Rates For Home Equity Loans

Rates For Home Equity Loans - A home equity loan is a second mortgage for a fixed amount at a fixed interest rate. The best home equity loan lenders offer a variety of repayment terms, low interest rates and few fees. Best home equity loan rates in december 2024. When you shop for a home equity loan, find out the annual percentage rate (apr). The amount you can borrow is based on the equity in your home, and you can. This reflects the interest rate, plus any points, fees or other charges you have to pay for the loan. Bankrate.com offers advice on home equity loans and lines of credit. Searching for home equity rates or advice? A home equity loan allows you to borrow a lump sum against your home's equity, usually at a fixed interest rate that’s lower than other forms of consumer debt.

Best home equity loan rates in december 2024. Searching for home equity rates or advice? The amount you can borrow is based on the equity in your home, and you can. A home equity loan allows you to borrow a lump sum against your home's equity, usually at a fixed interest rate that’s lower than other forms of consumer debt. When you shop for a home equity loan, find out the annual percentage rate (apr). This reflects the interest rate, plus any points, fees or other charges you have to pay for the loan. Bankrate.com offers advice on home equity loans and lines of credit. The best home equity loan lenders offer a variety of repayment terms, low interest rates and few fees. A home equity loan is a second mortgage for a fixed amount at a fixed interest rate.

A home equity loan allows you to borrow a lump sum against your home's equity, usually at a fixed interest rate that’s lower than other forms of consumer debt. This reflects the interest rate, plus any points, fees or other charges you have to pay for the loan. Bankrate.com offers advice on home equity loans and lines of credit. When you shop for a home equity loan, find out the annual percentage rate (apr). The best home equity loan lenders offer a variety of repayment terms, low interest rates and few fees. Best home equity loan rates in december 2024. A home equity loan is a second mortgage for a fixed amount at a fixed interest rate. The amount you can borrow is based on the equity in your home, and you can. Searching for home equity rates or advice?

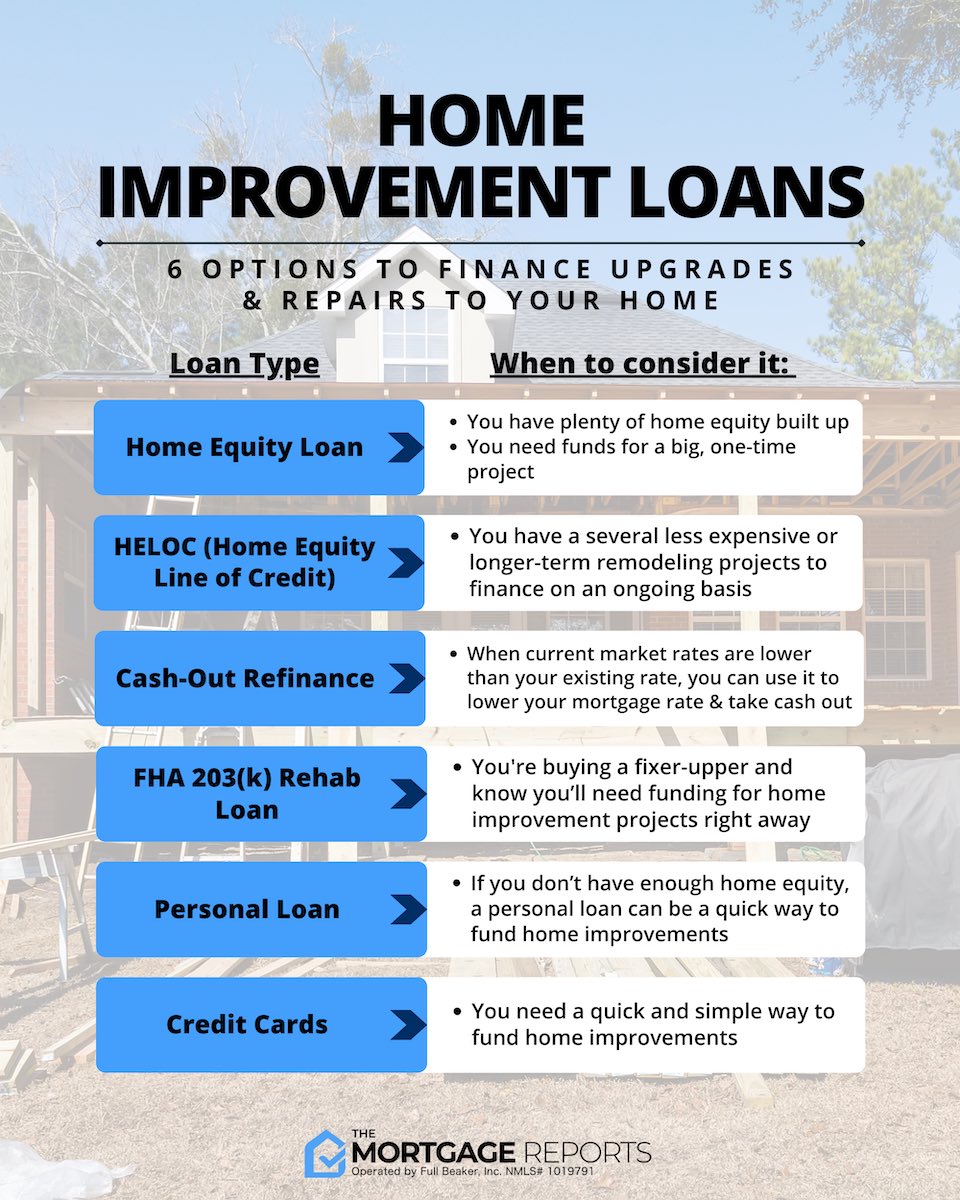

What are the pros and cons of pulling equity from your home? Leia aqui

Searching for home equity rates or advice? This reflects the interest rate, plus any points, fees or other charges you have to pay for the loan. The best home equity loan lenders offer a variety of repayment terms, low interest rates and few fees. A home equity loan allows you to borrow a lump sum against your home's equity, usually.

Home Equity Loans Which is the Best For You? I CentSai

This reflects the interest rate, plus any points, fees or other charges you have to pay for the loan. The best home equity loan lenders offer a variety of repayment terms, low interest rates and few fees. A home equity loan allows you to borrow a lump sum against your home's equity, usually at a fixed interest rate that’s lower.

200000 Home May Be Worth How Much In 5 Years Store head.hesge.ch

The amount you can borrow is based on the equity in your home, and you can. A home equity loan is a second mortgage for a fixed amount at a fixed interest rate. This reflects the interest rate, plus any points, fees or other charges you have to pay for the loan. A home equity loan allows you to borrow.

Is Now a Good Time for a Home Equity Loan? Integrity First Lending

Bankrate.com offers advice on home equity loans and lines of credit. Best home equity loan rates in december 2024. A home equity loan allows you to borrow a lump sum against your home's equity, usually at a fixed interest rate that’s lower than other forms of consumer debt. A home equity loan is a second mortgage for a fixed amount.

Home Equity Loan vs. Mortgage What's the Difference?

The amount you can borrow is based on the equity in your home, and you can. The best home equity loan lenders offer a variety of repayment terms, low interest rates and few fees. Searching for home equity rates or advice? When you shop for a home equity loan, find out the annual percentage rate (apr). A home equity loan.

Understanding Home Equity Loans

Searching for home equity rates or advice? The best home equity loan lenders offer a variety of repayment terms, low interest rates and few fees. When you shop for a home equity loan, find out the annual percentage rate (apr). This reflects the interest rate, plus any points, fees or other charges you have to pay for the loan. A.

Home Equity Loan vs. Line of Credit Cobalt Credit Union

Bankrate.com offers advice on home equity loans and lines of credit. The amount you can borrow is based on the equity in your home, and you can. When you shop for a home equity loan, find out the annual percentage rate (apr). A home equity loan allows you to borrow a lump sum against your home's equity, usually at a.

5 Tips For Choosing A Home Equity Loan In 2021 Best Finance Blog

This reflects the interest rate, plus any points, fees or other charges you have to pay for the loan. The best home equity loan lenders offer a variety of repayment terms, low interest rates and few fees. Bankrate.com offers advice on home equity loans and lines of credit. A home equity loan allows you to borrow a lump sum against.

Home Equity Line of Credit Loan Rates Finance Strategists

This reflects the interest rate, plus any points, fees or other charges you have to pay for the loan. A home equity loan allows you to borrow a lump sum against your home's equity, usually at a fixed interest rate that’s lower than other forms of consumer debt. Searching for home equity rates or advice? Bankrate.com offers advice on home.

What is the Interest Rate on a Home Equity Loan? Lionsgate Financial

The best home equity loan lenders offer a variety of repayment terms, low interest rates and few fees. A home equity loan allows you to borrow a lump sum against your home's equity, usually at a fixed interest rate that’s lower than other forms of consumer debt. A home equity loan is a second mortgage for a fixed amount at.

A Home Equity Loan Is A Second Mortgage For A Fixed Amount At A Fixed Interest Rate.

Searching for home equity rates or advice? The amount you can borrow is based on the equity in your home, and you can. The best home equity loan lenders offer a variety of repayment terms, low interest rates and few fees. This reflects the interest rate, plus any points, fees or other charges you have to pay for the loan.

Best Home Equity Loan Rates In December 2024.

A home equity loan allows you to borrow a lump sum against your home's equity, usually at a fixed interest rate that’s lower than other forms of consumer debt. When you shop for a home equity loan, find out the annual percentage rate (apr). Bankrate.com offers advice on home equity loans and lines of credit.

:max_bytes(150000):strip_icc()/homeequityloan-e11896bf4ac1475a9806a55f92e0c312.jpg)

:max_bytes(150000):strip_icc()/dotdash-mortgage-heloc-differences-Final-6e9607c933e9467ba4d676601497a330.jpg)