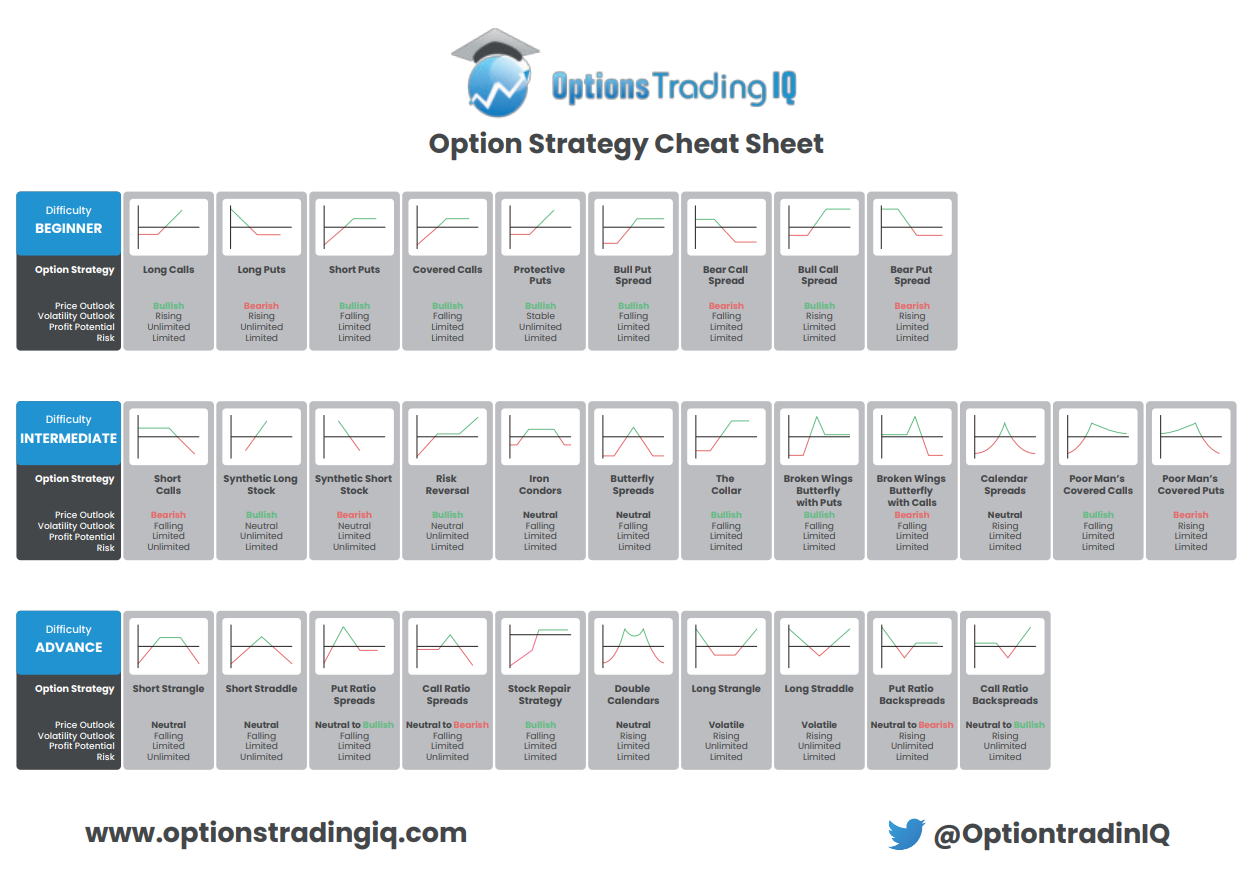

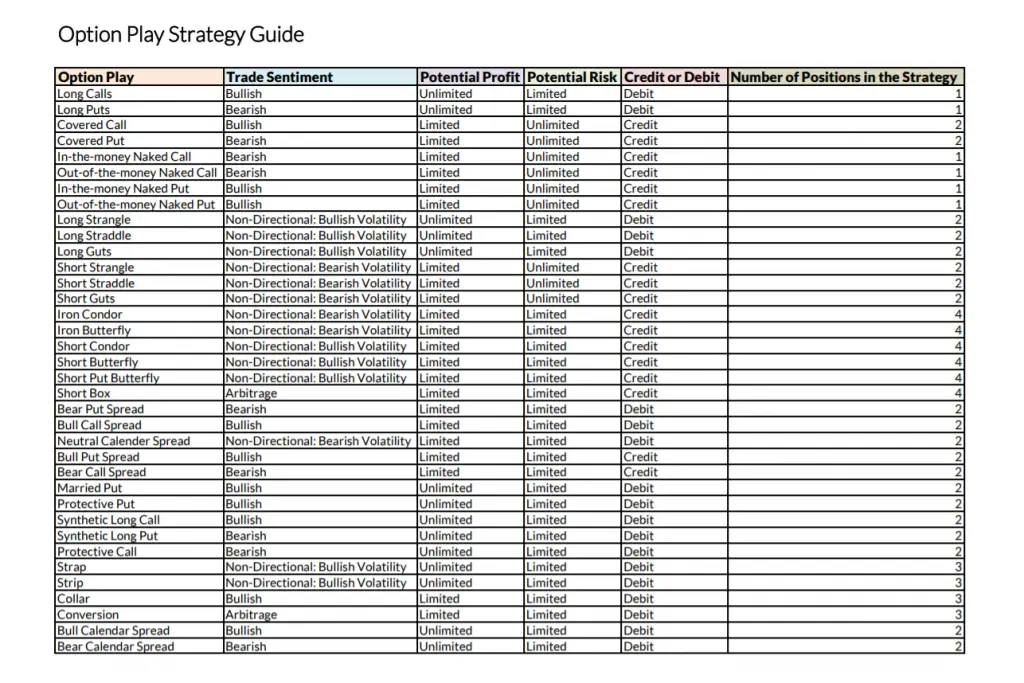

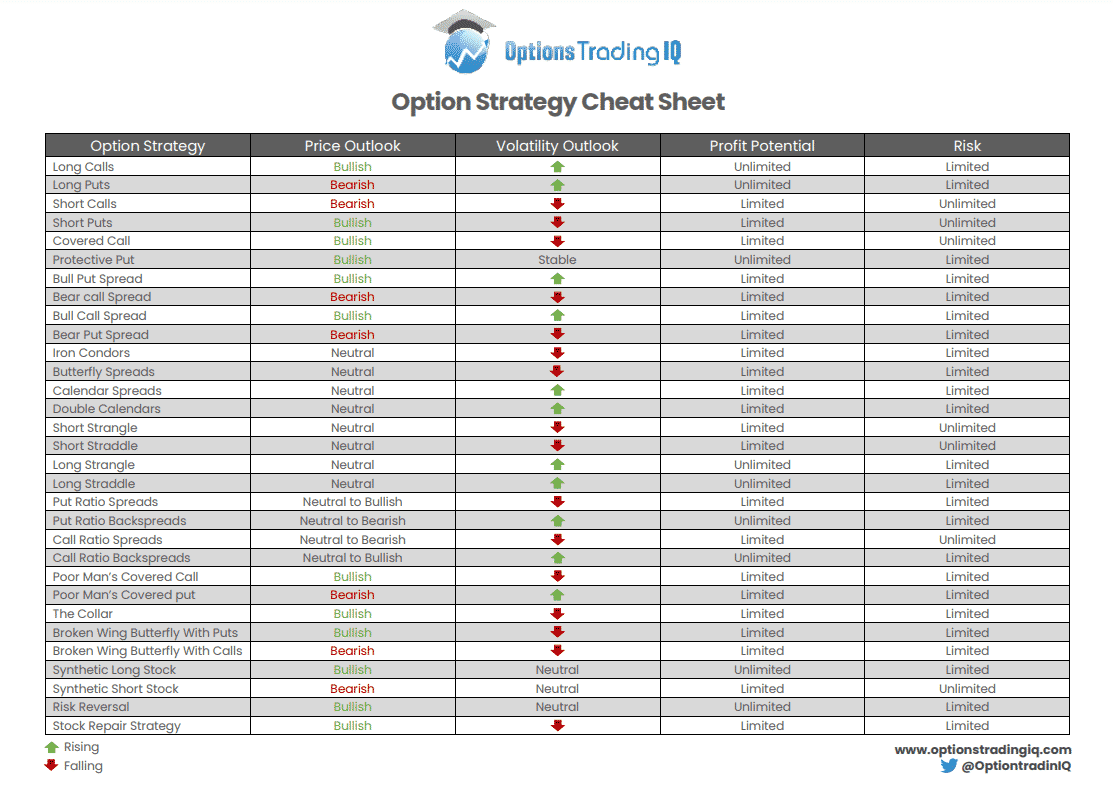

Option Strategies Cheat Sheet

Option Strategies Cheat Sheet - Options trading might sound complex, but there are basic strategies that most investors can use to improve returns, bet on the market's movement, or hedge existing. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. You must know the structure of options, how to analyze options greeks, and ultimately, how to trade the markets using options strategies. The right to buy is called a call option and the right to sell is. To start, you must have a cheat. Option strategy price outlook volatility outlook profit potential risk long calls

Option strategy price outlook volatility outlook profit potential risk long calls The right to buy is called a call option and the right to sell is. You must know the structure of options, how to analyze options greeks, and ultimately, how to trade the markets using options strategies. To start, you must have a cheat. Options trading might sound complex, but there are basic strategies that most investors can use to improve returns, bet on the market's movement, or hedge existing. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date.

To start, you must have a cheat. Option strategy price outlook volatility outlook profit potential risk long calls You must know the structure of options, how to analyze options greeks, and ultimately, how to trade the markets using options strategies. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. The right to buy is called a call option and the right to sell is. Options trading might sound complex, but there are basic strategies that most investors can use to improve returns, bet on the market's movement, or hedge existing.

Options Strategies Cheat Sheet [FREE Download] How to Trade

Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. The right to buy is called a call option and the right to sell is. You must know the structure of options, how to analyze options greeks, and ultimately, how to trade.

Option Strategies Cheat Sheet New Trader U

You must know the structure of options, how to analyze options greeks, and ultimately, how to trade the markets using options strategies. To start, you must have a cheat. Option strategy price outlook volatility outlook profit potential risk long calls Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a.

Investing

You must know the structure of options, how to analyze options greeks, and ultimately, how to trade the markets using options strategies. Option strategy price outlook volatility outlook profit potential risk long calls The right to buy is called a call option and the right to sell is. Options trading might sound complex, but there are basic strategies that most.

Option Strategies Cheat Sheet New Trader U

Option strategy price outlook volatility outlook profit potential risk long calls Options trading might sound complex, but there are basic strategies that most investors can use to improve returns, bet on the market's movement, or hedge existing. The right to buy is called a call option and the right to sell is. You must know the structure of options, how.

Option Strategy cheatsheet Trader Journal Options, Equities, and

Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. You must know the structure of options, how to analyze options greeks, and ultimately, how to trade the markets using options strategies. The right to buy is called a call option and.

Options Strategies Cheatsheet. Here is a ready referral to Option… by

Option strategy price outlook volatility outlook profit potential risk long calls Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. You must know the structure of options, how to analyze options greeks, and ultimately, how to trade the markets using options.

Option basics Cheatsheet Trade Options With Me

Option strategy price outlook volatility outlook profit potential risk long calls The right to buy is called a call option and the right to sell is. Options trading might sound complex, but there are basic strategies that most investors can use to improve returns, bet on the market's movement, or hedge existing. You must know the structure of options, how.

Options Greeks Cheat Sheet 4 Greeks Delta, Gamma, Theta, Vega

Option strategy price outlook volatility outlook profit potential risk long calls The right to buy is called a call option and the right to sell is. To start, you must have a cheat. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain.

Option Strategy Cheat Sheet PDF Greeks (Finance) Financial Economics

Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. Option strategy price outlook volatility outlook profit potential risk long calls The right to buy is called a call option and the right to sell is. Options trading might sound complex, but.

Option Strategy Cheat Sheet Two Free Downloads

Options trading might sound complex, but there are basic strategies that most investors can use to improve returns, bet on the market's movement, or hedge existing. You must know the structure of options, how to analyze options greeks, and ultimately, how to trade the markets using options strategies. The right to buy is called a call option and the right.

You Must Know The Structure Of Options, How To Analyze Options Greeks, And Ultimately, How To Trade The Markets Using Options Strategies.

To start, you must have a cheat. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. The right to buy is called a call option and the right to sell is. Option strategy price outlook volatility outlook profit potential risk long calls

![Options Strategies Cheat Sheet [FREE Download] How to Trade](https://howtotrade.com/wp-content/uploads/2023/02/options-strategy-cheat-sheet-1170x827.png)