Loan To Shareholder On Balance Sheet

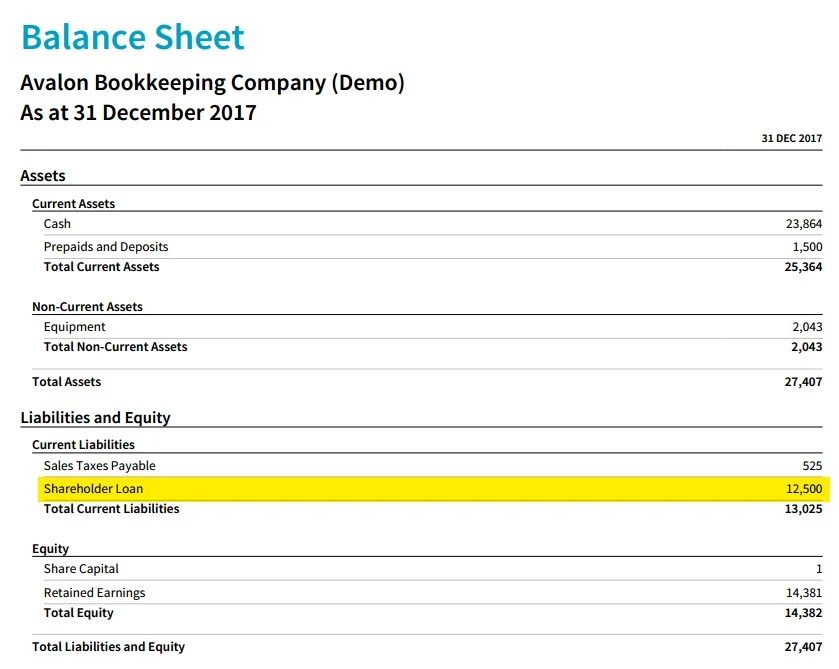

Loan To Shareholder On Balance Sheet - When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the. When you are dealing with shareholder loans, they should appear in the liability section of the balance sheet. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent.

When you are dealing with shareholder loans, they should appear in the liability section of the balance sheet. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have.

In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the. When you are dealing with shareholder loans, they should appear in the liability section of the balance sheet.

How Are Shareholder Loans Shown on the Balance Sheet? Bizfluent

When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the. When you are dealing with shareholder loans, they should appear in the liability section of the balance sheet. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent..

Loan To Shareholder On Balance Sheet Empowering Your Financial Journey

Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus.

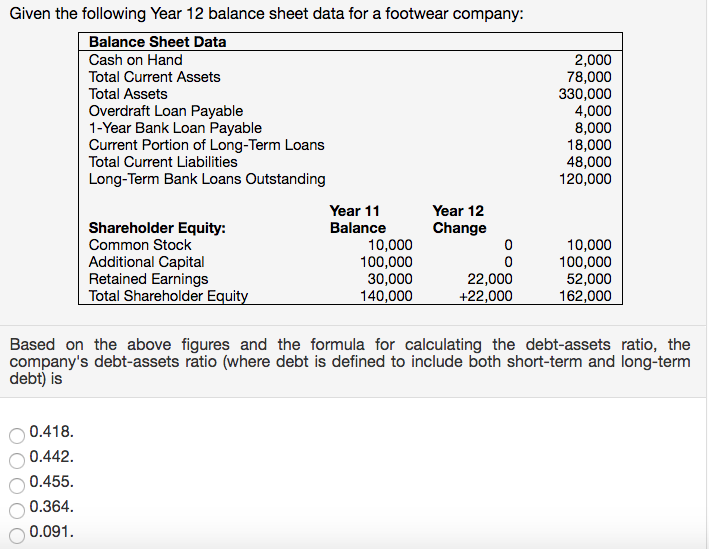

Irs Loans From Shareholders

When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus.

What is a Shareholder Loan? Vertical CPA

When you are dealing with shareholder loans, they should appear in the liability section of the balance sheet. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the..

Shareholder Loan Understand it and Avoid Trouble with the CRA Blog

When you are dealing with shareholder loans, they should appear in the liability section of the balance sheet. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the..

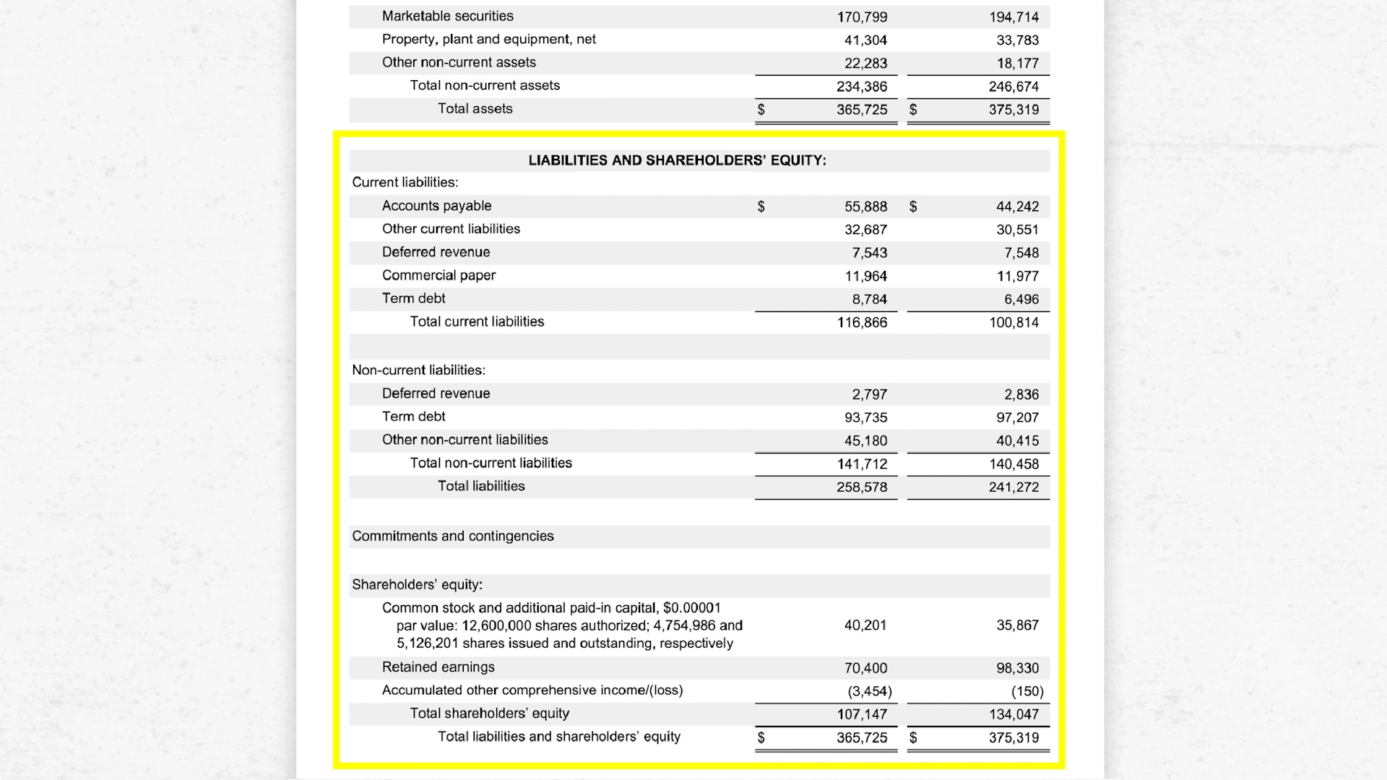

Project Finance Funding with Shareholder Loan and Capitalised Interest

When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus.

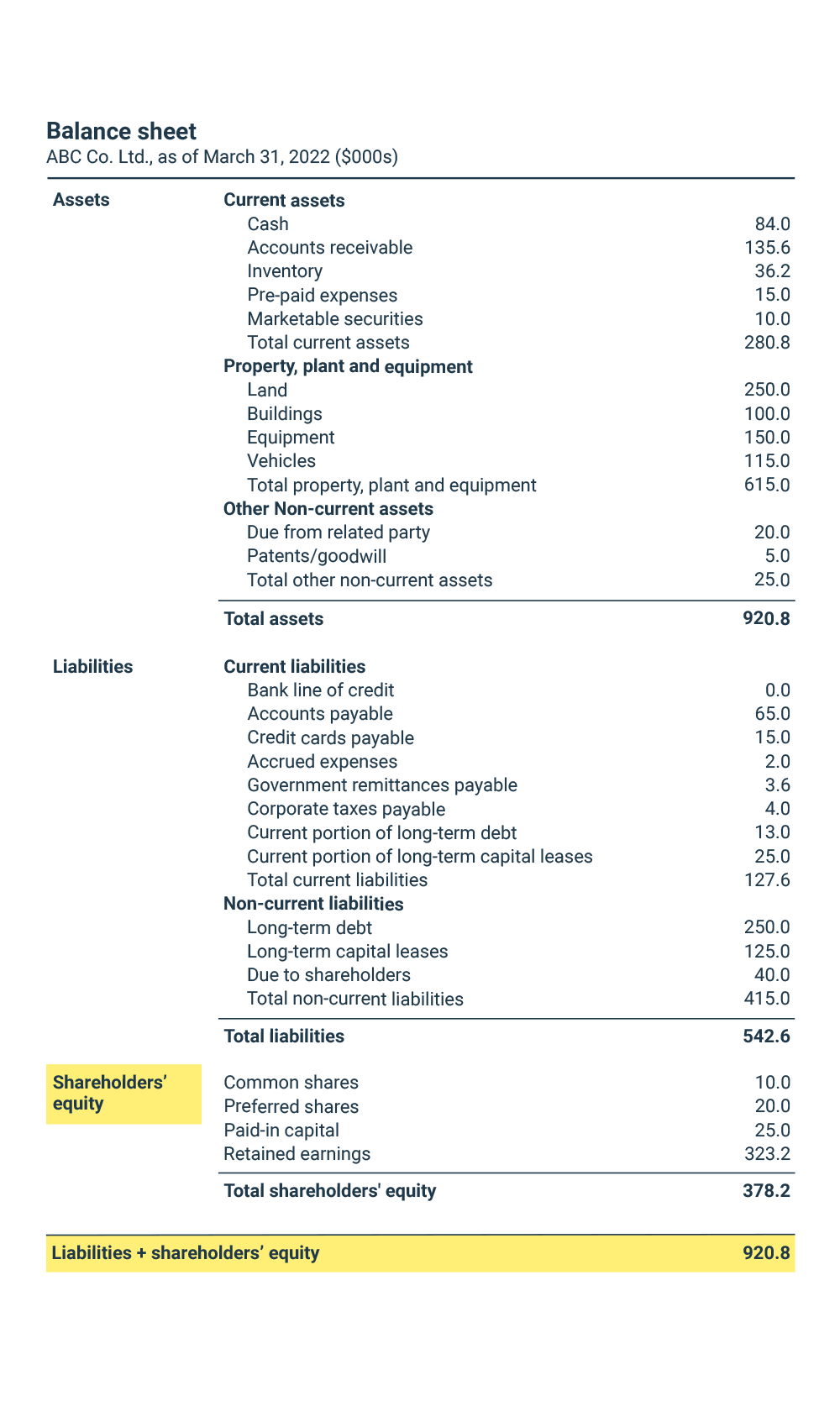

Balance Sheet Categories

When you are dealing with shareholder loans, they should appear in the liability section of the balance sheet. When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you.

What Is a Balance Sheet? Complete Guide Pareto Labs

Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus.

How To Prepare Projected Financial Statements For Bank Loan

In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income.

Shareholder Loan The Benefits, Risks, and What You Need to Know

Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. When you are dealing with shareholder loans, they should appear in the liability section of the balance sheet. When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the..

When You Are Dealing With Shareholder Loans, They Should Appear In The Liability Section Of The Balance Sheet.

When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent.