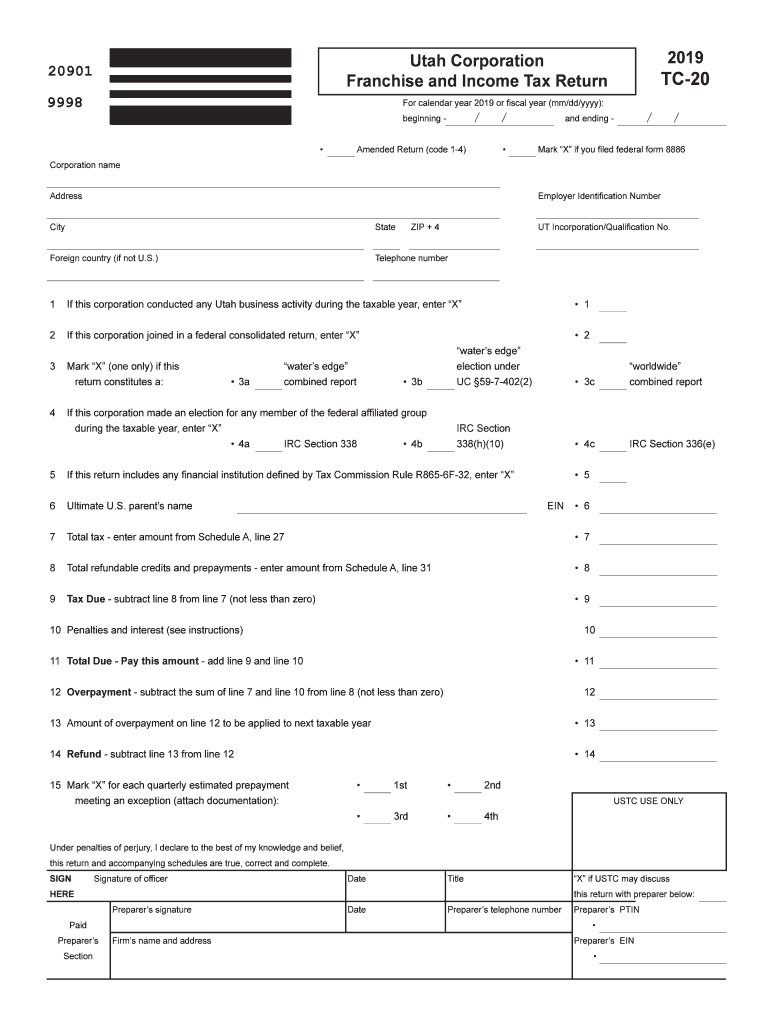

Utah Sales Tax Form

Utah Sales Tax Form - I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return. There are a total of. 270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%.

There are a total of. 270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return.

I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return. 270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. There are a total of.

Vadrs Utah Complete with ease airSlate SignNow

I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return. 270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. There are a total of.

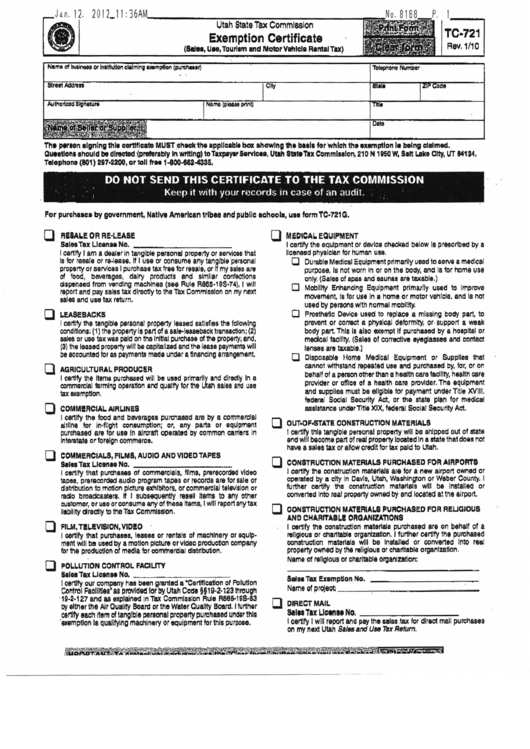

State Of Utah Tax Exempt Form Form example download

I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return. 270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. There are a total of.

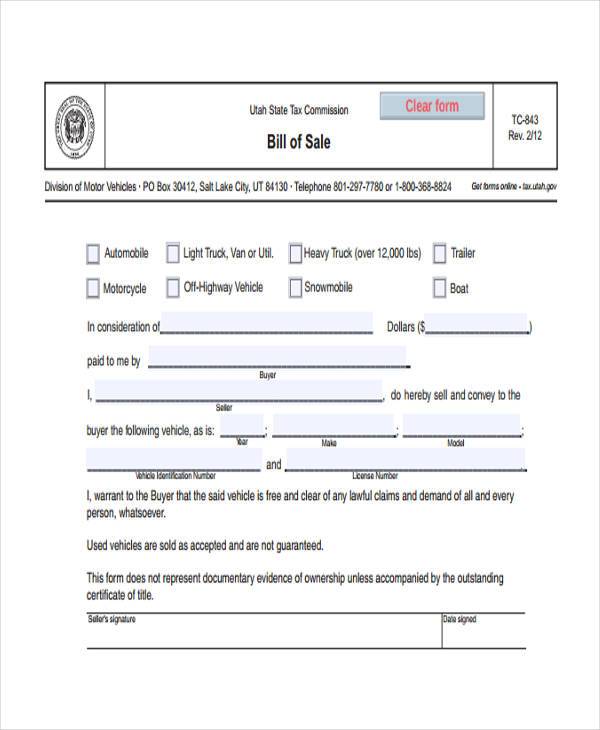

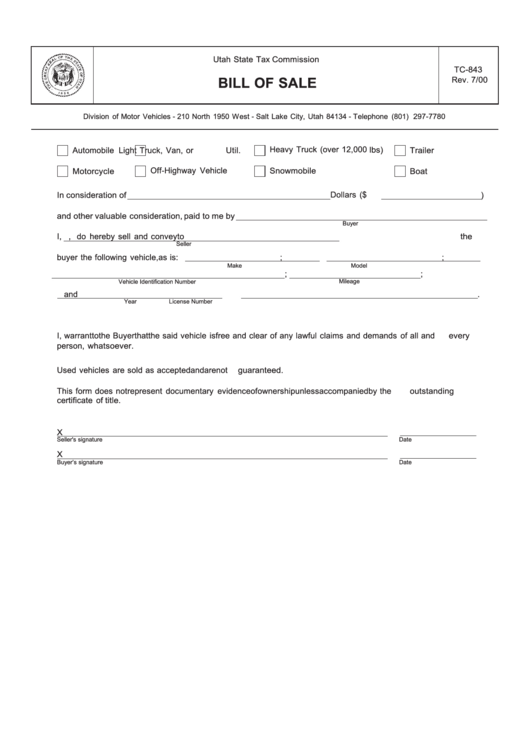

Free Utah Vehicle Bill Of Sale Form Tc 843 Download Pdf Word Images

I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return. There are a total of. 270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%.

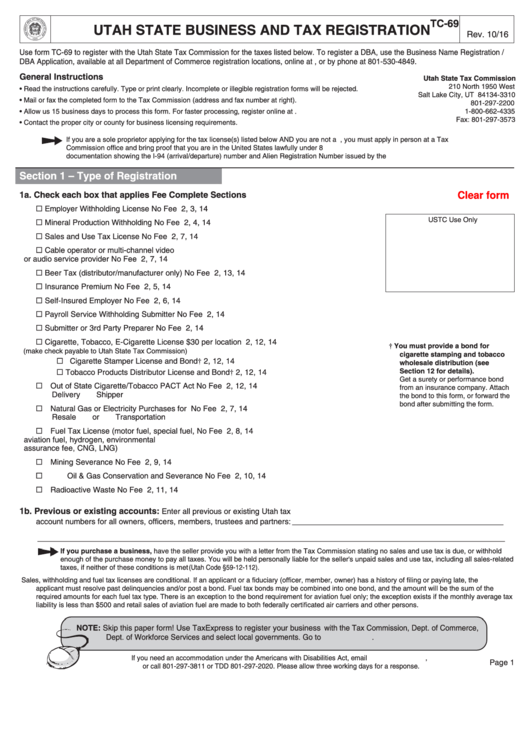

Fillable Form Tc69 Utah State Business And Tax Registration

270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return. There are a total of.

Register Utha Sales Tax, UT Reseller Pertmit Sales tax, Tax, Registration

I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return. There are a total of. 270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%.

Fillable Online Utah Sales Tax Exemption Certificate Fax Email Print

270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. There are a total of. I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return.

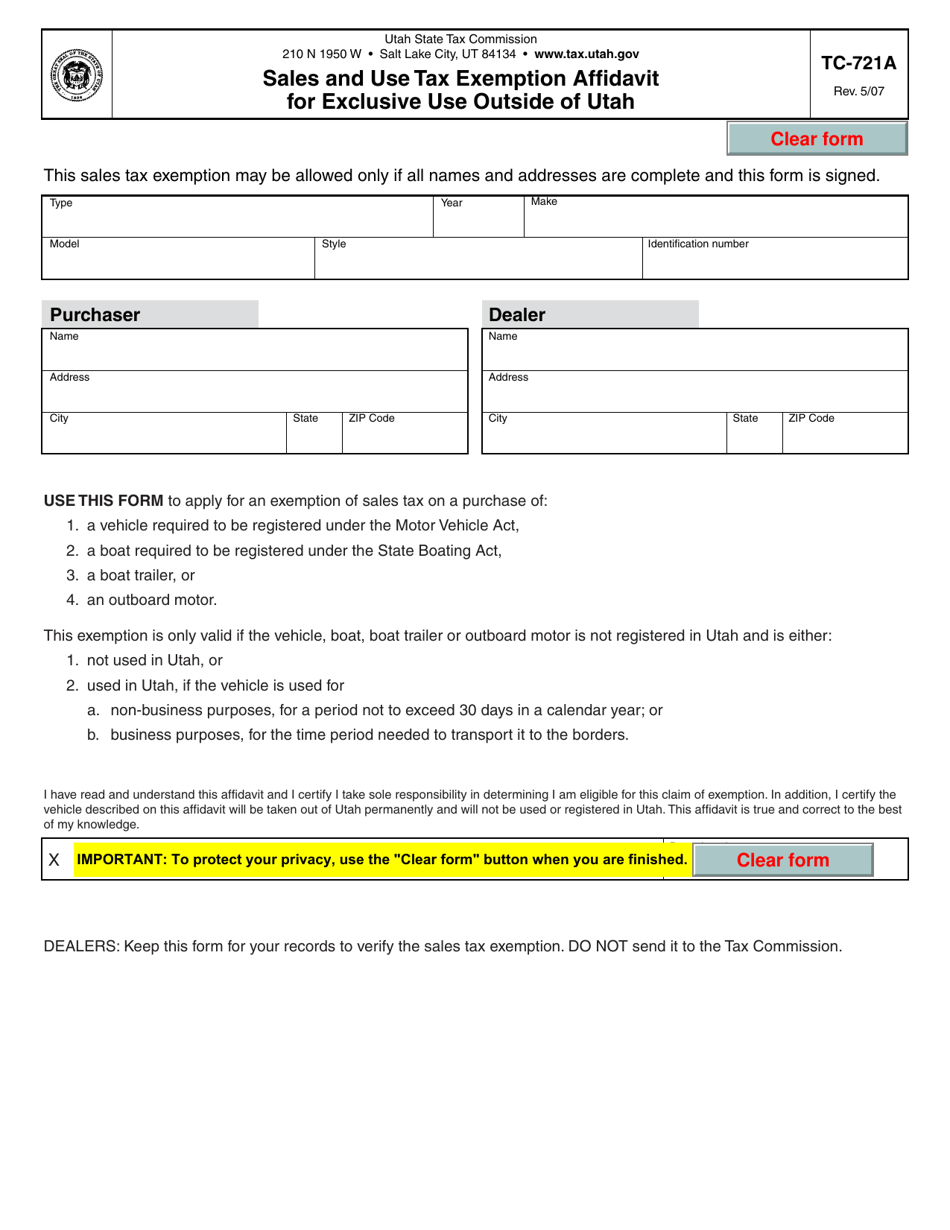

Form TC721A Fill Out, Sign Online and Download Fillable PDF, Utah

270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return. There are a total of.

Fillable Online Free fillable Tax Exempt Certificate TC721G, Utah

270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. There are a total of. I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return.

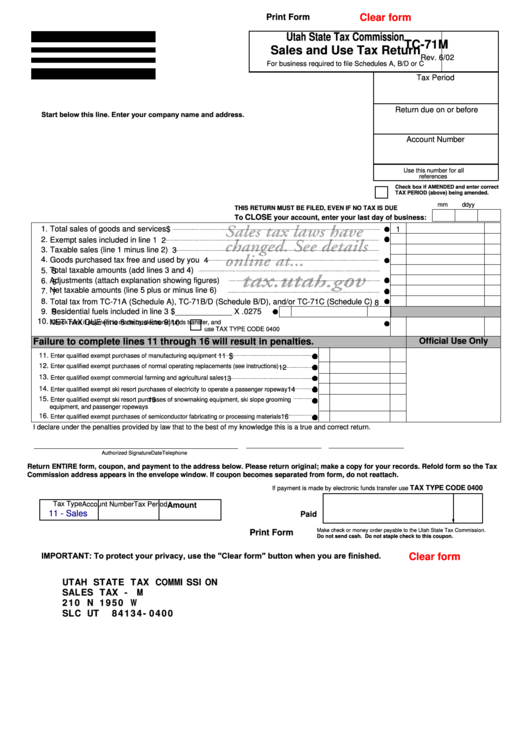

Fillable Form Tc71m Sales And Use Tax Return Utah State Tax

I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return. 270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. There are a total of.

There Are A Total Of.

I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return. 270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%.