Schedule B 1040 Form

Schedule B 1040 Form - You had over $1,500 of taxable interest or ordinary dividends. You received interest from a. Schedule b is a form you file with your regular income tax return by april 15 (or. Use schedule b (form 1040) if any of the following applies. What is schedule b (form 1040) for?

You had over $1,500 of taxable interest or ordinary dividends. What is schedule b (form 1040) for? Schedule b is a form you file with your regular income tax return by april 15 (or. You received interest from a. Use schedule b (form 1040) if any of the following applies.

Use schedule b (form 1040) if any of the following applies. Schedule b is a form you file with your regular income tax return by april 15 (or. You had over $1,500 of taxable interest or ordinary dividends. What is schedule b (form 1040) for? You received interest from a.

Schedule B Printable Form Printable Forms Free Online

Use schedule b (form 1040) if any of the following applies. What is schedule b (form 1040) for? You had over $1,500 of taxable interest or ordinary dividends. You received interest from a. Schedule b is a form you file with your regular income tax return by april 15 (or.

Schedule b Fill out & sign online DocHub

You had over $1,500 of taxable interest or ordinary dividends. Schedule b is a form you file with your regular income tax return by april 15 (or. Use schedule b (form 1040) if any of the following applies. You received interest from a. What is schedule b (form 1040) for?

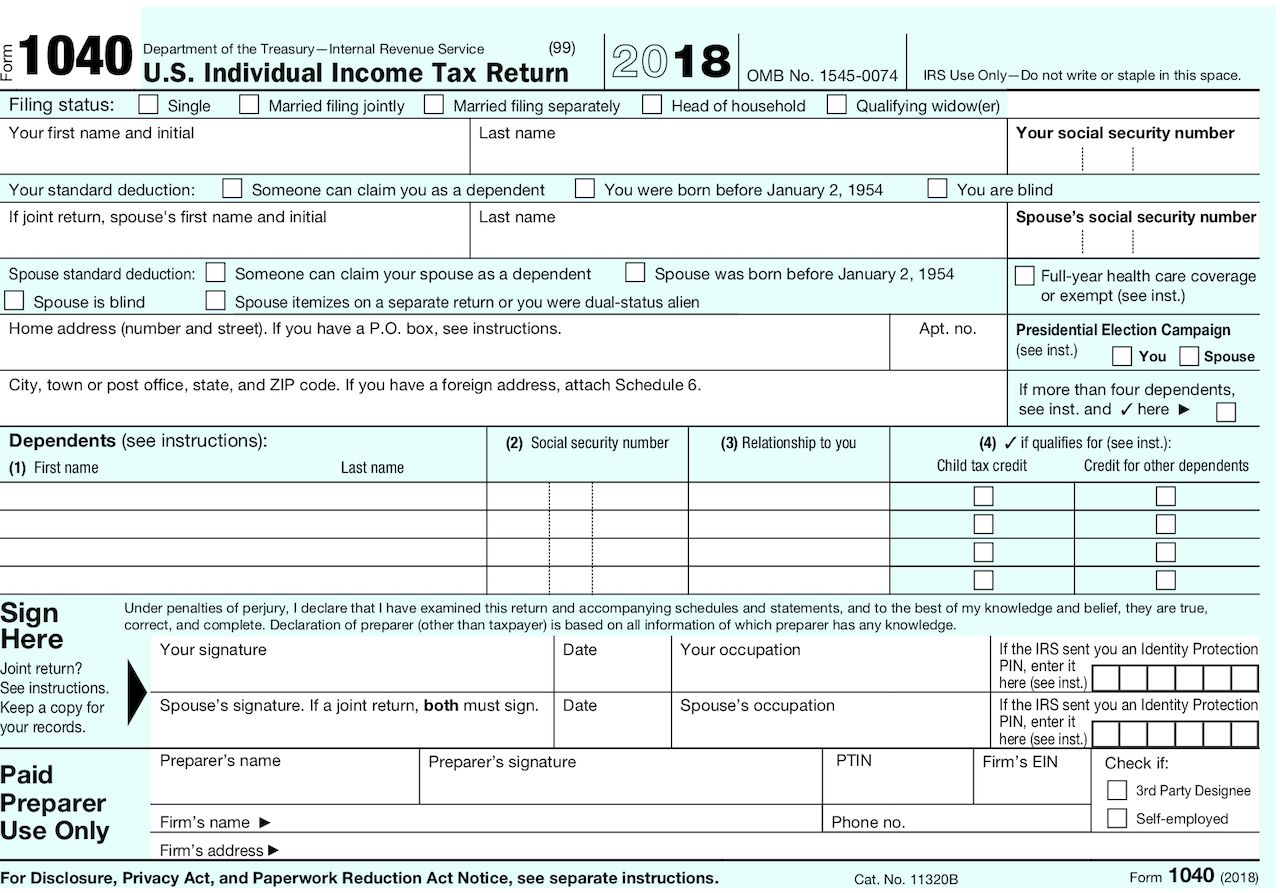

IRS Form 1040 (Schedule B) 2018 2019 Fill out and Edit Online PDF

Schedule b is a form you file with your regular income tax return by april 15 (or. What is schedule b (form 1040) for? Use schedule b (form 1040) if any of the following applies. You had over $1,500 of taxable interest or ordinary dividends. You received interest from a.

2023 Form 1040sr Printable Forms Free Online

Schedule b is a form you file with your regular income tax return by april 15 (or. What is schedule b (form 1040) for? You had over $1,500 of taxable interest or ordinary dividends. Use schedule b (form 1040) if any of the following applies. You received interest from a.

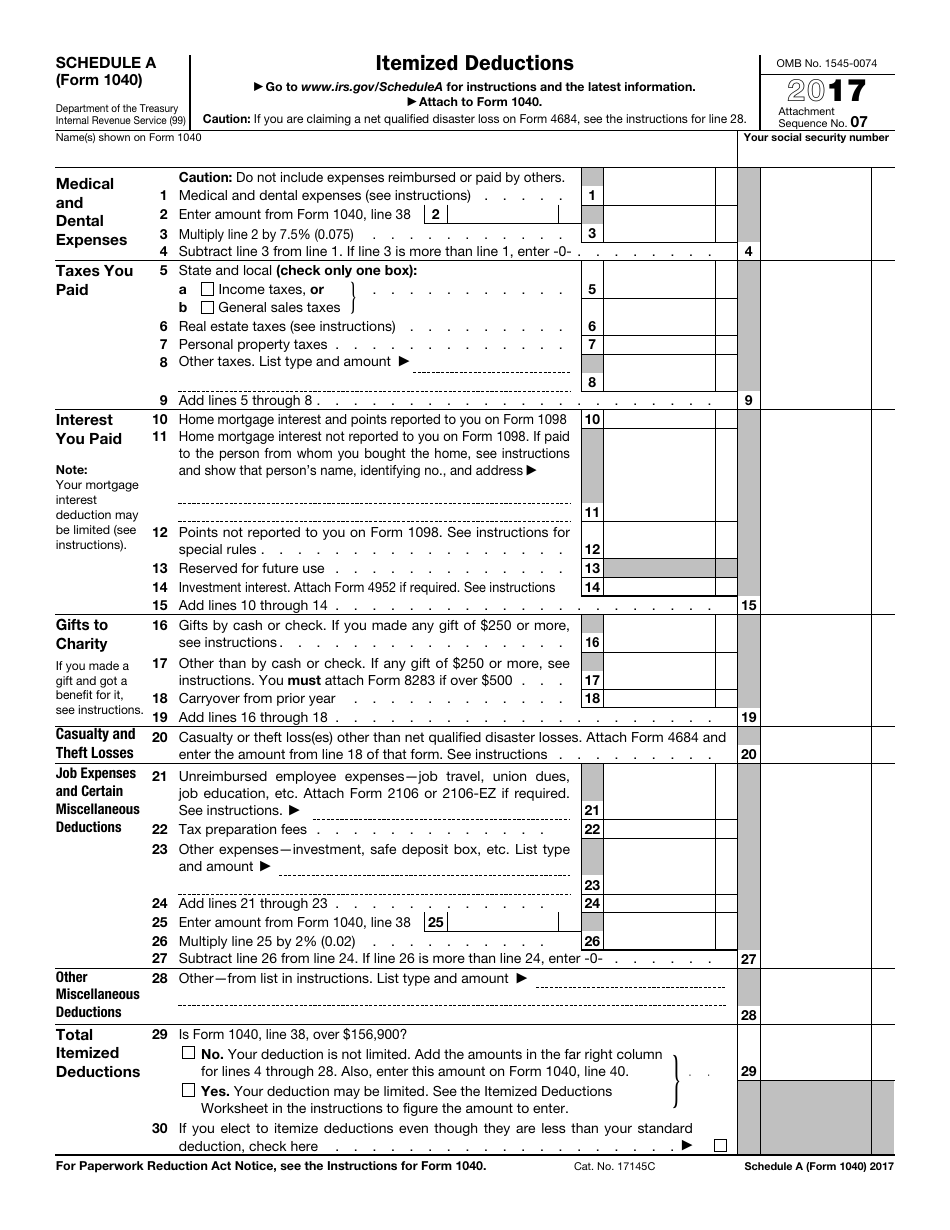

IRS Form 1040 Schedule A 2017 Fill Out, Sign Online and Download

You had over $1,500 of taxable interest or ordinary dividends. What is schedule b (form 1040) for? Use schedule b (form 1040) if any of the following applies. You received interest from a. Schedule b is a form you file with your regular income tax return by april 15 (or.

1040 form instructions tax table

What is schedule b (form 1040) for? Use schedule b (form 1040) if any of the following applies. You had over $1,500 of taxable interest or ordinary dividends. Schedule b is a form you file with your regular income tax return by april 15 (or. You received interest from a.

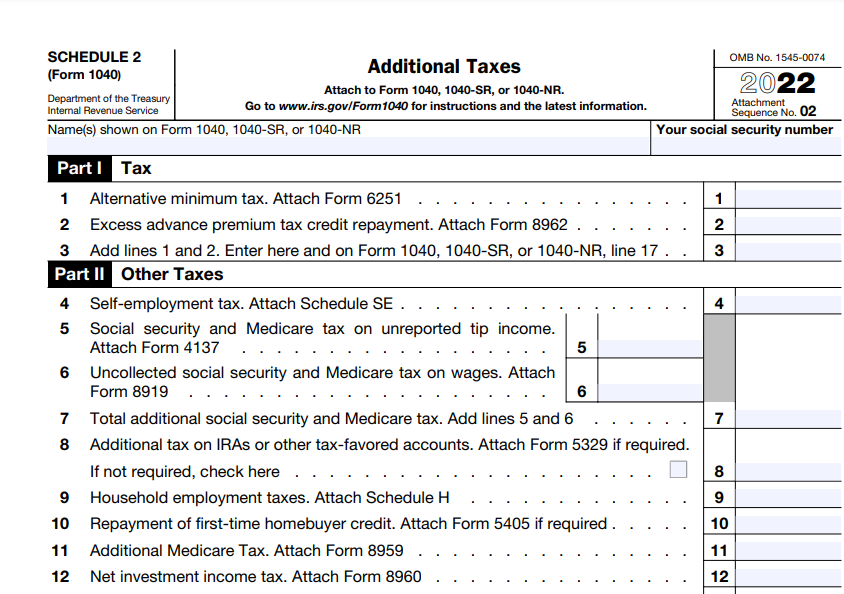

IRS Form 1040 Schedule 2. Additional Taxes Forms Docs 2023

Schedule b is a form you file with your regular income tax return by april 15 (or. You received interest from a. You had over $1,500 of taxable interest or ordinary dividends. What is schedule b (form 1040) for? Use schedule b (form 1040) if any of the following applies.

1040 forms airSlate SignNow

Schedule b is a form you file with your regular income tax return by april 15 (or. You had over $1,500 of taxable interest or ordinary dividends. What is schedule b (form 1040) for? Use schedule b (form 1040) if any of the following applies. You received interest from a.

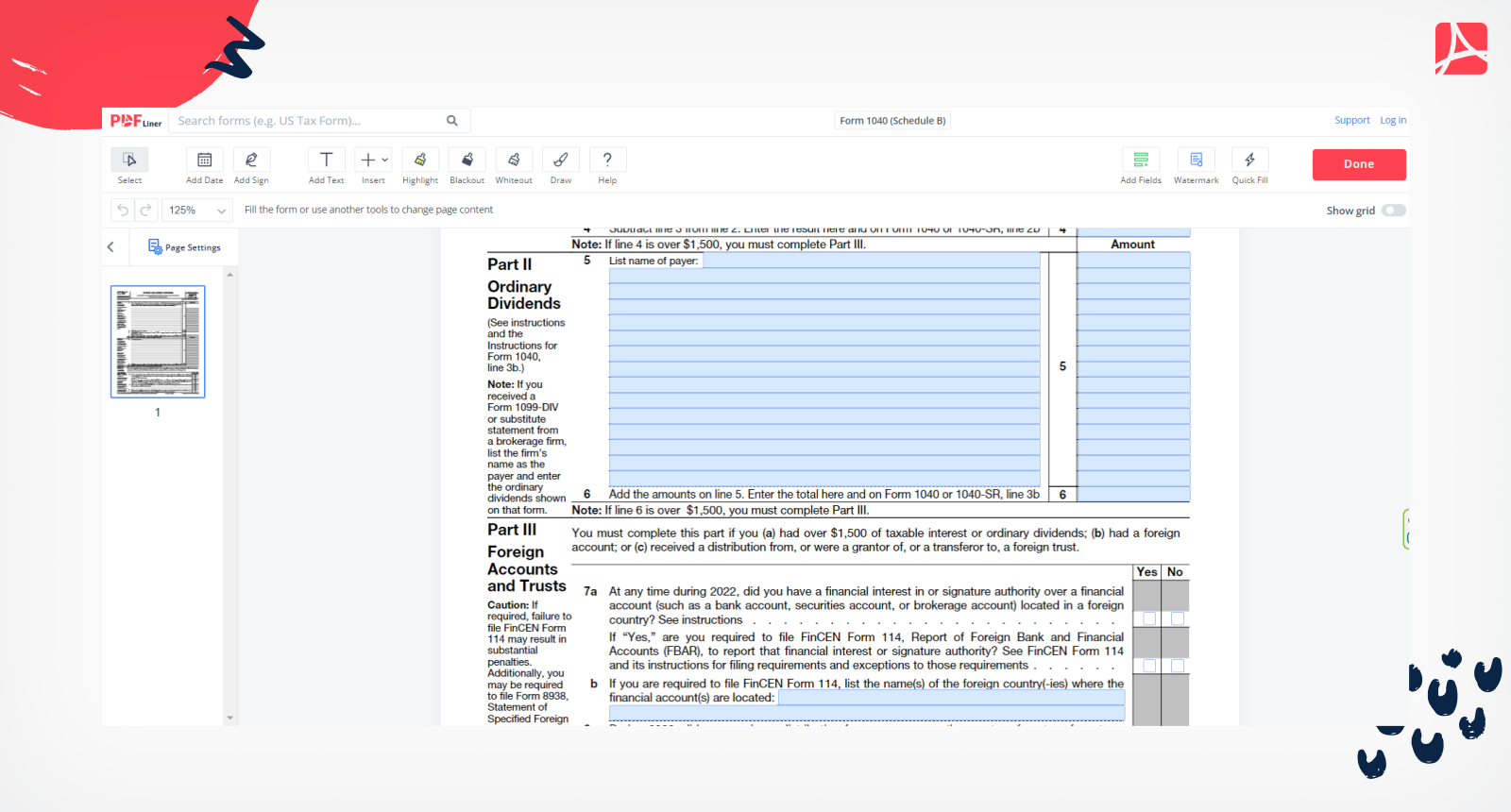

IRS Schedule B Form 1040, sign Schedule B online PDFliner

You received interest from a. Schedule b is a form you file with your regular income tax return by april 15 (or. You had over $1,500 of taxable interest or ordinary dividends. What is schedule b (form 1040) for? Use schedule b (form 1040) if any of the following applies.

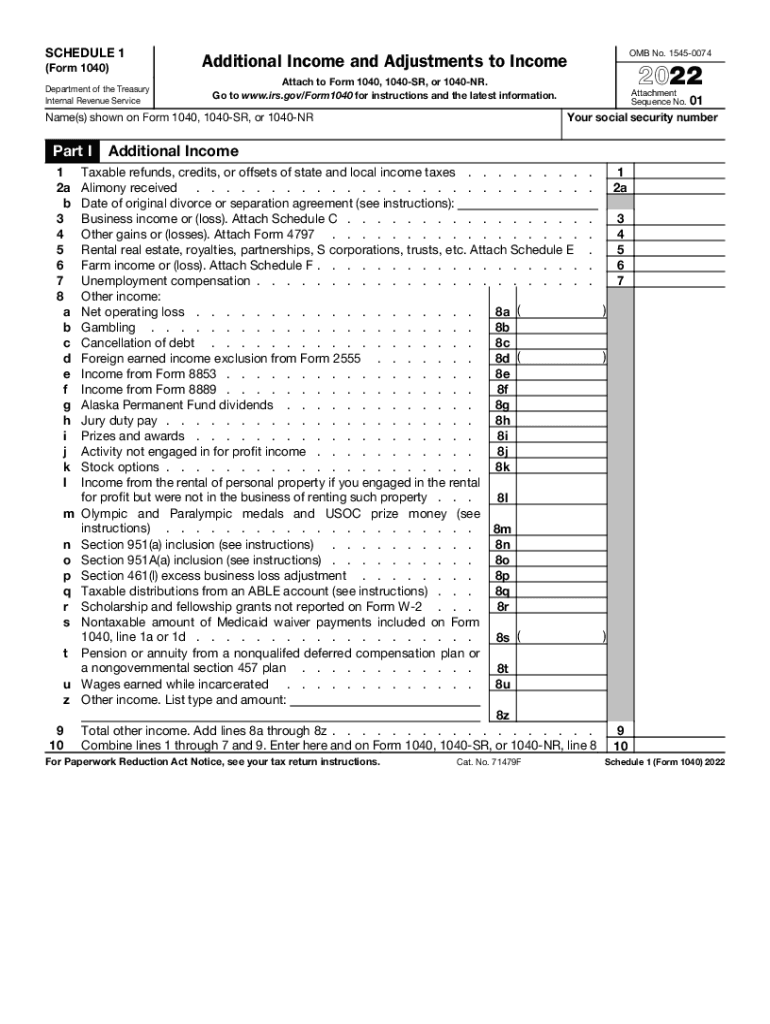

Schedule 1 20222024 Form Fill Out and Sign Printable PDF Template

What is schedule b (form 1040) for? You had over $1,500 of taxable interest or ordinary dividends. Schedule b is a form you file with your regular income tax return by april 15 (or. You received interest from a. Use schedule b (form 1040) if any of the following applies.

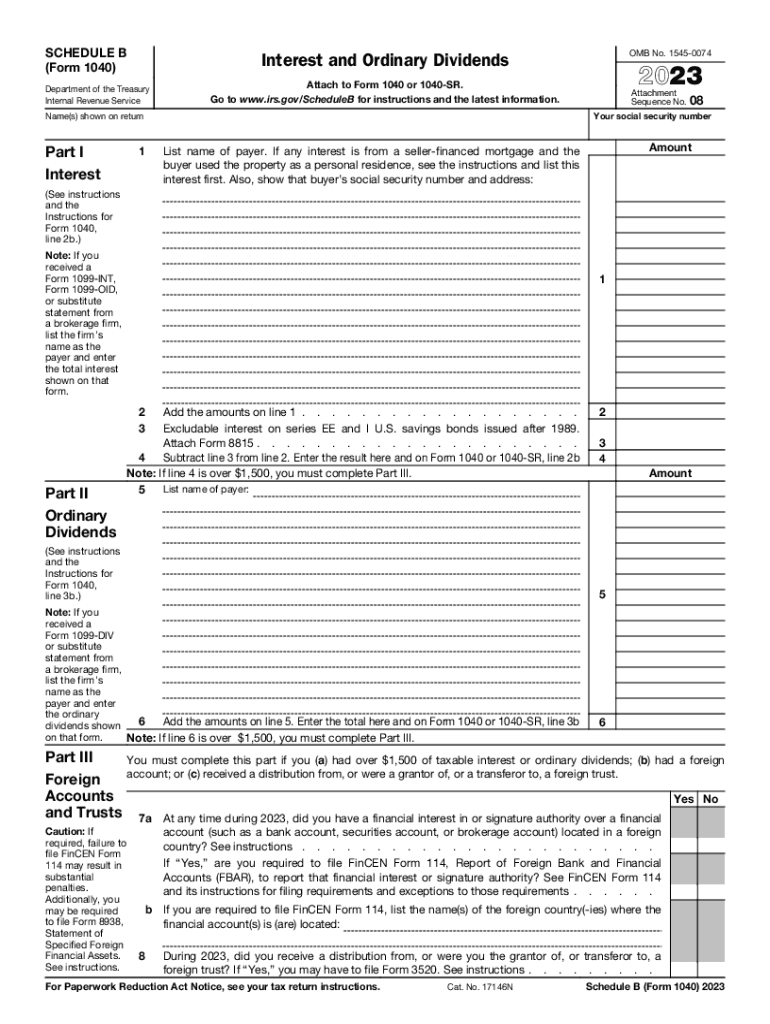

What Is Schedule B (Form 1040) For?

Schedule b is a form you file with your regular income tax return by april 15 (or. Use schedule b (form 1040) if any of the following applies. You had over $1,500 of taxable interest or ordinary dividends. You received interest from a.

:max_bytes(150000):strip_icc()/ScheduleB-InterestandOrdinaryDividends-c6ff80bf2c1f4de981e0b0625a4e3dc7.png)

:max_bytes(150000):strip_icc()/ScreenShot2022-12-15at9.44.37AM-f619eccef6a84e3ab500003fcc088ce8.png)