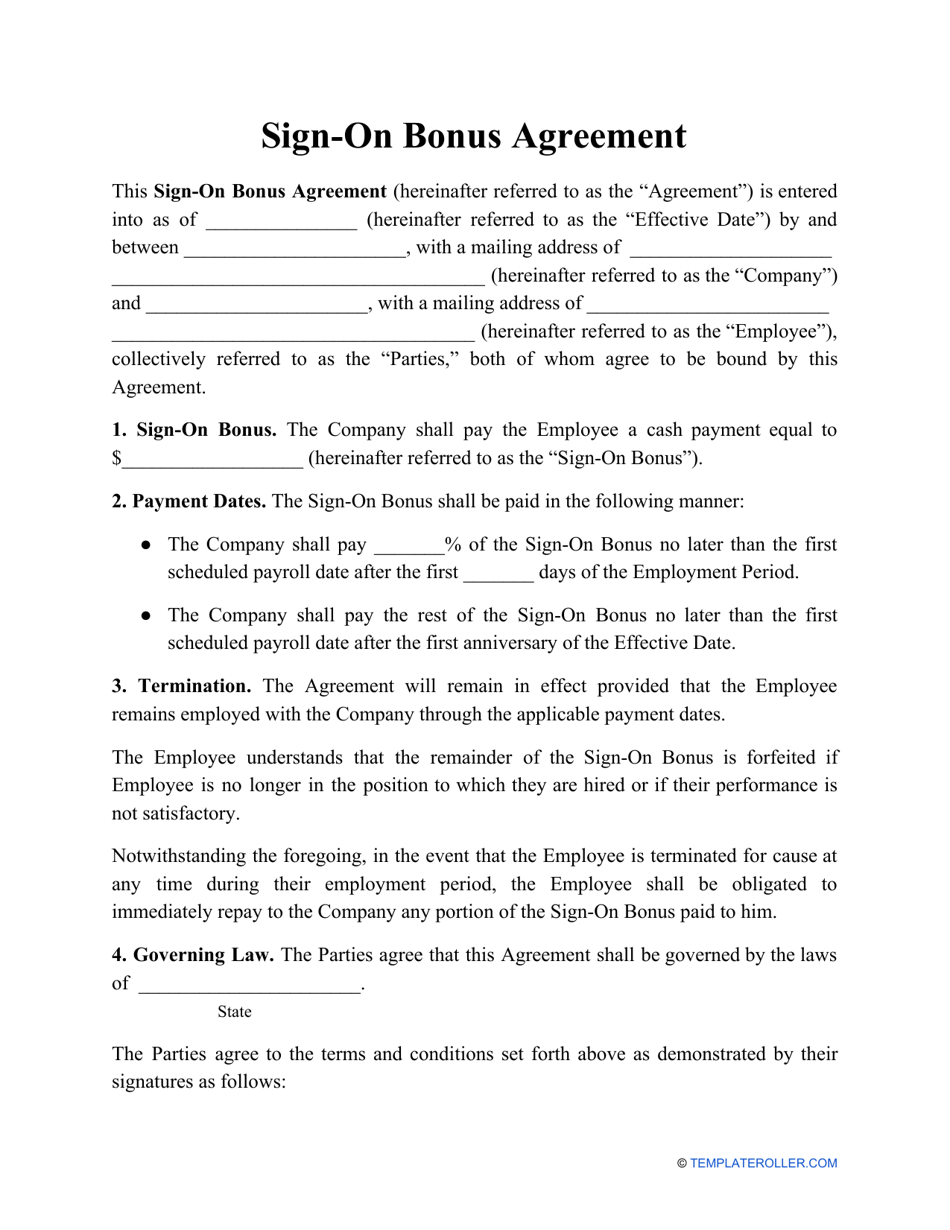

Sign On Bonus Contract Template

Sign On Bonus Contract Template - We are pleased to offer you a signing bonus of $50,000. This bonus will be paid in one lump sum and will be taxable. In the event that you leave the company within six (6) months of your date of. This bonus will be paid in one lump sum in a separate check on the next scheduled pay. In connection with the commencement of your employment, you will receive a cash payment in the aggregate.

In the event that you leave the company within six (6) months of your date of. This bonus will be paid in one lump sum and will be taxable. In connection with the commencement of your employment, you will receive a cash payment in the aggregate. This bonus will be paid in one lump sum in a separate check on the next scheduled pay. We are pleased to offer you a signing bonus of $50,000.

In connection with the commencement of your employment, you will receive a cash payment in the aggregate. This bonus will be paid in one lump sum and will be taxable. This bonus will be paid in one lump sum in a separate check on the next scheduled pay. In the event that you leave the company within six (6) months of your date of. We are pleased to offer you a signing bonus of $50,000.

Sign On Bonus Contract Template

In connection with the commencement of your employment, you will receive a cash payment in the aggregate. In the event that you leave the company within six (6) months of your date of. We are pleased to offer you a signing bonus of $50,000. This bonus will be paid in one lump sum and will be taxable. This bonus will.

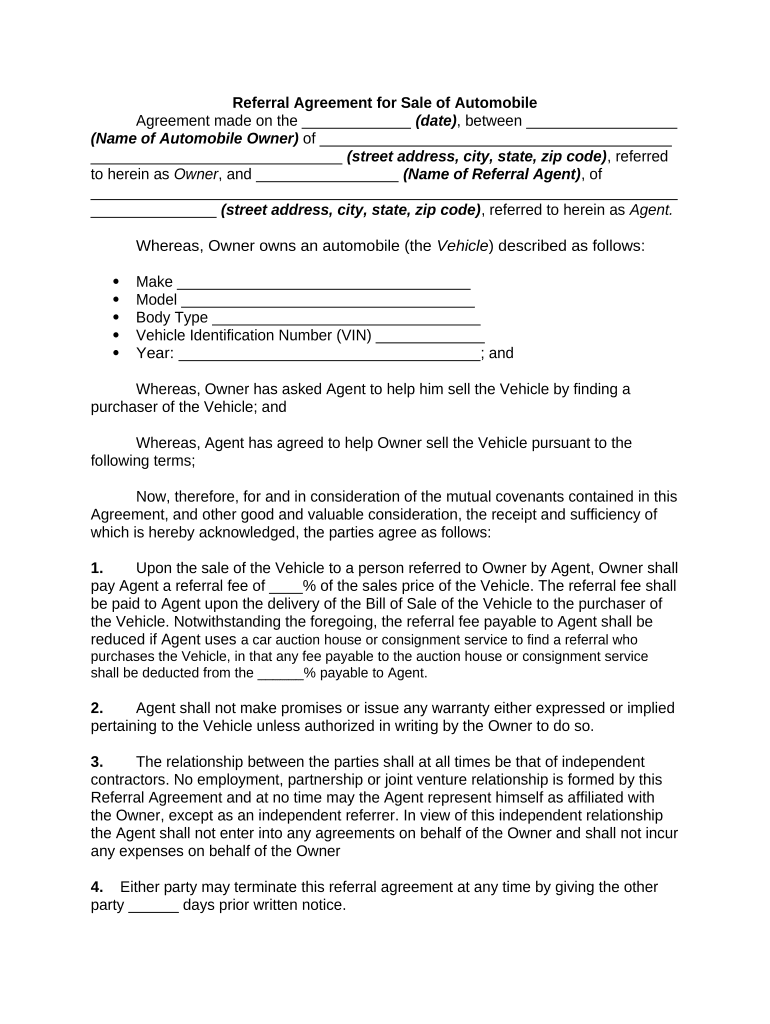

SignOn Bonus Agreement Template Fill Out, Sign Online and Download

This bonus will be paid in one lump sum in a separate check on the next scheduled pay. In the event that you leave the company within six (6) months of your date of. In connection with the commencement of your employment, you will receive a cash payment in the aggregate. We are pleased to offer you a signing bonus.

Sign On Bonus Contract Template

In the event that you leave the company within six (6) months of your date of. We are pleased to offer you a signing bonus of $50,000. This bonus will be paid in one lump sum in a separate check on the next scheduled pay. This bonus will be paid in one lump sum and will be taxable. In connection.

Employee Bonus Plan Template

We are pleased to offer you a signing bonus of $50,000. In the event that you leave the company within six (6) months of your date of. In connection with the commencement of your employment, you will receive a cash payment in the aggregate. This bonus will be paid in one lump sum in a separate check on the next.

Annual Bonus Policy Template

This bonus will be paid in one lump sum in a separate check on the next scheduled pay. This bonus will be paid in one lump sum and will be taxable. In connection with the commencement of your employment, you will receive a cash payment in the aggregate. In the event that you leave the company within six (6) months.

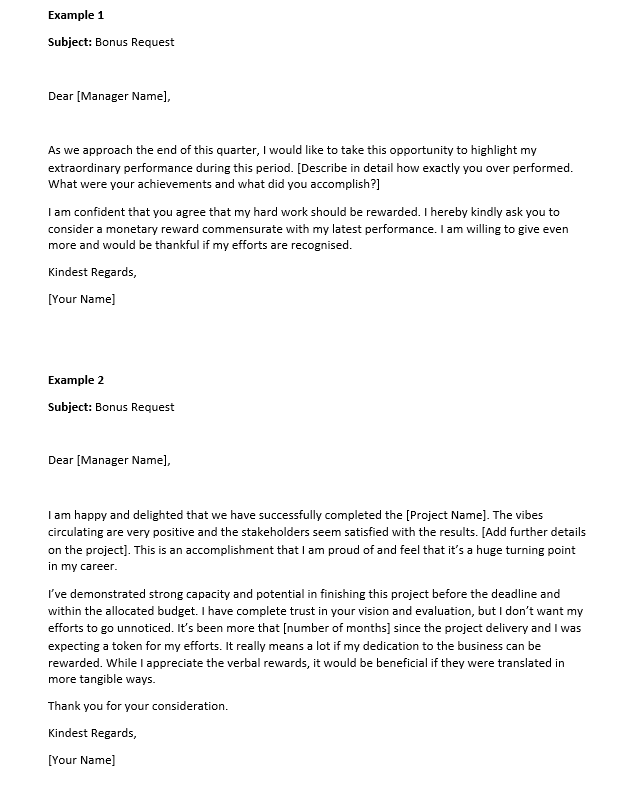

Fun Tips About Bonus Request Letter Format Cv Template Master Profitlayer

This bonus will be paid in one lump sum in a separate check on the next scheduled pay. This bonus will be paid in one lump sum and will be taxable. In the event that you leave the company within six (6) months of your date of. In connection with the commencement of your employment, you will receive a cash.

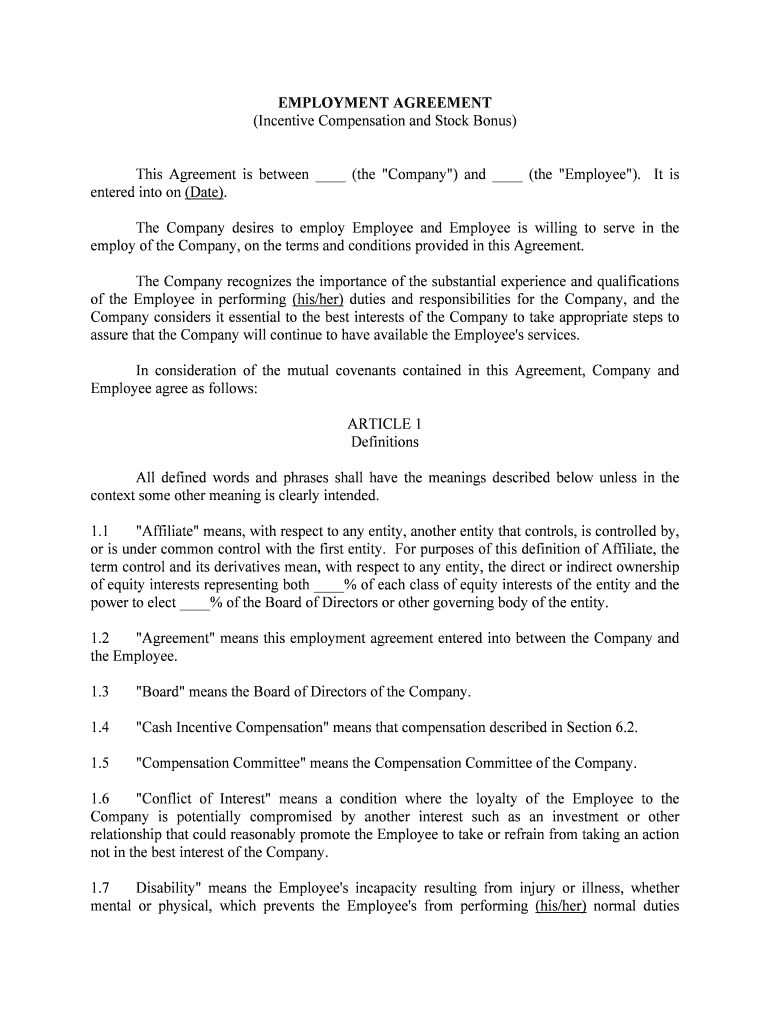

Sample Employee Bonus Plan Agreements RealDealDocs Form Fill Out and

This bonus will be paid in one lump sum in a separate check on the next scheduled pay. In the event that you leave the company within six (6) months of your date of. We are pleased to offer you a signing bonus of $50,000. This bonus will be paid in one lump sum and will be taxable. In connection.

SignOn Bonus Letter Template

This bonus will be paid in one lump sum and will be taxable. In the event that you leave the company within six (6) months of your date of. This bonus will be paid in one lump sum in a separate check on the next scheduled pay. In connection with the commencement of your employment, you will receive a cash.

Retention Bonus Agreement Template

This bonus will be paid in one lump sum and will be taxable. This bonus will be paid in one lump sum in a separate check on the next scheduled pay. In the event that you leave the company within six (6) months of your date of. In connection with the commencement of your employment, you will receive a cash.

Bonus agreement template Fill out & sign online DocHub

In connection with the commencement of your employment, you will receive a cash payment in the aggregate. We are pleased to offer you a signing bonus of $50,000. This bonus will be paid in one lump sum in a separate check on the next scheduled pay. This bonus will be paid in one lump sum and will be taxable. In.

In The Event That You Leave The Company Within Six (6) Months Of Your Date Of.

In connection with the commencement of your employment, you will receive a cash payment in the aggregate. This bonus will be paid in one lump sum in a separate check on the next scheduled pay. We are pleased to offer you a signing bonus of $50,000. This bonus will be paid in one lump sum and will be taxable.