Proceeds From Issuance Of Long Term Debt

Proceeds From Issuance Of Long Term Debt - The company can raise capital. Gasb 65 paragraph 15, eliminates the amortization of issuance costs, except for prepaid insurance. Upon issuance, the issuer recognizes a liability equal to the proceeds (e.g., cash) received, less any allocation of proceeds to other instruments issued. In a nutshell, we can say that cash flow from financing activities reports the issuance and repurchase of the company’s bonds and stock.

The company can raise capital. Upon issuance, the issuer recognizes a liability equal to the proceeds (e.g., cash) received, less any allocation of proceeds to other instruments issued. Gasb 65 paragraph 15, eliminates the amortization of issuance costs, except for prepaid insurance. In a nutshell, we can say that cash flow from financing activities reports the issuance and repurchase of the company’s bonds and stock.

The company can raise capital. Gasb 65 paragraph 15, eliminates the amortization of issuance costs, except for prepaid insurance. Upon issuance, the issuer recognizes a liability equal to the proceeds (e.g., cash) received, less any allocation of proceeds to other instruments issued. In a nutshell, we can say that cash flow from financing activities reports the issuance and repurchase of the company’s bonds and stock.

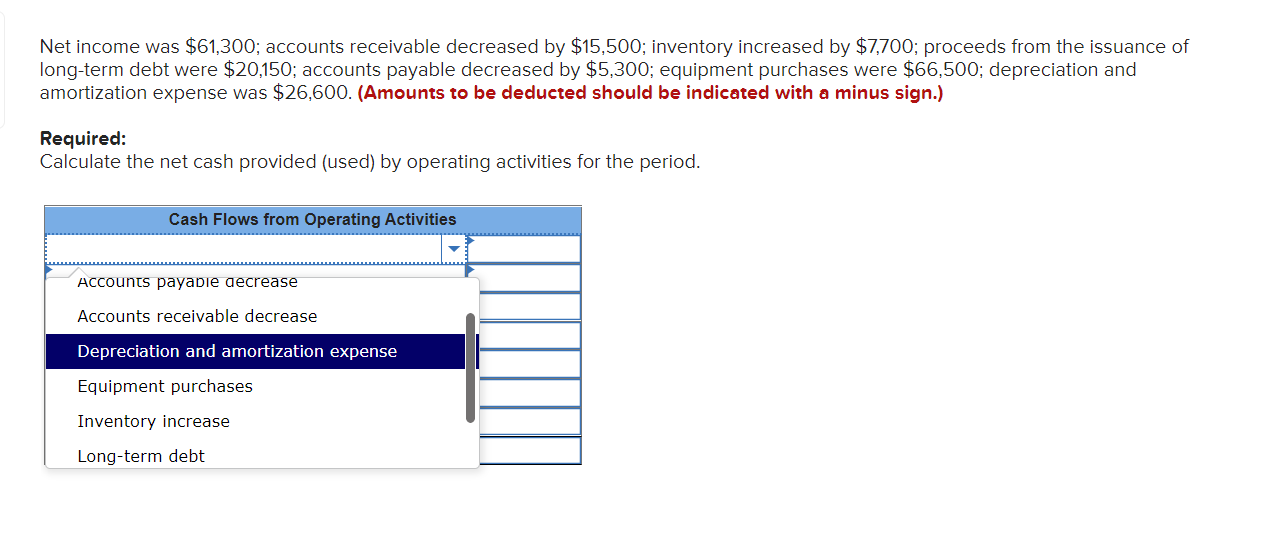

Solved Net was 61,300; accounts receivable decreased

Gasb 65 paragraph 15, eliminates the amortization of issuance costs, except for prepaid insurance. In a nutshell, we can say that cash flow from financing activities reports the issuance and repurchase of the company’s bonds and stock. The company can raise capital. Upon issuance, the issuer recognizes a liability equal to the proceeds (e.g., cash) received, less any allocation of.

Goldman, Sachs & Co. Controllers University Capital Markets Curriculum

Upon issuance, the issuer recognizes a liability equal to the proceeds (e.g., cash) received, less any allocation of proceeds to other instruments issued. The company can raise capital. In a nutshell, we can say that cash flow from financing activities reports the issuance and repurchase of the company’s bonds and stock. Gasb 65 paragraph 15, eliminates the amortization of issuance.

Solved 1. Dunkin Company provided the following information during the

In a nutshell, we can say that cash flow from financing activities reports the issuance and repurchase of the company’s bonds and stock. Gasb 65 paragraph 15, eliminates the amortization of issuance costs, except for prepaid insurance. The company can raise capital. Upon issuance, the issuer recognizes a liability equal to the proceeds (e.g., cash) received, less any allocation of.

YOUR ANNUAL FINANCIAL STATEMENTS WHAT TO LOOK FOR AND HOW TO LOOK FOR

In a nutshell, we can say that cash flow from financing activities reports the issuance and repurchase of the company’s bonds and stock. Gasb 65 paragraph 15, eliminates the amortization of issuance costs, except for prepaid insurance. The company can raise capital. Upon issuance, the issuer recognizes a liability equal to the proceeds (e.g., cash) received, less any allocation of.

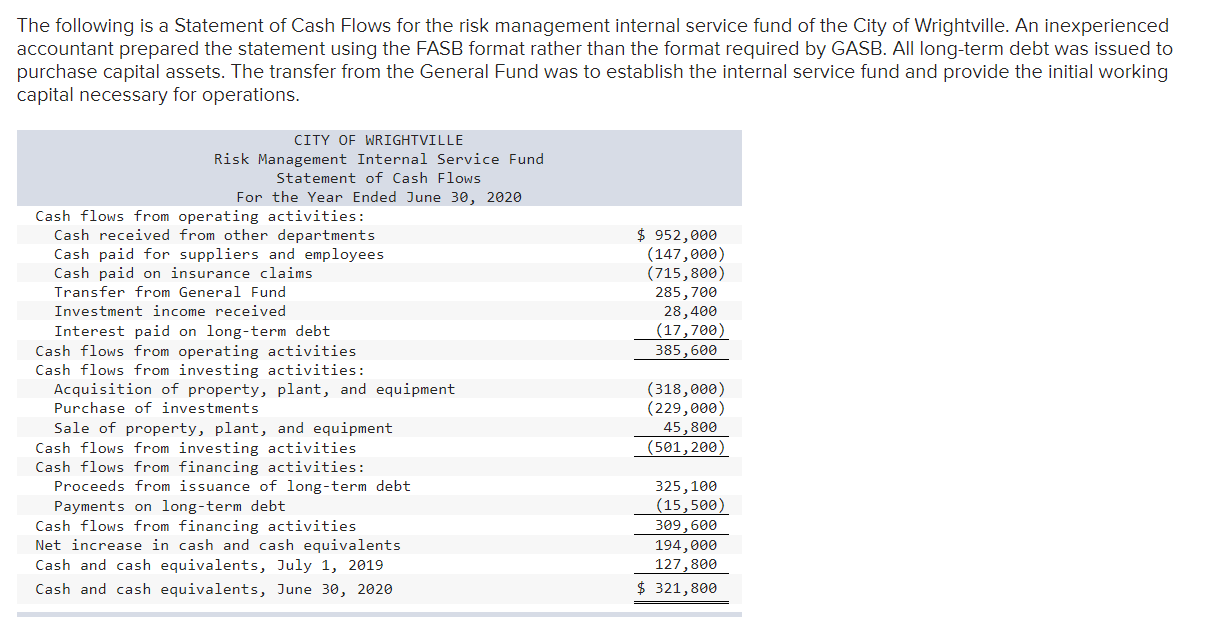

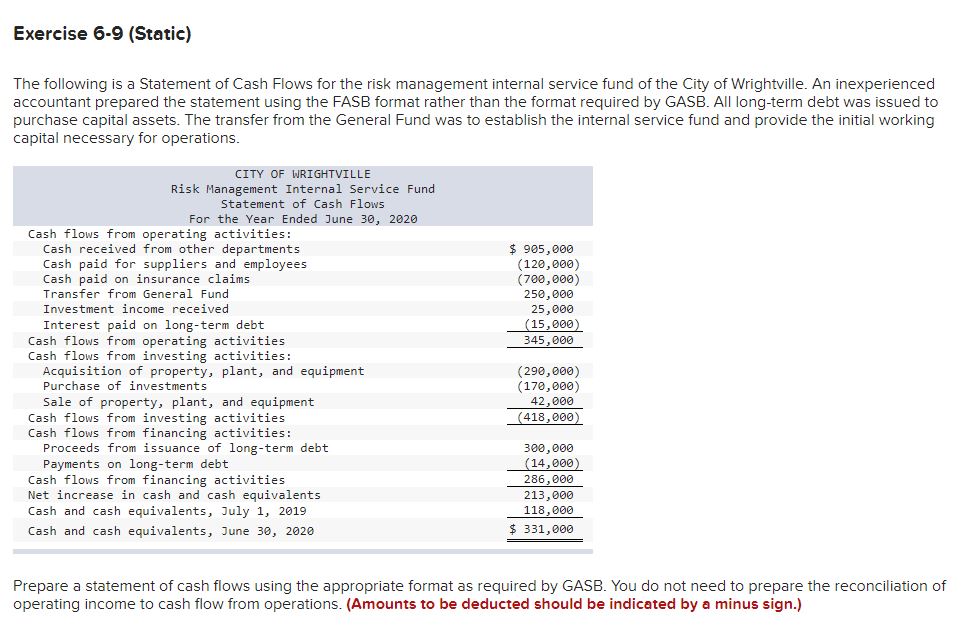

Solved The following is a Statement of Cash Flows for the

Gasb 65 paragraph 15, eliminates the amortization of issuance costs, except for prepaid insurance. In a nutshell, we can say that cash flow from financing activities reports the issuance and repurchase of the company’s bonds and stock. Upon issuance, the issuer recognizes a liability equal to the proceeds (e.g., cash) received, less any allocation of proceeds to other instruments issued..

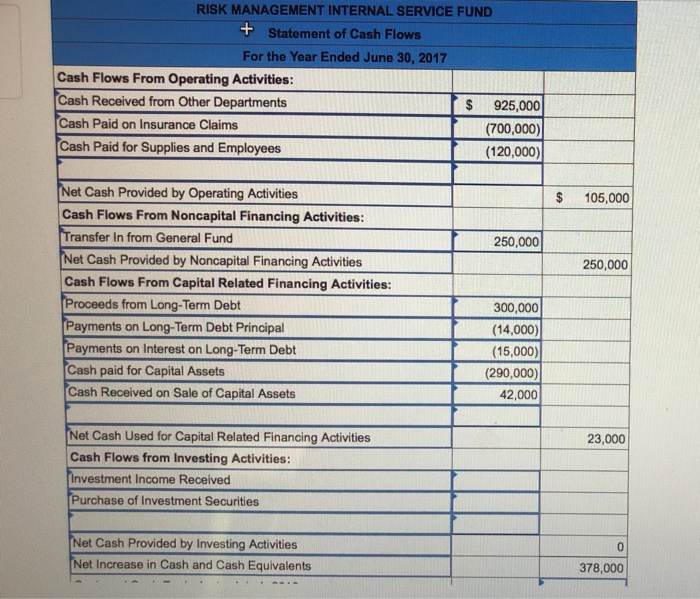

Solved The following is a Statementiof Cash Flows for the

Gasb 65 paragraph 15, eliminates the amortization of issuance costs, except for prepaid insurance. In a nutshell, we can say that cash flow from financing activities reports the issuance and repurchase of the company’s bonds and stock. The company can raise capital. Upon issuance, the issuer recognizes a liability equal to the proceeds (e.g., cash) received, less any allocation of.

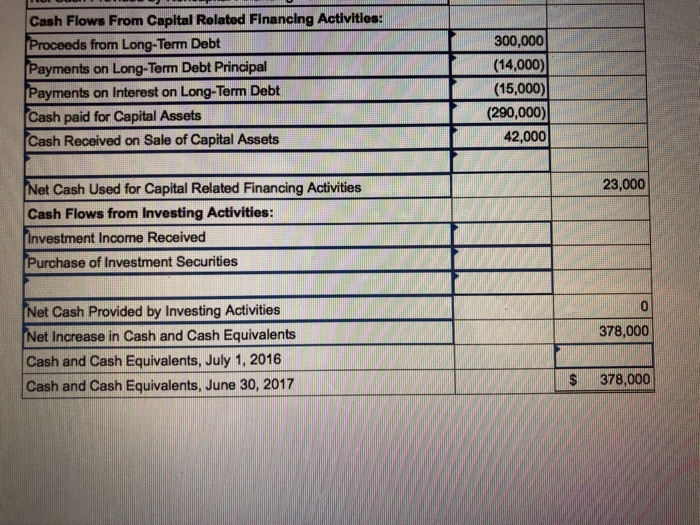

Solved The following is a Statementiof Cash Flows for the

The company can raise capital. Upon issuance, the issuer recognizes a liability equal to the proceeds (e.g., cash) received, less any allocation of proceeds to other instruments issued. In a nutshell, we can say that cash flow from financing activities reports the issuance and repurchase of the company’s bonds and stock. Gasb 65 paragraph 15, eliminates the amortization of issuance.

Solved The following is a Statement of Cash Flows for the

In a nutshell, we can say that cash flow from financing activities reports the issuance and repurchase of the company’s bonds and stock. The company can raise capital. Gasb 65 paragraph 15, eliminates the amortization of issuance costs, except for prepaid insurance. Upon issuance, the issuer recognizes a liability equal to the proceeds (e.g., cash) received, less any allocation of.

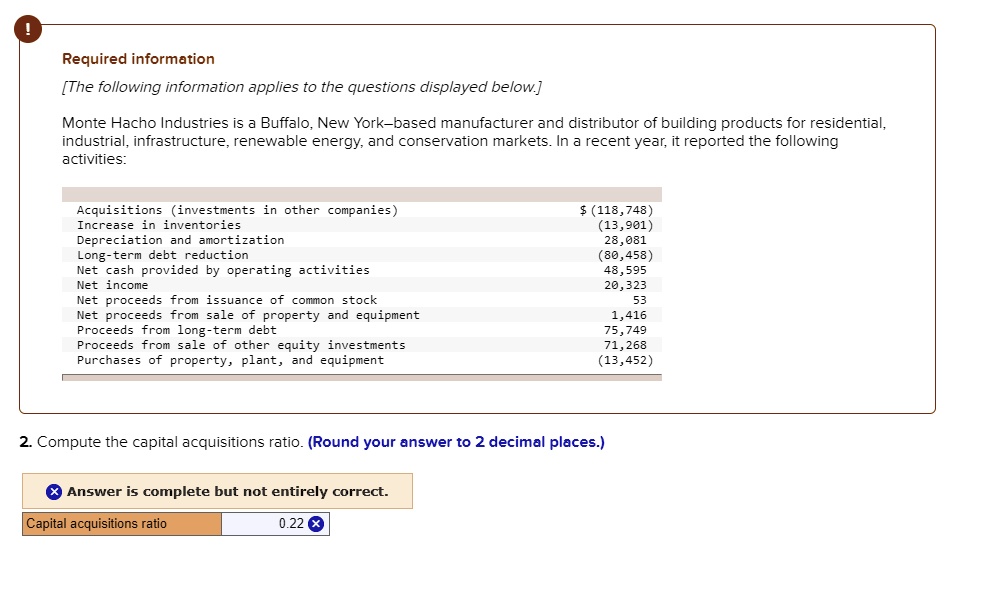

SOLVED Required information [The following information applies to the

In a nutshell, we can say that cash flow from financing activities reports the issuance and repurchase of the company’s bonds and stock. Upon issuance, the issuer recognizes a liability equal to the proceeds (e.g., cash) received, less any allocation of proceeds to other instruments issued. The company can raise capital. Gasb 65 paragraph 15, eliminates the amortization of issuance.

Long Term Liabilities

Upon issuance, the issuer recognizes a liability equal to the proceeds (e.g., cash) received, less any allocation of proceeds to other instruments issued. In a nutshell, we can say that cash flow from financing activities reports the issuance and repurchase of the company’s bonds and stock. The company can raise capital. Gasb 65 paragraph 15, eliminates the amortization of issuance.

In A Nutshell, We Can Say That Cash Flow From Financing Activities Reports The Issuance And Repurchase Of The Company’s Bonds And Stock.

The company can raise capital. Gasb 65 paragraph 15, eliminates the amortization of issuance costs, except for prepaid insurance. Upon issuance, the issuer recognizes a liability equal to the proceeds (e.g., cash) received, less any allocation of proceeds to other instruments issued.

:max_bytes(150000):strip_icc()/Long-TermDebt-FINAL-78bb33e797684e6d85085b02a68ed204.png)