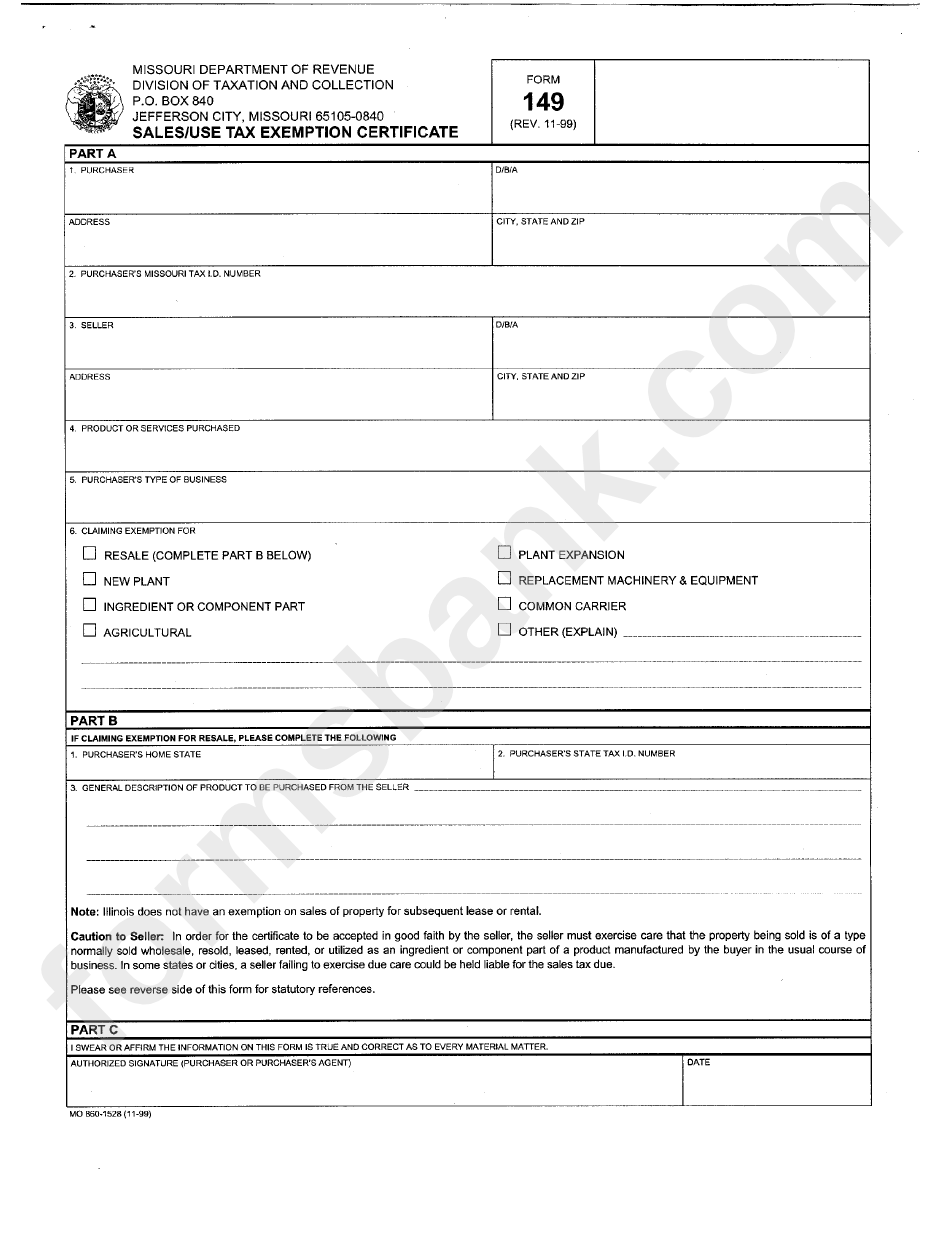

Mo Sales Tax Exemption Form

Mo Sales Tax Exemption Form - When a purchaser is claiming an exemption for purchases of items that qualify for the full manufacturing exemption and other items that. Generally, missouri taxes all retail sales of tangible personal property and certain taxable services. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states. However, there are a number of.

To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states. However, there are a number of. Generally, missouri taxes all retail sales of tangible personal property and certain taxable services. When a purchaser is claiming an exemption for purchases of items that qualify for the full manufacturing exemption and other items that.

When a purchaser is claiming an exemption for purchases of items that qualify for the full manufacturing exemption and other items that. Generally, missouri taxes all retail sales of tangible personal property and certain taxable services. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states. However, there are a number of.

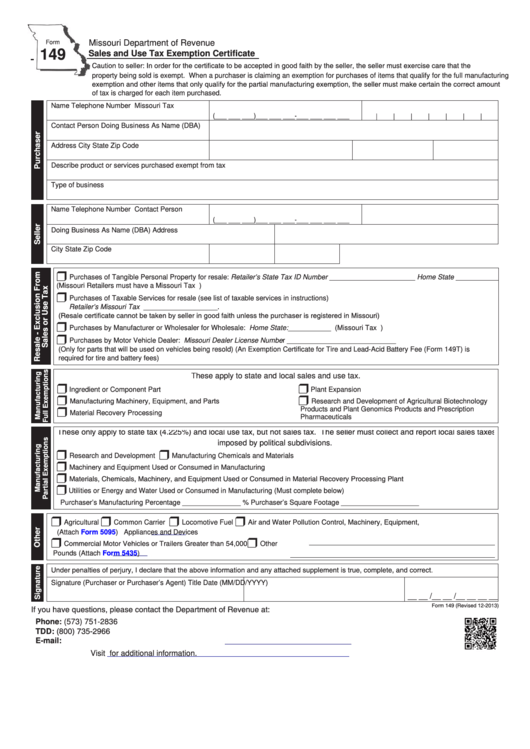

Missouri Sales Tax Exemption Certificate Form

When a purchaser is claiming an exemption for purchases of items that qualify for the full manufacturing exemption and other items that. However, there are a number of. Generally, missouri taxes all retail sales of tangible personal property and certain taxable services. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri.

Online Tax Exemption by West Tech Shipping Issuu

Generally, missouri taxes all retail sales of tangible personal property and certain taxable services. However, there are a number of. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states. When a purchaser is claiming an exemption for purchases of items that qualify for the full manufacturing exemption and.

Fillable Online pasalestaxexemptionform.pdf Fax Email Print pdfFiller

To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states. When a purchaser is claiming an exemption for purchases of items that qualify for the full manufacturing exemption and other items that. Generally, missouri taxes all retail sales of tangible personal property and certain taxable services. However, there are.

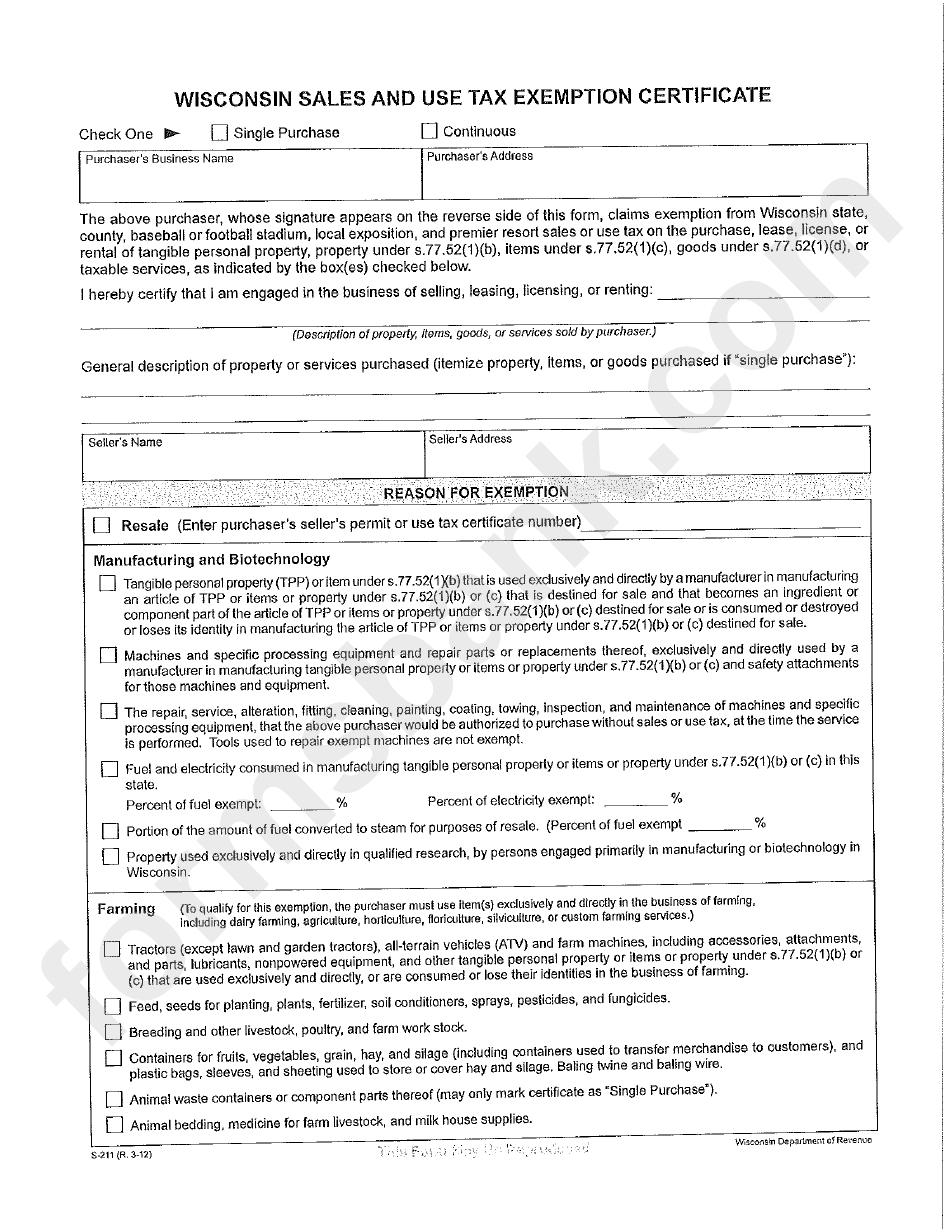

Wi Sales Tax Exemption Form

However, there are a number of. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states. Generally, missouri taxes all retail sales of tangible personal property and certain taxable services. When a purchaser is claiming an exemption for purchases of items that qualify for the full manufacturing exemption and.

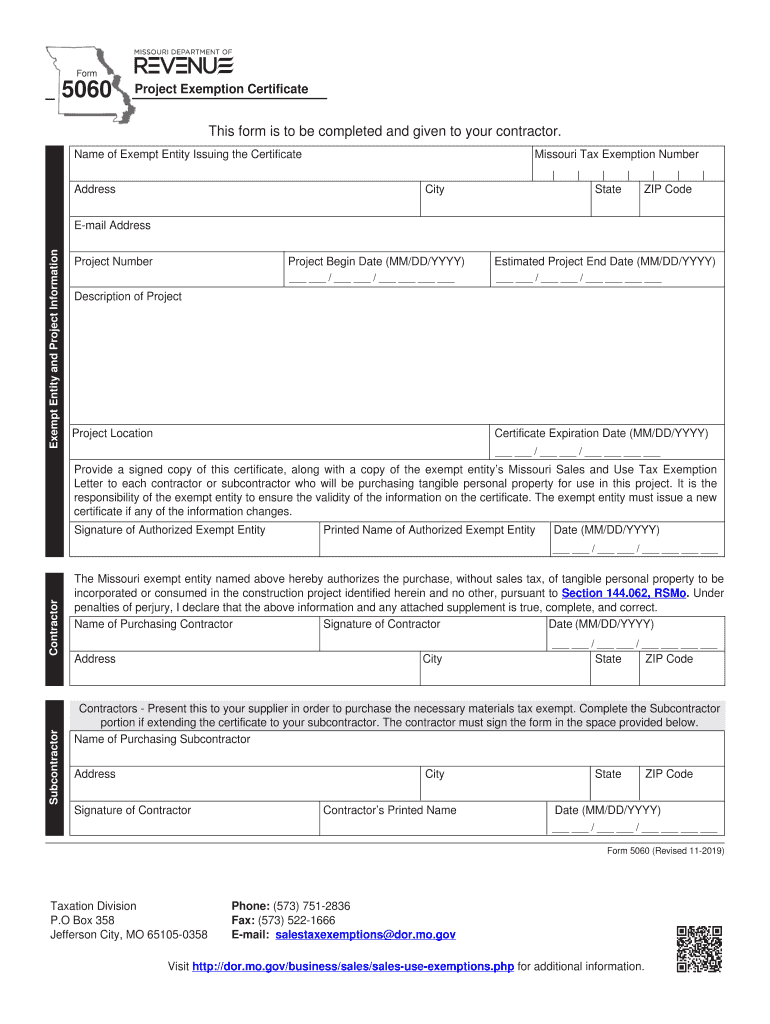

5060 Form Complete with ease airSlate SignNow

However, there are a number of. Generally, missouri taxes all retail sales of tangible personal property and certain taxable services. When a purchaser is claiming an exemption for purchases of items that qualify for the full manufacturing exemption and other items that. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri.

Louisiana Sales Tax Exemption Form For Out Of State Company

When a purchaser is claiming an exemption for purchases of items that qualify for the full manufacturing exemption and other items that. Generally, missouri taxes all retail sales of tangible personal property and certain taxable services. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states. However, there are.

Pa Tax Exempt Form Printable Printable Forms Free Online

However, there are a number of. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states. Generally, missouri taxes all retail sales of tangible personal property and certain taxable services. When a purchaser is claiming an exemption for purchases of items that qualify for the full manufacturing exemption and.

Fillable Online PDF 149 Sales and Use Tax Exemption Certificate

Generally, missouri taxes all retail sales of tangible personal property and certain taxable services. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states. When a purchaser is claiming an exemption for purchases of items that qualify for the full manufacturing exemption and other items that. However, there are.

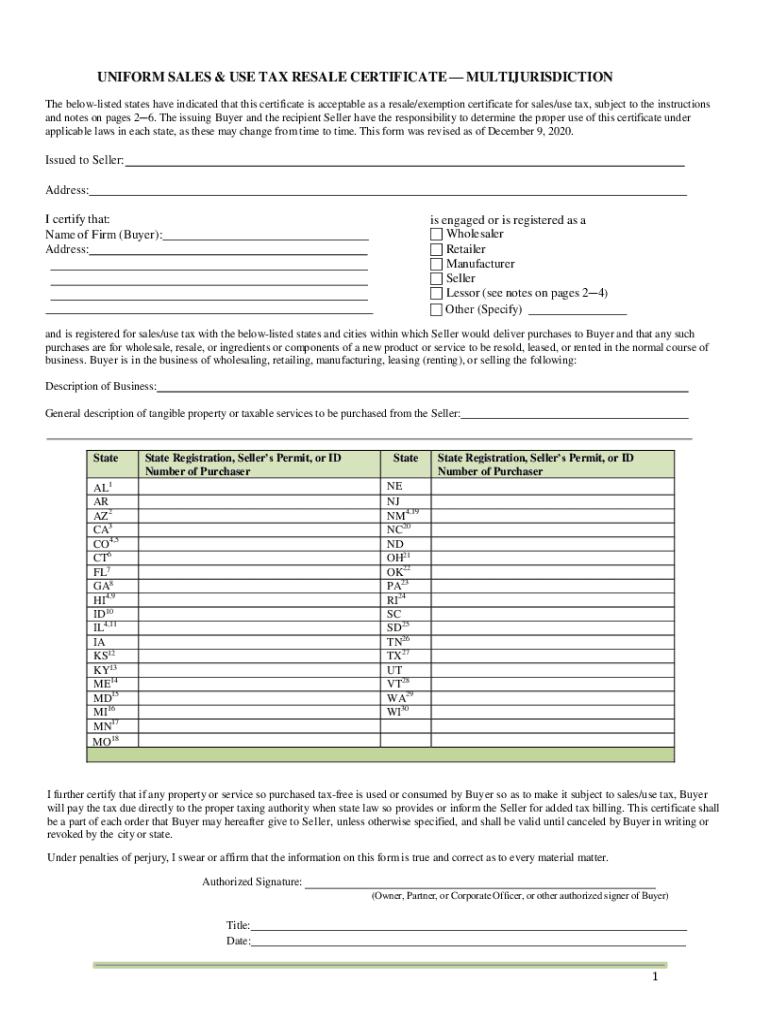

MTC Uniform Sales & Use Tax Certificate Multijurisdiction 20202022

However, there are a number of. When a purchaser is claiming an exemption for purchases of items that qualify for the full manufacturing exemption and other items that. Generally, missouri taxes all retail sales of tangible personal property and certain taxable services. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri.

What is the sales tax exemption in Shopify? FreeCashFlow.io 2024

To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states. Generally, missouri taxes all retail sales of tangible personal property and certain taxable services. When a purchaser is claiming an exemption for purchases of items that qualify for the full manufacturing exemption and other items that. However, there are.

Generally, Missouri Taxes All Retail Sales Of Tangible Personal Property And Certain Taxable Services.

To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states. When a purchaser is claiming an exemption for purchases of items that qualify for the full manufacturing exemption and other items that. However, there are a number of.