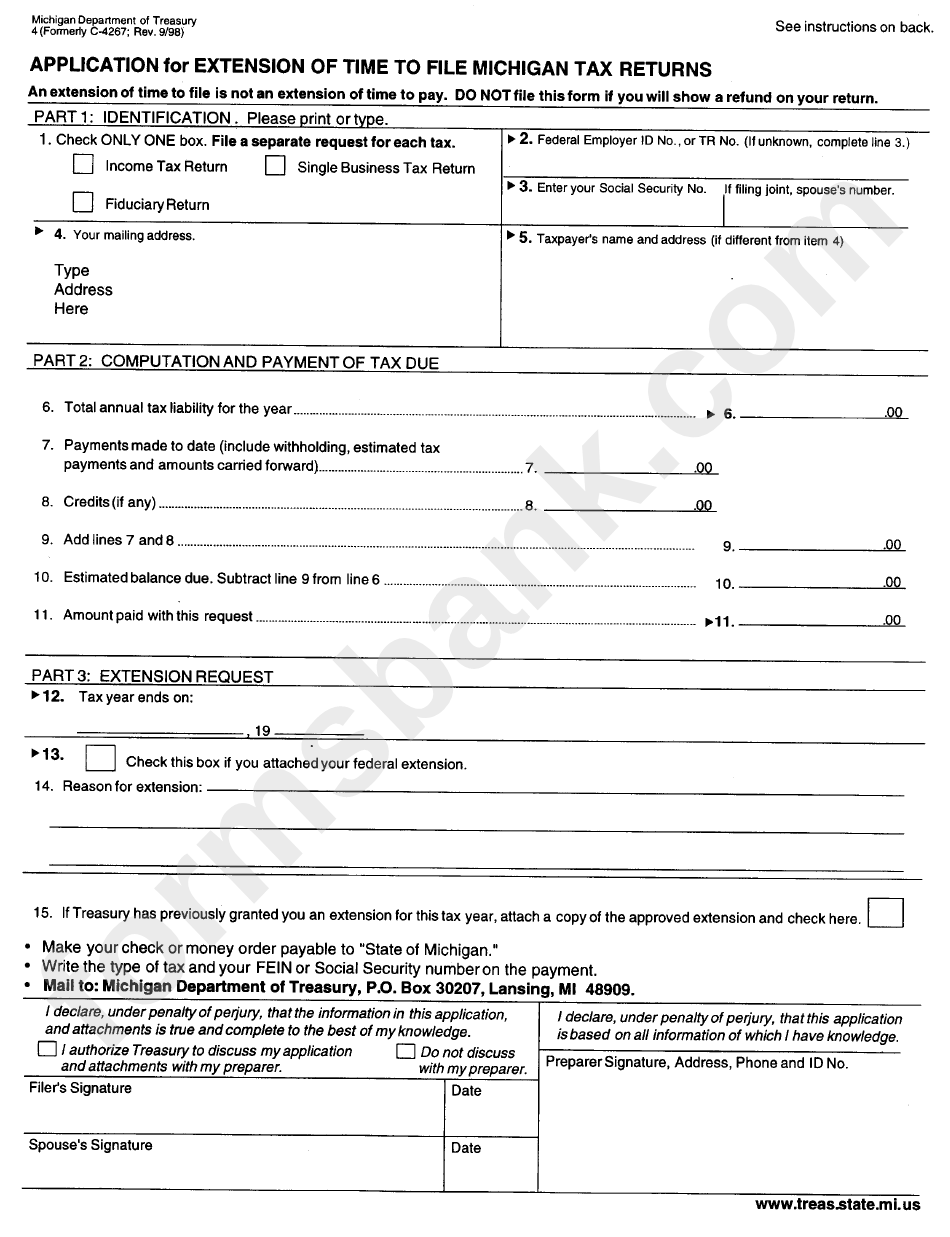

Michigan Form 4

Michigan Form 4 - Individual and fiduciary filers submit form 4 or a copy of your federal extension. Form 4 is used to request an extension of time to file michigan tax returns for individuals, fiduciaries, and businesses. Use michigan form 4 to make any additional payments by the april due date. An extension of time to file the federal return automatically. Michigan allows an automatic extension to october 15 if no payment is due and if the taxpayer files form 4868 with the irs and. If the federal return is extended, then the michigan return is. Learn how to file a michigan personal income tax extension using form 4 or a valid federal extension. Form 4 is used to request an extension of time to file michigan tax returns for individuals, fiduciaries, composites, and businesses. Find out the requirements, deadlines,.

Form 4 is used to request an extension of time to file michigan tax returns for individuals, fiduciaries, and businesses. Individual and fiduciary filers submit form 4 or a copy of your federal extension. Use michigan form 4 to make any additional payments by the april due date. Form 4 is used to request an extension of time to file michigan tax returns for individuals, fiduciaries, composites, and businesses. An extension of time to file the federal return automatically. Find out the requirements, deadlines,. Learn how to file a michigan personal income tax extension using form 4 or a valid federal extension. If the federal return is extended, then the michigan return is. Michigan allows an automatic extension to october 15 if no payment is due and if the taxpayer files form 4868 with the irs and.

If the federal return is extended, then the michigan return is. Form 4 is used to request an extension of time to file michigan tax returns for individuals, fiduciaries, and businesses. Learn how to file a michigan personal income tax extension using form 4 or a valid federal extension. Find out the requirements, deadlines,. Individual and fiduciary filers submit form 4 or a copy of your federal extension. An extension of time to file the federal return automatically. Michigan allows an automatic extension to october 15 if no payment is due and if the taxpayer files form 4868 with the irs and. Form 4 is used to request an extension of time to file michigan tax returns for individuals, fiduciaries, composites, and businesses. Use michigan form 4 to make any additional payments by the april due date.

Michigan Eviction Notice 1

Individual and fiduciary filers submit form 4 or a copy of your federal extension. Michigan allows an automatic extension to october 15 if no payment is due and if the taxpayer files form 4868 with the irs and. If the federal return is extended, then the michigan return is. An extension of time to file the federal return automatically. Use.

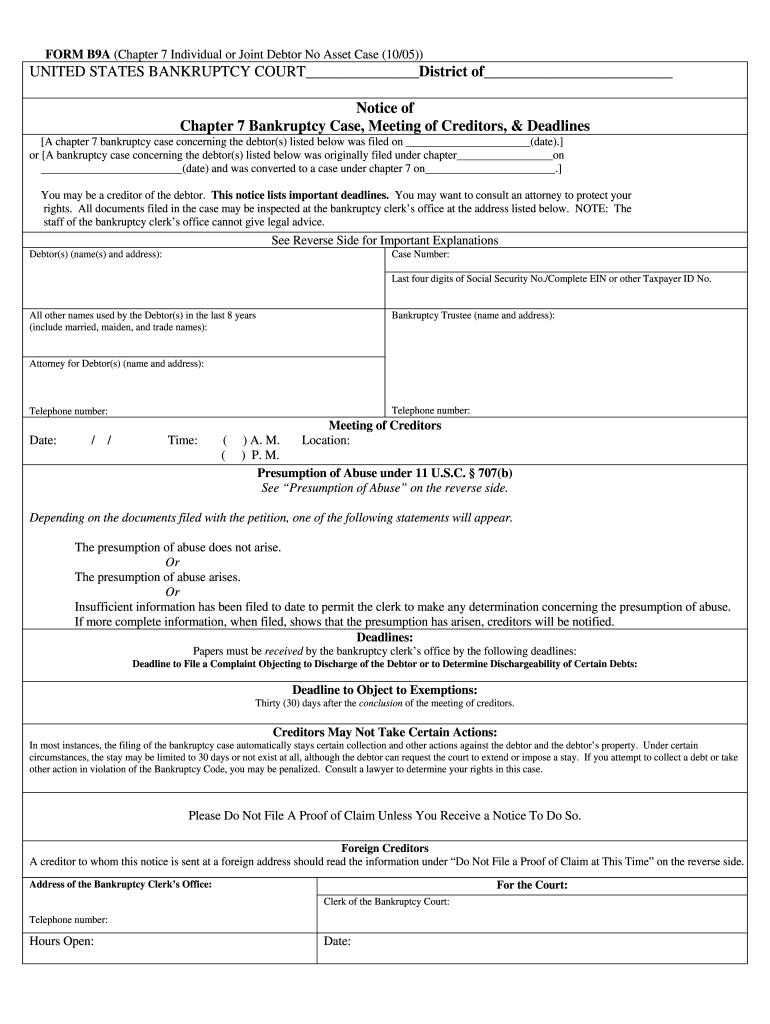

Michigan form b9a 2005 Fill out & sign online DocHub

Individual and fiduciary filers submit form 4 or a copy of your federal extension. Use michigan form 4 to make any additional payments by the april due date. Learn how to file a michigan personal income tax extension using form 4 or a valid federal extension. Form 4 is used to request an extension of time to file michigan tax.

Dba michigan pdf Fill out & sign online DocHub

Use michigan form 4 to make any additional payments by the april due date. If the federal return is extended, then the michigan return is. Michigan allows an automatic extension to october 15 if no payment is due and if the taxpayer files form 4868 with the irs and. Form 4 is used to request an extension of time to.

Michigan michigan Fill out & sign online DocHub

Use michigan form 4 to make any additional payments by the april due date. Form 4 is used to request an extension of time to file michigan tax returns for individuals, fiduciaries, and businesses. An extension of time to file the federal return automatically. Individual and fiduciary filers submit form 4 or a copy of your federal extension. Michigan allows.

Michigan Form Uia 1025 ≡ Fill Out Printable PDF Forms Online

Individual and fiduciary filers submit form 4 or a copy of your federal extension. Learn how to file a michigan personal income tax extension using form 4 or a valid federal extension. Use michigan form 4 to make any additional payments by the april due date. Find out the requirements, deadlines,. An extension of time to file the federal return.

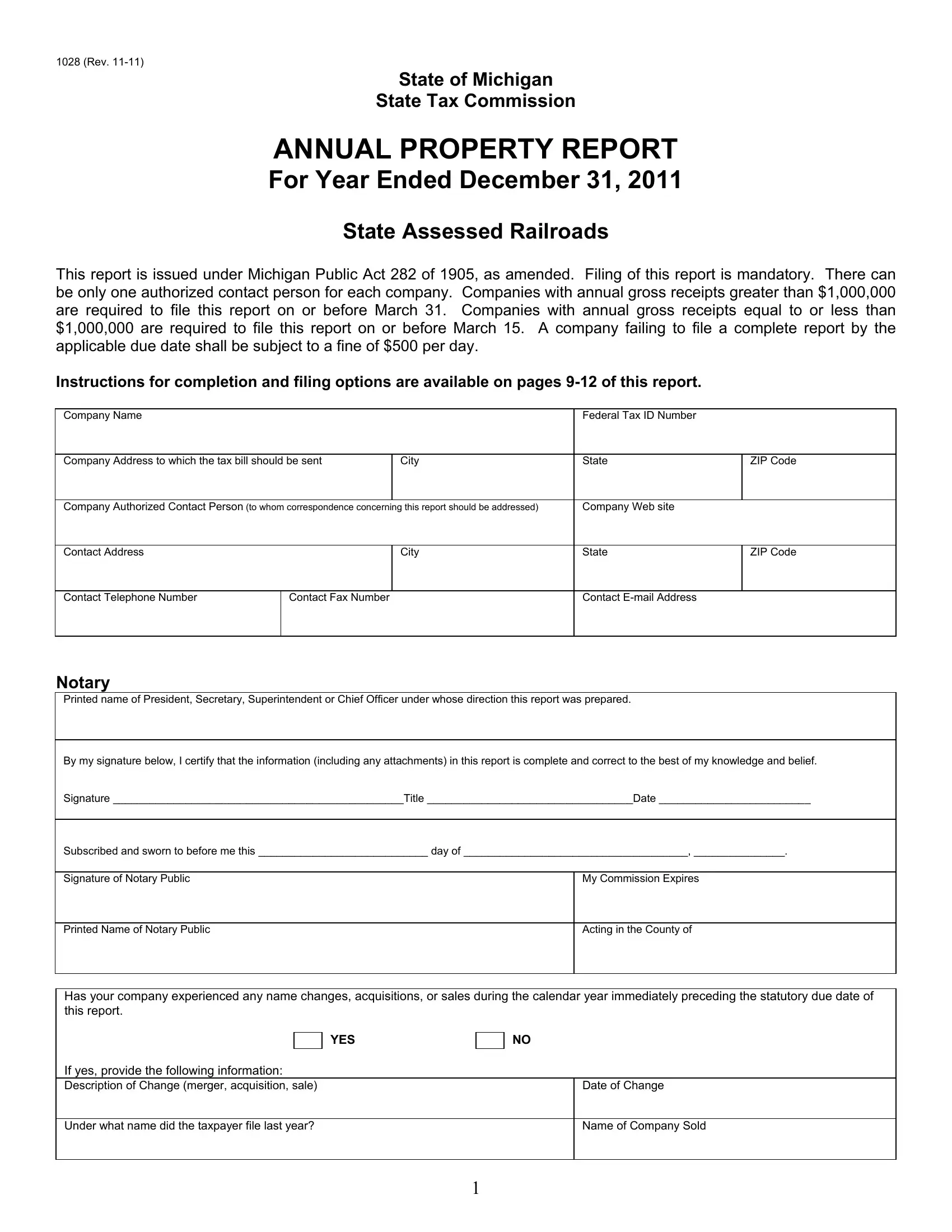

Michigan Form 1028 ≡ Fill Out Printable PDF Forms Online

Individual and fiduciary filers submit form 4 or a copy of your federal extension. If the federal return is extended, then the michigan return is. An extension of time to file the federal return automatically. Use michigan form 4 to make any additional payments by the april due date. Form 4 is used to request an extension of time to.

Fillable Form 4 Application For Extension Of Time To File Michigan

Individual and fiduciary filers submit form 4 or a copy of your federal extension. Find out the requirements, deadlines,. Form 4 is used to request an extension of time to file michigan tax returns for individuals, fiduciaries, and businesses. Learn how to file a michigan personal income tax extension using form 4 or a valid federal extension. If the federal.

Form 2368 Michigan ≡ Fill Out Printable PDF Forms Online

An extension of time to file the federal return automatically. Find out the requirements, deadlines,. Use michigan form 4 to make any additional payments by the april due date. If the federal return is extended, then the michigan return is. Michigan allows an automatic extension to october 15 if no payment is due and if the taxpayer files form 4868.

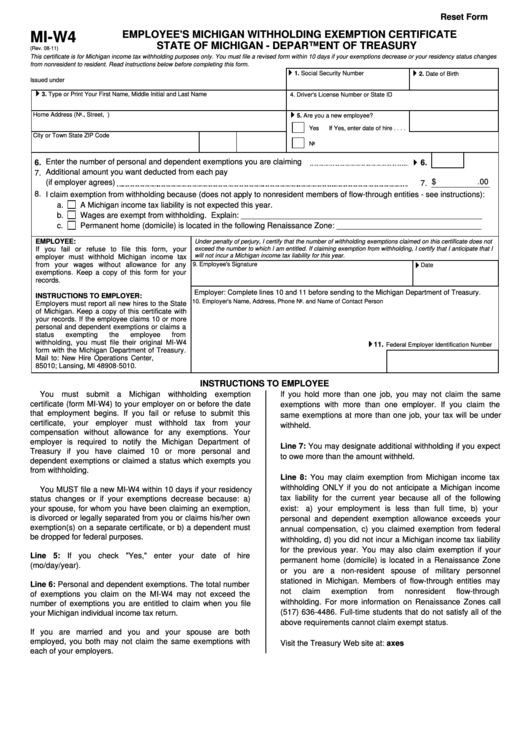

Fillable Mi W4 Employee S Michigan Withholding Exemption Certificate

An extension of time to file the federal return automatically. Individual and fiduciary filers submit form 4 or a copy of your federal extension. Learn how to file a michigan personal income tax extension using form 4 or a valid federal extension. If the federal return is extended, then the michigan return is. Form 4 is used to request an.

Mi w4 Fill out & sign online DocHub

Form 4 is used to request an extension of time to file michigan tax returns for individuals, fiduciaries, and businesses. Find out the requirements, deadlines,. Use michigan form 4 to make any additional payments by the april due date. Individual and fiduciary filers submit form 4 or a copy of your federal extension. If the federal return is extended, then.

Michigan Allows An Automatic Extension To October 15 If No Payment Is Due And If The Taxpayer Files Form 4868 With The Irs And.

Find out the requirements, deadlines,. Use michigan form 4 to make any additional payments by the april due date. Learn how to file a michigan personal income tax extension using form 4 or a valid federal extension. Form 4 is used to request an extension of time to file michigan tax returns for individuals, fiduciaries, and businesses.

Form 4 Is Used To Request An Extension Of Time To File Michigan Tax Returns For Individuals, Fiduciaries, Composites, And Businesses.

If the federal return is extended, then the michigan return is. Individual and fiduciary filers submit form 4 or a copy of your federal extension. An extension of time to file the federal return automatically.