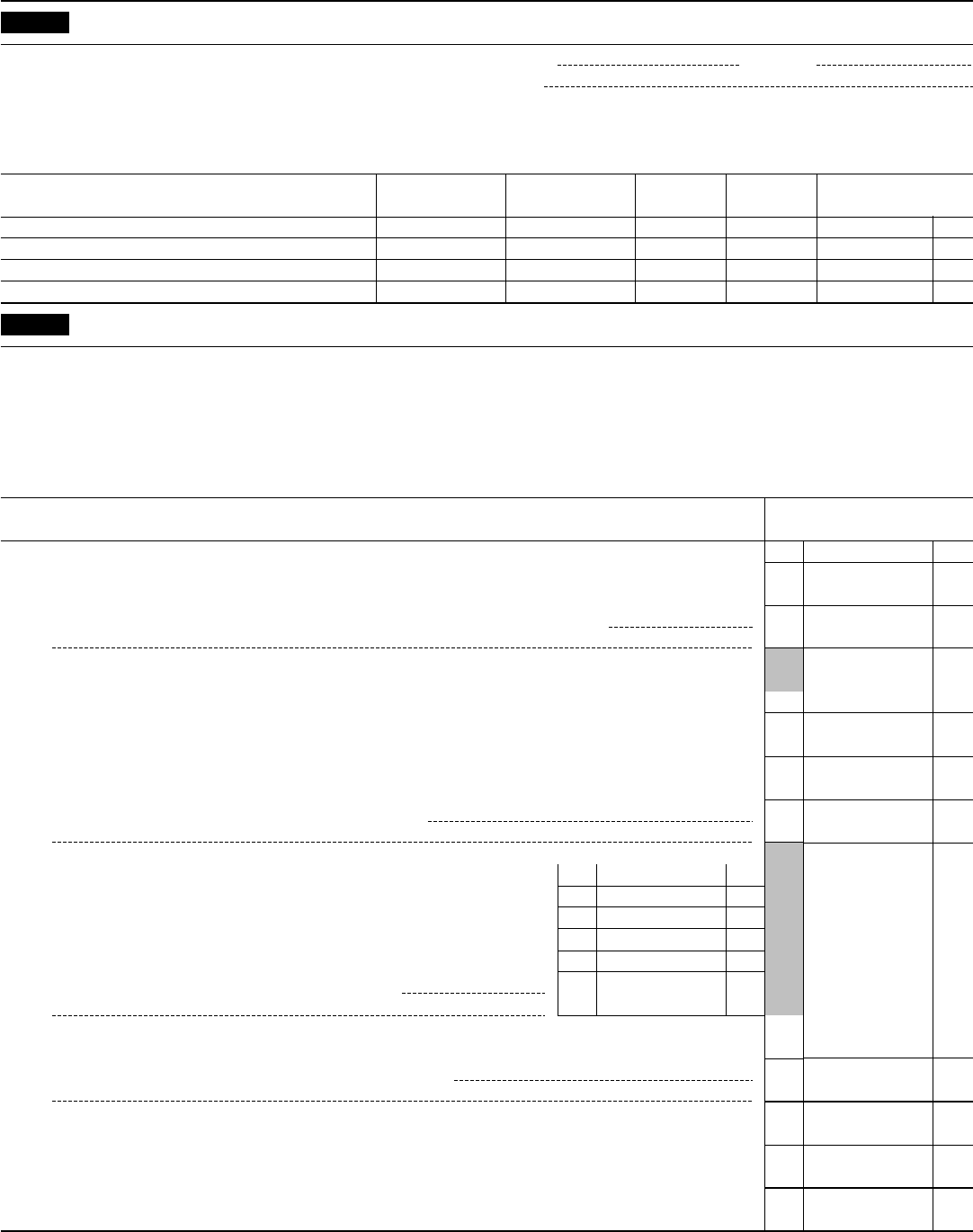

Sample Form 2555

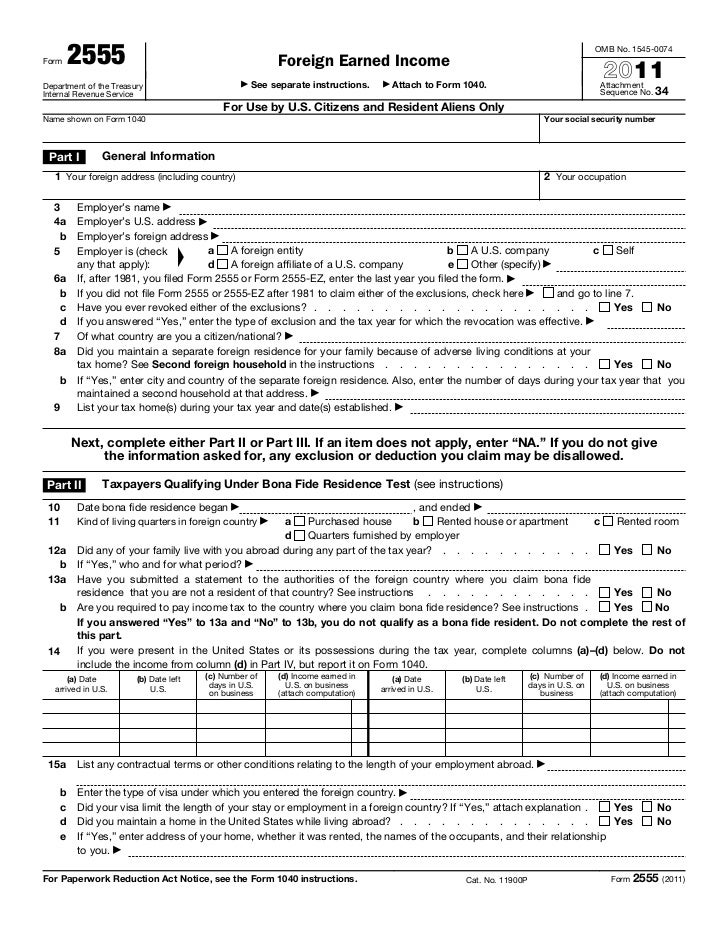

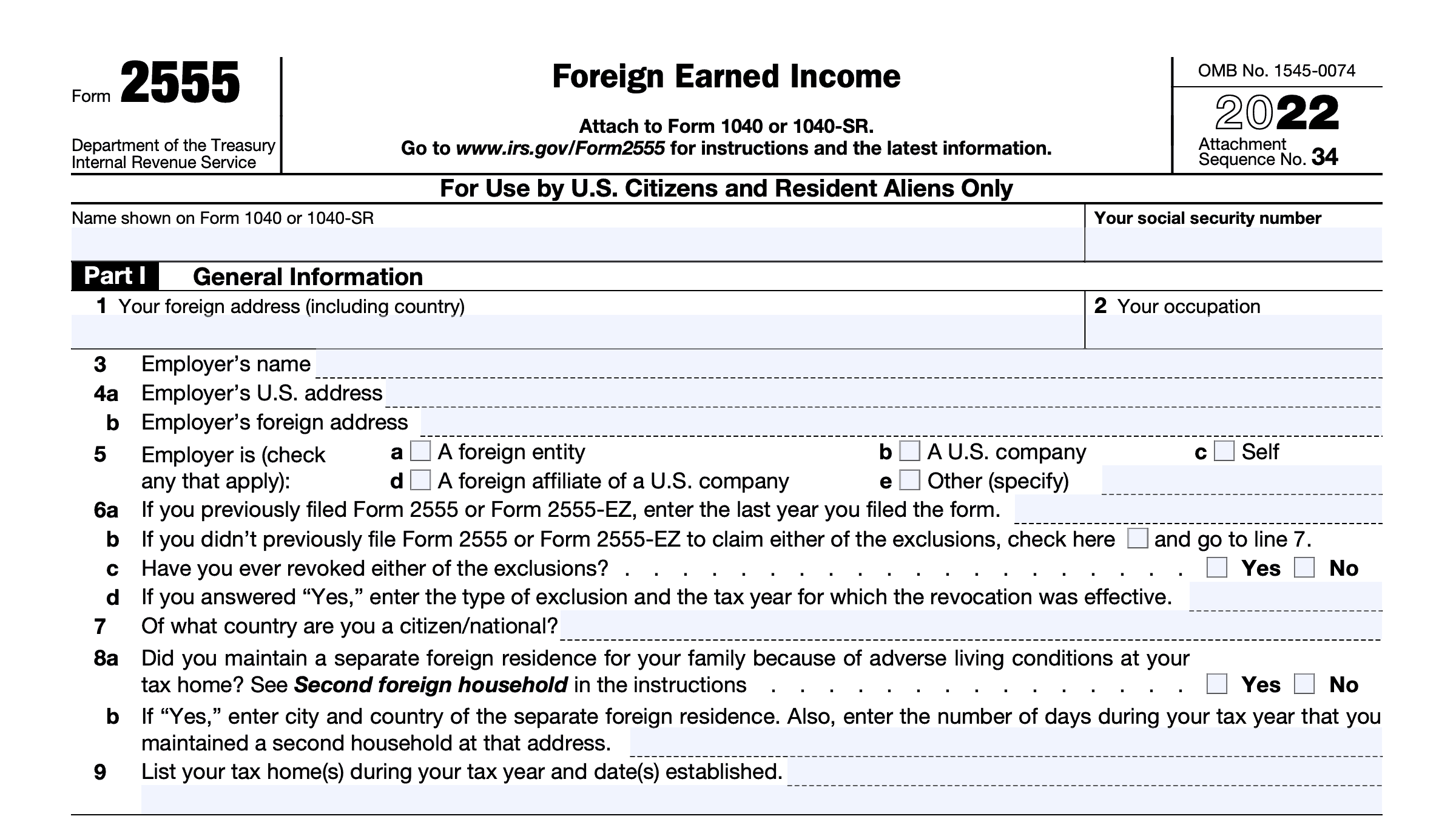

Sample Form 2555 - If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Irs form 2555 is an important tax form for u.s. With this form, you can claim the foreign earned. Citizens and resident aliens living abroad. Information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. The foreign earned income exclusion is claimed by filling out irs tax form 2555 and filing it along with your tax return.

Irs form 2555 is an important tax form for u.s. Information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. The foreign earned income exclusion is claimed by filling out irs tax form 2555 and filing it along with your tax return. Citizens and resident aliens living abroad. With this form, you can claim the foreign earned.

Information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Irs form 2555 is an important tax form for u.s. The foreign earned income exclusion is claimed by filling out irs tax form 2555 and filing it along with your tax return. Citizens and resident aliens living abroad. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. With this form, you can claim the foreign earned.

Publication 54 Tax Guide for U.S. Citizens and Resident Aliens Abroad

If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Irs form 2555 is an important tax form for u.s. Information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. With this form, you can claim the foreign earned. Citizens and.

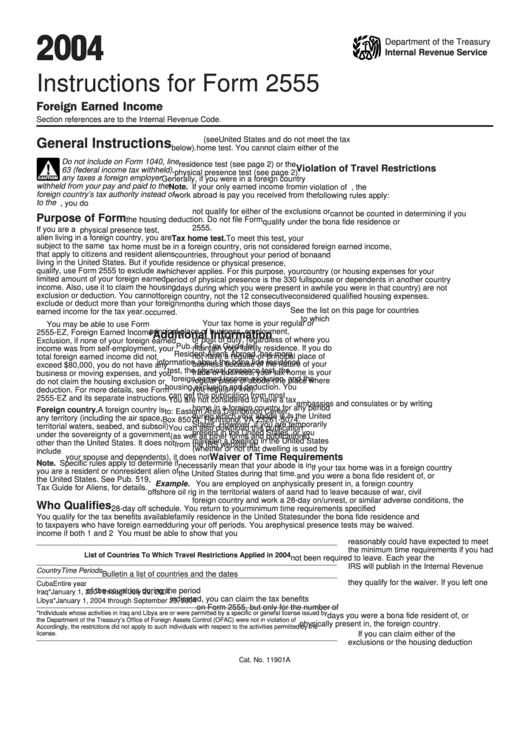

Instructions For Form 2555 printable pdf download

Information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Irs form 2555 is an important tax form for u.s. With this form, you can claim the foreign earned. The foreign.

US Tax Abroad Expatriate Form 2555

If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Irs form 2555 is an important tax form for u.s. With this form, you can claim the foreign earned. The foreign earned income exclusion is claimed by filling out irs tax form 2555 and filing it along with your.

Fillable Online Sample Of Form 2555 Sample Of Form

Irs form 2555 is an important tax form for u.s. With this form, you can claim the foreign earned. Citizens and resident aliens living abroad. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Information about form 2555, foreign earned income, including recent updates, related forms, and instructions.

Create any 1040 Form Online Instantly ThePayStubs Worksheets Library

Citizens and resident aliens living abroad. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. With this form, you can claim the foreign earned. Information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Irs form 2555 is an important.

Filing Form 2555 for the Foreign Earned Exclusion

Irs form 2555 is an important tax form for u.s. Citizens and resident aliens living abroad. The foreign earned income exclusion is claimed by filling out irs tax form 2555 and filing it along with your tax return. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Information.

Form 2555, Foreign Earned Exclusion YouTube

The foreign earned income exclusion is claimed by filling out irs tax form 2555 and filing it along with your tax return. With this form, you can claim the foreign earned. Citizens and resident aliens living abroad. Irs form 2555 is an important tax form for u.s. If you qualify, you can use form 2555 to figure your foreign earned.

Fillable Online Sample Of Form 2555 Sample Of

Citizens and resident aliens living abroad. Information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. With this form, you can claim the foreign earned. The foreign earned income exclusion is.

Form 2555 2023 Printable Forms Free Online

Irs form 2555 is an important tax form for u.s. Citizens and resident aliens living abroad. With this form, you can claim the foreign earned. The foreign earned income exclusion is claimed by filling out irs tax form 2555 and filing it along with your tax return. If you qualify, you can use form 2555 to figure your foreign earned.

Form 2555 Edit, Fill, Sign Online Handypdf

Information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. With this form, you can claim the foreign earned. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. The foreign earned income exclusion is claimed by filling out irs tax.

Irs Form 2555 Is An Important Tax Form For U.s.

Citizens and resident aliens living abroad. With this form, you can claim the foreign earned. The foreign earned income exclusion is claimed by filling out irs tax form 2555 and filing it along with your tax return. Information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file.