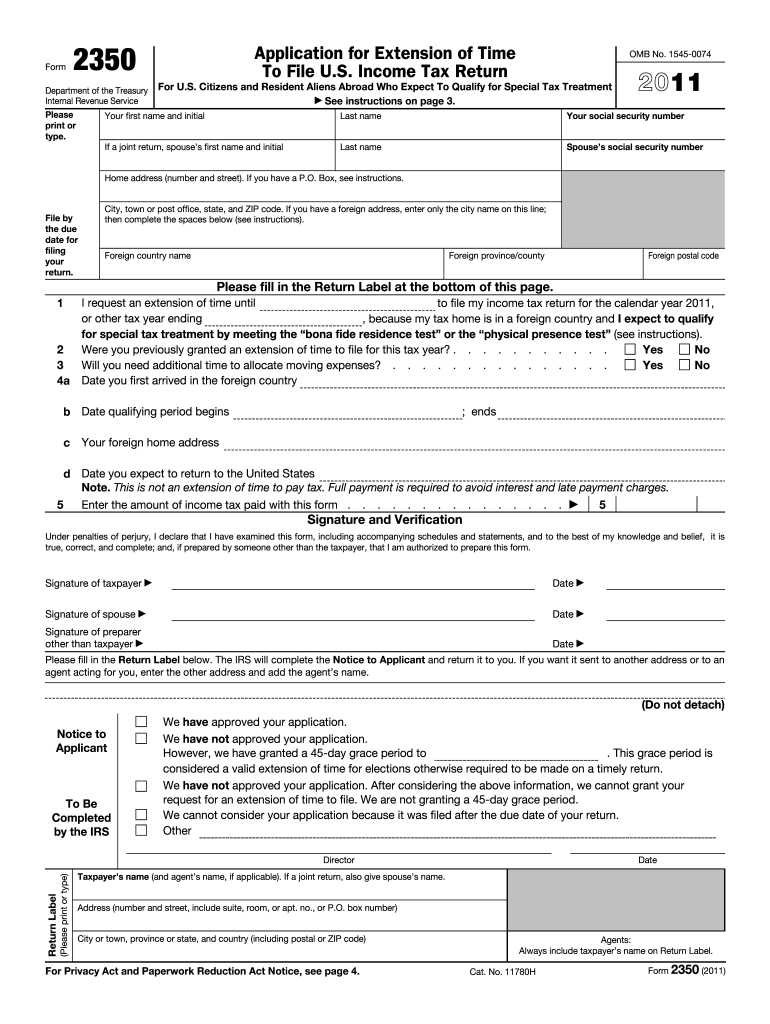

Form 31113b Iowa Sales Tax Exemption Certificate Energy Used In

This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. An iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. This document is to be completed by a.

Exemption California State Tax Form 2024

Certificates are valid for up to three years. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. This document is to be completed by a purchaser when claiming exemption from sales/use/excise.

Top 26 Iowa Tax Exempt Form Templates free to download in PDF format

This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. The seller must retain this. Certificates are valid for up to three years. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to.

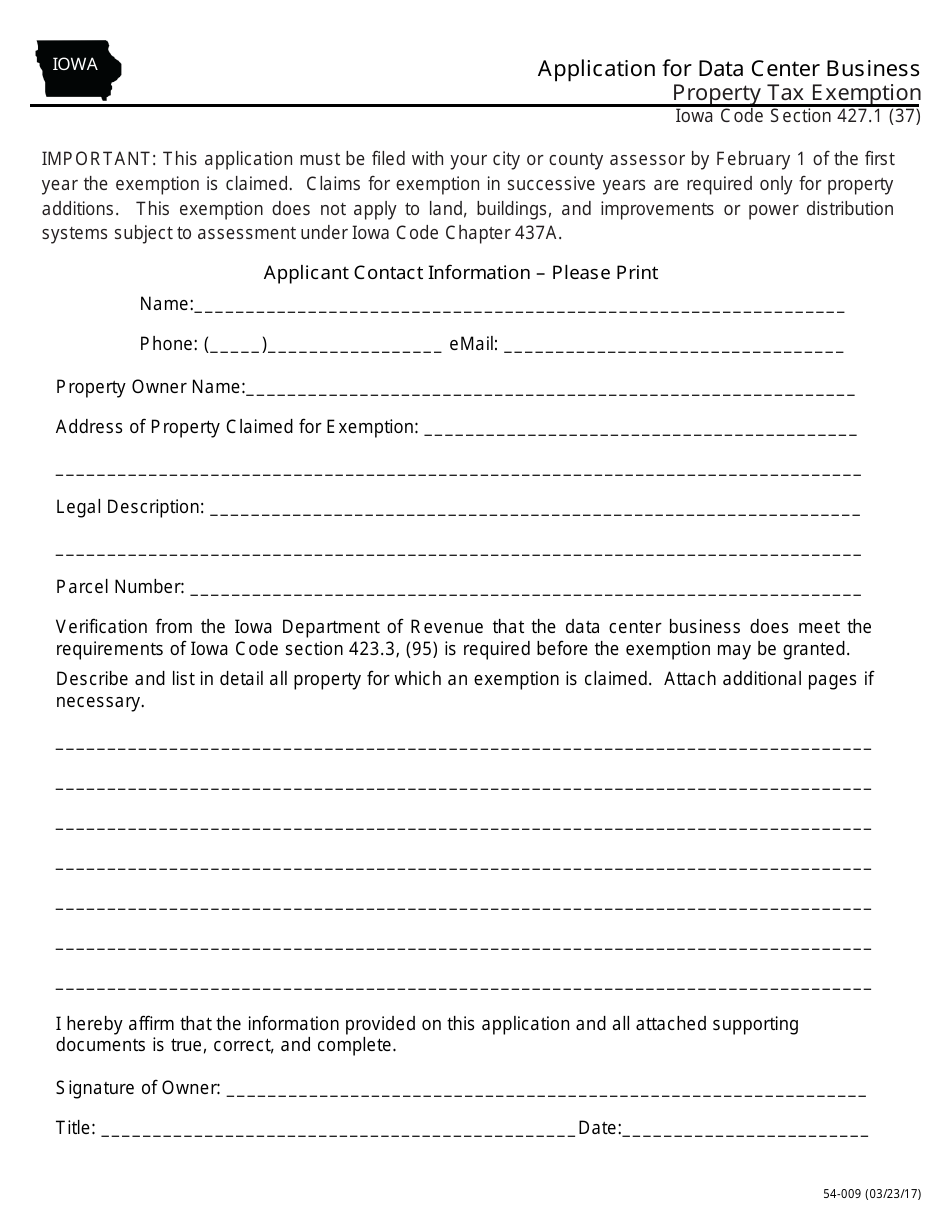

Form 54009 Download Fillable PDF or Fill Online Application for Data

This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. Usually, these are items for. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. The seller must retain this.

Fillable Form 31 014 Iowa Sales Tax Exemption Certificate 2007

An iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free. Certificates are valid for up to three years. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. This exemption certificate is.

How To Fill Out Tax Exempt Form

Certificates are valid for up to three years. The seller must retain this. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. The seller must retain this.

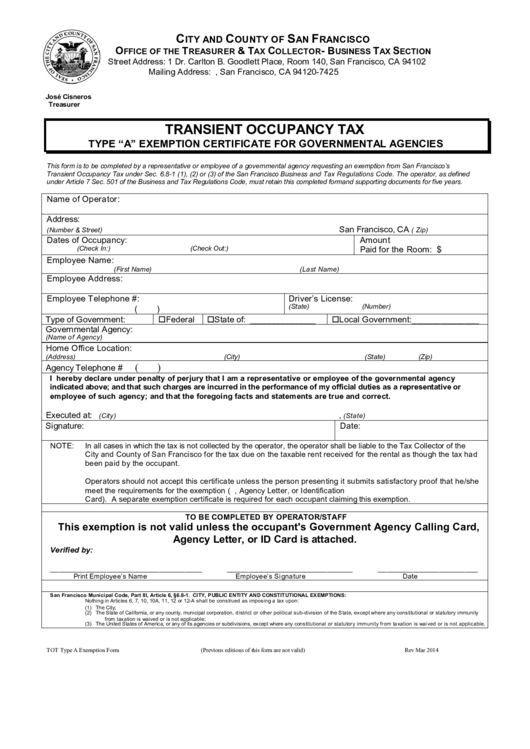

Gsa Hotel Tax Exempt Form Florida

Certificates are valid for up to three years. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. The seller must retain this. An iowa sales tax exemption certificate is required when normally taxable items or.

Iowa Construction Sales Tax Exemption Form

This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. An iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. The seller must retain this. This exemption certificate.

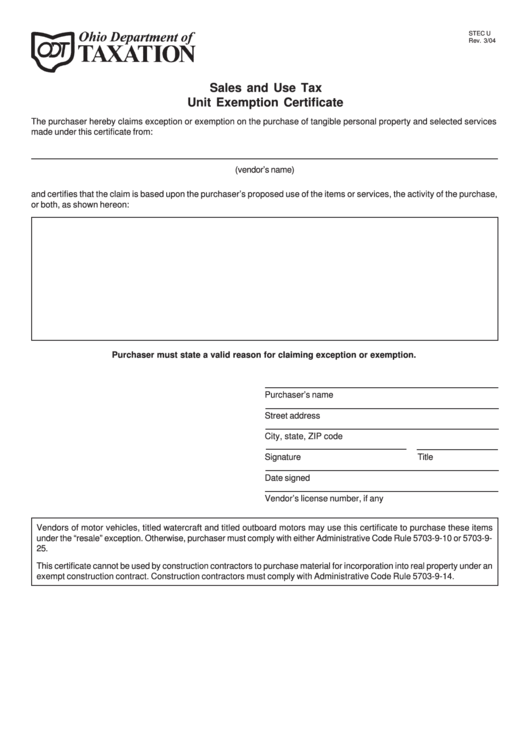

Fillable Sales And Use Tax Unit Exemption Certificate printable pdf

This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. The seller must retain this. An iowa.

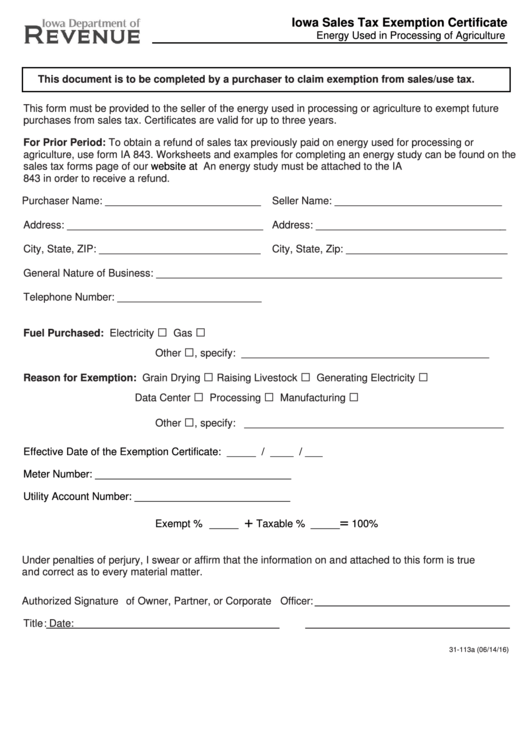

Gov Tax Iowa Sales Tax Exemption Certificate Energy Used in Processing

Usually, these are items for. The seller must retain this. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. Certificates are valid for up to three years. Certificates are valid for up to three years.

This Document Is To Be Completed By A Purchaser When Claiming Exemption From Sales/Use/Excise Tax.

The seller must retain this. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. An iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free.

Usually, These Are Items For.

This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. Certificates are valid for up to three years. The seller must retain this.