Qualified Business Income Deduction

Qualified Business Income Deduction - Use form 8995 to figure your qualified business income (qbi) deduction. The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified publicly traded.

The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified publicly traded. Use form 8995 to figure your qualified business income (qbi) deduction.

Use form 8995 to figure your qualified business income (qbi) deduction. The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified publicly traded.

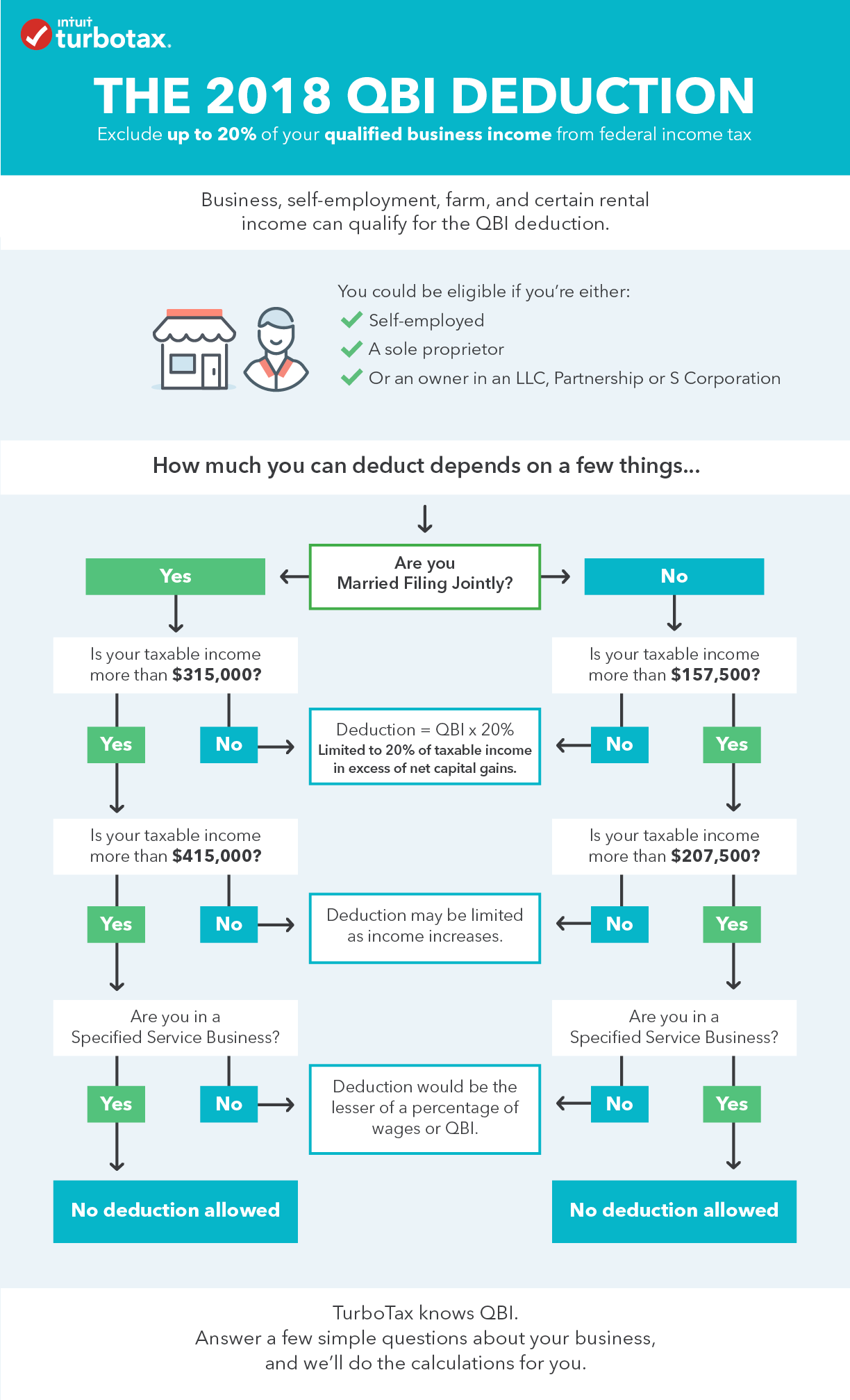

Do I qualify for the qualified business TurboTax® Support

The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified publicly traded. Use form 8995 to figure your qualified business income (qbi) deduction.

Do I Qualify for the Qualified Business (QBI) Deduction? Alloy

The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified publicly traded. Use form 8995 to figure your qualified business income (qbi) deduction.

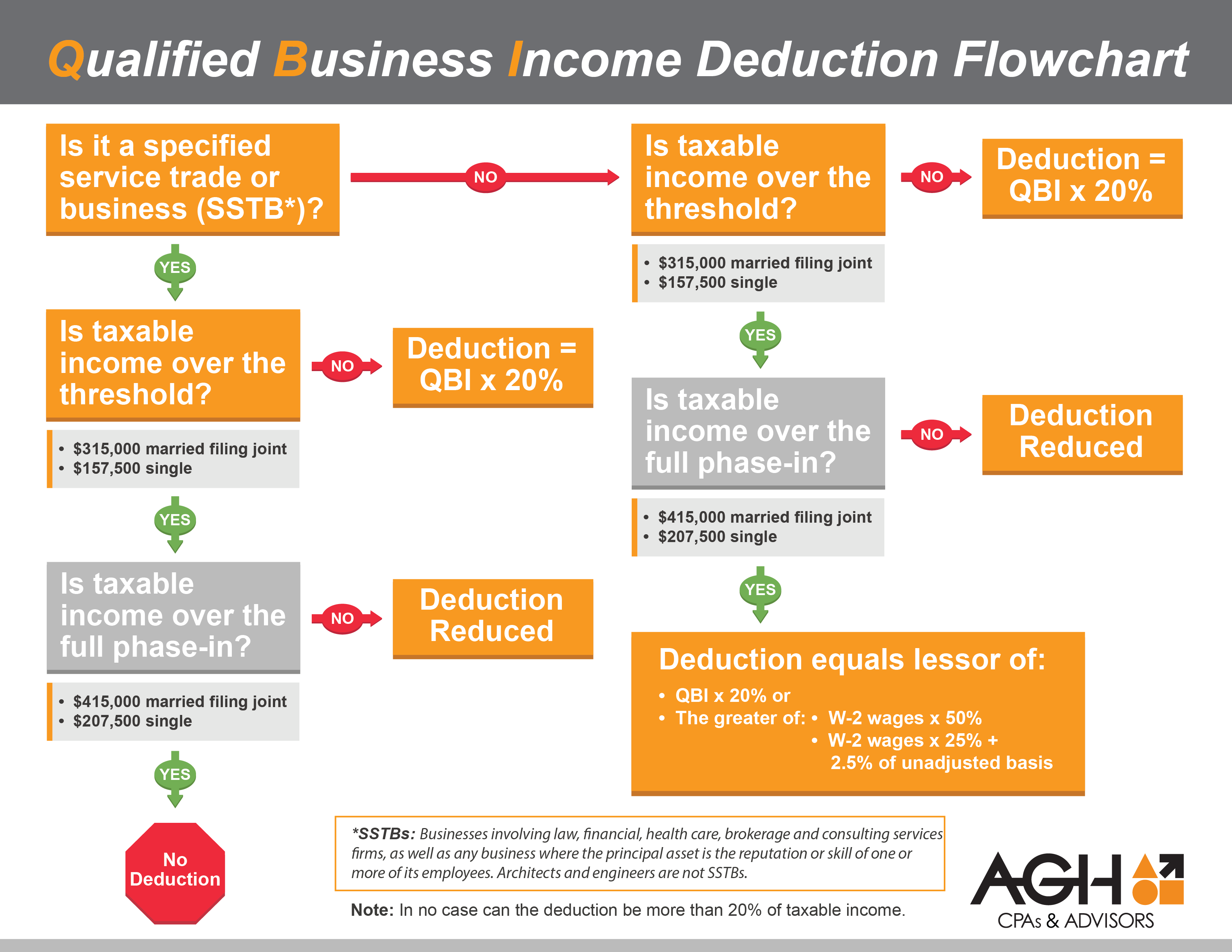

Qualified Business Deduction Flowchart

The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified publicly traded. Use form 8995 to figure your qualified business income (qbi) deduction.

Qualified Business Deduction Flowchart

Use form 8995 to figure your qualified business income (qbi) deduction. The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified publicly traded.

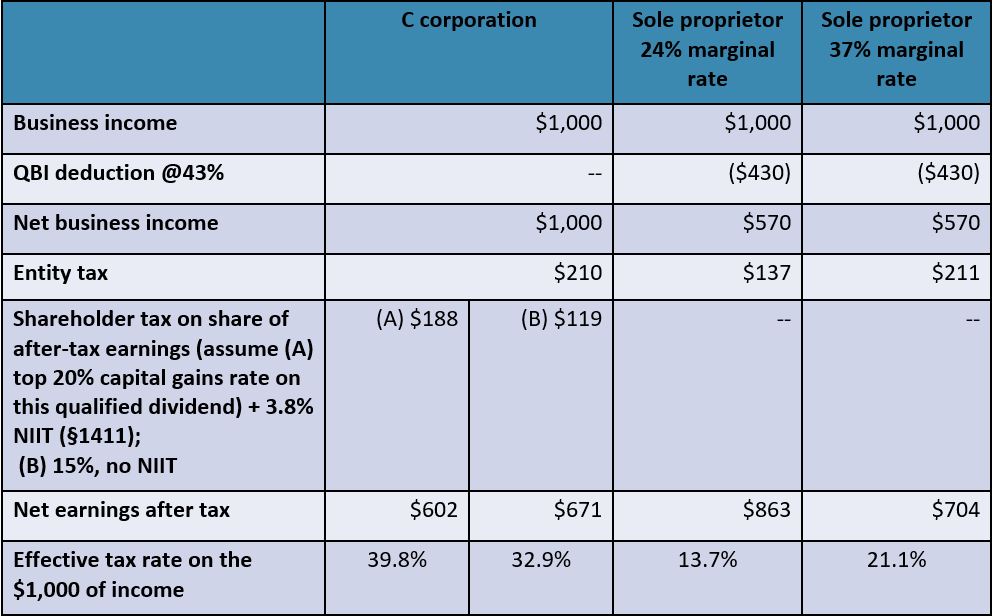

Qualified Business Deduction And The SelfEmployed, 44 OFF

The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified publicly traded. Use form 8995 to figure your qualified business income (qbi) deduction.

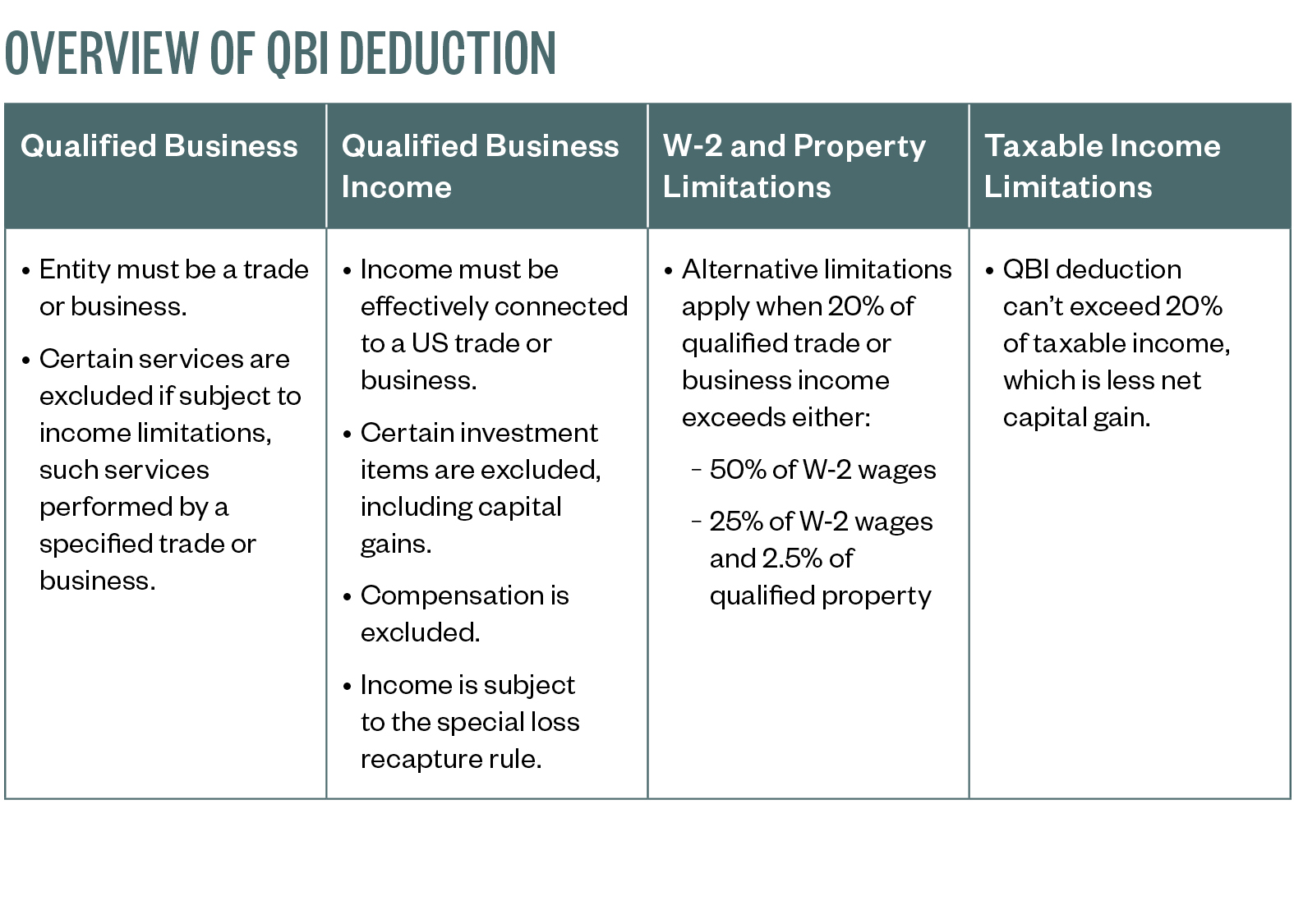

Qualified Business Deduction 2024 Prudi Carlotta

Use form 8995 to figure your qualified business income (qbi) deduction. The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified publicly traded.

Qualified Business Deduction And The SelfEmployed, 44 OFF

Use form 8995 to figure your qualified business income (qbi) deduction. The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified publicly traded.

How to enter and calculate the qualified business deduction

Use form 8995 to figure your qualified business income (qbi) deduction. The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified publicly traded.

Qbi deduction calculator LoreneAleigha

The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified publicly traded. Use form 8995 to figure your qualified business income (qbi) deduction.

IRS Form 8995 Get The Qualified Business Deduction, 45 OFF

Use form 8995 to figure your qualified business income (qbi) deduction. The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified publicly traded.

The Deduction Allows Eligible Taxpayers To Deduct Up To 20 Percent Of Their Qbi, Plus 20 Percent Of Qualified Real Estate Investment Trust (Reit) Dividends And Qualified Publicly Traded.

Use form 8995 to figure your qualified business income (qbi) deduction.