Kentucky Farm Exemption Form

Kentucky Farm Exemption Form - Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items. A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the. Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in.

Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items. A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the. Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in.

Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items. A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the. Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in.

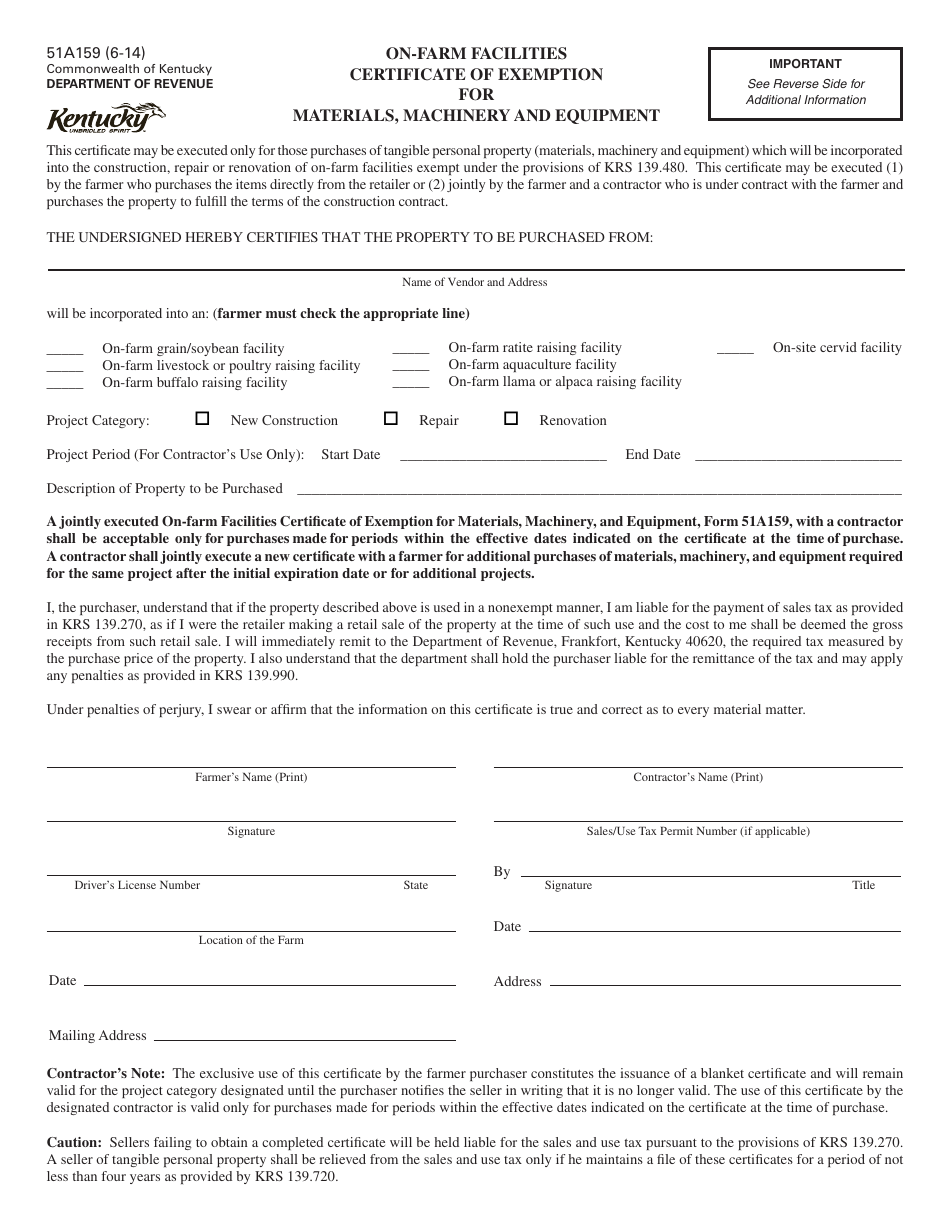

Form 51A159 Fill Out, Sign Online and Download Printable PDF

A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the. Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in. Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items.

Kentucky Homestead Exemption Application Form 2024 2025

A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the. Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items. Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in.

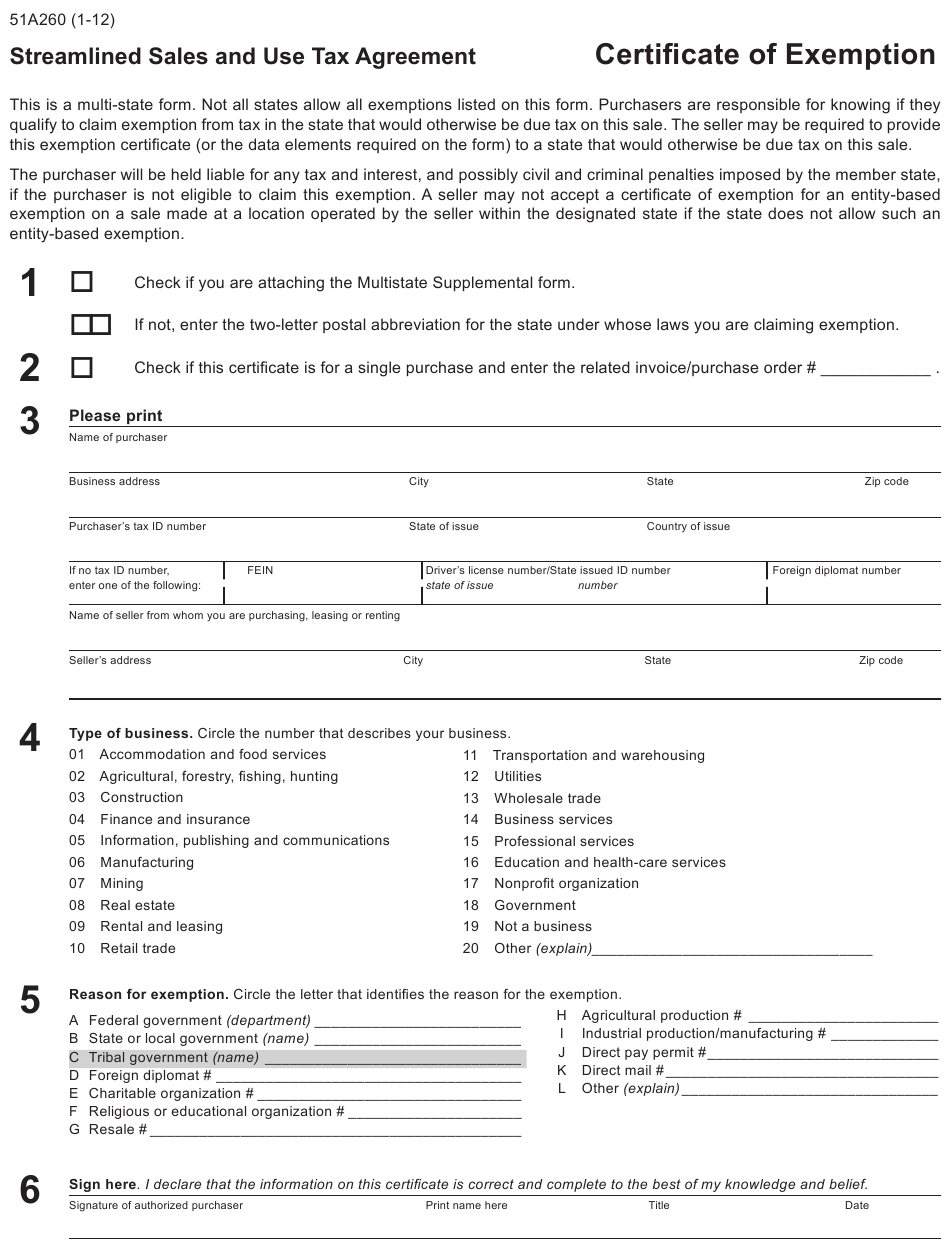

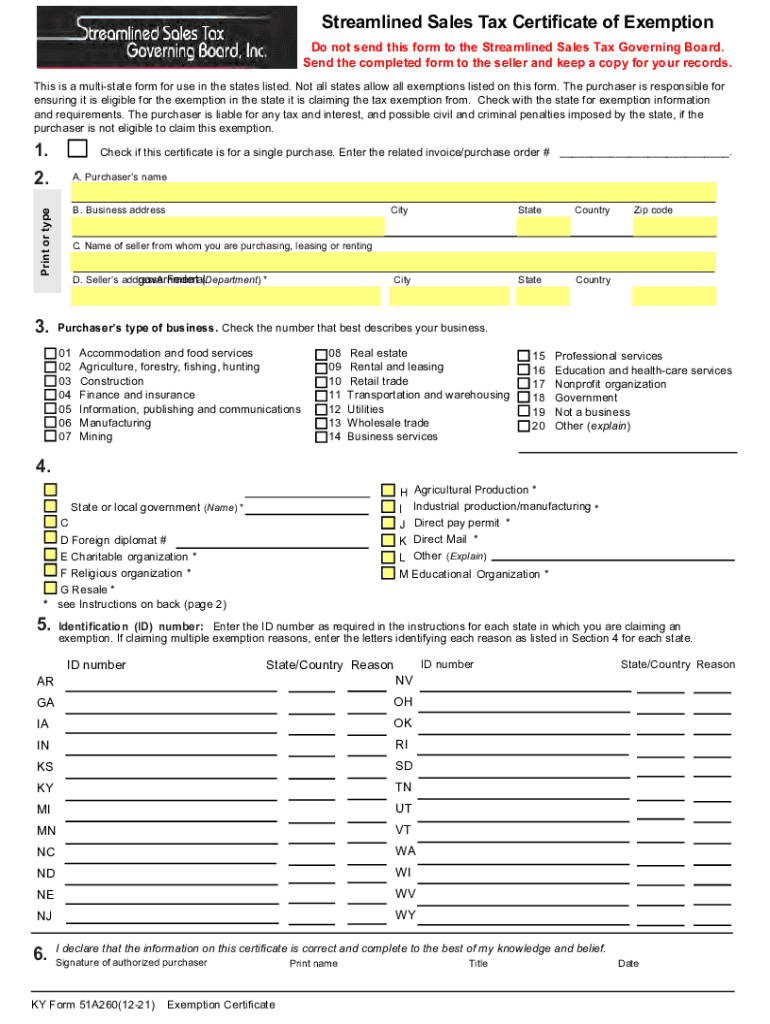

Kentucky Sales Tax Exemption Form

Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items. A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the. Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in.

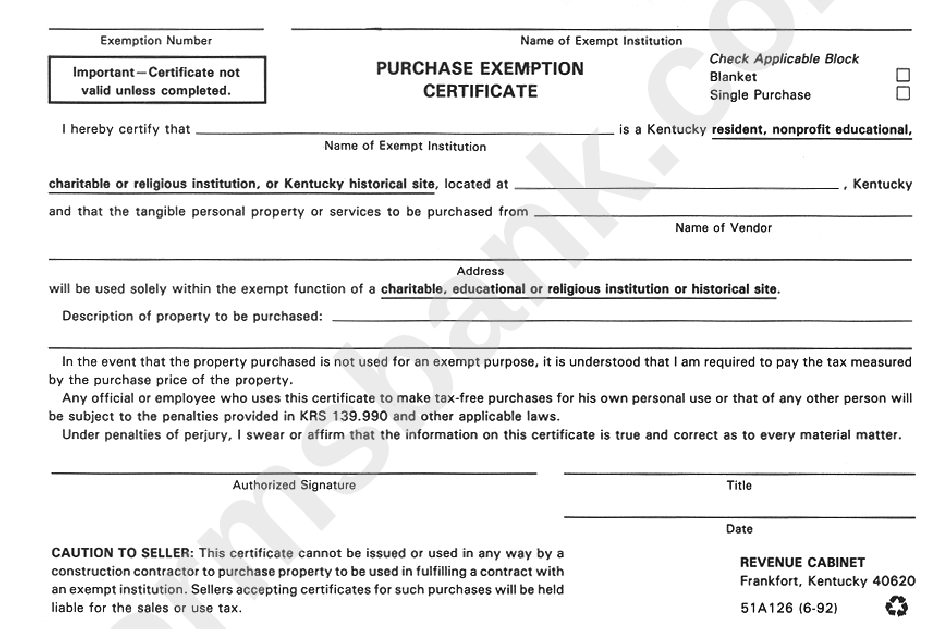

Form 51a126 Purchase Exemption Certificate printable pdf download

A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the. Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items. Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in.

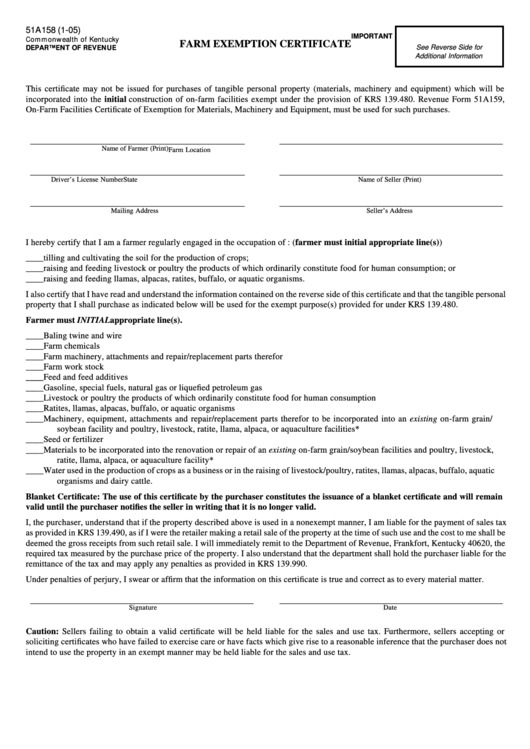

Kentucky Sales Tax Farm Exemption Form Fill Online Printable

Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in. A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the. Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items.

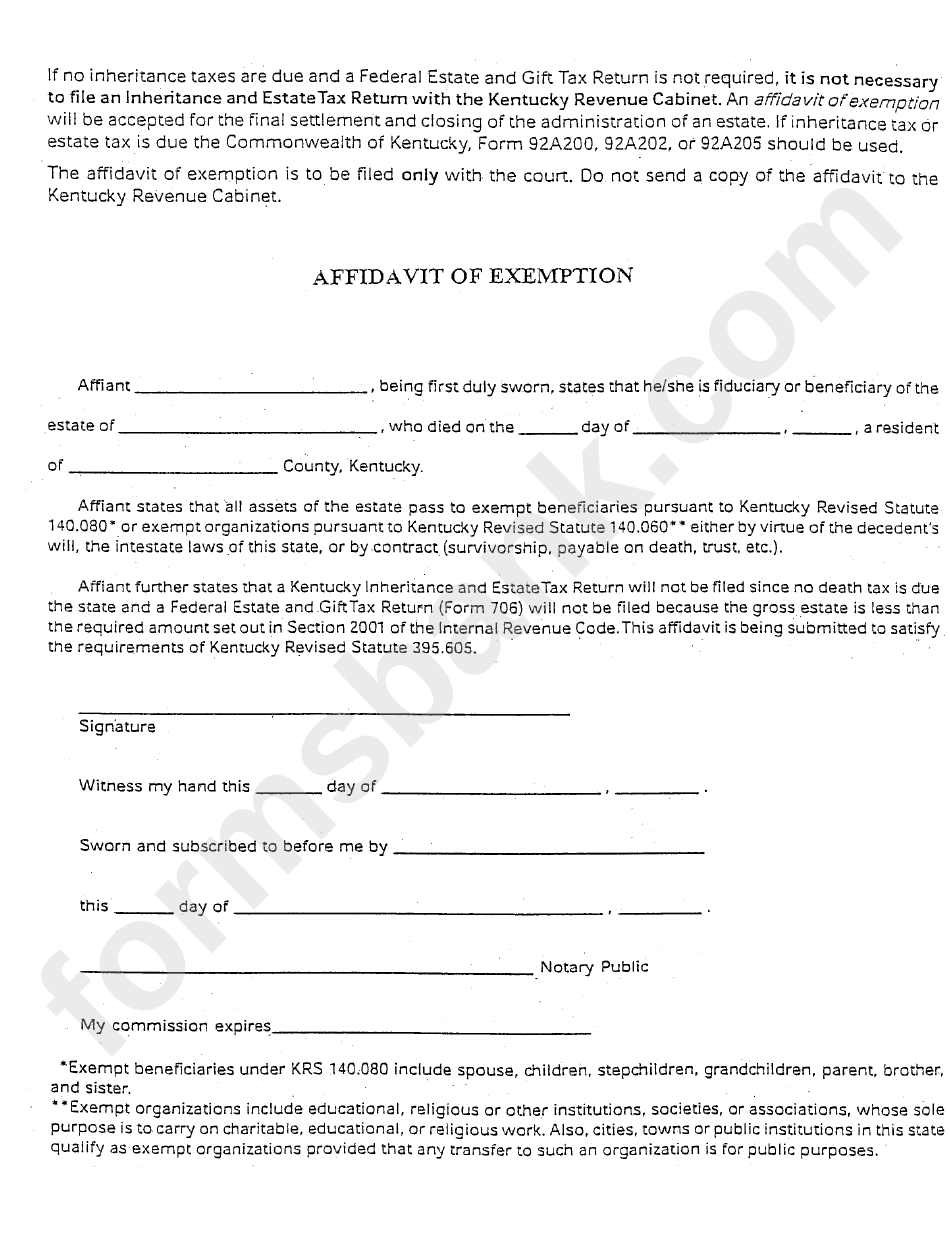

Affidavit Of Exemption Form Kentucky Revenue Kentucky

A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the. Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in. Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items.

Ky tax exempt form pdf Fill out & sign online DocHub

A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the. Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items. Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in.

Individual Tax Exemption 2024 Mona Sylvia

A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the. Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in. Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items.

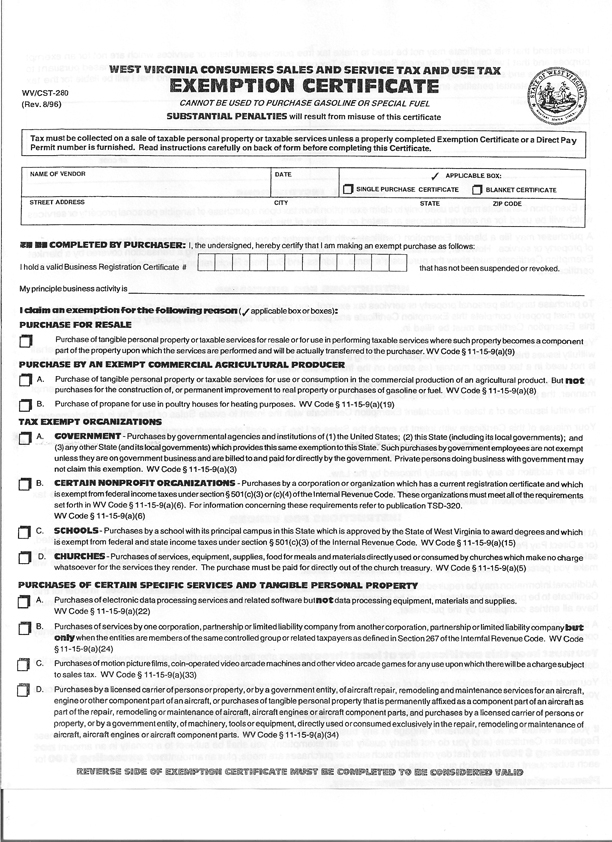

Ky Revenue Form 51a105 REVNEUS

Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in. Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items. A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the.

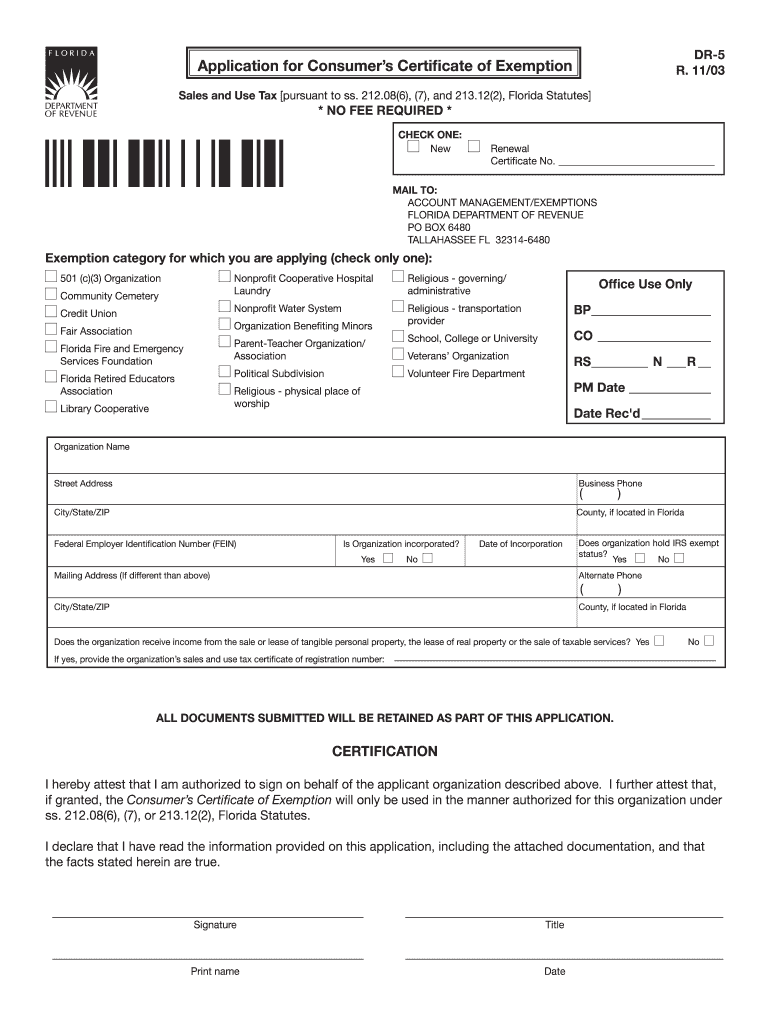

Agriculture Tax Exempt Form Florida

Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in. Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items. A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the.

Eligible Farmers Must Apply For And Use A New Tax Id Number To Claim Sales And Use Tax Exemptions For Certain Items.

Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in. A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the.