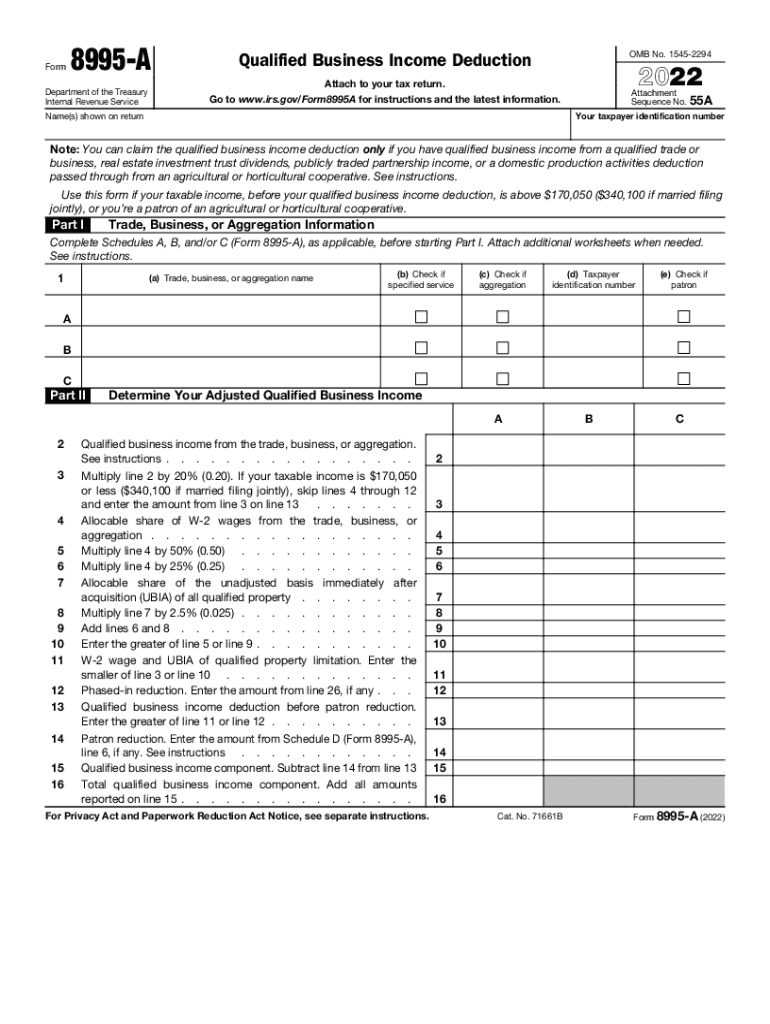

Qualified Business Income Deduction Form

Qualified Business Income Deduction Form - The qualified business income deduction (qbi) lowers the tax rate on qualified business income. Use form 8995 to calculate your deduction for qualified business income (qbi) based on your taxable income. Use form 8995 to figure your qualified business income (qbi) deduction. Individual taxpayers and some trusts and estates may be entitled to a. Find out who is eligible, what qualifies as qbi, and how to. It's calculated using form 8995. Learn how to claim the qbi deduction for tax years beginning after december 31, 2017.

Use form 8995 to figure your qualified business income (qbi) deduction. Use form 8995 to calculate your deduction for qualified business income (qbi) based on your taxable income. The qualified business income deduction (qbi) lowers the tax rate on qualified business income. Find out who is eligible, what qualifies as qbi, and how to. Learn how to claim the qbi deduction for tax years beginning after december 31, 2017. It's calculated using form 8995. Individual taxpayers and some trusts and estates may be entitled to a.

Individual taxpayers and some trusts and estates may be entitled to a. The qualified business income deduction (qbi) lowers the tax rate on qualified business income. Use form 8995 to figure your qualified business income (qbi) deduction. Find out who is eligible, what qualifies as qbi, and how to. It's calculated using form 8995. Learn how to claim the qbi deduction for tax years beginning after december 31, 2017. Use form 8995 to calculate your deduction for qualified business income (qbi) based on your taxable income.

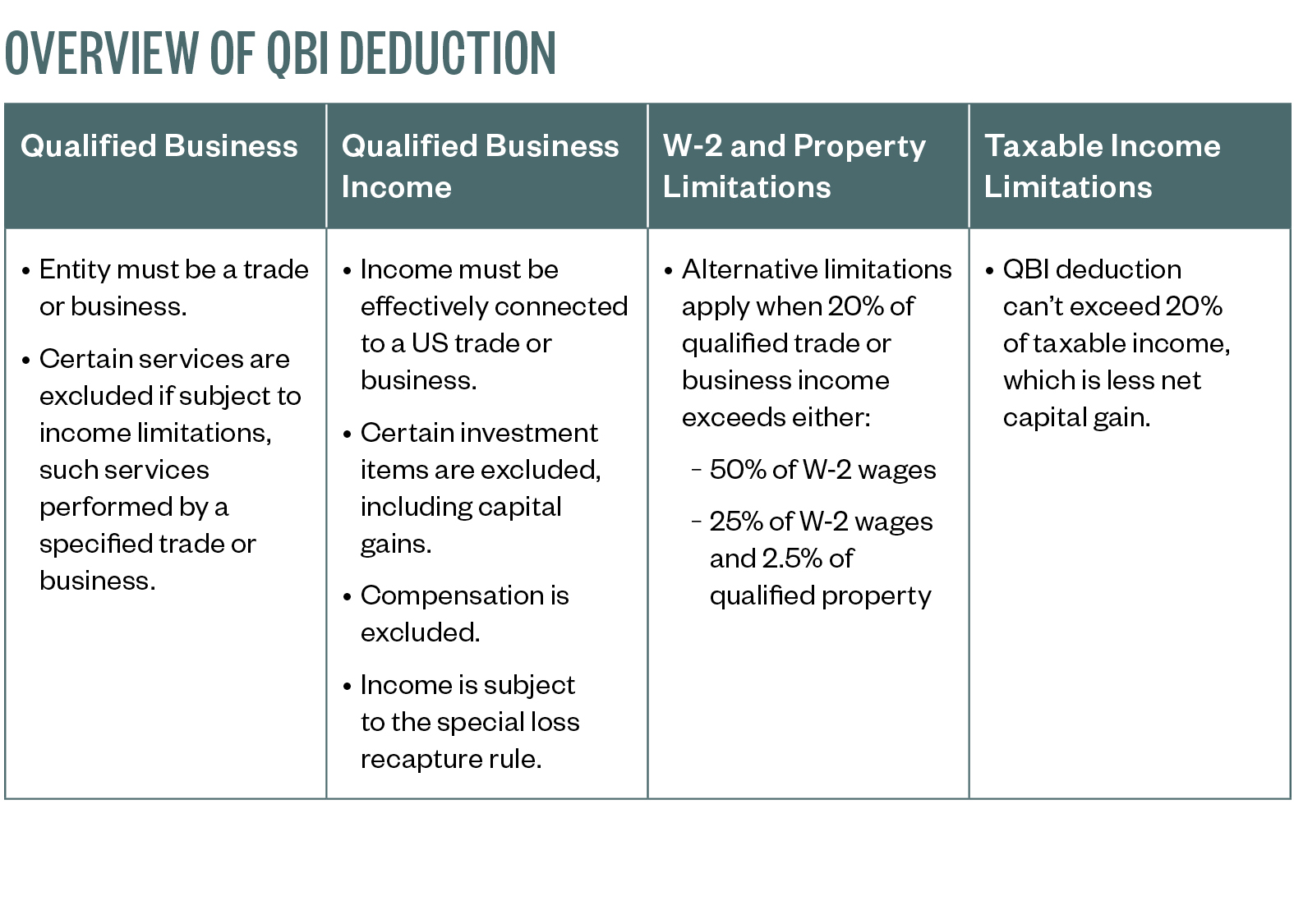

Do I Qualify for the Qualified Business (QBI) Deduction? Alloy

It's calculated using form 8995. The qualified business income deduction (qbi) lowers the tax rate on qualified business income. Find out who is eligible, what qualifies as qbi, and how to. Use form 8995 to calculate your deduction for qualified business income (qbi) based on your taxable income. Learn how to claim the qbi deduction for tax years beginning after.

Irs 8995 a 20222024 Form Fill Out and Sign Printable PDF Template

The qualified business income deduction (qbi) lowers the tax rate on qualified business income. Individual taxpayers and some trusts and estates may be entitled to a. Use form 8995 to figure your qualified business income (qbi) deduction. Learn how to claim the qbi deduction for tax years beginning after december 31, 2017. Use form 8995 to calculate your deduction for.

IRS Form 8995 Get The Qualified Business Deduction, 45 OFF

Learn how to claim the qbi deduction for tax years beginning after december 31, 2017. Use form 8995 to figure your qualified business income (qbi) deduction. It's calculated using form 8995. Individual taxpayers and some trusts and estates may be entitled to a. Find out who is eligible, what qualifies as qbi, and how to.

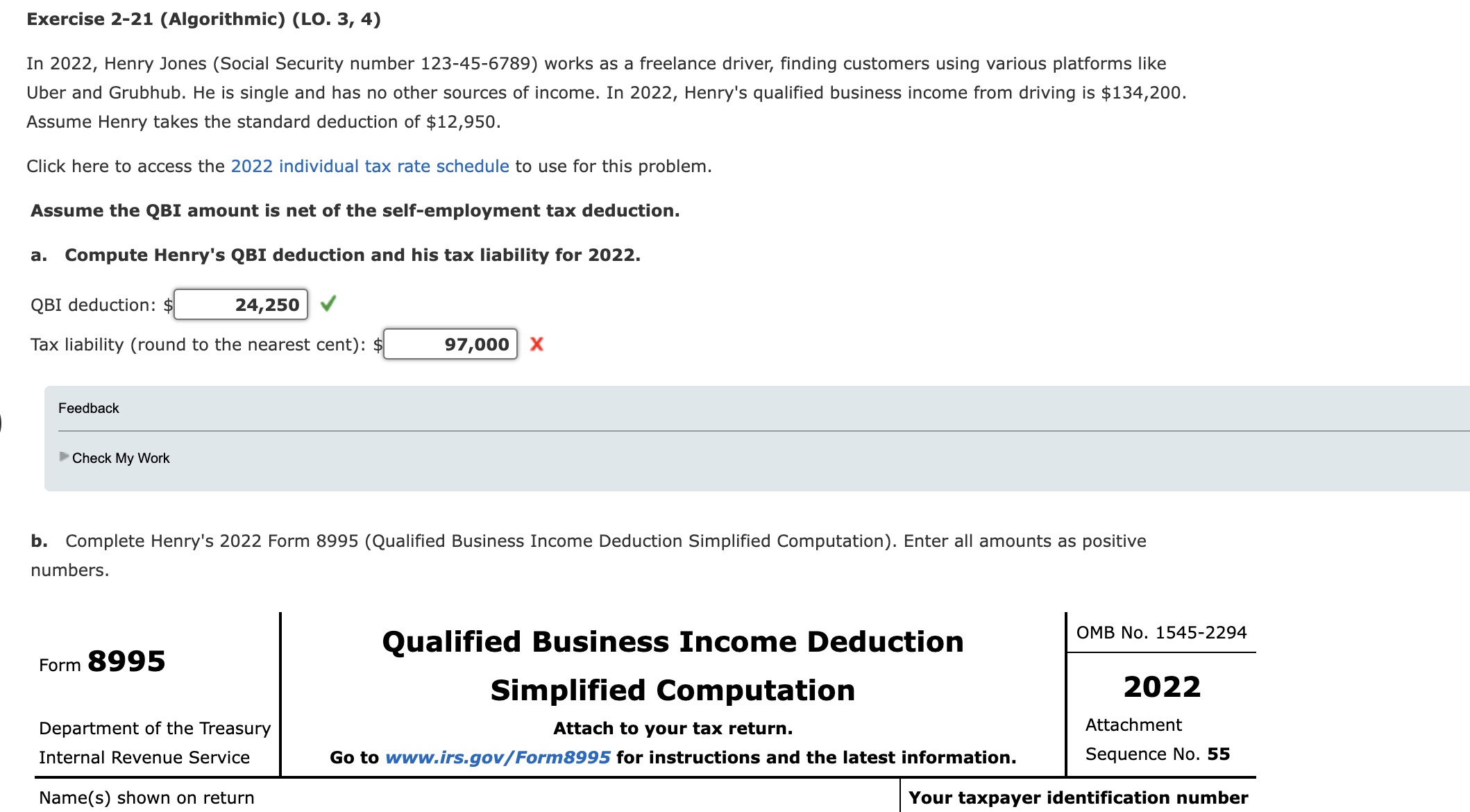

b. Henry's 2022 Form 8995 (Qualified

Find out who is eligible, what qualifies as qbi, and how to. Learn how to claim the qbi deduction for tax years beginning after december 31, 2017. Use form 8995 to figure your qualified business income (qbi) deduction. The qualified business income deduction (qbi) lowers the tax rate on qualified business income. It's calculated using form 8995.

What Is The Deduction For Qualified Business businesser

Find out who is eligible, what qualifies as qbi, and how to. The qualified business income deduction (qbi) lowers the tax rate on qualified business income. Learn how to claim the qbi deduction for tax years beginning after december 31, 2017. Use form 8995 to calculate your deduction for qualified business income (qbi) based on your taxable income. It's calculated.

Form 8995a Qualified Business Deduction Phrase on the Sheet

The qualified business income deduction (qbi) lowers the tax rate on qualified business income. Learn how to claim the qbi deduction for tax years beginning after december 31, 2017. Use form 8995 to calculate your deduction for qualified business income (qbi) based on your taxable income. Individual taxpayers and some trusts and estates may be entitled to a. It's calculated.

How to use the new Qualified Business Deduction Worksheet for

Use form 8995 to calculate your deduction for qualified business income (qbi) based on your taxable income. Learn how to claim the qbi deduction for tax years beginning after december 31, 2017. Individual taxpayers and some trusts and estates may be entitled to a. The qualified business income deduction (qbi) lowers the tax rate on qualified business income. Find out.

What Is IRS Form 8995, Qualified Business Deduction? The Ray Group

Individual taxpayers and some trusts and estates may be entitled to a. Use form 8995 to calculate your deduction for qualified business income (qbi) based on your taxable income. Use form 8995 to figure your qualified business income (qbi) deduction. Learn how to claim the qbi deduction for tax years beginning after december 31, 2017. It's calculated using form 8995.

How to enter and calculate the qualified business deduction

Use form 8995 to figure your qualified business income (qbi) deduction. Learn how to claim the qbi deduction for tax years beginning after december 31, 2017. It's calculated using form 8995. Find out who is eligible, what qualifies as qbi, and how to. Use form 8995 to calculate your deduction for qualified business income (qbi) based on your taxable income.

Form 8995 Qualified Business Deduction Simplified Computation

Individual taxpayers and some trusts and estates may be entitled to a. Find out who is eligible, what qualifies as qbi, and how to. Use form 8995 to figure your qualified business income (qbi) deduction. Use form 8995 to calculate your deduction for qualified business income (qbi) based on your taxable income. Learn how to claim the qbi deduction for.

Find Out Who Is Eligible, What Qualifies As Qbi, And How To.

Use form 8995 to calculate your deduction for qualified business income (qbi) based on your taxable income. Individual taxpayers and some trusts and estates may be entitled to a. Use form 8995 to figure your qualified business income (qbi) deduction. Learn how to claim the qbi deduction for tax years beginning after december 31, 2017.

The Qualified Business Income Deduction (Qbi) Lowers The Tax Rate On Qualified Business Income.

It's calculated using form 8995.