New Employment Credit Form 3554

New Employment Credit Form 3554 - Taxpayers use form ftb 3554, new employment credit, to figure a credit for a qualified taxpayer that hires a qualified full. We last updated the new employment credit in february 2024, so this is the latest version of form 3554, fully updated for tax year 2023. Download or print the 2023 california (new employment credit) (2023) and other income tax forms from the california franchise tax board. Enter the amount of the credit claimed on the current year tax return. (do not include any assigned credit claimed on form.

Download or print the 2023 california (new employment credit) (2023) and other income tax forms from the california franchise tax board. We last updated the new employment credit in february 2024, so this is the latest version of form 3554, fully updated for tax year 2023. Taxpayers use form ftb 3554, new employment credit, to figure a credit for a qualified taxpayer that hires a qualified full. (do not include any assigned credit claimed on form. Enter the amount of the credit claimed on the current year tax return.

Taxpayers use form ftb 3554, new employment credit, to figure a credit for a qualified taxpayer that hires a qualified full. (do not include any assigned credit claimed on form. Enter the amount of the credit claimed on the current year tax return. Download or print the 2023 california (new employment credit) (2023) and other income tax forms from the california franchise tax board. We last updated the new employment credit in february 2024, so this is the latest version of form 3554, fully updated for tax year 2023.

IRS Form 5695 Residential Energy Tax Credits StepbyStep Guide

Enter the amount of the credit claimed on the current year tax return. Taxpayers use form ftb 3554, new employment credit, to figure a credit for a qualified taxpayer that hires a qualified full. We last updated the new employment credit in february 2024, so this is the latest version of form 3554, fully updated for tax year 2023. Download.

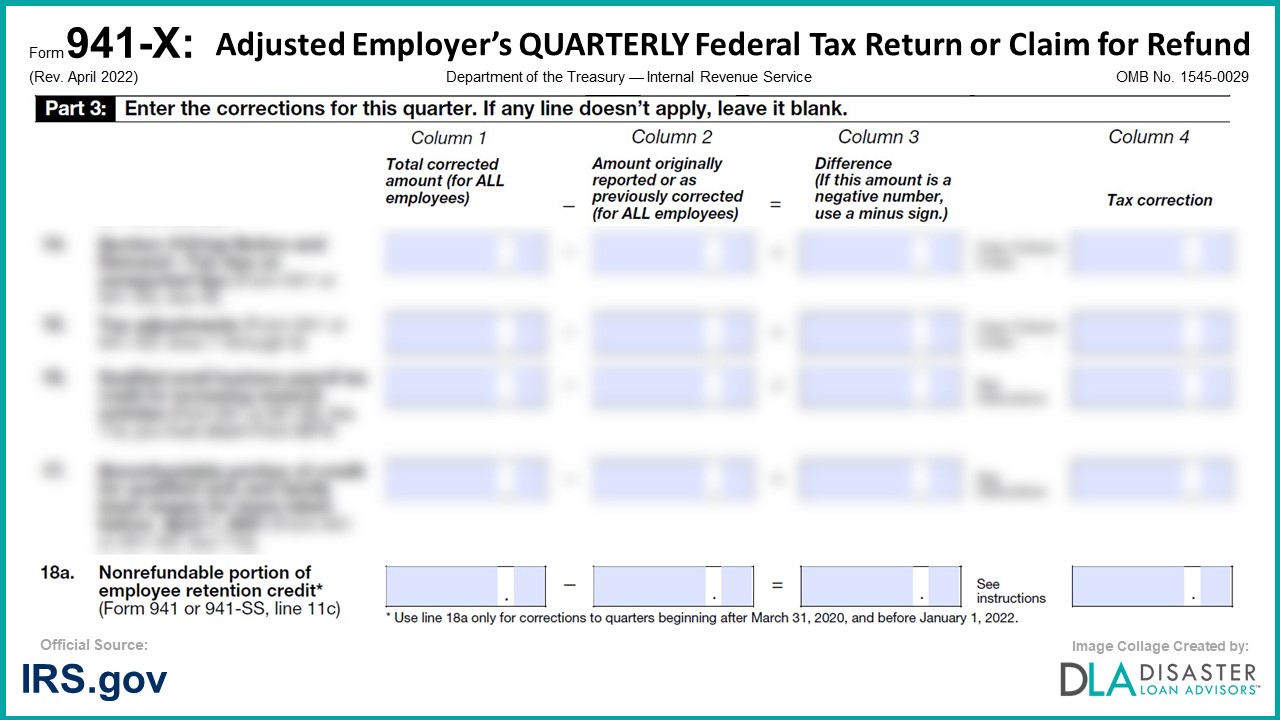

941X 18a. Nonrefundable Portion of Employee Retention Credit, Form

Enter the amount of the credit claimed on the current year tax return. (do not include any assigned credit claimed on form. We last updated the new employment credit in february 2024, so this is the latest version of form 3554, fully updated for tax year 2023. Taxpayers use form ftb 3554, new employment credit, to figure a credit for.

Fillable Online 2020 FORM 3554 New Employment Credit. 2020 FORM 3554

We last updated the new employment credit in february 2024, so this is the latest version of form 3554, fully updated for tax year 2023. Taxpayers use form ftb 3554, new employment credit, to figure a credit for a qualified taxpayer that hires a qualified full. (do not include any assigned credit claimed on form. Enter the amount of the.

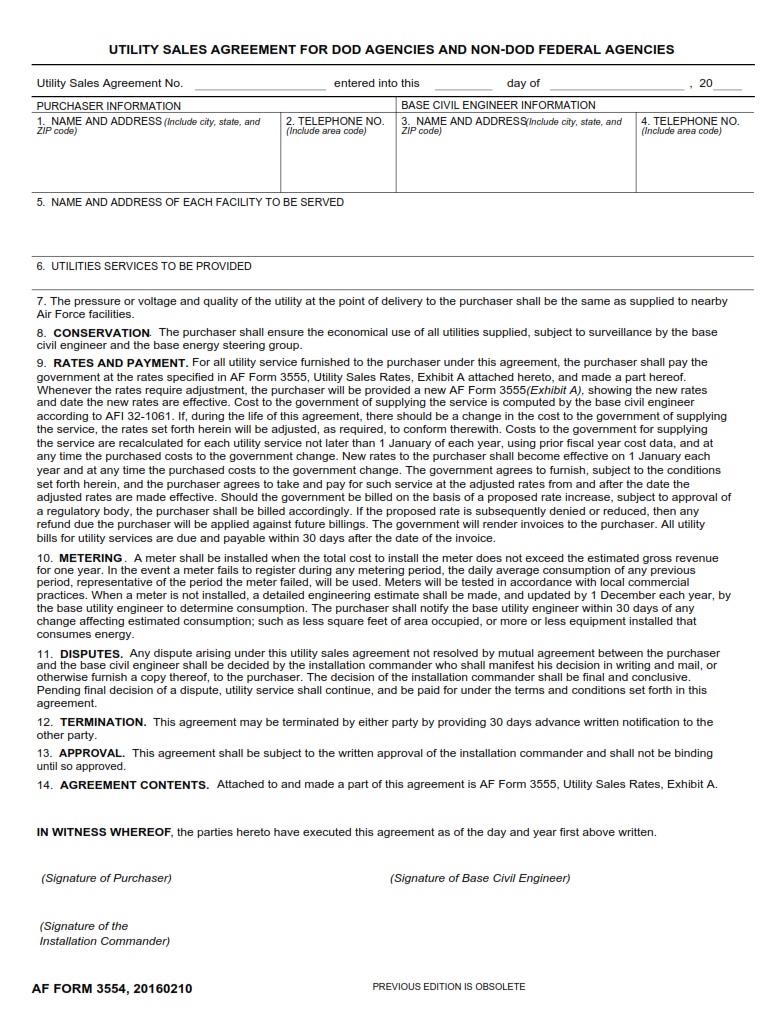

AF Form 3554 Utility Sales Agreement For DoD Agencies And NonFederal

(do not include any assigned credit claimed on form. Taxpayers use form ftb 3554, new employment credit, to figure a credit for a qualified taxpayer that hires a qualified full. Enter the amount of the credit claimed on the current year tax return. We last updated the new employment credit in february 2024, so this is the latest version of.

NEW Employment Authorization Card PSD Template RH Editography

Download or print the 2023 california (new employment credit) (2023) and other income tax forms from the california franchise tax board. We last updated the new employment credit in february 2024, so this is the latest version of form 3554, fully updated for tax year 2023. Enter the amount of the credit claimed on the current year tax return. (do.

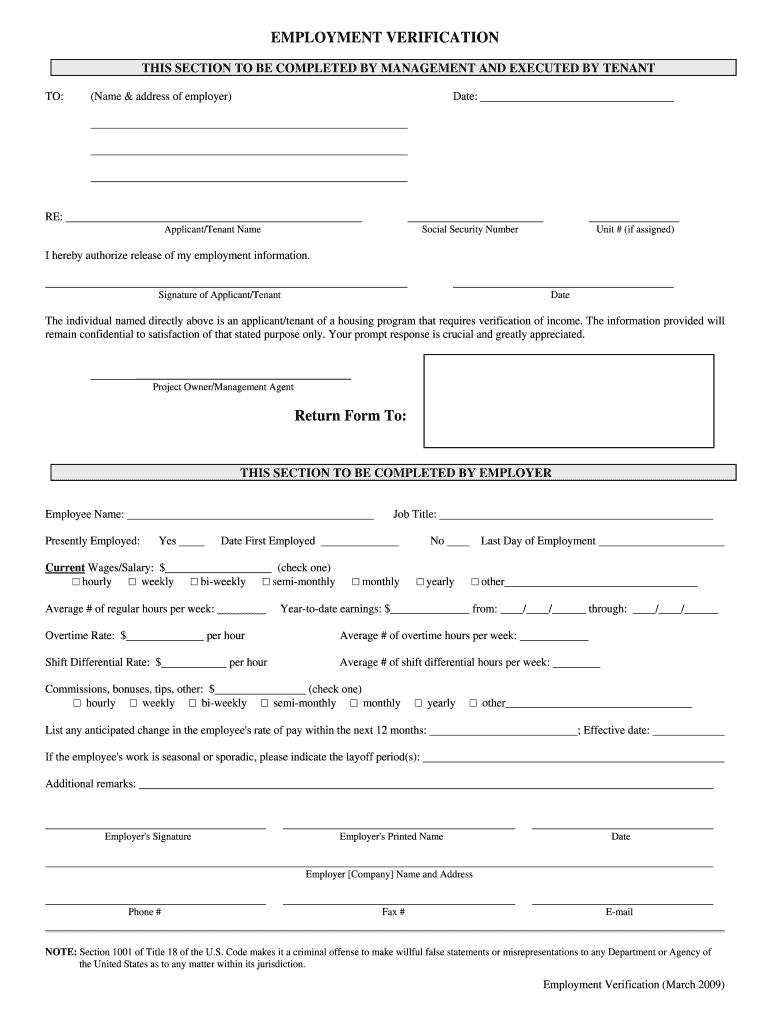

Pdf Printable Employment Verification Form Printable Form 2023 Free

Taxpayers use form ftb 3554, new employment credit, to figure a credit for a qualified taxpayer that hires a qualified full. Enter the amount of the credit claimed on the current year tax return. Download or print the 2023 california (new employment credit) (2023) and other income tax forms from the california franchise tax board. We last updated the new.

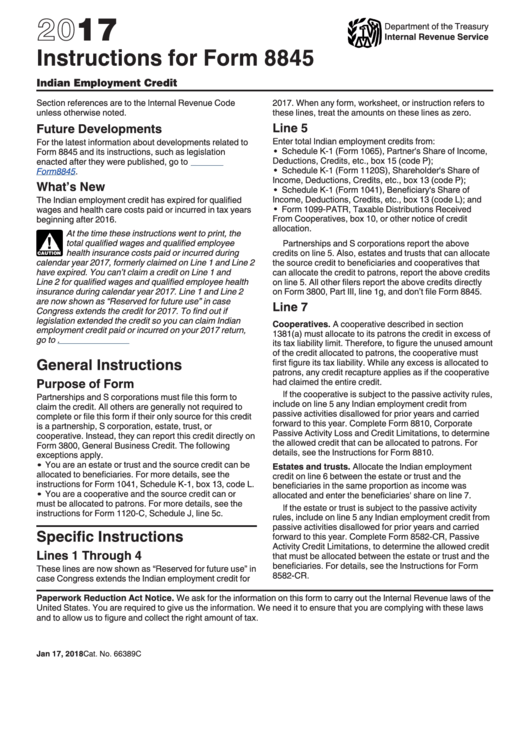

Instructions For Form 8845 Indian Employment Credit 2017 printable

We last updated the new employment credit in february 2024, so this is the latest version of form 3554, fully updated for tax year 2023. Download or print the 2023 california (new employment credit) (2023) and other income tax forms from the california franchise tax board. Taxpayers use form ftb 3554, new employment credit, to figure a credit for a.

Fillable Online 2021 Instructions for Form FTB 3554 New Employment

Enter the amount of the credit claimed on the current year tax return. We last updated the new employment credit in february 2024, so this is the latest version of form 3554, fully updated for tax year 2023. Taxpayers use form ftb 3554, new employment credit, to figure a credit for a qualified taxpayer that hires a qualified full. (do.

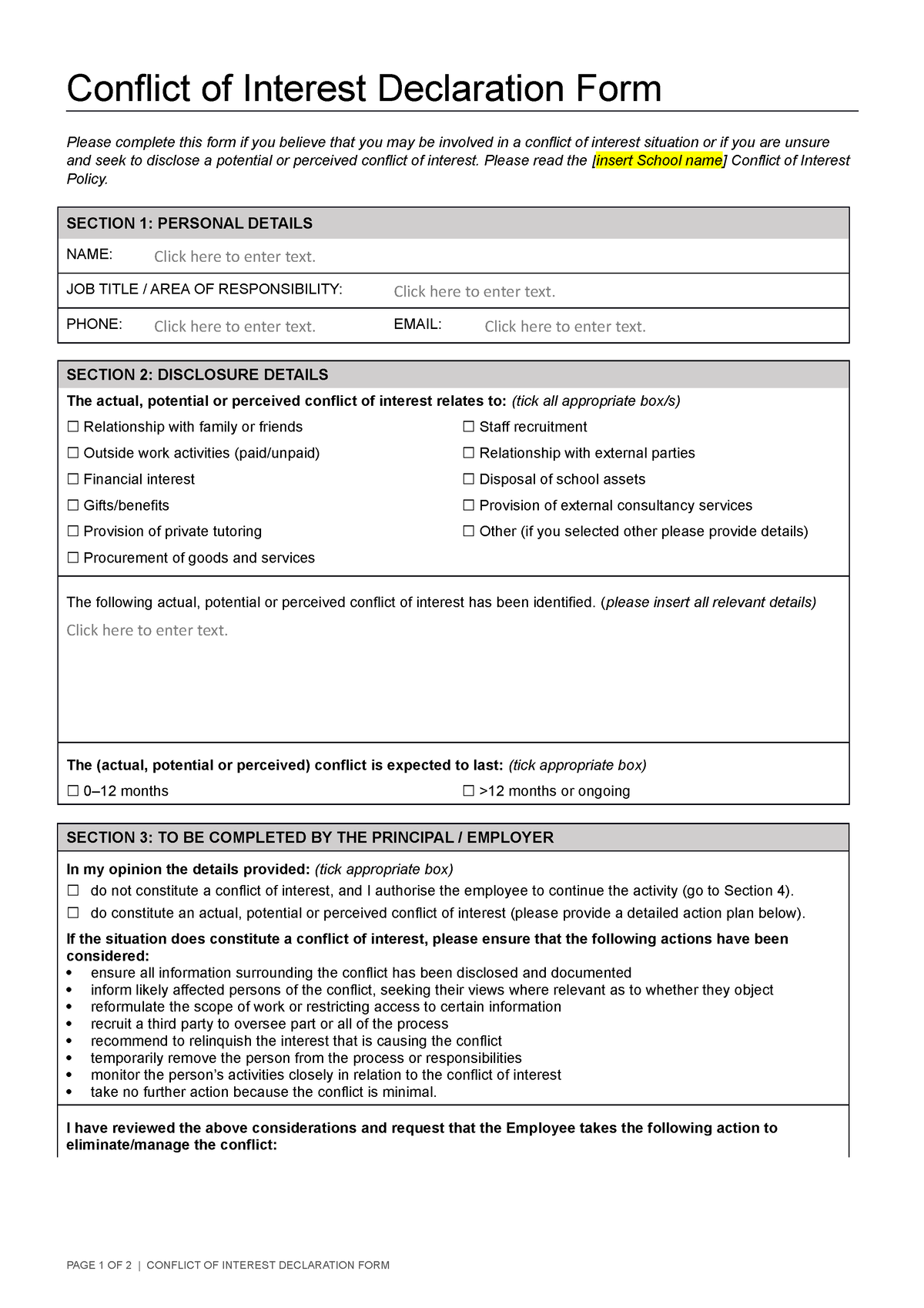

Conflict of Interest Template Declaration Form Conflict of Interest

Taxpayers use form ftb 3554, new employment credit, to figure a credit for a qualified taxpayer that hires a qualified full. Enter the amount of the credit claimed on the current year tax return. We last updated the new employment credit in february 2024, so this is the latest version of form 3554, fully updated for tax year 2023. Download.

New Employment Plan Ppt PowerPoint Presentation Complete Deck With Slides

(do not include any assigned credit claimed on form. Taxpayers use form ftb 3554, new employment credit, to figure a credit for a qualified taxpayer that hires a qualified full. Download or print the 2023 california (new employment credit) (2023) and other income tax forms from the california franchise tax board. Enter the amount of the credit claimed on the.

Taxpayers Use Form Ftb 3554, New Employment Credit, To Figure A Credit For A Qualified Taxpayer That Hires A Qualified Full.

Enter the amount of the credit claimed on the current year tax return. We last updated the new employment credit in february 2024, so this is the latest version of form 3554, fully updated for tax year 2023. Download or print the 2023 california (new employment credit) (2023) and other income tax forms from the california franchise tax board. (do not include any assigned credit claimed on form.