Varsity Tutors Tax Forms

Varsity Tutors Tax Forms - This comprehensive guide covers your tax responsibilities, obtaining 1099 forms,. As an independent contractor, taxes are not withheld from your payments. Includes full solutions and score. The actual income received is well under the amount that mandates reporting to the irs, but they may have their system set up to send all. Varsity tutors hires based on a 1099 status, which requires the individual to pay their state's taxes as well as filing federal taxes. Since vt is based in missouri, do i. If you are having trouble logging in, or have a payment question please contact. You are responsible for paying whatever taxes you owe. I lived in ohio all of last year. Explore the latest irs updates for varsity tutors 1099 taxes.

The actual income received is well under the amount that mandates reporting to the irs, but they may have their system set up to send all. This comprehensive guide covers your tax responsibilities, obtaining 1099 forms,. Includes full solutions and score. Varsity tutors hires based on a 1099 status, which requires the individual to pay their state's taxes as well as filing federal taxes. Explore the latest irs updates for varsity tutors 1099 taxes. If you are having trouble logging in, or have a payment question please contact. I lived in ohio all of last year. As an independent contractor, taxes are not withheld from your payments. Since vt is based in missouri, do i. You are responsible for paying whatever taxes you owe.

I lived in ohio all of last year. Explore the latest irs updates for varsity tutors 1099 taxes. Since vt is based in missouri, do i. You are responsible for paying whatever taxes you owe. If you are having trouble logging in, or have a payment question please contact. Varsity tutors hires based on a 1099 status, which requires the individual to pay their state's taxes as well as filing federal taxes. As an independent contractor, taxes are not withheld from your payments. Includes full solutions and score. The actual income received is well under the amount that mandates reporting to the irs, but they may have their system set up to send all. This comprehensive guide covers your tax responsibilities, obtaining 1099 forms,.

Review June 2024 Update GlobalDreamers

Varsity tutors hires based on a 1099 status, which requires the individual to pay their state's taxes as well as filing federal taxes. The actual income received is well under the amount that mandates reporting to the irs, but they may have their system set up to send all. Since vt is based in missouri, do i. Includes full solutions.

Varsity Tutors Jobs Levels.fyi

As an independent contractor, taxes are not withheld from your payments. Explore the latest irs updates for varsity tutors 1099 taxes. The actual income received is well under the amount that mandates reporting to the irs, but they may have their system set up to send all. Includes full solutions and score. This comprehensive guide covers your tax responsibilities, obtaining.

Varsity Tutors Review 2024 Is It Legit (Truth)

As an independent contractor, taxes are not withheld from your payments. I lived in ohio all of last year. You are responsible for paying whatever taxes you owe. Includes full solutions and score. If you are having trouble logging in, or have a payment question please contact.

Varsity Tutors LLC Better Business Bureau® Profile

Explore the latest irs updates for varsity tutors 1099 taxes. I lived in ohio all of last year. If you are having trouble logging in, or have a payment question please contact. Since vt is based in missouri, do i. You are responsible for paying whatever taxes you owe.

How Much Does Varsity Tutors Cost in 2024? EduReviewer

As an independent contractor, taxes are not withheld from your payments. You are responsible for paying whatever taxes you owe. If you are having trouble logging in, or have a payment question please contact. Since vt is based in missouri, do i. The actual income received is well under the amount that mandates reporting to the irs, but they may.

Varsity Tutors for Schools Resources

If you are having trouble logging in, or have a payment question please contact. As an independent contractor, taxes are not withheld from your payments. Varsity tutors hires based on a 1099 status, which requires the individual to pay their state's taxes as well as filing federal taxes. This comprehensive guide covers your tax responsibilities, obtaining 1099 forms,. Since vt.

Teacher Assigned Tutoring from Varsity Tutors

As an independent contractor, taxes are not withheld from your payments. I lived in ohio all of last year. The actual income received is well under the amount that mandates reporting to the irs, but they may have their system set up to send all. Explore the latest irs updates for varsity tutors 1099 taxes. If you are having trouble.

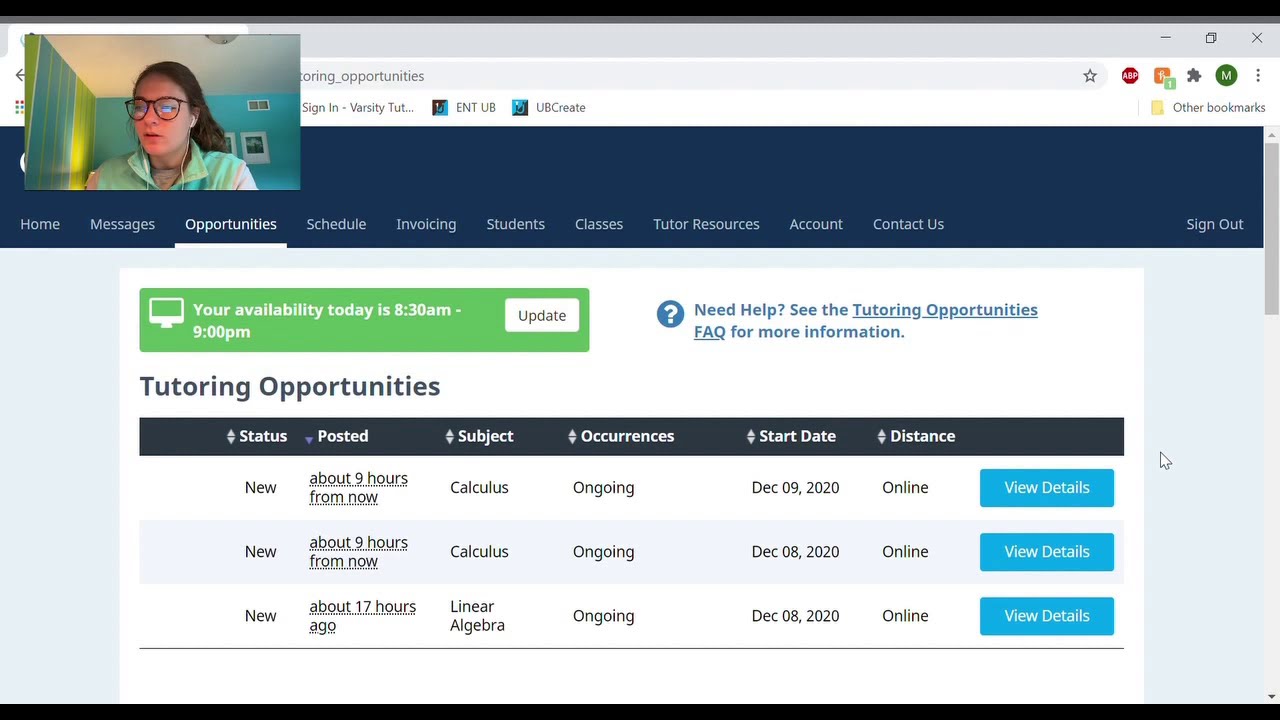

Online Tutoring with Varsity Tutors How it Works. YouTube

You are responsible for paying whatever taxes you owe. Varsity tutors hires based on a 1099 status, which requires the individual to pay their state's taxes as well as filing federal taxes. The actual income received is well under the amount that mandates reporting to the irs, but they may have their system set up to send all. Since vt.

Varsity Tutors Review 2024 Is It Legit (Truth)

Explore the latest irs updates for varsity tutors 1099 taxes. As an independent contractor, taxes are not withheld from your payments. Includes full solutions and score. This comprehensive guide covers your tax responsibilities, obtaining 1099 forms,. Varsity tutors hires based on a 1099 status, which requires the individual to pay their state's taxes as well as filing federal taxes.

Varsity Tutors Review The Smarter Learning Guide

This comprehensive guide covers your tax responsibilities, obtaining 1099 forms,. Explore the latest irs updates for varsity tutors 1099 taxes. You are responsible for paying whatever taxes you owe. Includes full solutions and score. As an independent contractor, taxes are not withheld from your payments.

This Comprehensive Guide Covers Your Tax Responsibilities, Obtaining 1099 Forms,.

You are responsible for paying whatever taxes you owe. If you are having trouble logging in, or have a payment question please contact. Varsity tutors hires based on a 1099 status, which requires the individual to pay their state's taxes as well as filing federal taxes. The actual income received is well under the amount that mandates reporting to the irs, but they may have their system set up to send all.

As An Independent Contractor, Taxes Are Not Withheld From Your Payments.

Includes full solutions and score. I lived in ohio all of last year. Explore the latest irs updates for varsity tutors 1099 taxes. Since vt is based in missouri, do i.