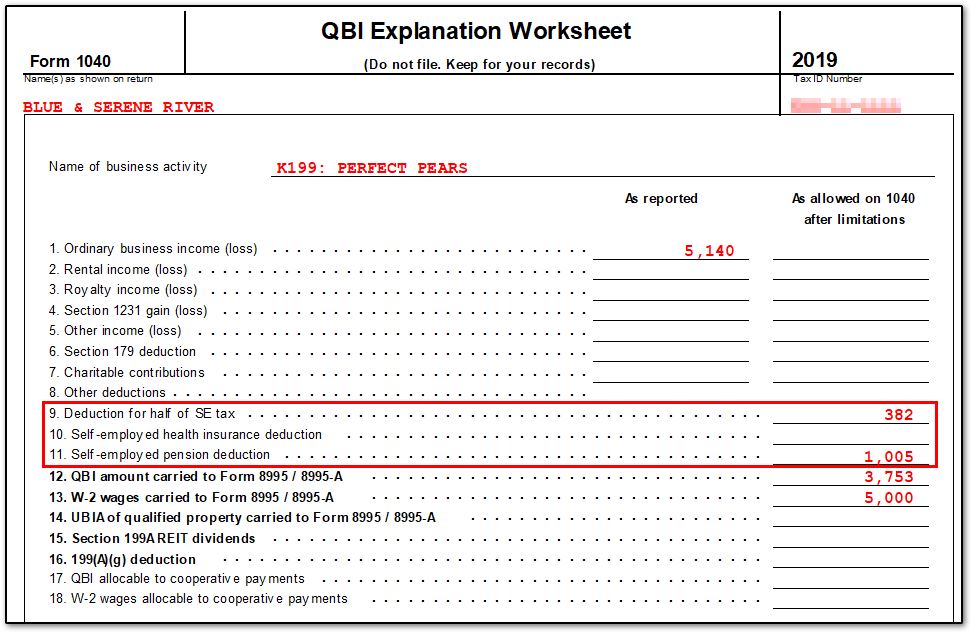

Qbi Deduction Form

Qbi Deduction Form - The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and. Individual taxpayers and some trusts and estates may be entitled to a. Use form 8995 to figure your qualified business income (qbi) deduction. Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on.

Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on. Individual taxpayers and some trusts and estates may be entitled to a. Use form 8995 to figure your qualified business income (qbi) deduction. The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and.

Use form 8995 to figure your qualified business income (qbi) deduction. Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on. Individual taxpayers and some trusts and estates may be entitled to a. The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and.

What Is the Qualified Business Deduction (QBI), and Can You

The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and. Individual taxpayers and some trusts and estates may be entitled to a. Use form 8995 to figure your qualified business income (qbi) deduction. Information about form 8995, qualified business income deduction simplified computation, including.

QBI Deduction Frequently Asked Questions (K1, QBI, ScheduleC

Individual taxpayers and some trusts and estates may be entitled to a. Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on. Use form 8995 to figure your qualified business income (qbi) deduction. The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified.

IRS Form 8995 Get The Qualified Business Deduction, 45 OFF

Use form 8995 to figure your qualified business income (qbi) deduction. Individual taxpayers and some trusts and estates may be entitled to a. Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on. The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified.

What you need to know about the QBI deduction

Use form 8995 to figure your qualified business income (qbi) deduction. The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and. Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on. Individual taxpayers and some trusts.

Irs Form 199a Deduction Worksheet

Individual taxpayers and some trusts and estates may be entitled to a. The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and. Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on. Use form 8995 to.

QBI Deduction What It Is, Who Qualifies & How to Take It Hourly, Inc.

Use form 8995 to figure your qualified business income (qbi) deduction. The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and. Individual taxpayers and some trusts and estates may be entitled to a. Information about form 8995, qualified business income deduction simplified computation, including.

Can qbi be investment

Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on. The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and. Individual taxpayers and some trusts and estates may be entitled to a. Use form 8995 to.

Qbi Calculation Worksheet Printable Word Searches

Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on. Use form 8995 to figure your qualified business income (qbi) deduction. The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and. Individual taxpayers and some trusts.

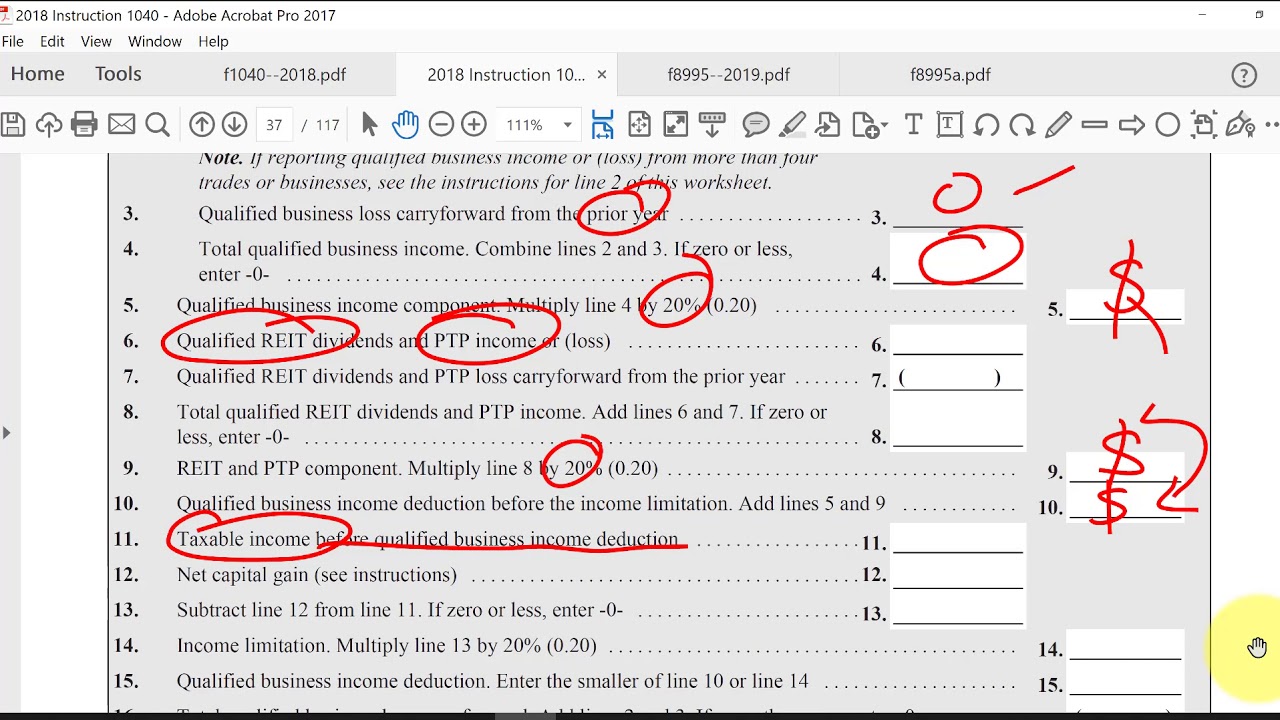

QBI Deduction (simplified calculation) YouTube

Use form 8995 to figure your qualified business income (qbi) deduction. The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and. Individual taxpayers and some trusts and estates may be entitled to a. Information about form 8995, qualified business income deduction simplified computation, including.

8895 Form Fill Online, Printable, Fillable, Blank PdfFiller, 40 OFF

The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and. Individual taxpayers and some trusts and estates may be entitled to a. Use form 8995 to figure your qualified business income (qbi) deduction. Information about form 8995, qualified business income deduction simplified computation, including.

Information About Form 8995, Qualified Business Income Deduction Simplified Computation, Including Recent Updates, Related Forms And Instructions On.

The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and. Use form 8995 to figure your qualified business income (qbi) deduction. Individual taxpayers and some trusts and estates may be entitled to a.