Journal Entry Worksheet Mcgraw Hill

Journal Entry Worksheet Mcgraw Hill - Made the following journal entries. Name date class mini practice set 1 (continued) dollars pay. Date account debit credit may 31 revenue 200 unearned revenue 200 (to correct the revenue account). Complete a worksheet for a corporation. Estimate the federal corporate income tax and prepare related journal entries. Balance sheet (10.0k) bank reconciliation form (5.0k) cash payments journal (39.0k) cash receipts.

Balance sheet (10.0k) bank reconciliation form (5.0k) cash payments journal (39.0k) cash receipts. Estimate the federal corporate income tax and prepare related journal entries. Name date class mini practice set 1 (continued) dollars pay. Complete a worksheet for a corporation. Made the following journal entries. Date account debit credit may 31 revenue 200 unearned revenue 200 (to correct the revenue account).

Name date class mini practice set 1 (continued) dollars pay. Date account debit credit may 31 revenue 200 unearned revenue 200 (to correct the revenue account). Complete a worksheet for a corporation. Balance sheet (10.0k) bank reconciliation form (5.0k) cash payments journal (39.0k) cash receipts. Estimate the federal corporate income tax and prepare related journal entries. Made the following journal entries.

Journal Entry Worksheet Mcgraw Hill

Date account debit credit may 31 revenue 200 unearned revenue 200 (to correct the revenue account). Made the following journal entries. Complete a worksheet for a corporation. Estimate the federal corporate income tax and prepare related journal entries. Balance sheet (10.0k) bank reconciliation form (5.0k) cash payments journal (39.0k) cash receipts.

Journal Entry Worksheet Mcgraw Hill Printable Word Searches

Name date class mini practice set 1 (continued) dollars pay. Estimate the federal corporate income tax and prepare related journal entries. Complete a worksheet for a corporation. Balance sheet (10.0k) bank reconciliation form (5.0k) cash payments journal (39.0k) cash receipts. Date account debit credit may 31 revenue 200 unearned revenue 200 (to correct the revenue account).

Journal Entry Worksheet Mcgraw Hill Printable Computer Tools

Made the following journal entries. Estimate the federal corporate income tax and prepare related journal entries. Balance sheet (10.0k) bank reconciliation form (5.0k) cash payments journal (39.0k) cash receipts. Name date class mini practice set 1 (continued) dollars pay. Date account debit credit may 31 revenue 200 unearned revenue 200 (to correct the revenue account).

Journal Entry Worksheet Mcgraw Hill Printable Calendars AT A GLANCE

Made the following journal entries. Estimate the federal corporate income tax and prepare related journal entries. Balance sheet (10.0k) bank reconciliation form (5.0k) cash payments journal (39.0k) cash receipts. Date account debit credit may 31 revenue 200 unearned revenue 200 (to correct the revenue account). Name date class mini practice set 1 (continued) dollars pay.

Journal Entry Worksheet Mcgraw Hill

Date account debit credit may 31 revenue 200 unearned revenue 200 (to correct the revenue account). Estimate the federal corporate income tax and prepare related journal entries. Name date class mini practice set 1 (continued) dollars pay. Made the following journal entries. Balance sheet (10.0k) bank reconciliation form (5.0k) cash payments journal (39.0k) cash receipts.

Journal Entry Worksheet Printable Word Searches

Name date class mini practice set 1 (continued) dollars pay. Estimate the federal corporate income tax and prepare related journal entries. Balance sheet (10.0k) bank reconciliation form (5.0k) cash payments journal (39.0k) cash receipts. Date account debit credit may 31 revenue 200 unearned revenue 200 (to correct the revenue account). Made the following journal entries.

Journal Entry Worksheet Mcgraw Hill

Date account debit credit may 31 revenue 200 unearned revenue 200 (to correct the revenue account). Estimate the federal corporate income tax and prepare related journal entries. Made the following journal entries. Name date class mini practice set 1 (continued) dollars pay. Complete a worksheet for a corporation.

Journal Entry Worksheet Mcgraw Hill Printable Calendars AT A GLANCE

Estimate the federal corporate income tax and prepare related journal entries. Date account debit credit may 31 revenue 200 unearned revenue 200 (to correct the revenue account). Balance sheet (10.0k) bank reconciliation form (5.0k) cash payments journal (39.0k) cash receipts. Made the following journal entries. Complete a worksheet for a corporation.

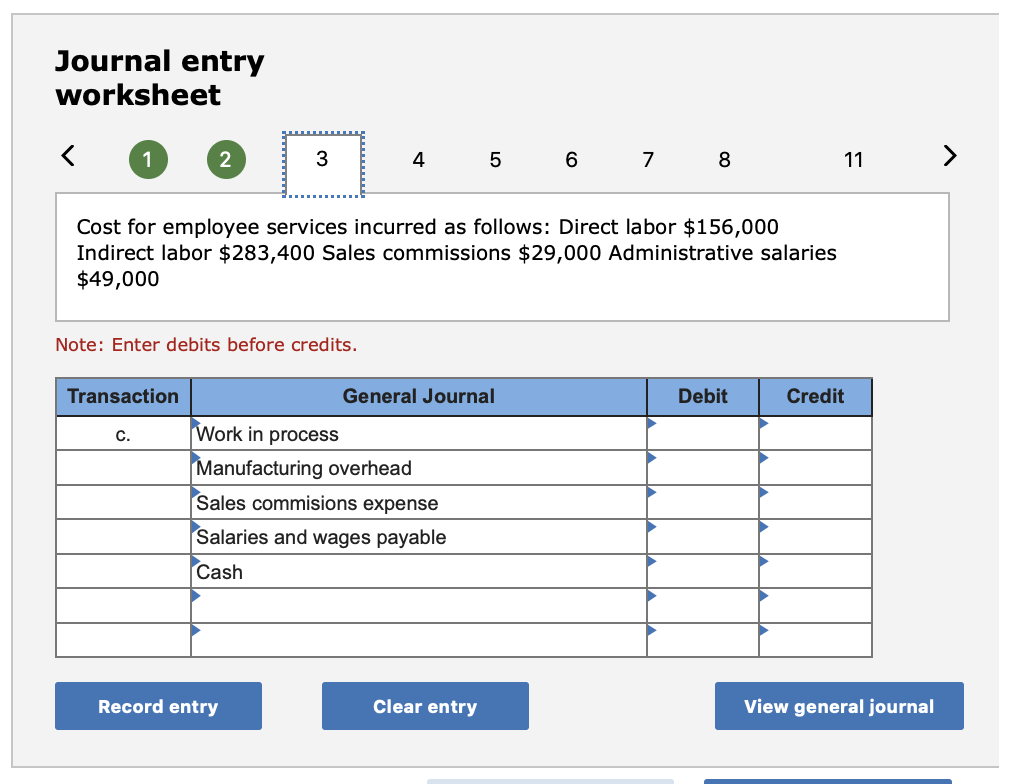

Solved Journal entry worksheet

Complete a worksheet for a corporation. Balance sheet (10.0k) bank reconciliation form (5.0k) cash payments journal (39.0k) cash receipts. Name date class mini practice set 1 (continued) dollars pay. Estimate the federal corporate income tax and prepare related journal entries. Made the following journal entries.

Journal Entry Worksheet Mcgraw Hill

Date account debit credit may 31 revenue 200 unearned revenue 200 (to correct the revenue account). Made the following journal entries. Complete a worksheet for a corporation. Estimate the federal corporate income tax and prepare related journal entries. Balance sheet (10.0k) bank reconciliation form (5.0k) cash payments journal (39.0k) cash receipts.

Name Date Class Mini Practice Set 1 (Continued) Dollars Pay.

Complete a worksheet for a corporation. Date account debit credit may 31 revenue 200 unearned revenue 200 (to correct the revenue account). Balance sheet (10.0k) bank reconciliation form (5.0k) cash payments journal (39.0k) cash receipts. Estimate the federal corporate income tax and prepare related journal entries.