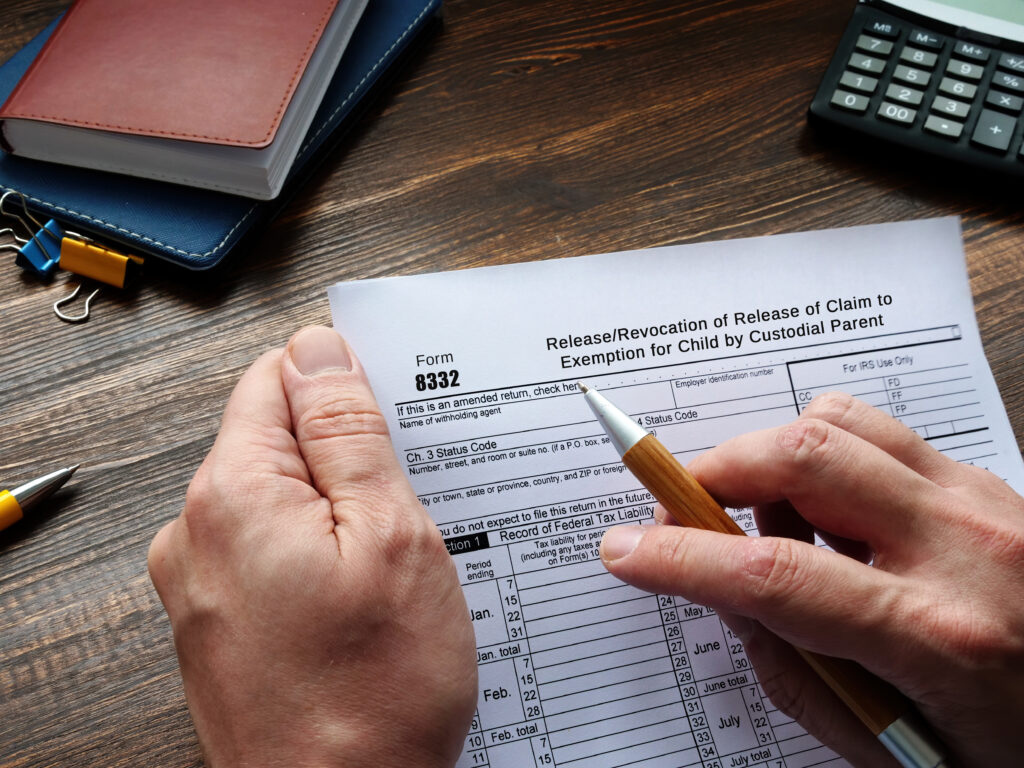

Is Form 8332 Mandatory

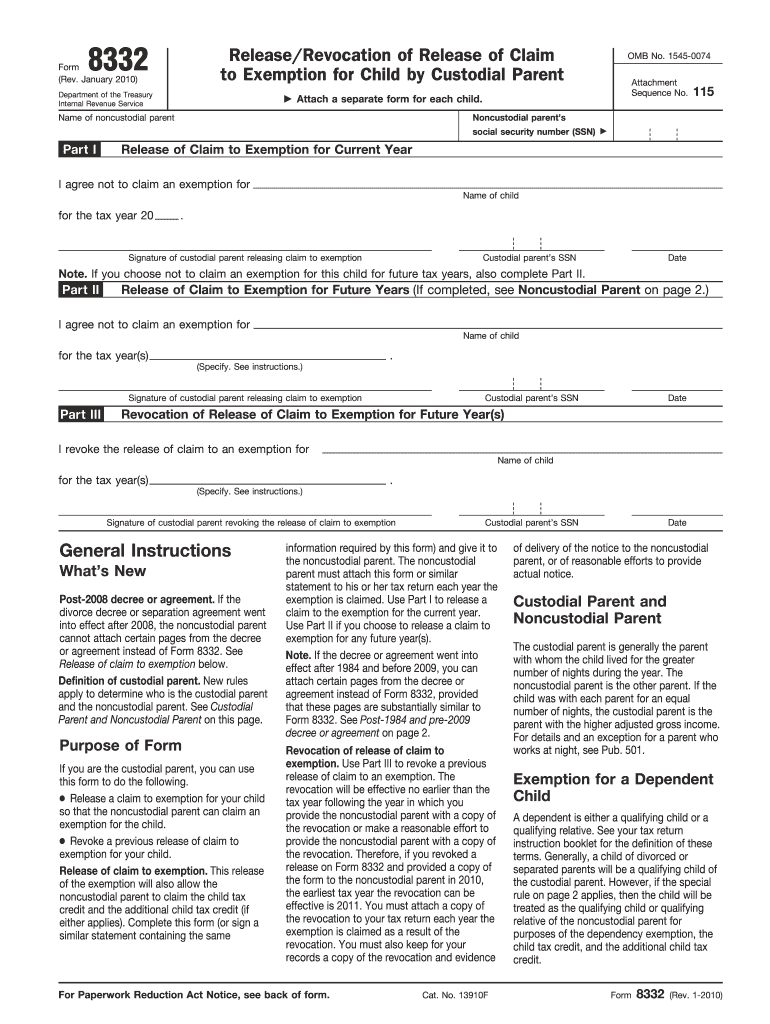

Is Form 8332 Mandatory - Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent,.

Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent,. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who.

Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent,. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent.

A brief guide on filing IRS Form 8332 for release of dependency exemption

Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent,. Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial.

Tax Form 8332 Printable

Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent,. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial.

Form 8332 Fill out & sign online DocHub

Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who. Information about form 8332, release/revocation of release of claim to exemption for child by custodial.

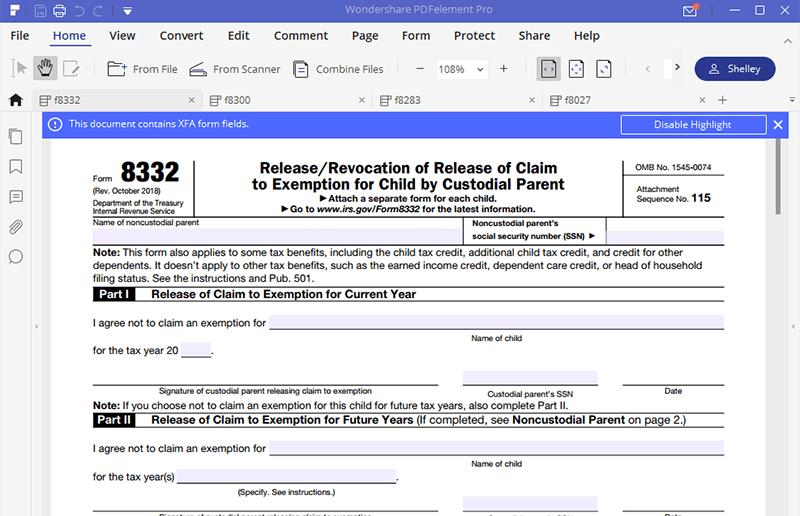

IRS Form 8332 Fill it with the Best PDF Form Filler

Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent,. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining.

Form 8332 Edit, Fill, Sign Online Handypdf

Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent,. Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial.

IRS Form 8332 walkthrough ARCHIVED COPY READ COMMENTS ONLY YouTube

Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent,. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining.

Irs Form 8332 Printable

Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who. Information about form 8332, release/revocation of release of claim to exemption for child by custodial.

Form 8332, Release of Claim to Exemption YouTube

Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent,. Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining.

IRS Form 8332 Explained Claiming Dependents and Benefits

Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent,. Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial.

8331 8332 HL 2 8767 Solo Tile Studio

Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent,. Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial.

Although Taxpayers Can’t Claim A Deduction For Exemptions, Eligibility To Claim An Exemption For A Child Remains Important For Determining Who.

Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent,.